“We’ve got strong financial institutions…Our markets are the envy of the world. They’re resilient, they’re…innovative, they’re flexible. I think we move very quickly to address situations in this country, and, as I said, our financial institutions are strong.” – Henry Paulson – 3/16/08

“I have full confidence in banking regulators to take appropriate actions in response and noted that the banking system remains resilient and regulators have effective tools to address this type of event. Let me be clear that during the financial crisis, there were investors and owners of systemic large banks that were bailed out . . . and the reforms that have been put in place means we are not going to do that again.” – Janet Yellen – 3/12/23

With the recent implosion of Silicon Valley Bank and Signature Bank, the largest bank failures since 2008, I had an overwhelming feeling of deja vu. I wrote the article Is the U.S. Banking System Safe on August 3, 2008 for the Seeking Alpha website, one month before the collapse of the global financial system. It was this article, among others, that caught the attention of documentary filmmaker Steve Bannon and convinced him he needed my perspective on the financial crisis for his film Generation Zero. Of course he was pretty unknown in 2009 (not so much anymore) , and I continue to be unknown in 2023.

Continue reading “IS THE U.S. BANKING SYSTEM SAFE? – 15 YEARS LATER”

Submitted by mark

![]()

Fears of a broad financial contagion spread on Friday after tech lender Silicon Valley Bank set off alarm bells over liquidity concerns — sparking share losses across the banking sector worth some $52 billion on Thursday.

Peter Thiel’s venture capital firm Founders Firm advised clients to withdraw their deposits from Silicon Valley Bank — despite the fact the lender has been a mainstay for tech startups for decades, according to Bloomberg News.

Bill Ackman, the billionaire hedge fund manager, called on the US government to step in and bail out Silicon Valley Bank.

Michael Burry, the eccentric investor featured in the 2015 film “The Big Short,” warned: “It is possible today we found our Enron.”

Continue reading “Silicon Valley Bank meltdown sparks contagion fears: ‘We found our Enron’”

Michael Burry warned US stocks have further to fall, compared the current market downturn to the onset of the dot-com crash, and predicted many investors would suffer painful losses in a flurry of since-deleted tweets over the weekend.

The investor of “The Big Short” fame noted in a Friday tweet that there are 218 companies with a primary stock listing in the US, a market capitalization north of $1 billion, and annual losses exceeding $100 million. Of those, 29 boast market caps over $10 billion and are worth a combined $655 billion, he added.

Michael Burry called out the Federal Reserve for not shrinking its balance sheet as much as planned in June, comparing its failure to resist stimulating the economy to a drug addiction.

“Drugs are hard to kick,” Burry said in a now-deleted tweet. “Fed was supposed to sell $30B Treasuries and $17.5B Mortgage-Backed Securities per month starting June 1. QT.”

“During June, MBS holdings rose almost $3B. Treasury holdings fell less than $10B,” the investor of “The Big Short” fame added.

Burry’s tweet refers to the Fed’s plan to reduce security holdings by up to $30 billion worth of Treasuries and $17.5 billion worth of mortgage-backed securities each month, with deeper cuts to follow. However, the central bank managed less than one-third of its Treasuries target in June, and actually added $3 billion of mortgage-backed securities to its stockpile.

10 years ago

“It’s an age of infinite distraction for those so willing. You are the generation that has had instant messaging, Facebook, Twitter…nagging your fingertips at every moment. It’s been arguably as addictive as any drug throughout history”

Michael Burry, the hedge fund manager of “The Big Short” fame, rang the alarm on the “greatest speculative bubble of all time in all things” last summer. He warned the retail investors piling into meme stocks and cryptocurrencies that they were careening towards the “mother of all crashes.”

The Scion Asset Management chief’s dire prediction may be coming true, as the S&P 500 and Nasdaq indexes have tumbled 15% and 24% respectively this year. In tweets he’s since deleted, Burry has taken credit for calling the sell-off, explained why he expects further declines, and cautioned against buying into relief rallies.

Having taken aim at Elon Musk earlier in the week, Famous short seller Michael Burry of The Big Short game emerged once again from his latest self-imposed twitter exile to lambast The Fed (and The SEC) for fiddling while Rome burns.

In one tweet, reflecting on the fact that Rivian – the newest entrant into the electric vehicle market – is now worth over $100 billion and larger than GM and Ford:

Dr. J Michael Burry of “The Big Short” fame went on a massive Twitter rant Tuesday, where he posted a series of tweets – including a fact check on Ivermectin, who’s actually paying their ‘fair share’ of taxes, ow many genders exist, and a defense of former President Donald J. Trump.

On taxes, Burry – who has since locked his account – tweeted “Top 1%, 20.9% of income, 40.1% of taxes. Bottom 90% paid just 28.6% of taxes. Top 1% tax rate is 7X HIGHER than rate paid by the bottom 50%. Biden tells rich to “pay like everybody else does.” So, a tax cut for the rich? Or class warfare built on lies.”

Burry – the head of Scion Asset Management who rose to prominence after making a mega-successful bet against mortgages into the 2008 financial crisis, linked to this article from taxfoundation.org. His tweet comes as Congressional Democrats debate a $3.5 trillion social spending bill that hinges on taxing the wealthy.

Continue reading “Michael Burry Drops Redpills In Epic Twitter Rant”

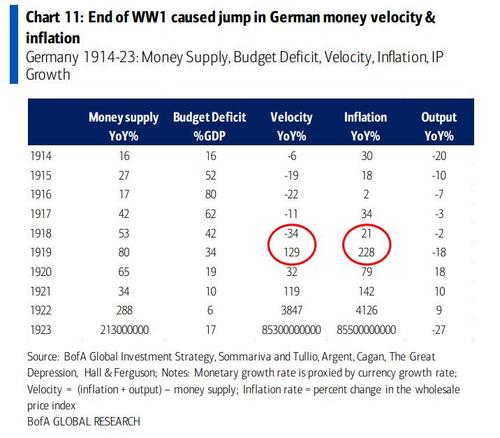

Earlier this year, none other than Michael ‘Big Short’ Burry confirmed BofA’s greatest fears, as he picked up on the theme of Weimar Germany and specifically its hyperinflation, as the blueprint for what comes next in a lengthy tweetstorm cribbing generously from Parsson’s seminal work, warning that:

“The US government is inviting inflation with its MMT-tinged policies. Brisk Debt/GDP, M2 increases while retail sales, PMI stage V recovery. Trillions more stimulus & re-opening to boost demand as employee and supply chain costs skyrocket.”

Update (1815 ET): one day after the Weimar tweetstorm below, and shortly after our article came out, Burry tweeted the following:

People say I didn’t warn last time. I did, but no one listened. So I warn this time. And still, no one listens. But I will have proof I warned.

Indeed he will.

* * *

One week ago, Bank of America hinted at the unthinkable: the tsunami of monetary and fiscal stimulus, coupled with the upcoming surge in monetary velocity as the world’s economy emerges from lockdowns, would lead to unprecedented economic overheating… or rather precedented as BofA’s CIO Michael Hartnett reflected back on the post-WW1 Germany which he said was the “most epic, extreme analog of surging velocity and inflation following end of war psychology, pent-up savings, lost confidence in currency & authorities” and specifically the Reichsbank’s monetization of debt, and extrapolated that this is similar to what is going on now.

Michael Burry’s investors hated him from 2005 through 2008 as his big short bet kept losing money. Someone with less courage of conviction would have folded and taken his losses. But he knew he was right. Everyone else was wrong. It was a bubble and it did burst. Excessive debt always causes the bubbles to pop. This time will be no different. You’ve been warned.

Speculative stock #bubbles ultimately see the gamblers take on too much debt. #MarginDebt popularity accelerates at peaks. At this point the market is dancing on a knife’s edge. Passive investing’s IQ drain, and #stonksgoup hype, add to the danger. pic.twitter.com/VLHrzdNumB

— Cassandra (@michaeljburry) February 21, 2021

Infamous for his massive (winning) “big short” bet against mortgage securities before the 2008 financial crisis, Michael Burry, the doctor-turned-hedge-fund-manager has been on a multi-day Twitter rant claiming that the lockdowns intended to contain the COVID-19 pandemic are worse than the disease itself.

Echoing the thoughts of many, Burry opined in a series of tweets over the past two weeks that the government-enforced lockdowns and business shutdowns across America may trigger one of the country’s deepest-ever economic contractions, and further still, are not necessary to contain the epidemic (on March 22nd).

COVID-19 policy cannot be settled by CYA politicians career ID docs. Too much hammer/nail and too little common sense.

POTUS must reflect the interests of the working class and small business here – the economy cannot crash 30% to save the 0.2%.

Set America Free!

If COVID-19 testing were universal, the fatality rate would be less than 0.2%.

This is no justication for sweeping government policies, lacking any and all nuance, that destroy the lives, jobs, and businesses of the other 99.8%.

“The next Fourth Turning is due to begin shortly after the new millennium, midway through the Oh-Oh decade. Around the year 2005, a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation and empire. The very survival of the nation will feel at stake. Sometime before the year 2025, America will pass through a great gate in history, commensurate with the American Revolution, Civil War, and twin emergencies of the Great Depression and World War II.” – Strauss & Howe – The Fourth Turning

The chart below was posted by Jesse a few weeks ago. It accompanied a post titled Gathering Storm. He doesn’t specifically refer to the chart, but his words reflect the ominous view of the future depicted in the chart.

“When gold and silver finally are able, through price action, to have their say about the state of Western fiscal and monetary policy actions, it may break a few ear drums and shatter a more than a few illusions about the wisdom and honesty of the money masters. Slowly, but surely, a reckoning is coming. And what has been hidden will be revealed.”

The title of the post and the chart both grabbed my attention and provide a glimpse into the reality of our present situation. The Gathering Storm was the title of Winston Churchill’s volume one history of World War II. Churchill documents the tumultuous twenty years leading up to World War II in The Gathering Storm. The years following World War I, through the Great Depression and the rise of Hitler were abysmal, but only a prelude to the approaching horror of 65 million deaths over the next six years. What appeared to be dark days in the 1930’s were only storm clouds gathering before a once in a lifetime tempest. In my view we stand at an equally perilous point in history today.

Submitted by Tyler Durden on 12/29/2015 12:25 -0500

We are sure, just as many of the so-called “smartest men in the room” ignored him last time, so every status-quo-maintaining, asset-gathering, commission-taker will be quick to dissonantly shrug off Michael Burry’s (the economic soothsayer from Michael Lewis’ book “The Big Short”) warnings this time.

As NYMag.com reports, in an email, which readers of the book will recognize as his preferred method of communication, the real-life head of Scion Asset Management answered some of questions about the state of the financial system, his ominous-sounding water trade, and what, if anything, we can feel hopeful about…

The movie portrays all of you as kind of swashbuckling heroes in some ways, but McKay suggested to me that you were very troubled by what happened. Is that the case?

I felt I was watching a plane crash. I actually had that dream again and again. I knew what was happening, but there was nothing I, or anyone else, could do to stop it. The last day of 2007, I couldn’t come home. I was in the office till late at night, I couldn’t calm down. I wrote my wife an email and just said, “I can’t come home; it’s just too upsetting what’s happening, and I didn’t want to come home to my kids like this.” As for punishment of those responsible, borrowers were punished for their overindulgences — they lost homes and lives. Let’s not forget that. But the executives at the lenders simply got rich.

Were you surprised no one went to jail?