Via Off-Guardian

Our successor to This Week in the Guardian, This Week in the New Normal is our weekly chart of the progress of autocracy, authoritarianism and economic restructuring around the world.

1. …is a recession good for the planet?

Technically from last week, but more than worthy of note, the Independent headlines that:

Europe and China carbon emissions lowest since Covid lockdown amid economic downturn

Going on to say…

Beijing’s Covid restrictions and high global energy prices are thought to be behind the drop in emissions

So, apparently the “economic downturn” (or global recession, if you’re not interested in twisting words) has a silver lining – lower emissions.

Now, the idea that lockdowns were good for the planet has been peddled before – it wasn’t at all true, but since does that make any difference? – they were laying the groundwork for a “climate lockdown” which has yet to materialise (it is till very much on the agenda, see this article from a few days ago).

But the idea that a recession can be good for the climate because people can’t afford to fuel their cars or heat their homes is both new and very unsettling.

That can easily be parlayed into carbon taxes and so on. Just wait for it.

2. The 30×30 plant: The UN’s eminent domain?

Speaking at the UN’s Ocean Summit this week French President Emmanuel Macron called for either an international ban or some kind of international regulations governing sea-bed mining.

The concept of the United Nations having jurisdiction over the globe, and a responsibility to protect its ecosystems as is bogus as NATO’s claims of a “responsibility to protect” civilians in Libya, Syria or Iraq. It’s all about establishing power and providing pretext.

In 2019, during the (massively exaggerated) Amazon wildfires “crisis”, it suddenly became very trendy to suggest that the rainforest was too important to be a matter of national sovereignty and that an “Amazon treaty” should be established that treated the rainforest as the possession of the entire world.

Such a document would, in essence, be a landgrab on behalf of the United Nations (or whichever acronym agency takes charge, or is formed specially for the purpose).

That plan still exists in the form of the “30×30” initiative, a planned treaty which would see 30% of the sea and 30% of the Earth’s landmass classified as “protected” under UN durisdiction.

Essentially, the treaty would hand immediate control of 30% of the entire planet to the United Nations.

Again, back in the 2019, the Amazon wild fires fuelled talk of a “Climate New World Order”, to quote The Atlantic:

inherited ideas about the sovereignty of states no longer hold in the face of climate change

That’s always the agenda when politicians start talking about the environment.

The draft of the 30×30 treaty is set to be published at the COP15 Biodiversity Summit in Montreal this December. Something to keep an eye on.

3. Monkeypox is apparently still a thing

They really don’t want to just let monkeypox die.

No news yet on the new name, but WHO is warning against “complacency”, the UK is now vaccinating gay men at “high risk” of contracting it, and the media are rolling out new scare stories every day.

Like this one:

Warning early flu wave could join Covid surge and monkeypox outbreak in triple threat

Chilling, isn’t it? Flu AND Covid AND Monkeypox?

Flucoveypox. There’s your new name.

Across the pond, the US’s first “monkeypox case” has finally been “brave” enough to come forward.

He filmed a “confession video” where he warns that disease is super serious and criticises the CDC for not testing enough, which went viral – totally and completely by accident.

Oh, and by chance, he happens to be an actor from Los Angeles.

And if you believe all that, then congratulations you are our millionth visitor this month, click here to claim your prize.

Seriously guys, stop trying to make monkeypox happen…it’s NOT going to happen!

BONUS: Propaganda lesson of the week

The news (especially in the US) has been FULL of opinions on the Supreme Court decisions published in recent days.

You will have heard that they overturned Roe v Wade, handing the power to decide abortion laws back to individual states.

You may have heard that they upheld overruling local gun control laws, claiming they infringed rights granted under the 2nd ammendment.

What you almost definitely didn’t hear about is the decision supporting state vaccine mandates that provide no right to refuse on religious grounds.

Two partisan issues adding fuel to divisive political fires trumpeted widely throughout the media, and one unheralded reinforcement of the state’s power over the individual. Classic.

It’s not all bad…

…right back to vaccine mandates, Biden’s federal vaccine mandate has been blocked by the courts. Again. Of course, since the SCOTUS upheld state-level vaccine mandates, it’s questionable how much this matters, but it’s a win nonetheless.

We covered the Dutch farmers’ protest in a story yesterday, but it deserves a positive mention here too. At least 40 to 50 thousand farmers blocking traffic with tractors, bringing cows into Amsterdam and making themselves heard (or should I say “herd”?). There are half-hearted efforts to paint them as “violent”, but nothing more than yet. Well done to them.

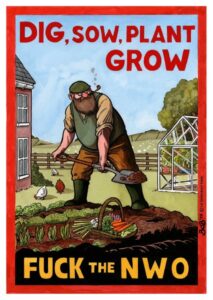

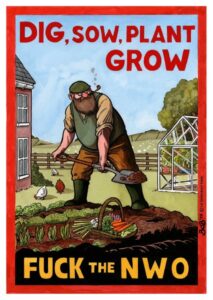

And, given the ongoing war on food, Bob Moran’s latest could not be more apropos…

*

All told a pretty hectic week for the new normal crowd, and we didn’t even mention the ever-present bug-eating propaganda or the gentle rehabilitation of the social credit system.

/107692038-56a9a6ed5f9b58b7d0fdb144.jpg)

)