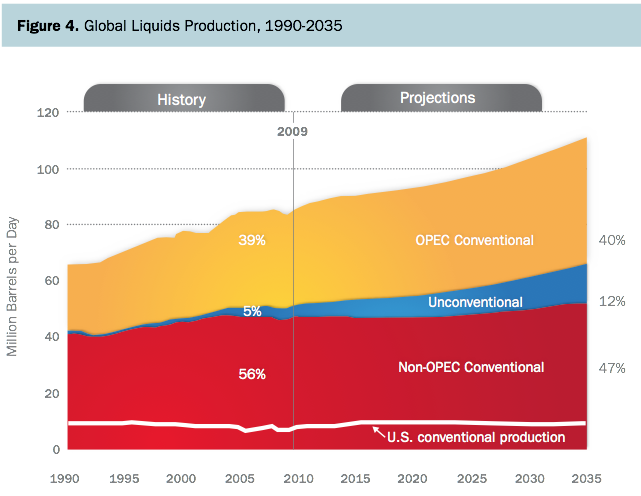

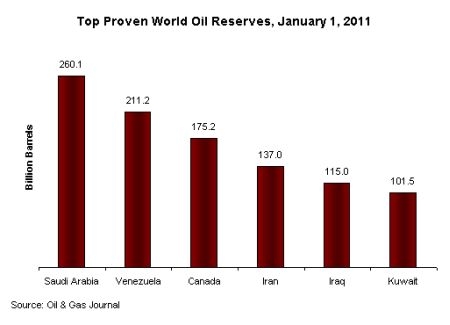

The two articles below reflect the desperate times that lie ahead. Despite the propaganda and misinformation about the wars in the Middle East and in the Ukraine being about terrorism and the noble spreading of democracy, they are solely being fought over energy resources. Iraq has the 5th highest proven oil reserves in the world, behind Saudi Arabia, Venezuela, Canada, and Iran. They have 6 times the reserves of the United States. We aren’t going to war against 30,000 ISIS terrorists. We are protecting “our” oil. The Israeli/U.S. fear mongering and sanctions against Iran are to weaken a country that sits on top of 151 billion barrels of “our” oil. A nuclear Iran could not be invaded without potential dire consequences for the invader.

The war against Syria is about a gas pipeline that Saudi Arabia and Qatar want to build across their land to Europe. This is because Russia has complete control over the fate of Europe with their gas pipelines through the Ukraine. The America/EU engineered overthrow of a democratically elected government in the Ukraine was simply because the president was moving closer to Russia and away from the EU/U.S. alliance. The propaganda about evil Putin and the false flag shooting down of a Malaysian airliner are nothing but chess pieces in the global resource war.

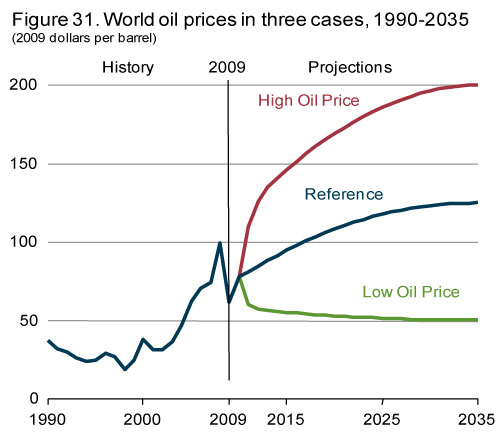

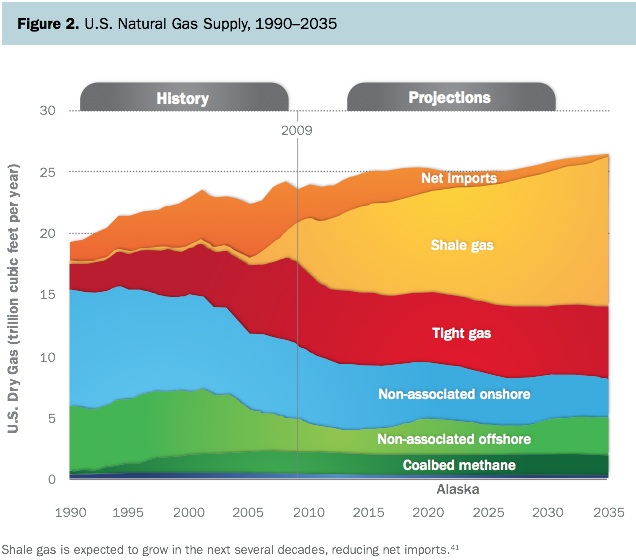

Russia has the 8th highest level of proven oil reserves on the planet. The new discovery in the arctic could up those reserves dramatically. This would really throw a monkey wrench into the U.S./EU plan to try and make Putin bow to their economic pressure. The U.S. leadership knows the shale oil and shale gas “miracle” is essentially a Wall Street engineered fraud that will peak out in the next few years and then decline precipitously. They are desperately seeking a solution, but Russia and China have begun to foil their plans.

The various competing factions and ideologies in the U.S. are setting us up for a nasty turn of events. The neo-cons, military industrial complex, and greenies have blocked all rational methods of expanding the use of safer, cheaper, and smaller nuclear energy technologies. The military like the existing nuclear power plants because they provide the uranium needed for their weapons. Meanwhile the Chinese are treating nuclear power solutions like a Manhattan Project. Obama shuts down coal powered plants, even though we have ample supplies of coal under our feet. While we fiddle, our future burns.

As worldwide peak cheap oil becomes more expensive, the worldwide economy will continue to slow. As the shale boom goes bust, we produce less energy from coal, and our nuclear expansion wallows in cost overruns and bureaucracy, the only option will be war. The oligarch billionaires will use their control of the media and politicians to peddle stories of imminent threats, terrorists, and evil empires, as their excuse to go to war. But the wars will be about energy resources, as they have always been. This Fourth Turning will end with a showdown between the U.S./EU and Russia/China. I have a feeling their won’t be any winners.

“I know not with what weapons World War III will be fought, but World War IV will be fought with sticks and stones.” ― Albert Einstein

Russia Discovers Massive Arctic Oil Field Which May Be Larger Than Gulf Of Mexico

Submitted by Tyler Durden on 09/27/2014 22:30 -0400

In a dramatic stroke of luck for the Kremlin, this morning there is hardly a person in the world who is happier than Russian president Vladimir Putin because overnight state-run run OAO Rosneft announced it has discovered what may be a treasure trove of black oil, one which could boost Russia’s coffers by hundreds of billions if not more, when a vast pool of crude was discovered in the Kara Sea region of the Arctic Ocean, showing the region has the potential to become one of the world’s most important crude-producing areas, arguably bigger than the Gulf Of Mexico. The announcement was made by Igor Sechin, Rosneft’s chief executive officer, who spent two days sailing on a Russian research ship to the drilling rig where the find was unveiled today.

The oil production platform at the Sakhalin-I field in Russia,

partly owned by ONGC Videsh Ltd., Rosneft Oil Co., Exxon Mobil

Corp. and Japan’s Sakhalin Oil and Gas Development Co. on June 9, 2009.

Well, one person who may have been as happy as Putin is the CEO of Exxon Mobil, since the well was discovered with the help of America’s biggest energy company (and second largest by market cap after AAPL). Then again, maybe not: as Bloomberg explains “the well was drilled before the Oct. 10 deadline Exxon was granted by the U.S. government under sanctions barring American companies from working in Russia’s Arctic offshore. Rosneft and Exxon won’t be able to do more drilling, putting the exploration and development of the area on hold despite the find announced today.”

Which means instead of generating billions in E&P revenue, XOM could end up with, well, nothing. And that would be quite a shock to the US company because the unveiled Arctic field may hold about 1 billion barrels of oil and similar geology nearby means the surrounding area may hold more than the U.S. part of the Gulf or Mexico, he said.

For a sense of how big the spoils are we go to another piece by Bloomberg, which tells us that “Universitetskaya, the geological structure being drilled, is the size of the city of Moscow and large enough to contain more than 9 billion barrels, a trove worth more than $900 billion at today’s prices.”

The only way to reach the prospect is a four-day voyage from Murmansk, the largest city north of the Arctic circle. Everything will have to shipped in — workers, supplies, equipment — for a few months of drilling, then evacuated before winter renders the sea icebound. Even in the short Arctic summer, a flotilla is needed to keep drifting ice from the rig.

Sadly, said bonanza may be non-recourse to Exxon after Obama made it quite clear that all western companies will have to wind down operations in Russia or else feel the wrath of the DOJ against sanctions breakers. Which leaves XOM two options: ignore Obama’s orders (something which many have been doing of late), or throw in the towel on what may be the largest oil discovery in years.

And while the Exxon C-suite contemplates its choices, here is some more on today’s finding from Bloomberg:

“It exceeded our expectations,” Sechin said in an interview. This discovery is of “exceptional significance in showing the presence of hydrocarbons in the Arctic.”

The development of Arctic oil reserves, an undertaking that will cost hundreds of billions of dollars and take decades, is one of Putin’s grandest ambitions. As Russia’s existing fields in Siberia run dry, the country needs to develop new reserves as it vies with the U.S. to be the world’s largest oil and gas producer.

Output from the Kara Sea field could begin within five to seven years, Sechin said, adding the field discovered today would be named “Victory.”

Duh.

The Kara Sea well — the most expensive in Russian history — targeted a subsea structure named Universitetskaya and its success has been seen as pivotal to that strategy. The start of drilling, which reached a depth of more than 2,000 meters (6,500 feet), was marked with a ceremony involving Putin and Sechin.

The importance of Arctic drilling was one reason that offshore oil exploration was included in the most recent round of U.S. sanctions. Exxon and Rosneft have a venture to explore millions of acres of the Arctic Ocean.

But what’s worse for Exxon is that now that the hard work is done, Rosneft may not need its Western partner much longer:

“Once the well is plugged, there will be a lot of work to do in interpreting the results and this is probably something that Rosneft can do,” Julian Lee, an oil strategist at Bloomberg First Word in London, said before today’s announcement. “Both parties are probably hoping that by the time they are ready to start the next well the sanctions will have been lifted.”

And here is why there is nothing Exxon would like more than to put all the western sanctions against Moscow in the rearview mirror: “The stakes are high for Exxon, whose $408 billion market valuation makes it the world’s largest energy producer. Russia represents the second-biggest exploration prospect worldwide. The Irving, Texas-based company holds drilling rights across 11.4 million acres in Russia, only eclipsed by its 15.1 million U.S. acres.”

Proving just how major this finding is, and how it may have tipped the balance of power that much more in Russia’s favor is the emergence of paid experts, desperate to talk down the relevance of the Russian discovery:

More drilling and geological analysis will be needed before a reliable estimate can be tallied for the size of the oil resources in the Universitetskaya area and the Russian Arctic as a whole, said Frances Hudson, a global thematic strategist who helps manage $305 billion at Standard Life Investments Ltd. in Edinburgh. Sanctions forbidding U.S. and European cooperation with Russian entities mean that country’s nascent Arctic exploration will be stillborn because Rosneft and its state-controlled sister companies don’t know how to drill in cold offshore conditions alone, she said.

“Extrapolating from a small data sample is perhaps not going to give you the best information,” Hudson said in a telephone interview. “And because of sanctions, it looks like there’s going to be less exploration rather than more.” In addition, the expense and difficulty of operating in such a remote part of the world, where hazards include icebergs and sub-zero temperatures, mean that the developing discoveries may not be economic at today’s oil prices.

Maybe. Then again perhaps the experts’ time is better suited to estimating just how much longer the US shale miracle has left before the US is once again at the mercy of offshore sellers of crude.

In any event one country is sure to have a big smile on its face: China, since today’s finding simply means that as Russia has to ultimately sell the final product to someone, that someone will almost certainly be the Middle Kingdom, which if the “Holy Gas Grail” deal is any indication, will be done at whatever terms Beijing chooses.

Technology revolution in nuclear power could slash costs below coal

A report by UBS said the latest reactors will be obsolete by within 10 to 20 years, yet Britain is locking in prices until 2060

The cost of conventional nuclear power has spiralled to levels that can no longer be justified. All the reactors being built across the world are variants of mid-20th century technology, inherently dirty and dangerous, requiring exorbitant safety controls.

This is a failure of wit and will. Scientists in Britain, France, Canada, the US, China and Japan have already designed better reactors based on molten salt technology that promise to slash costs by half or more, and may even undercut coal. They are much safer, and consume nuclear waste rather than creating more. What stands in the way is a fortress of vested interests.

The World Nuclear Industry Status Report for 2014 found that 49 of the 66 reactors under construction – mostly in Asia – are plagued with delays, and are blowing through their budgets.

Average costs have risen from $1,000 per installed kilowatt to around $8,000/kW over the past decade for new nuclear, which is why Britain could not persuade anybody to build its two reactors at Hinkley Point without fat subsidies and a “strike price” for electricity that is double current levels.

All five new reactors in the US are behind schedule. Finland’s giant EPR reactor at Olkiluoto has been delayed again. It will not be up and running until 2018, nine years late. It was supposed to cost €3.2bn. Analysts now think it will be €8.5bn. It is the same story with France’s Flamanville reactor.

We have reached the end of the road for pressurised water reactors of any kind, whatever new features they boast. The business is not viable – even leaving aside the clean-up costs – and it makes little sense to persist in building them. A report by UBS said the latest reactors will be obsolete by within 10 to 20 years, yet Britain is locking in prices until 2060.

The Alvin Weinberg Foundation in London is tracking seven proposals across the world for molten salt reactors (MSRs) rather than relying on solid uranium fuel. Unlike conventional reactors, these operate at atmospheric pressure. They do not need vast reinforced domes. There is no risk of blowing off the top.

The reactors are more efficient. They burn up 30 times as much of the nuclear fuel and can run off spent fuel. The molten salt is inert so that even if there is a leak, it cools and solidifies. The fission process stops automatically in an accident. There can be no chain-reaction, and therefore no possible disaster along the lines of Chernobyl or Fukushima. That at least is the claim.

The most revolutionary design is by British scientists at Moltex. “I started this three years ago because I was so shocked that EDF was being paid 9.25p per kWh for electricity,” said Ian Scott, the chief inventor. “We believe we can achieve parity with gas (in the UK) at 5.5p, and our real goal is to reach 3.5p and drive coal of out of business,” he said.

The Moltex project can feed off low-grade spent uranium, cleaning up toxic waste in the process. “There are 120 tonnes of purified plutonium from nuclear weapons in Britain. We could burn that up in 10 to 15 years,” he said. What remained would be greatly purified, with a shorter half-life, and could be left safely in salt mines. It does not have to be buried in steel tanks deep underground for 240,000 years. Thereafter the plant could be redesigned to use thorium, a cleaner fuel.

The reactor can be built in factories at low cost. It uses tubes that rest in molten salt, working through a convection process rather than by pumping the material around the reactor. This cuts corrosion. There is minimal risk of leaking deadly cesium or iodine for hundreds of miles around.

Transatomic Power, in Boston, says it can build a “waste-burning reactor” using molten salts in three years, after regulatory approval. The design is based on models built by US physicist Alvin Weinberg at Oak Ridge National Laboratory in the 1960s, but never pursued – some say because the Pentagon wanted the plutonium residue for nuclear warheads.

It would cost $2bn (overnight cost) for a 550-megawatt plant, less than half the Hinkley Point project on a pro-rata basis. Transatomic says it can generate 75 times as much electricity per tonne of uranium as a conventional light-water reactor. The waste would be cut by 95pc, and the worst would be eliminated. It operates in a sub-critical state. If the system overheats, a plug melts at the bottom and salts drain into a cooling basin. Again, these are the claims.

The most advanced project is another Oak Ridge variant designed by Terrestrial’s David LeBlanc, who worked on the original models with Weinberg. It aims to produce power by the early 2020s from small molten salt reactors of up to 300MW, for remote regions and industrial plants. “We think we can take on fossil fuel power on a pure commercial basis. This is a revolution for global energy,” said Simon Irish, the company’s chief executive.

Toronto-based Terrestrial prefers the “dry tinder” of uranium rather than the “wet wood” of thorium, which needs a blowtorch to get started and keep going, typically plutonium 239. But it could use either fuel.

A global race is under way, with the Chinese trying everything at the Shanghai Institute of Nuclear and Applied Physics, reportedly working under “warlike” pressure. They have brought forward their target date for a fully-functioning molten salt reactor – using thorium – from 25 to 10 years.

Ian Scott, at Moltex, originally planned to sell his technology to China, having given up on the West as a lost cause. He was persuaded to stay in Britain, and is talking to ministers. “The first stage will cost around £1bn, to get through the regulatory process and build a prototype. Realistically, only the government can do this,” he said.

A state-venture of such a kind should not be ruled out. The travails of Hinkley Point show that the market cannot or will not deliver nuclear power on tolerable terms. The project has degenerated into a bung for ailing foreign companies. We have had to go along with it as an insurance, because years of drift in energy policy have left us at an acute risk of black-outs in the 2020s.

There is no reason why Britain cannot seize the prize of molten salt reactors, if necessary funded entirely by the government – now able to borrow for 10 years at 2.5pc – and run like a military undertaking. A new Brabazon Committee might not go amiss.

The nation still has world-class physicists. The death of Britain’s own nuclear industry has a silver lining: there are fewer vested interests in the way. We start from scratch. The UK’s “principles-based” philosophy of regulation means that a sudden pivot in technology of this kind could be approved very fast, in contrast to the America’s “rules-based” system. “I would never even think of doing it in the US,” said Dr Scott.

It would be hard to argue that any one of the molten salt technologies would be more expensive than arrays of wind turbines in the Atlantic. Indeed, there is a high likelihood that the best will prove massively cheaply on a kW/hour basis.

Such a project would kickstart Britain’s floundering efforts to rebuild industry. It would offer some hope of plugging a chronic and dangerously high current account deficit, already 5pc of GDP even before North Sea oil and gas fizzles out. It is fracking on steroids for import substitution.

Britain split the atom at the Cavendish Laboratory in Cambridge in 1911. It opened the world’s first commercial reactor at Calder Hall in 1956. Surely it can rise to the challenge once again. If not, let us cheer on the Chinese.