It was bad enough when my local Wal-Mart had aisle upon aisle of Halloween candy available in early August. How many bags of Halloween candy purchased in August or September will really make it to Halloween night? With the land whales roaming the countryside today, I’d reckon NONE. The desperation of American retailers to siphon every ounce of possible profit from the ignorant masses is palpable as you observe retail outlets today. Kohl’s sends out 30% coupons on a weekly basis and when you go to the store, it is virtually empty with dozens and dozens of overstock racks with clothes 60%, 70% and 80% off, before even using the 30% coupon. You can smell the decay.

On Sunday morning while doing my weekly 7:00 am (before the People of Wal-Mart awake and remove their sleep apnea machines) trek to Wal-Mart for paper goods, prepping supplies, and a few other miscellaneous items, I turned my head toward the outdoor department and to my utter amazement saw Christmas trees, decorations, and other assorted Christmas crap already overflowing from that department. I thought to myself WTF!!! It is still 80 degrees outside. I was wearing shorts and flip flops. Halloween is still over a month away. Sure signs of desperation from the biggest retailer in the world.

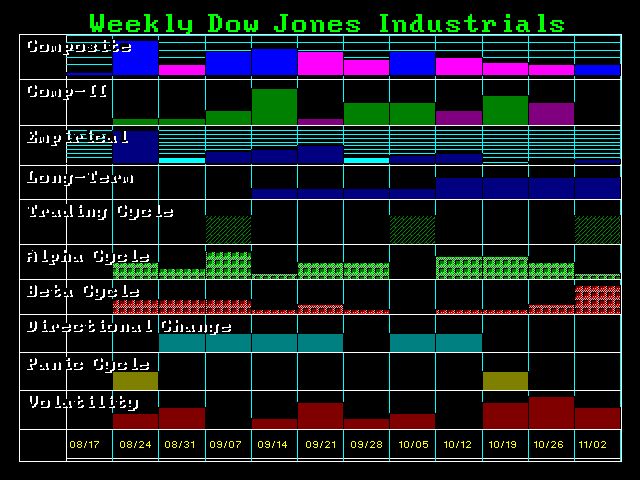

The retail pain has only just begun. As this recession gathers strength, job losses build, and the stock market crashes, the number of retail outlets that will close will be beyond comprehension. Retail CEOs have been living in a delusional world where they think the consumer will be coming back. That delusion is going to be shattered into a million pieces. Wal-Mart might as well sell their Chinese made Christmas crap all year long. It won’t do a bit of good.