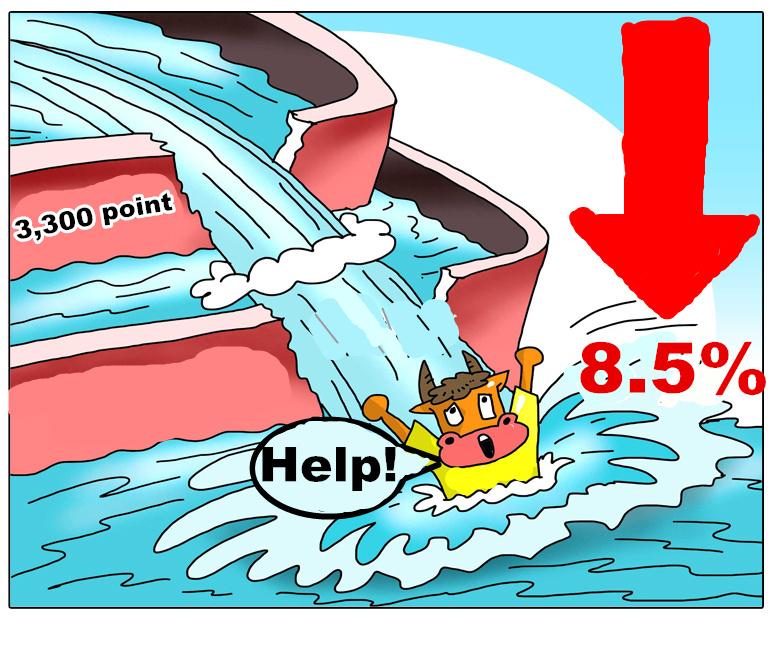

If it looks like a crash, walks like a crash, and talks like a crash, it’s a CRASH. The Chinese stock market crashed by 8.5% last night. An equal level crash in the U.S. would be about 1,400 Dow points. I wonder if that would get Jimmy Cramer’s attention and send the CNBC bimbo spokes models into a tizzy.

The Chinese stock market has fallen 20% in one week and it can’t get up. Fraud, corruption, debt, greed, and now massive amounts of fear have combined for an epic debacle. The reverberations are being felt around the world. Welcome to the Fourth Turning Part Deux.

But don’t you worry. U.S. Stock futures are only down 850 points. That would bring the 5 day loss on the Dow to about 1,900 points, or 11% in one week. Poof!!! Months of ephemeral profits gone in the blink of an HFT supercomputer.

I’m sure the 30 year old Lemmings ( I mean Wall Street investment gurus) have got everything under control. Their HFT super computer algorithms will surely tell them what to do. Here is an actual picture of the Wall Street titans of investing prowess arriving at their trading terminals this morning.

You were warned by smart, honest, upstanding analysts, based on facts and history. If you chose not to listen, tough shit. You deserve what you get. When the market rebounds by 400 or 500 points sometime this week. Don’t think that means this is over. The dramatic bounces always happen during raging bear markets. The path is down. The fat lady hasn’t even warmed up yet.