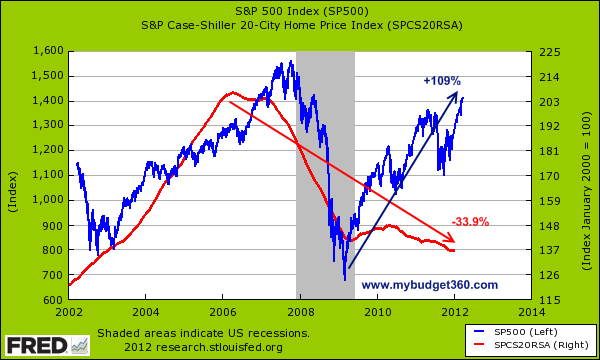

The cronies have effectively used propaganda and lies to convince Americans that naive and greedy homeowners crashed the global credit markets in 2008.

They blamed the crash and current economic malaise on homeowners who bought too much house.

This couldn’t be further from the truth.

The fact of the matter is that the cronies crashed the global markets when they revealed that there are no mortgages to back the mortgage backed securities. They told Paulsen there was no there there. That’s why he panicked and tossed his cookies.

They could have pulled an Iceland, told the truth, arrested the bad actors and instituted real safeguards to restore the capital markets and consumer confidence.

But they chose to continue the lies and backstop the fraud on the taxpayer’s dime. The cronies covered up their partners’ crimes and orchestrated the bailout.

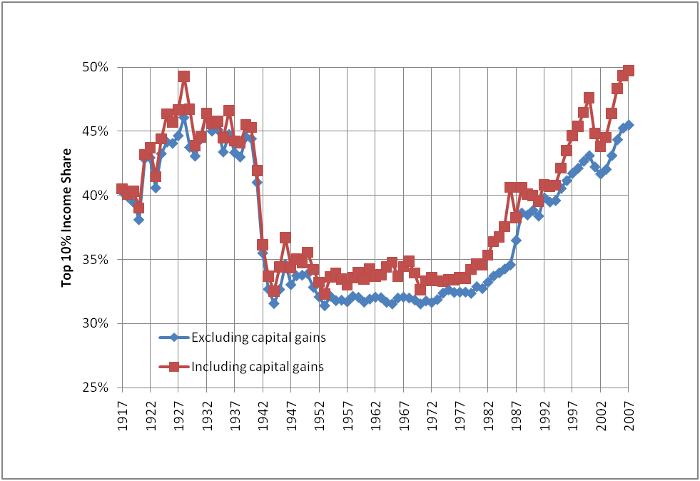

They feasted on our pension money and left us with the tab.

The bare naked truth is that tens of millions of mortgages were fake securitized. The cronies who fleeced Institutional Investors of $13 trillion clouded title on all the mortgages they originated and purportedly sold on the secondary market. They stole the pension money and now they’re stealing our houses.

The fake securitization scheme will make your head hurt and your heart break. So I’m not going to travel down that rabbit hole.

In the end, it all comes down to old fashioned title. Who holds the mortgage on your home? Will you have clear title at the end of the schedule? Do you have MERS in your chain of title? Was your loan ‘Assigned’ to another entity? If so, where is the evidence that substantiates those claims?

We have abandoned our efforts to convince the mighty and powerful to do the right thing. So we’re not going to waste any more of our time trying to convince members of Congress, Governors, state Attorneys General or the DOJ to arrest the bad actors on Wall Street and K Street and end the fraud.

We’re taking the fight to every local state courthouse and giving homeowners the tools to secure their homes and restore private property rights. This is a ground game and it is entirely winnable. It takes tenacity but once you learn to navigate the local state court system it’s entirely doable.

We’re working with community organizers on the left to educate all homeowners about the fraud, how it affects their mortgages and how to use the state courts systems to get real relief. We’re restoring the rule of law one mortgage at a time.

We’re getting results. Law firms are dropping foreclosure cases and homeowners who have been trying to get modifications are uncovering evidence that gives them real clout in negotiations.

It’s time we turn the tables and use the laws they have flouted as a weapon to win back our economic freedom.

We will win this war one house at a time.

This is a crime scene, so the first step is to gather evidence about your loan. All homeowners, regardless of your payment status need to take the following steps:

MERS look-up: https://www.mers-servicerid.org/sis/index.jsp

Fannie Mae look-up: http://www.fanniemae.com/loanlookup/

Freddie Mac look-up: https://ww3.freddiemac.com/corporate/

Capture the screen grabs, save and print. File the record in a binder or folder specifically for your mortgage documents.

Next step, send a Qualified Written Request Letter to your servicer. This is a way to gather evidence about your loan without going to court. The letter should be mailed to the CEO of your servicer. Contact customer service and ask for the name of the exec – could be the CEO – and the company address where the QWR letter should be sent. Be sure to send it certified mail, return receipt requested. Save the receipt and file it in your binder.

The QWR letter is a feature of RESPA, which was strengthened in the Dodd-Frank bill. The servicer is required to respond to the QWR letter in 5 business days with a written acknowledgement. Within the next 25 days they are required to deliver a written response that includes documents such as the promissory note, mortgage, closing documents, appraisal, title policy, assignments of mortgage.

If they do not answer within the 30 days or fail to provide you with evidence you’ve requested, the servicer will have to pay you $4,000 fine. You’ll have to go into Federal Court to file a complaint and get the judgement.

Here’s a template for the QWR:

Date

Servicer Name

Address

Re: Client Name

Loan Number:

Property Address:

Dear Madam or Sir:

In accordance with RESPA and Section 131(f) of the Truth-in-Lending Act, 15 U.S.C. Section 1641(f) (2), please provide me with the name, address, and Telephone number of the owner of the Promissory Note signed by me and secured by the deed of trust in my mortgage loan referenced above.

By their signatures below, I authorize you to furnish me with the requested information, and any other information regarding my account and my mortgage loan.

You should be advised that you must acknowledge receipt of this request within five (5) business days, and respond within thirty (30) business days, pursuant to 12 U.S.C. Section 2605(e) (1)(A) as amended effective July 16, 2010 by the Dodd-Frank Financial Reform Act and Reg. X Section 3500.21(e)(1).

Thanking you in advance, I am

Very truly yours,

Homeowner name

cc: Law firm for servicer if there has been any correspondence

If they respond, carefully verify all information they have provided. If they provide you with the name of the investor of your loan, check it against the results of your MERS, Fannie and Freddie look-ups. If they provide the name of the trust, go to secinfo.com and look-up the prospectus for that trust. The report is called a 424B. Read it and look for the closing and cut-off dates of the trust. Did your loan close within the window, or after? What parties are listed in the deal? Is your loan listed in the Pool Servicing Agreement that is contained within the Prospectus? You can spot it by reviewing all loans listed – according to principal and interest rate by state.

Find the name of the Trustee. The Trustee contact info is located in the PSA. Call the 800 telephone number provided. The recording will tell you to send an email providing your loan number, address and contact info. Write and email to the Trustee and confirm they are in fact your true creditor. Tell them the Trust was named as investor by the servicer. You’d like evidence that the mortgage was properly securitized, which includes all assignments of mortgage (there should be 4), along with the original Promissory Note.

In several weeks, the Trustee should send you an email response to your request. We’ve sent three of these requests so far, and each time the Trustee has told us that they are NOT the investor, and the homeowner should contact the servicer.

If this occurs with your loan, print out all docs, save them in your binder. You can present this document as evidence that you have a wild deed in a Quiet Title Action.

Next step is to gather all your loan documents recorded in the county registry. Ask the Register or County Clerk to print out all pages and certify them as true copies.

Be sure to determine if there is an Assignment of Mortgage in your chain of title. Examine the wording closely. Did they assign only the mortgage, or the mortgage and the note. If just the mortgage is assigned, that means the chain of title has been broken. Everything that occurred after that assignment is a nullity.

Was the mortgage assigned by a company that s no longer in business? Did the originator declare bankruptcy? If so, did the bankruptcy or demise of the firm occur before or safer the assignment? We’ve found a number of assignments where the originator – Accredited, New Century – was in bankruptcy months and years before the date of the assignment. In a Chapter 11 bankruptcy, companies repudiate all their executory contracts, which includes MERS. So, if you have an assignment of mortgage that features a bankrupt originator dated after they filed chapter 11, you could get the assignment declared invalid by a judge. Which of course means the mortgage was never properly assigned to another party. Your mortgage may be a defective instrument and invalid.

Back to the documents from the registry.

Compare the documents from the registry to those you received in the QWR response. Are they the same, or are there notable differences? Record the notations on a document, attach it to the docs and file in your binder.

Examine the signatures on all documents and start googling. Type in signers name, along with keywords like their title, MERS, name of lender, robo-signer. Chances are you will find their signatures on a number of other documents recorded in registries around the country. Carefully examine the signatures – are there notable differences? Is the signer an employee of the company they are purportedly signing for? You can check their Linkedin profiles to verify employment. If their title is Assistant Secretary, MERS, drill down and expand your search. Many times these signers have various titles from different companies. This is important because if you can find evidence they are not who they say they are and don’t work for the company they claim to, you have a fatal defect in the chain of title.

Be sure to examine all ‘Discharges of Mortgages’ in your chain too. We’ve found robo-signers on a number of the discharges. Real estate attorneys tell us this means that the debt has been satisfied, but the lien has not been extinguished. So, you could challenge the current mortgage and file a claim in state court arguing that the current mortgage is no longer in first position.

Lots here that can keep you busy for awhile – at least the next thirty days.

If this sounds too daunting, just take a deep breath and take the first steps of performing the look-ups and sending the QWR letter.

Once you get a response, leave me a message on TBP and I’ll help you make sense of it all.

Remember, this fight is about restoring our property rights and the rule of law.