“The world says: ‘You have needs— satisfy them. You have as much right as the rich and the mighty. Don’t hesitate to satisfy your needs; indeed, expand your needs and demand more.’ This is the worldly doctrine of today. And they believe that this is freedom. The result for the rich is isolation and suicide, for the poor, envy and murder.”

Fyodor Dostoyevsky

“The tyrant is a child of Pride

Who drinks from his sickening cup

Recklessness and vanity,

Until from his high crest headlong

He plummets to the dust of hope.”

Sophocles, Oedipus Rex

“Lo, all our pomp of yesterday

Is one with Nineveh and Tyre!

Judge of the Nations, spare us yet,

Lest we forget, lest we forget!”

Rudyard Kipling

“Show me your ways, O Lord, and teach me your paths.

Lead me in your truth, and teach me: for you are the God of my salvation; and I wait for you all the day.

Remember, O Lord, your tender mercies and loving kindness, as they have ever been of old.”

Psalm 25:4-6

Continue reading “QUOTES OF THE DAY”

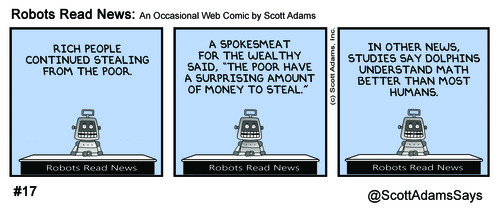

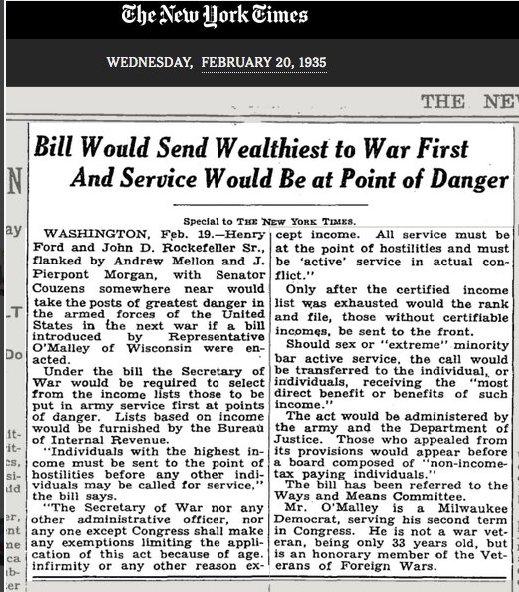

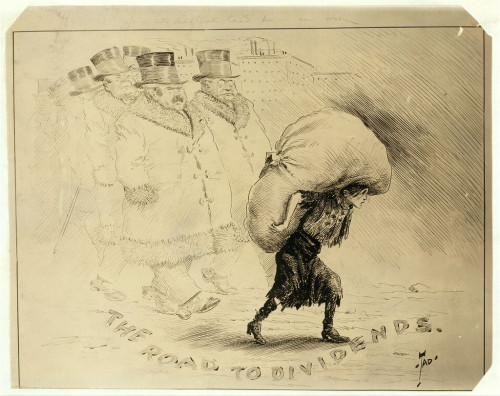

Year after year around tax time, a tired war horse of a story gets trotted out about how the heavily burdened rich already shoulder eighty percent of the tax load. Poor rich. They are oxen doing the heavy pulling to make things easier on the rest of us dumb cows. Thank God we have them!

Year after year around tax time, a tired war horse of a story gets trotted out about how the heavily burdened rich already shoulder eighty percent of the tax load. Poor rich. They are oxen doing the heavy pulling to make things easier on the rest of us dumb cows. Thank God we have them!

From poor to rich and back? Read on …

From poor to rich and back? Read on … Getty Images

Getty Images