“Eyes blinded by the fog of things

cannot see truth.

Ears deafened by the din of things

cannot hear truth.

Brains bewildered by the whirl of things

cannot think truth.

Hearts deadened by the weight of things

cannot feel truth.

Throats choked by the dust of things

cannot speak truth.”

― Harald Bell Wright – The Uncrowned King

I consider myself a seeker of truth. It isn’t easy finding it in todays’ world. In an alternate version of the famous scene from A Few Good Men, I picture myself telling Turbo Tax Timmy Geithner that I want the truth and his angry truthful response:

“Son, we live in a world that has Wall Street banks, and those banks have to be guarded by puppet politicians in Washington D.C. with lobbyist written laws and Madison Avenue PR maggots with media propaganda. Who’s gonna do it? You? You, Representative Paul? I have a greater responsibility than you could possibly fathom. You weep for the average middle class American family, and you curse the ruling oligarchs. You have that luxury. You have the luxury of not knowing what I know. That the death of the American middle class, while tragic, probably saved the bonuses of thousands of Wall Street bankers. And my existence, while grotesque and incomprehensible to you, increases the wealth of these same bankers who destroyed the worldwide economic system in 2008. You don’t want the truth because deep down in places you don’t talk about in the food bank line, you want me on Wall Street, you need me on Wall Street. We use words like derivative, fiscal stimulus, quantitative easing. We use these words as the backbone of a life spent syphoning off the wealth of the nation. You use them as a punch line. I have neither the time nor the inclination to explain myself to a man who rises and sleeps under the blanket of the very debt that I provide, and then questions the manner in which I provide it. I would rather you just said thank you, and went on your way, Otherwise, I suggest you pick up 1000 shares of Apple, and hope our high frequency trading supercomputers can ramp the market for a while longer. Either way, I don’t give a damn what you think you are entitled to.”

I find myself more amazed than ever at the ability of those in power to lie, misinform and obfuscate the truth, while millions of Americans willfully choose to be ignorant of the truth and yearn to be misled. It’s a match made in heaven. Acknowledging the truth of our society’s descent from a country of hard working, self-reliant, charitable, civic minded citizens into the abyss of entitled, dependent, greedy, materialistic consumers is unacceptable to the slave owners and the slaves. We can’t handle the truth because that would require critical thought, hard choices, sacrifice, and dealing with the reality of an unsustainable economic and societal model. It’s much easier to believe the big lies that allow us to sleep at night. The concept of lying to the masses and using propaganda techniques to manipulate and form public opinion really took hold in the 1920s and have been perfected by the powerful ruling elite that control the reins of finance, government and mass media.

Peddlers of Propaganda

“Great is truth, but still greater, from a practical point of view, is silence about truth.” – Aldous Huxley – Brave New World

Adolf Hitler understood the power of the big lie over the ignorant masses who want to believe:

“All this was inspired by the principle–which is quite true within itself–that in the big lie there is always a certain force of credibility; because the broad masses of a nation are always more easily corrupted in the deeper strata of their emotional nature than consciously or voluntarily; and thus in the primitive simplicity of their minds they more readily fall victims to the big lie than the small lie, since they themselves often tell small lies in little matters but would be ashamed to resort to large-scale falsehoods. It would never come into their heads to fabricate colossal untruths, and they would not believe that others could have the impudence to distort the truth so infamously. Even though the facts which prove this to be so may be brought clearly to their minds, they will still doubt and waver and will continue to think that there may be some other explanation. For the grossly impudent lie always leaves traces behind it, even after it has been nailed down, a fact which is known to all expert liars in this world and to all who conspire together in the art of lying.” – Adolf Hitler – Mein Kampf

We are all liars. We lie to friends, family and co-workers. We convince ourselves they are only small lies and just protect others from being hurt. We would rather be lied to than face the blunt truth about our deficiencies, shortcomings and failures. Willfully believing mistruths allows a person to become dependent upon those promulgating the mistruths. It relieves them of their responsibility to act upon the knowledge that something is wrong and must be fixed. It is a cowardly path to ultimate servitude and destruction. The German people chose this path in the 1930s and the American people have chosen a similar and ultimately destructive path today. The United States Office of Strategic Services prepared a psychological profile report during the war describing Adolf Hitler’s method for controlling the minds of the German masses:

“His primary rules were: never allow the public to cool off; never admit a fault or wrong; never concede that there may be some good in your enemy; never leave room for alternatives; never accept blame; concentrate on one enemy at a time and blame him for everything that goes wrong; people will believe a big lie sooner than a little one; and if you repeat it frequently enough people will sooner or later believe it.”

America’s corruptible politicians, greedy corporate chieftains, criminal banking overlords, and despicable media manipulators all learned the sordid lessons of mass propaganda from the masters. Our willingness to lie and be lied to set us up to be manipulated by those who understood the mass psychology of a nation. Goebbels and Hitler were heavily influenced by the father of propaganda – Edward Bernays. He and his disciples are professional poisoners of the public mind, exploiters of public foolishness and ignorance, and never allow truth to interfere with a good story. What master manipulators realized is that it is easier to change the attitude of millions than the attitude of one man. By analyzing and understanding the process and motives of how the group mind works, the invisible government has been able to manipulate and regulate the masses according to their will without the masses knowing they are being managed. Bernays described this elitist view of the world in 1928:

“Those who manipulate the unseen mechanism of society constitute an invisible government which is the true ruling power of our country. We are governed, our minds are molded, our tastes formed, our ideas suggested, largely by men we have never heard of. This is a logical result of the way in which our democratic society is organized. Vast numbers of human beings must cooperate in this manner if they are to live together as a smoothly functioning society. In almost every act of our lives whether in the sphere of politics or business in our social conduct or our ethical thinking, we are dominated by the relatively small number of persons who understand the mental processes and social patterns of the masses. It is they who pull the wires that control the public mind.” – Edward Bernays – Propaganda

The super-rich elite believe they are more intelligent, more capable of managing the affairs of state, masters of the financial world, and chosen to decide what is best for the masses. In reality, they are egocentric, psychotic, power hungry, myopic, self-serving ravenous vultures, feasting upon the carcass of a once great nation. Truth is inconsequential and irritating to their plans for world domination and control. Therefore, no truth will be forthcoming from any organization or person that is associated with the existing political, economic, financial or social order. Every bit of information that is permitted into the public realm has been vetted, manipulated and spun for public consumption. The public does not like bad news. They do not like hard facts. They do not like to think or do math. They want to be spoon fed mindless sound bites and happy talk. The oligarchs need to keep the masses sedated and subservient while they continue to plunder and pillage, so all data is massaged to provide a happy ending.

This is where I deviate from the ideologue one-trick ponies that refuse to see both sides of the issue. The ruling oligarchs are wealthy, influential, psychotic, amoral, and few. The masses are relatively poor, easily influenced, willfully ignorant, and many. The ruling oligarchs are most certainly evil, but the masses are not the hard working, stoic, downtrodden portrayed by liberal ideologues. One just needs to walk down the street in one of our urban enclaves, saunter through a suburban mall, or click on People of Wal-Mart to witness the tattooed, pierced, butt crack showing, slovenly, obese, and ignorant, attached to their electronic iGadgets, to understand how far our society has deteriorated. Every individual born into this world has the capability to become educated, think critically, not follow the herd, live beneath their means, and not be influenced by propaganda. Aldous Huxley understood in 1931 that those in power could use material goods to invoke passivity and egotism among the populace. He feared that truth would be obscured by an avalanche of irrelevance (500 Reality TV shows), cultural trivialities (Lady Gaga, Lindsey Lohan), distractions (Professional sports), and pharmaceutical enhanced escape (Prozac). He saw the possibility that we would grow to love our servitude as the pleasures of life provided by our controllers overwhelmed any desire to think or question authority.

“There will be in the next generation or so a pharmacological method of making people love their servitude and producing dictatorship without tears, so to speak, producing a kind of painless concentration camp for entire societies so that people will in fact have their liberties taken away from them but will rather enjoy it.” ― Aldous Huxley

By 1962 when Huxley wrote his last book, he was certain that his worst dystopian nightmares had been unleashed. His description of Western society fifty years ago could have been written today and accurately reflected our current economic paradigm. War, debt and consumption still make our world go round, but the end is nigh.

“Armaments, universal debt, and planned obsolescence – those are the three pillars of Western prosperity. If war, waste, and moneylenders were abolished, you’d collapse. And while you people are over-consuming the rest of the world sinks more and more deeply into chronic disaster.” – Aldous Huxley – Island

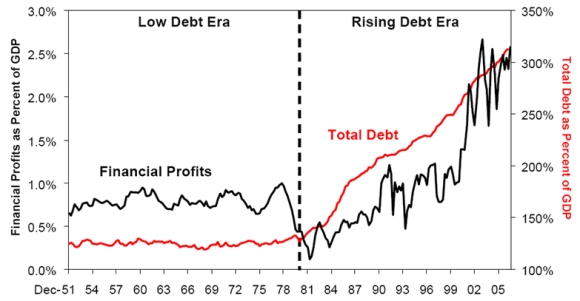

The pillars are crumbling. The $1.4 trillion wasted on two worthless wars of choice in the Middle East, the trillions wasted and liberties sacrificed for the never ending unwinnable War on Terror, the Keynesian spending frenzy that has driven the National Debt from $9 trillion to $16.3 trillion in the last five years, the looting of the American taxpayer by Wall Street and their co-conspirators at the Federal Reserve and in Congress, and the belief that ramping up the debt driven consumption that drives 71% of our GDP is our path to prosperity is absolutely freaking nuts. The pillars will not be abolished willingly. The ruling class depends upon their continued existence and expansion. There is the rub. The math doesn’t work. We’ve reached the point where continued expansion of debt and money printing no longer works. With a national debt to GDP ratio of 102% and a total credit market debt to GDP ratio of 350%, we have passed the Rogoff & Reinhart point of no return. This time is not different. A country cannot run trillion dollar deficits indefinitely and expect to not suffer the consequences. This is why those in power are increasingly resorting to propaganda, data manipulation, and outright lies to convince the masses of their omnipotence and brilliance in managing the fiscal affairs of the state.

“One believes things because one has been conditioned to believe them.” – Aldous Huxley – Brave New World

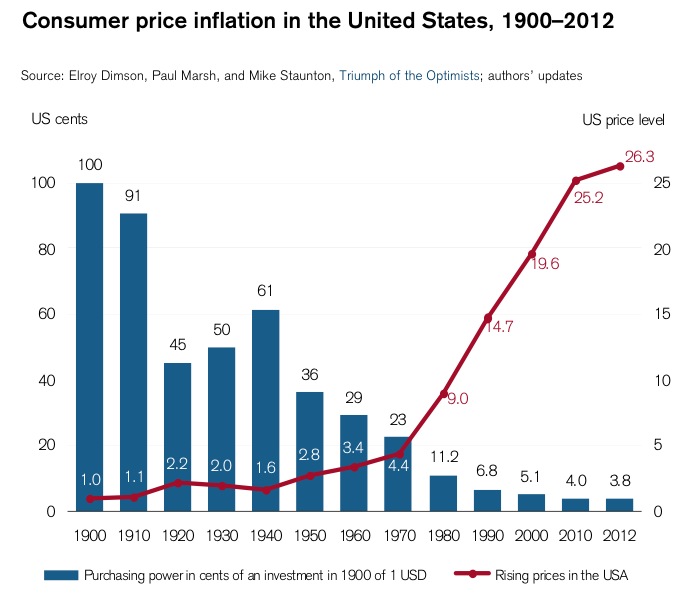

Through decades of mass media messaging the masses have been conditioned to believe whatever those in power want them to believe. To our invisible government rulers we are nothing but rats to be manipulated through food pellets and shock therapy. Pleasure and fear of pain are the drivers of our warped society. The ruling oligarchs truly think they know what is best for the masses and believe any means is worthwhile as long as the ends support their agenda. This is blatantly obvious to anyone with their eyes open and their brain functioning. Sadly, the government run educational system produces mostly drones that are barely able to tie their own shoes, spell Cat, or make change from a one dollar bill. Only 20% of all high school seniors score high enough on the SAT test to get a B minus in college and most of these kids come from private and parochial schools. This is exactly what those in power prefer. They want non-critical thinking, mindless consumers, who don’t understand the criminal nature of Federal Reserve created inflation or their enslavement in the chains of debt at the hands of their Wall Street slave owners. They certainly don’t want the masses to understand that real median household net worth is lower today than it was in 1969. Luckily for the oligarchs, 95% of the public couldn’t define the terms: real, median or net worth. Math is hard.

The average person is inundated on a 24/7 basis with pabulum from liberal network media talking heads, CNBC Wall Street shills regurgitating whatever their sponsors desire, Fox News blonde bimbos and neo-con war mongers programmed to spew Rupert Murdoch talking points, MSNBC tingling leg faux journalists, NYT intellectually corrupt Nobel prize winners, NAR nitwits repeating “best time to buy” on a daily basis for the last 12 years, and government agencies whose sole purpose is to manipulate data in a way that supports the agenda of those in power. The intellectually lazy and willfully ignorant masses are no match for those who control the message and the media. How else can you explain their ability to convince millions of drones to line up for hours in front of a store and stampede like crazed hyenas to grab a $5 crockpot, the Chinese produced gadget of the moment or a designer top made by slave labor in safety conscious Bangladesh factories? How else can you explain a population willing to be molested by government TSA dregs in the name of security from phantom terrorists, the passive acceptance of military exercises in US cities, unquestioning submissiveness as Presidential Executive Orders allow the government dictatorial powers based on their judgment, the monitoring of internet and voice correspondence of all citizens, and believing that FBI agents luring clueless teenage Muslim dupes into fake terrorist plots, providing the fake explosives, and then announcing with great fanfare how they saved us from another 9/11?

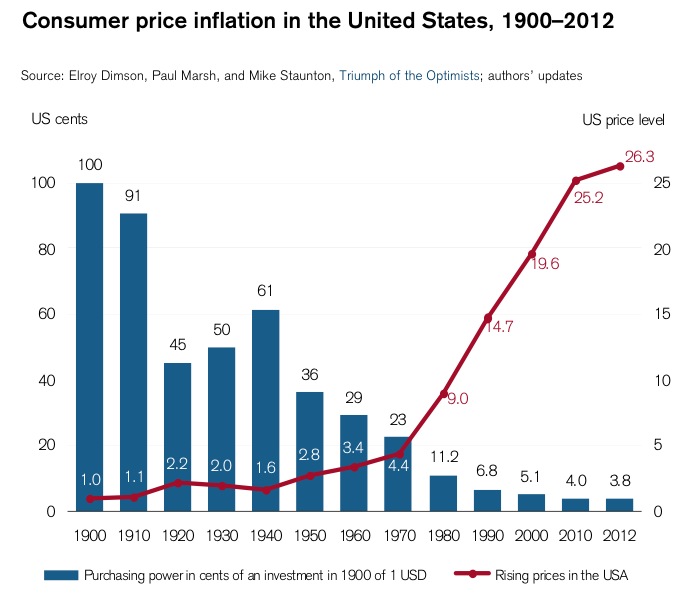

But, the prize for boldest, most outrageous, blatant use of propaganda and misinformation to cover-up their criminal looting of America goes to Ben Bernanke, his cronies at the Federal Reserve, and the Wall Street banks that own and control our Central Bank. Having the gall to portray themselves as the stabilizer of our economic system over the last 100 years is a putrid joke on the dying and broke middle class. Their mandate has been stable prices, full employment, and avoiding financial crisis. It is a tribute to Bernays and the rest of the public relations swine that the average American actually believes inflation is a good thing and it is under control despite the FACT that 96.2% of their purchasing power has disappeared since 1900, with the most rapid decline occurring since Nixon closed the gold window in 1971.

The average American actually believes Ben Bernanke saved us from a Great Depression when in actuality he saved the owners of the Federal Reserve from accepting the losses they generated through the greatest financial fraud in history. His “solutions” have zombified our economic system, just as the Japanese Central Bank did 20 years ago. He has destroyed the concept of saving, while rewarding the indebted and profligate with his QE to Infinity money printing policies. And the ignorant masses have been convinced by the corporate media and their corrupt government lackeys that Ben did this for them. Kyle Bass knows otherwise. He knows how the Fed and their backers have preyed upon the masses through their understanding of human psychology:

“Humans are optimistic by nature. People’s lives are driven by hopes and dreams which are all second derivatives of their innate optimism. Humans also suffer from optimistic biases driven by the first inalienable right of human nature which is self-preservation. It is this reflex mechanism in our cognitive pathways that makes difficult situations hard to reflect and opine on. These biases are extended to economic choices and events. The primary difficulty with this train of thought is the bias that most investors have for the baseline facts: they tend to believe that the central bankers, politicians, and other governmental agencies are omnipotent due to their success in averting a financial meltdown in 2009.

Central banks have become the great enablers of fiscal profligacy. The overarching belief is that there will always be someone or something there to act as the safety net. The safety nets worked so well recently that investors now trust they will be underneath them ad-infinitum. Markets and economists alike now believe that quantitative easing (“QE”) will always “work” by flooding the market with relatively costless capital. Unlimited QE and the zero lower bound (“ZLB”) are likely to bankrupt pension funds whose expected returns happen to be a good 600 basis points (or more) higher than the 10?year “risk-free” rate. The ZLB has many unintended consequences that are impossible to ignore.

Our belief is that markets will eventually take these matters out of the hands of the central bankers. These events will happen with such rapidity that policy makers won’t be able to react fast enough. The fallacy of the belief that countries that print their own currency are immune to sovereign crisis will be disproven in the coming months and years. Trillions of dollars of debts will be restructured and millions of financially prudent savers will lose large percentages of their real purchasing power at exactly the wrong time in their lives. Again, the world will not end, but the social fabric of the profligate nations will be stretched and in some cases torn. Sadly, looking back through economic history, all too often war is the manifestation of simple economic entropy played to its logical conclusion. We believe that war is an inevitable consequence of the current global economic situation.” – Kyle Bass

What’s Normal in a Profoundly Abnormal Society?

“The real hopeless victims of mental illness are to be found among those who appear to be most normal. Many of them are normal because they are so well adjusted to our mode of existence, because their human voice has been silenced so early in their lives, that they do not even struggle or suffer or develop symptoms as the neurotic does.” They are normal not in what may be called the absolute sense of the word; they are normal only in relation to a profoundly abnormal society. Their perfect adjustment to that abnormal society is a measure of their mental sickness. These millions of abnormally normal people, living without fuss in a society to which, if they were fully human beings, they ought not to be adjusted.” – Aldous Huxley – Brave New World Revisited

No sane person could honestly say that what has happened to our society over the last forty years, and particularly in the last five years, is normal. But somehow those in power have convinced the masses that $1.2 trillion deficits, 0% interest rates, declining real wages, the highest average gas prices in history, pre-emptive wars, policing the world and buying rubber dog shit produced in China with a credit card is normal and beneficial to our economy. It seems that I and a few million other people in this country are the abnormal ones. We choose not to be led to slaughter by our masters. The seekers of truth have turned to the alternative media and are able to connect with like-minded critical thinking individuals on websites like Zero Hedge, Jesse’s Americain Café, Of Two Minds, Mish, Financial Sense, among many other truth seeking blogs. This is dangerous to the powers that be and they are using their political clout and extreme wealth to try and lock down and control free speech on the internet. If this is accomplished all hope at disseminating truth will be lost.

Abraham Lincoln once said that he believed in the people and that if you told them the truth and gave them the cold hard facts they would meet any crisis. That may have been true in 1860, but not today. The cold hard facts are available for all to see:

- A $16.3 trillion National Debt

- 47 million people on food stamps

- Over $222 trillion of unfunded Federal entitlement liabilities

- Over $5 trillion of unfunded State entitlement liabilities

- True unemployment above 20%.

- True inflation above 5%.

- A stock market at the same level as 1999, with a 10 year expected annual return of less than 4% – Stocks for the really, really long run. 10 year bond returns of 0% will be a miracle.

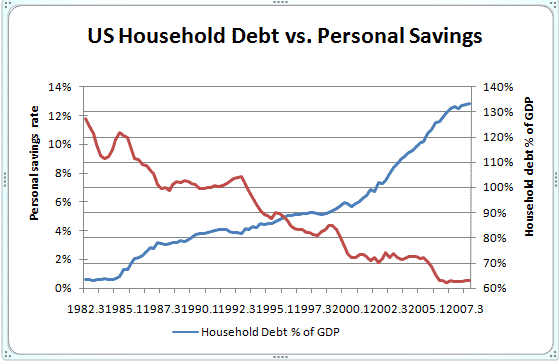

- A savings rate of 3.7% and with Bernanke’s ZIRP, no incentive to save. Real hourly earnings continue to fall.

- Baby Boomers within 10 years of retirement have saved an average of only $78,000, and more than a third of them have less than $25,000. More than half of U.S. workers have no retirement plan at all.

- A crumbling, decaying infrastructure, with 150,000 structurally deficient bridges, bursting water mains, and an overstressed electrical grid.

- Horrific government public education producing millions of low functioning morons.

- Rotting social fabric, with 40% of children born out of wedlock (72% of black children) and a 50% divorce rate.

- An energy policy based upon unicorns farting rainbows and press releases about green energy and the miracle of shale fracking, as average gas prices in 2012 and 2011 were the highest in U.S. history.

As the pitiful excuses for statesmen in Washington D.C. pander and posture about the dreaded fiscal cliff which was purposely created by the oligarchs as a show for the masses, none of the true issues above are being addressed. The dramatic compromise that will ultimately be reached between the equally corrupt parties will be hailed by the corporate media and Wall Street shysters and an HFT supercomputer engineered stock market rally will ensue. The cowardice of these politicians is revolting. As Huxley knew in 1958, politicians and propagandists prefer nonsense and storylines to truth, knowledge and honesty.

“Human beings act in a great variety of irrational ways, but all of them seem to be capable, if given a fair chance, of making a reasonable choice in the light of available evidence. Democratic institutions can be made to work only if all concerned do their best to impart knowledge and to encourage rationality. But today, in the world’s most powerful democracy, the politicians and the propagandists prefer to make nonsense of democratic procedures by appealing almost exclusively to the ignorance and irrationality of the electors.” – Aldous Huxley – Brave New World Revisited

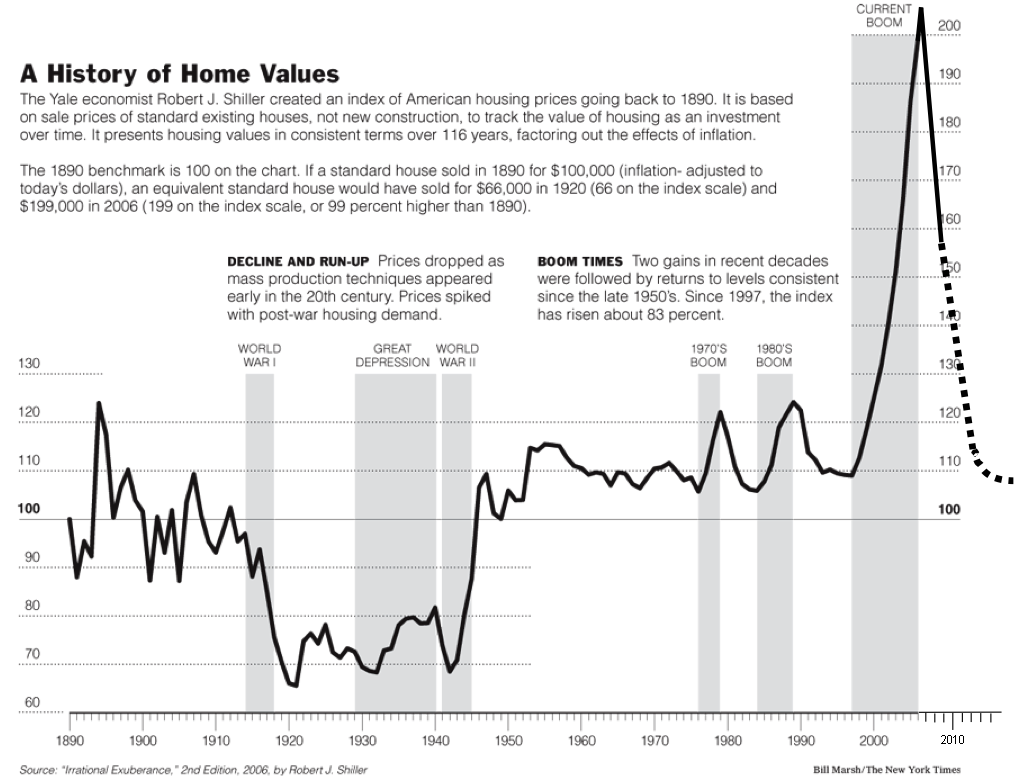

We want to be lied to because the truth is too painful. Hope and denial with a dash of delusion is the recipe the mindless masses prefer. The average person doesn’t want to understand the chart below. They want to believe the U.S. will dominate economically and lead the world for decades to come. We are still the bright shining beacon of democracy on the mountaintop. Even though the facts unequivocally reveal a declining empire, the masses desperately grasp at straws in the wind. The United States share of world GDP will be vastly lower in 2021, as the hubris of declining empires never allows them to take the necessary steps to reverse the decline (Rome, Great Britain).

It is fitting that during this magical Christmas season of fantasy, delusion, debt fueled material over-consumption and fairy tales, we look at the biggest fairy tale of all – the great jobs recovery. I know from the two thousand Obama campaign commercials I was forced to watch in the last few months and 500 robo-calls at dinner every night that we’ve added 4 million jobs due to Obama’s wise economic policies. The magical journey from a 10.3% unemployment rate to a 7.9% rate is a humdinger. I stumbled across a myriad of charts on those truth-telling websites that I had previously mentioned.

“You shall know the truth and the truth shall make you mad.” ― Aldous Huxley

The first chart that grabbed my attention shows the historical relationship between the U3 unemployment rate reported to the masses versus the U6 truer picture of unemployment, along with the percentage of people unemployed for longer than 15 weeks. A funny thing happened shortly after the election of Barack Obama. From 1994 through 2008 the gap between the U3 and U6 rates consistently ranged between 3% and 4%. Suddenly, the gap surged to 7% and currently sits at almost 8%. The figure reported to the masses of 7.9% is so much easier to digest than the 15% to 17% that captures the truer level of unemployment. If the gap between these two figures had remained at the levels of the previous 14 years, the unemployment that should be reported to the masses would be 11%. That is unacceptable to those in power, so the data is massaged and the propaganda machine spins the storyline necessary to confuse and mislead the masses.

The next two charts from Mike Shedlock again reveal truths the existing social order doesn’t want you to know. Even though the working age population has grown by 10 million people since 2008, the BLS expects critical thinking people to believe the labor force has only grown by 1.3 million people. You see, the unemployment rate is calculated using the labor force. If your economic policies don’t create jobs, just adjust the labor force dramatically lower based on nothing. In desperate economic times, people do not voluntarily leave the workforce. Only a non-thinking drone would believe that 8.7 million Americans voluntarily left the workforce since 2008, when only 4 million left the workforce from 2003 through 2007. It is not a coincidence that student loan debt, which was taken over by the Obama administration in 2009 rose by $300 billion. Those in power have doled out these billions with no concern for credit risk or academic credentials in order to reduce the number of people in the labor force. Unemployed union Twinkie workers seeking a new career in lesbian studies can get a $20,000 loan from the American taxpayer to sit in their basement along with the 500,000 other University of Phoenix enrollees. The future $300 billion taxpayer bailout was worth it to keep the unemployment rate low enough to insure Obama’s re-election.

The Obama PR machine never fails to expound upon the fact that the economy added 4.9 million jobs since January 2009. In the same timeframe, uncovered employment rose by 6.6 million. Inquiring minds might want to know what an “uncovered” job entails. Selling your accumulated Chinese crap on Ebay is an uncovered job. Calling yourself a consultant while sleeping until noon is an uncovered job. Day trading Facebook and Apple stock is an uncovered job. Trash picking is an uncovered job. The truth is that real jobs are 1.7 million lower than they were at the depths of the recession, while bullshit jobs paying virtually nothing and offering no benefits have surged by 6.6 million. These facts don’t make a great campaign commercial. The number of employed Americans is at the same level as mid-2005, even though the working age population has grown by 18 million. Since 2008 there are 3 million less full-time jobs and 3 more part-time jobs. This trend is accelerating as small businesses react rationally to the oncoming Obamacare train, resulting in aggregate work hours declining and wage growth stagnating.

Zero Hedge reveals more truth about our glorious jobs recovery with the following two charts. They obliterate the false narrative spun by liberal ideologues that the reason for the increase of those not in the labor force is due to Baby Boomers retiring. The truth is that while those in the 55-69 age brackets have gained nearly 4 million jobs under President Obama, everyone else has lost just over 2.5 million jobs. Is this a positive development or a sign of extreme desperation among older Americans who have seen their interest income vaporized by Ben Bernanke and there food, energy, and healthcare expenses skyrocket?

Those in their prime earning years of 25 to 54 still have a net cumulative loss of 2.2 million jobs since 2009. Recent college graduates, with their billions of student loan debt, have nabbed 400,000 TGI Fridays jobs, singing happy birthday to 3 year olds, with their newly minted college degrees. This is the “normal” healthy jobs market sold to the American public by the propagandists and politicians.

The final jobs chart that portrays the truth of what has been a decades’ long spiral downward paints a picture of a country that once created wealth through producing goods from the 1940s through 1970. Since 1970 we’ve degenerated into a debt creating country that consumes foreign produced goods and makes entitlement promises it can never keep. Selling houses to each other, peddling crap on Ebay, and eating out three times a week has shockingly failed to propel our economy. The jobs picture has deteriorated rapidly since 2008 and is not improving, despite the best propaganda money can buy. There is absolutely no chance of any substantive improvement over the next four years based on the policies in place and refusal to acknowledge the economic realities that we face.

The accumulation of material possessions through the use of consumer debt, peddled by bankers and reinforced through relentless corporate marketing propaganda has left the country’s citizens weary, miserable, greedy, indebted and sick. Our obsession with technology has merely provided another means of distracting ourselves from confronting the dire challenges that must be addressed. We can ignore the facts but that doesn’t mean they do not exist. The abnormality that grips this nation is breathtaking to behold, as the status quo cheer on and encourage consumers to buy more things with money they don’t have in order to support an economic recovery that is dependent upon zero interest rates for Wall Street banks, QE to infinity, and the delusional desire for a miraculous return to the good old days when getting something for nothing was possible. We can no longer deny reality. If we want to add 30 million people to Medicaid, it must be paid for. If we want to wage never ending wars and police the world, it must be paid for. If we want a Federal government to spend $3.8 trillion per year, it must be paid for. Nothing is free in this world, but more than 50% of Americans seem to believe that to be true.

“Our economy is based on spending billions to persuade people that happiness is buying things, and then insisting that the only way to have a viable economy is to make things for people to buy so they’ll have jobs and get enough money to buy things.” – Philip Elliot Slater

We are seen by those in control as nothing more than common house flies caught in their web of lies. Your owners don’t care about you. They only care about their own wealth and power. They want to control and manipulate you. They want to keep you enslaved in debt and running on the treadmill of consumption. They want passive, non-critical thinking drones to do the menial service jobs that remain in this country, while they use their control of our financial, political, tax, and legal systems to ransack and pillage the wealth of the dwindling middle class. The truth is the continuation of our current economic system is mathematically impossible. Your owners know this. This is why the use of propaganda, misinformation, fake data, and false storylines has taken on astronomical proportions. The time for passivity and accepting the deceitfulness of our leaders is coming to an end. While you’re waiting in line this Christmas season at Wal-Mart to purchase a fabulously priced shirt that only required the deaths of 112 Bangladesh slave laborers, try to figure out how we got here. Your owners think they have you by the balls.

“They spend billions of dollars every year lobbying to get what they want. Well, we know what they want; they want more for themselves and less for everybody else. But I’ll tell you what they don’t want—they don’t want a population of citizens capable of critical thinking. They don’t want well informed, well educated people capable of critical thinking. They’re not interested in that. That doesn’t help them. That’s against their interest. You know something, they don’t want people that are smart enough to sit around their kitchen table and figure out how badly they’re getting fucked by a system that threw them overboard 30 fucking years ago. Because the owners of this country know the truth, it’s called the American Dream, because you have to be asleep to believe it.” – George Carlin

How many Americans are awake enough to handle the truth?

All I want for Christmas is the truth.