“You see in this world there’s two kinds of people, my friend. Those with loaded guns, and those who dig. You dig.” – Blondie – The Good, the Bad and the Ugly

“There are two kinds of people in the world, my friend. Those who have a rope around their neck and those who have the job of doing the cutting.” – Tuco – The Good, the Bad and the Ugly

The economic peril that we find ourselves confronted with, has been ninety-eight years in the making. The confluence of debt, demographics, delusion, and denial has left the country at the precipice of annihilation. There are two kinds of people in the world, those who control the money and those that are controlled by those who control the money. The last century has been marked by a methodical looting of the good (working middle class) by the bad (Federal Reserve & bankers) and supported by the ugly (Washington D.C. politicians). When historians pinpoint the year in which the Great American Empire began its downward spiral they will conclude that year to be 1913. In this dark year for the Republic, slimy politicians, at the behest of the biggest bankers in the country, created a private central bank that has since controlled the currency of the United States. This same Congress staked their claim as the most damaging group of politicians in US history by passing the personal income tax in the same year. These two acts unleashed the two headed monster of inflation and taxation on the American people.

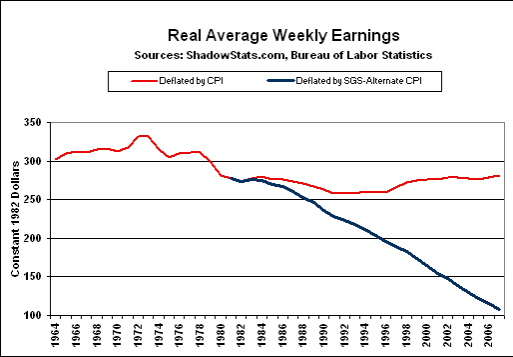

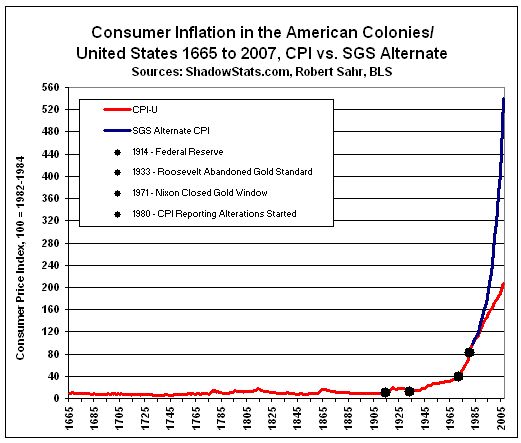

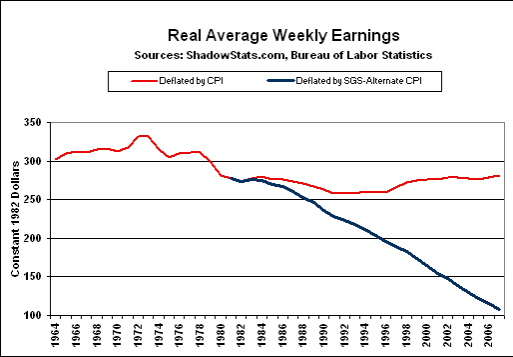

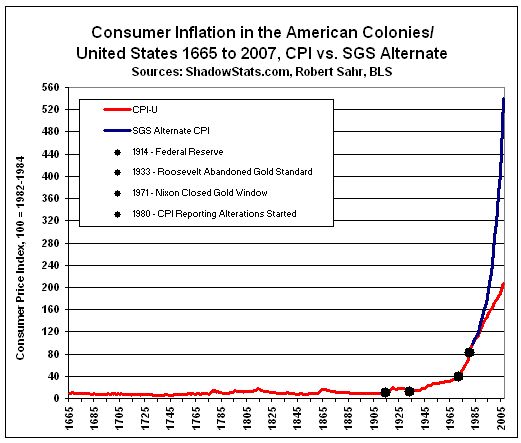

The government began keeping official track of inflation in 1913, the year the Federal Reserve was created. The CPI on January 1, 1914 was 10.0. The CPI on January 1, 2011 was 220.2. This means that a man’s suit that cost $10 in 1913 would cost $220 today, a 2,172% increase in ninety-eight years. This is a 95.6% loss in purchasing power of the dollar. The average American does not understand the insidious nature of central bank created inflation. It makes you think you are wealthier while you are driven into abject poverty. The Federal Reserve and politicians have pulled the wool over your eyes. The CPI was 30.9 in 1964. Today, it is 223.5. This means prices have risen 723% since 1964. The only problem is your wages have not risen at the same rate, even using the government manipulated CPI. Using a true CPI figure, average weekly earnings are 64% below what they were in 1964. This explains why a family of five could live well with one parent working in 1964, but even with both parents working and accumulating debt in prodigious amounts, the average family cannot live as well today.

It is not a coincidence that the percentage of the working age population employed bottomed in 1964 at 59%. The participation rate rose steadily for the next thirty six years, topping out in 2000 at 67.1%. The employment to population ratio also bottomed at 55% in 1964. It rose to 64.4% by 2000. It seems that future historians will mark the year 2000 as the peak of the American Empire. Apologists for the Federal Reserve and politicians who have steered this country since 1964 would argue the increase in the percentage of the population working was a positive development. Nothing could be further from the truth.

The American middle class was forced to send both parents into the workforce just to keep up with the ever declining real weekly earnings. The Federal Reserve created inflation has methodically destroyed the American dream for the middle class. As both parents had to go into the workforce, American children were left to fend for themselves or be raised by strangers in daycare centers. The pressure of trying to keep up with inflation strained families to the breaking point. The number of divorces per thousand marriages was 10 in the early 1960s. It more than doubled to 22.6 by 1980 and still resides at 17 today. There are many factors for the disintegration of the traditional family unit, but the financial strain on families to maintain a consistent standard of living due to relentless inflation has been a key factor.

From the founding of our country there had been constant conflict between corrupt bankers trying to control the currency of the nation to further their own enrichment at the expense of the people and a few courageous leaders willing to fight them. The bankers won the century old battle in 1913.

Den of Vipers & Thieves

“I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the Bank…You are a den of vipers and thieves. I have determined to rout you out and, by the Eternal, I will rout you out.” – Andrew Jackson

The First Bank of the United States was created in 1791. Alexander Hamilton, the 1st Secretary of the Treasury, proposed this bank and convinced a hesitant President Washington to agree. John Adams and Thomas Jefferson were against the concept. It favored the moneyed classes of the North versus the agrarian South. The bank was given a 20 year charter and President James Madison let it expire in 1811. He understood the true nature of the banking interests:

“History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and its issuance”.

Madison had to renew the charter in 1816 as the War of 1812 resulted in large government debts. Politicians always turn to bankers when funding wars and programs to get them re-elected. As usual, once unshackled, the bankers immediately caused a boom through their loose monetary policies. The Bank created a fake boom by 1818 through its reckless lending, which encouraged speculation in land. This lending allowed almost anyone to borrow money and speculate in land, sometimes doubling or even tripling the prices of land (remind you of another time in recent history?). In the summer of 1818, the national bank managers realized the bank’s massive over-extension, and instituted a policy of contraction and the calling in of loans. This recalling of loans simultaneously curtailed land sales and slowed the U.S. production boom due to the recovery of Europe. The result was the Panic of 1819. There was a wave of bankruptcies, bank failures, and bank runs; prices dropped and wide-scale urban unemployment struck the country. By 1819 many Americans did not have enough money to pay off their property loans. Do you see any difference between 1816 – 1819 and 2005 – 2011? Central banks don’t eliminate financial panics, they cause them. Booms and busts have always existed. They have become more common and extreme since the unleashing of greedy corrupt central bankers in the U.S., going back two centuries.

Andrew “Old Hickory” Jackson became President in 1829 and proceeded to declare war on the Second National Bank. He was the first and only President in U.S. history to pay off the National Debt. He worked tirelessly to rescind the charter of the Second Bank of the United States. His reasons for abolishing the bank were:

- It concentrated the nation’s financial strength in a single institution.

- It exposed the government to control by foreign interests.

- It served mainly to make the rich richer.

- It exercised too much control over members of Congress.

- It favored northeastern states over southern and western states.

President Jackson believed that only Congress should be responsible for the issuance and control of the currency. Delegating that duty to powerful New York bankers was distasteful to him:

“If Congress has the right to issue paper money, it was given to them to be used … and not to be delegated to individuals or corporations”

President Jackson vetoed the extension of their bank charter in 1832. He redirected government tax revenue to other state banks. The Second Bank of the United States was left with little money and, in 1836, its charter expired and it turned into an ordinary bank. Five years later, the former Second Bank of the United States went bankrupt. Those who believe that a central bank is essential to economic progress need to examine the “free banking” period from 1837 to 1861. In the last five years of the Second Bank’s existence prices rose by 28%. Over the next 25 years, prices in the U.S. fell by 11%. We experienced the dreaded deflation. Did deflation destroy America? Not quite. GDP grew from $1.5 billion in 1836 to $4.6 billion in 1861. Deflation is only fatal to debtors. Inflation is the friend of lenders and the moneyed classes.

The American Civil War brought about the National Banking Act of 1863, which created a network of national banks. Politicians always need bankers to fight their wars and Abraham Lincoln was no different. By 1870 there were 1,638 national banks. This did not eliminate the booms and busts that punctuate human history, but the booms and busts were not scientifically created by a small cabal of bankers. With thousands of banks, those who made bad lending decisions failed. The economy withstood the periodic panics and continued to grow. The GDP of the U.S. grew from $7.6 billion in 1863 to $39 billion by 1913, with virtually no inflation. The Federal government ran surpluses or very small deficits during this entire time period. These facts refute the argument that a strong central bank was necessary to keep our economic system operating smoothly. It seems the Big Lie was not invented by the Nazis.

Creature from Jekyll Island – Control the Money, Control the Country

“I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. No longer a government by free opinion, no longer a government by conviction and vote of majority, but a government by the opinion and duress of a small group of dominant men.” – President Woodrow Wilson

Any impartial assessment of inflation throughout the history of the United States confirms that from the beginning of our nation through the War of 1812, the Mexican American War, the Civil War, the Spanish American War and the Industrial Revolution, the country experienced virtually no inflation as bankers were kept from controlling the U.S. currency and our legal tender was backed by gold. The creation of the Federal Reserve in 1913 and the closing of the gold window by Richard Nixon in 1971 unleashed a tsunami of inflation that continues to inundate our country today, killing the once prosperous middle class.

The Rothschilds of London understood that a fiat currency system would benefit the few (bankers & politicians) who understood it and the masses would be too ignorant to understand they were being screwed:

“Those few who can understand the system (check book money and credit) will either be so interested in its profits, or so dependent on it favors, that there will be little opposition from that class, while on the other hand, the great body of people mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear it burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.”

The House of Rothschild had been the dominant banking family in Europe for two centuries. They were known for making fortunes during Panics and War. Some claimed they would cause Panics in order to take advantage of those who panicked. American bankers learned the lesson well. The Panic of 1907 was the used as the reason for creating the Federal Reserve. A small cabal of powerful U.S. banking interests understood that if they could control the currency of the U.S., they could control the country, its politicians, and its people.

In 1906, Frank Vanderlip, Vice President of the Rockefeller owned National City Bank, convinced many of New York’s banking establishment they needed a banker-controlled central bank that could serve the nation’s financial system. Up to that time, the House of Morgan had filled that role. JP Morgan had initiated previous panics in order to initiate stronger control over the banking system. Morgan initiated the Panic of 1907 by circulating rumors the Knickerbocker Bank and Trust Co. of America was going broke. There was a run on the banks creating a financial crisis which began to solidify support for a central banking system. During this panic Paul Warburg, a Rothschild associate, wrote an essay called “A Plan for a Modified Central Bank” which called for a Central Bank in which 50% would be owned by the government and 50% by the nation’s banks.

In November 1910 a secret conference took place on Jekyll Island off the coast of Georgia. Those in attendance were: Paul Warburg, Bernard Baruch, Senator Nelson Aldrich, Colonel House, Frank Vanderlip, Benjamin Strong, Charles Norton, Jacob Schiff, and Henry Davison. From this meeting of the most powerful bankers and politicians in the country came the plan for a Central Bank. This conference was unknown until 1933. In 1935, Frank Vanderlip wrote in the Saturday Evening Post: “I do not feel it is any exaggeration to speak of our secret expedition to Jekyll Island as the occasion of the actual conception of what eventually became the Federal Reserve System.”

Behind the scenes these powerful men were formulating the plan for a Federal Reserve System. There was no outcry from the public to implement this plan. The public knew nothing of this. The Aldrich Plan was renamed the Federal Reserve Act and pushed forward by Paul Warburg and Colonel House. Warburg essentially wrote the Act and pressured Congressmen to see his way or lose the next election. Colonel House, who had socialist leanings, was the top advisor to President Wilson.

The Glass Bill (the House version of the final Federal Reserve Act) had passed the House on September 18, 1913 by 287 to 85. On December 19, 1913, the Senate passed their version by a vote of 54-34. More than forty important differences in the House and Senate versions remained to be settled, and the opponents of the bill in both houses of Congress were led to believe that many weeks would elapse before the Conference bill would be taken up. The Congressmen prepared to leave Washington for the annual Christmas recess, assured that the Conference bill would not be brought up until the following year. The creators of the bill then pulled the ultimate swindle on the American public. In a single day, they ironed out all forty of the disputed passages in the bill and quickly brought it to a vote. On Monday, December 22, 1913, the bill was passed by the House 282-60 and the Senate 43-23. This meant that the single most important piece of legislation ever passed by the Senate was missing the votes of 26 Senators because it was passed during the Christmas recess. President Wilson, at the urging of Bernard Baruch, signed the bill on December 23, 1913.

The Road to Hell is Paved by Central Bankers

“Banking was conceived in iniquity, and was born in sin. The Bankers own the Earth. Take it away from them, but leave them the power to create deposits, and with the flick of the pen, they will create enough deposits, to buy it back again. However, take it away from them, and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a happier and better world to live in. But if you wish to remain the slaves of Bankers, and pay the cost of your own slavery, let them continue to create deposits.” – Sir Josiah Stamp (President of the Bank of England in the 1920’s, the second richest man in Britain)

The results speak for themselves. The Federal Reserve has been in existence for ninety eight years and over that time the U.S. Dollar has lost 95.6% of its purchasing power. In other terms, the bankers who have controlled our currency since 1913 have generated 2,172% of inflation in just under a century. In the prior one hundred years, when the country was growing by leaps and bounds, there was virtually no inflation. I’m not sure the average person fully understands this concept. To put it in layman’s terms, something that cost $4.40 in 1913 will cost you $100 today. A pair of boys’ school shoes cost 98 cents in 1913. You could purchase three loaves of bread for 10 cents. You could purchase six rolls of toilet paper for 26 cents. The truly frightening impact on the American middle class has happened since Richard Nixon closed the gold window in 1971 and allowed the Federal Reserve to print money unfettered by consequences and slimy politicians to make irresponsible unfulfilled promises as bribes for votes. This chart should worry even the most ignorant of the masses.

| Items |

1971 |

2010/11 |

% Increase |

| Average Cost of new house |

$28,000 |

$273,000 |

975% |

| Median HH Income |

$10,300 |

$47,000 |

456% |

| Average Monthly Rent |

$150 |

$750 |

500% |

| Cost of a gallon of Gas |

$0.40 |

$3.80 |

950% |

| Average New Car Price |

$3,430 |

$29,200 |

851% |

| United States postage Stamp |

$0.08 |

$0.44 |

550% |

| Movie Ticket |

$1.50 |

$7.89 |

526% |

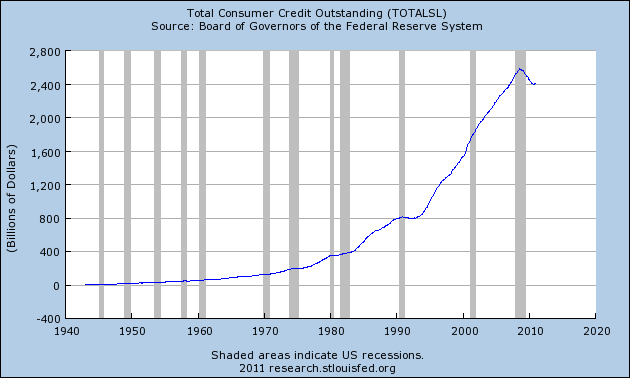

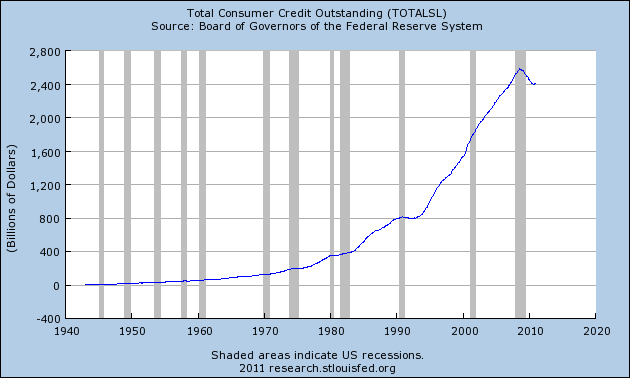

Even with the proliferation of two worker households since 1971, household income has not come close to keeping up with the costs of daily living. The average American’s standard of living has declined dramatically over the last forty years and they don’t even know it. Americans have become the slaves of bankers and pay the cost of their own slavery through inflation and debt. It is not a coincidence that consumer debt, which was virtually non-existent prior to the 1960s, began to take off in the 1970s and went nearly parabolic from the early 1990s until the 2008 financial collapse. As the Federal Reserve and political class created inflation, which reduced your standard of living, the bankers who own the Federal Reserve and control the politicians used their slick marketing machine to convince you that acquiring goods using vast quantities of debt was just as good as buying things with cash you saved.

Who benefits from inflation and the issuance of trillions in debt to average Americans? Based upon the decades of gargantuan Wall Street profits, mammoth bonuses paid to bank executives, and fact that Washington politicians absconded with trillions from American taxpayers to save their Wall Street masters, it appears that bankers and politicians are the beneficiaries. A gutted, indebted, jobless, demoralized middle class were the recipients of the downside of inflation and debt. Without a Central Bank issuing a fiat currency, with no constraints, none of this could have happened.

The Federal Reserve is primarily responsible for the destruction of the American middle class. In 1915, according the Federal Reserve annual report, they operated with 35 total employees. Today, they operate with over 20,000 employees and the cost to operate the system exceeds $3.3 billion. The Federal Reserve has failed on every one of its stated mandates:

- It was created to stabilize the banking system and keep bank panics from occurring. Within sixteen years of its creation it caused the near collapse of the banking system and the Great Depression. The stagflation of the 1970s was caused by Fed policies. The Savings & Loan crisis was created by their policies. The internet bubble, housing bubble and eventual financial collapse were caused by Federal Reserve blunders. There have been 18 recessions since the creation of the Federal Reserve.

- The stable prices mandate has been a wretched failure, as the Fed has manufactured 2,171% of inflation and destroyed 96% of the currency’s purchasing power. This manufactured inflation has enabled the creation of our welfare/warfare state.

- The Federal Reserve mandate of moderate long-term interest rates has clearly not been met. The Fed Funds Rate has plotted a path of extremes over the decades, ranging from 0% to 19%, not exactly stable. The Federal Reserve has consistently set rates too low, leading to credit bubbles, which always pop and end in recession or depression.

- The mandate of maximum employment has also been a miserable failure. The easy credit policy of the Federal Reserve during the 1920s led to the Great Depression with unemployment rates exceeding 20%. Unemployment has averaged between 5% and 15% consistently since the formation of the Federal Reserve. The true unemployment rate today exceeds 15%.

- The Federal Reserve was supposed to supervise and control the activities of banks. Instead, under Alan Greenspan and Ben Bernanke, they stepped aside and let banks take preposterous risks while giving an unspoken assurance that the Fed would clean up any messes they caused with their debt based enrichment schemes. This total dereliction of duty and gross regulatory negligence led the greatest financial collapse in history.

The American working middle class (Good) have been deceived by the Federal Reserve, the banks that control them (Bad) and the Washington DC political class (Ugly) into believing that a fiat currency, un-backed by gold, supported by systematic inflation is beneficial to their wealth. This has been the Big Lie for the last century and has positioned the country for an epic collapse. Presidential candidate Ron Paul has been the lone voice of sanity in Washington DC for the last two decades and his assessment of the Federal Reserve while questioning Ben Bernanke in 2009 needs to be understood by every American:

“The Federal Reserve in collaboration with the giant banks has created the greatest financial crisis the world has ever seen. The foolish notion that unlimited amounts of money and credit created out of thin air can provide sustainable economic growth has delivered this crisis to us. Instead of economic growth and stable prices, (The Fed) has given us a system of government and finance that now threatens the world financial and political institutions. Pursuing the same policy of excessive spending, debt expansion and monetary inflation can only compound the problems that prevent the required corrections. Doubling the money supply didn’t work, quadrupling it won’t work either. Buying up the bad debt of privileged institutions and dumping worthless assets on the American people is morally wrong and economically futile.”

I’ve now completed three parts of the five part series, documenting the downfall of the great American Empire. Part four, Outlaw Josey Wales, will scrutinize the looting of America by a small group of powerful, connected, super rich men lurking in the shadows, but pulling the strings on our puppet politicians. Lastly, Unforgiven will detail the impending collapse of our economic system and the retribution that will be handed out to the guilty.

The smell of revolution is in the air.

Part One – For a Few Dollars More

Part Two – Fistful of Dollars