Tag: taxpayers

10 YEARS LATER – NO LESSONS LEARNED

“A variety of investors provided capital to financial companies, with which they made irresponsible loans and took excessive risks. These activities resulted in real losses, which have largely wiped out the shareholder equity of the companies. But behind that shareholder equity is bondholder money, and so much of it that neither depositors of the institution nor the public ever need to take a penny of losses. Citigroup, for example, has $2 trillion in assets, but also has $600 billion owed to its own bondholders. From an ethical perspective, the lenders who took the risk to finance the activities of these companies are the ones that should directly bear the cost of the losses.” – John Hussman – May 2009

This month marks the 10th anniversary of the Wall Street/Fed/Treasury created financial disaster of 2008/2009. What should have happened was an orderly liquidation of the criminal Wall Street banks who committed the greatest control fraud in world history and the disposition of their good assets to non-criminal banks who did not recklessly leverage their assets by 30 to 1, while fraudulently issuing worthless loans to deadbeats and criminals. But we know that did not happen.

You, the taxpayer, bailed the criminal bankers out and have been screwed for the last decade with negative real interest rates and stagnant real wages, while the Wall Street scum have raked in risk free billions in profits provided by their captured puppets at the Federal Reserve. The criminal CEOs and their executive teams of henchmen have rewarded themselves with billions in bonuses while risk averse grandmas “earn” .10% on their money market accounts while acquiring a taste for Fancy Feast savory salmon cat food.

JOE TAXPAYER

A BANKER’S LIFE

WHAT IF ONLY TAXPAYERS VOTED?

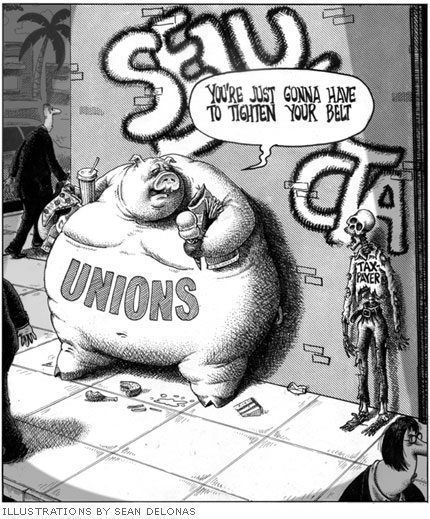

GOVERNMENT UNIONS vs TAXPAYER

Shocking Statistic: Over 40% Of Student Borrowers Don’t Make Payments

It’s funny how the faux journalists at the WSJ do an article about this a month after I already ripped apart the Obama lies.

http://www.theburningplatform.com/2016/03/19/the-great-student-loan-scam/

Submitted by Mike “Mish” Shedlock of MishTalk

Department of Education Wonders “Why 40% of Student Borrowers Don’t Make Payments”; Blame Bush (Seriously)!

Over 40 percent of those in student loan programs have stopped making payments. Many borrowers have never made any payments.

The department of education (a useless body that I would eliminate in one second if given the chance), cannot figure out why this is happening.

“We obviously have not cracked that nut but we want to keep working on it,” said Ted Mitchell, the Education Department’s under secretary.

The Wall Street Journal reports More Than 40% of Student Borrowers Aren’t Making Payments.

More than 40% of Americans who borrowed from the government’s main student-loan program aren’t making payments or are behind on more than $200 billion owed, raising worries that millions of them may never repay.

While most have since left school and joined the workforce, 43% of the roughly 22 million Americans with federal student loans weren’t making payments as of Jan. 1, according to a quarterly snapshot of the Education Department’s $1.2 trillion student-loan portfolio.

About 1 in 6 borrowers, or 3.6 million, were in default on $56 billion in student debt, meaning they had gone at least a year without making a payment. Three million more owing roughly $66 billion were at least a month behind.

Meantime, another three million owing almost $110 billion were in “forbearance” or “deferment,” meaning they had received permission to temporarily halt payments due to a financial emergency, such as unemployment. The figures exclude borrowers still in school and those with government-guaranteed private loans.

Navient Corp. , which services student loans and offers payment plans tied to income, says it attempts to reach each borrower on average 230 to 300 times—through letters, emails, calls and text messages—in the year leading up to his or her default. Ninety percent of those borrowers, which include federal borrowers as well as those who hold private loans, never respond and more than half never make a single payment before they default, the company says.

Crisis Easy to Explain

Continue reading “Shocking Statistic: Over 40% Of Student Borrowers Don’t Make Payments”

Happy New Year — Bail-In Passed for Europe’s Banks

The mainstream media is not extensively reporting on the “experimental” bail-in that the EU imposed on Cyrus. The bail-in, that they swore would never be applied to Europe, will officially begin in January. This new power will be in the interest of taxpayers as they will no longer be forced to pay for failed banks that were created by the childish structure of the euro that was created by lawyers who never understood the economy. But wait a minute — aren’t taxpayers the people with deposits in banks? Hm. Moving to electronic money is also about preventing bank runs. The bottom-line here is that they will just take your money to save bankers. Eliminating cash accomplishes two things: (1) they get to tax everything, and (2) you cannot withdraw money from banks.

The bail-in directive was agreed upon on January 1, 2015, and the bail-in system will take effect on January 1, 2016. So here we are, just in case you missed this one. Their website states:

Parliament and Council Presidency negotiators reached a political agreement Wednesday on the draft bank recovery and resolution directive, the first step towards setting up an EU system to deal with struggling banks. This directive will introduce the “bail-in” principle by January 2016, thereby ensuring that taxpayers will not be first in line to pay for bank failures.

Continue reading “Happy New Year — Bail-In Passed for Europe’s Banks”

THANKSTAKING

National Oceanic and Atmospheric Administration Will Not Release Documents To Prove Global Warming

National Oceanic and Atmospheric Administration (NOAA) has been subpoenaed to turn over its documentation to prove global warming and they are REFUSING to show the data. They are claiming confidentiality when it is taxpayer money that funds them. How can this be confidential?

Government Gives Away Billions In Grants To Students Who Never Graduate

Submitted by Tyler Durden on 08/23/2015 17:10 -0400

In “Who Is Stoking The Trillion Dollar Student Debt Bubble?,” we highlighted the rather disconcerting fact that in 2014, the US government gave out some $16 billion in loans to students attending colleges that graduated fewer than a third of their students after six years.

As WSJ suggested, accrediting agencies are part of the problem. “One problem may be that the accreditation game suffers from similar conflicts of interest as those which caused ratings agencies like Moody’s and S&P to rate subprime-ridden MBS triple-A in the lead-up to the crisis,” we argued.

In the end, the disbursal of billions in federal aid to students attending schools where they’re unlikely to graduate is, like lending to students that attend for-profit colleges that the government is fully aware will likely one day be shut down, just another example of the misappropriation of taxpayer funds.

Well, if you needed further evidence of this, look no further than the Pell grant program.

As NBC reminds us, “Pell grants are given to low-income families and, unlike student loans, do not need to be paid back – [they] are the costliest education initiative in the nation.”

Continue reading “Government Gives Away Billions In Grants To Students Who Never Graduate”

FEEL GOOD STORY OF THE DAY: A family in public housing makes $498,000 a year

This doesn’t even take into account the hundreds of thousands of people in Section 8 housing who are “earning” money under the table and not reporting it to the IRS. Then there are the additional “tenants” who pay to live there, which is also not reported. This article is only the tip of the iceberg.

A public housing project in Brooklyn. (Reuters/Lucas Jackson/File)

A family of four in New York City makes $497,911 a year but pays $1,574 a month to live in public housing in a three-bedroom apartment subsidized by taxpayers.

In Los Angeles, a family of five that’s lived in public housing since 1974 made $204,784 last year but paid $1,091 for a four-bedroom apartment. And a tenant with assets worth $1.6 million — including stocks, real estate and retirement accounts — last year paid $300 for a one-bedroom apartment in public housing in Oxford, Neb.

In a new report, the watchdog for the Department of Housing and Urban Development describes these and more than 25,000 other “over income” families earning more than the maximum income for government-subsidized housing as an “egregious” abuse of the system. While the family in New York with an annual income of almost $500,000 raked in $790,500 in rental income on its real estate holdings in recent years, more than 300,000 families that really qualify for public housing lingered on waiting lists, auditors found.

(HUD Office of Inspector General)

Continue reading “FEEL GOOD STORY OF THE DAY: A family in public housing makes $498,000 a year”

BANKERS ARE OK

WE’RE HUNTING TAXPAYWERS

Hunt for Taxes Target Corporations

The world economy is imploding faster than anyone suspects. Governments cannot get it through their thick skulls that they consume money – they do not create economic growth. The higher the tax burden, the less disposable income, and the lower economic growth be it individuals or corporations. The difference is capital can flee, labor cannot. That is changing with FATCA. They are hunting global capital but in the process they are wiping out international commerce. The NSA has contributed by now inspiring others to replace US technology because American companies have been compromised. All of this bodes very badly for the future post 2015.

CHRIS CHRISTIE – JUST MISSED BY THAT MUCH

If you build something in the real world and you project $560 million of annual revenue from your $2.4 billion investment, and you actually generate $200 million of revenue, you get fired. When you are the governor of New Jersey and you’ve handed out $261 million of taxpayer dollars to the fuckwads running this joint, you get re-elected to another term and get selected to make the keynote address at the Republican Convention. Christie also promised 5,000 NEW FULL-TIME jobs for Atlantic City and the Revel actually has 2,780 full time employees. So Christie’s promises were only off by 64% on revenue and 44% on number of jobs.

This is the Republican method of less government in your lives. It actually means less money in your pocket. This albatross will not be able to make its loan payments in the next year. It will declare bankruptcy. It will be a vacant rotting hulk that should be renamed Christie’s Delusion as a tribute to his brilliance in picking winners.

Down on its luck: Revel jobs, revenue falling below projections

Published: Thursday, August 16, 2012, 6:24 AM Updated: Thursday, August 16, 2012, 6:24 AM

By Jarrett Renshaw and Salvador Rizzo/Statehouse Bureau

The fledgling Revel casino and resort hotel is generating much less gaming revenue and fewer full-time jobs than the Christie administration expected when it showered the new Atlantic City venture with a $261 million tax incentive package last year, state records show.

The shiny $2.4 billion resort, acclaimed for its beauty and amenities, is on pace to take in $200 million in gaming revenue during its first 12 months of operation, according to a Star-Ledger analysis of records filed with Economic Develeopment Authority and the state Division of Gaming Enforcement.

That would mean Revel will fall roughly $360 million short of what the Christie administration banked on when it agreed to help salvage the project last year.

Comparatively, the highest-grossing casino in the city, Borgata Hotel Casino and Spa, took in $651 million in gaming revenue last year, according to annual revenue figures compiled by Gaming Enforcement.

Maureen Siman, a Revel spokeswoman, said the initiall estimate of $560 million doesn’t apply to the first nine months, but to the first full calendar year, or 2013. She noted there are already signs of a turnaround, citing a 17 percent uptick in gaming revenue and a 21 percent jump in the occupancy rate last month.

Siman said too much importance is being attached of the weak gaming revenue figures, saying the resort aspires to be more than just a slot shop, but also a global tourist destination. “Our revenue and profit is driven in large part by non-gaming sources rather than just the gaming-centric model which has unfortunately been the focus for Atlantic City, at least historically,” Siman wrote in an email.

But gaming analysts say the property’s financial problems are real. They say the casino is not taking enough cash from its slot machines and table games to keep up with monthly debt payments, setting off concerns among industry watchers of an untimely bankruptcy

“Look, Revel is opening in a tough location, in a rough economy, and it’s 100 percent no-smoking, which is a little tougher,” Larry Klatzkin, a long-time casino industry analyst, said. “In the next summer, it will be doing fine. The question is, does it have enough financial wherewithal to make it to the next summer?”

Hailed as a game-changing addition to Atlantic City, Revel became the city’s 12th casino this year and the first to open in nine years. The hotel features 1,400 guest rooms, 14 restaurants, and seven pools.

The outgoing executive at the EDA, Caren Franzini, told the agency’s board in a 2011 memo that Revel would generate $560 million in revenue in its first year from its sprawling 150,000 square-foot gaming floor. But the initial returns have been lackluster.

In the first full four months of operation — which includes the peak summer months — Revel has been running near the end of the pack among the city’s other casinos and is on pace to take in roughly $200 million after its first 12 months, the Star-Ledger analysis shows.

Mike Pollock, a managing director at Spectrum Gaming, said Revel may be stumbling through its first summer season but its long-term strategy — relying less on the casino and more on the resort — is Atlantic City’s future.

“Atlantic City was built under the assumption that it was the most convenient place in the east to gamble,” he said. “That is a failed model going forward.”

Revel’s own financial projections suggest the casino may have been been too optimistic about gaming revenue.

The casino’s officials told the state they anticipated raking in $46.6 million a month — roughly triple its current pace — in gaming revenue.

John Kempf, a casino industry analyst at RBC Capital Markets, calculates that Revel needs to bring in $25 million to $30 million every month in gaming revenue just to make its monthly debt payments. But the casino has collected only $15 million a month on average from April to July, Gaming Enforcement records show.

Revel may not want to build its long-term business on the slot market, but it will need to ramp it up anyway to find its financial footing in the short term, Kempf said.

“The slot customers have loyalty to their casinos. They want amenities. They want free play. They’re not interested in high-cost restaurants,” Kempf added.

Christie and the EDA both touted the project as a job creator, predicting it would bring in about 5,000 full-time jobs. “Now completed, the Revel project supports over 10,000 jobs, with more than 5,000 being permanent jobs for New Jerseyans,” a Christie March news release boasted.

But the latest job figures submitted to the Casino Control Commission show Revel has only 2,780 full-time jobs. When you include part-timers the number grows to 3,837 employees, records show.

Siman says the company incorrectly described the initial job numbers as exclusively full-time, when they also included part-time workers.

In one of Christie’s biggest gambles, his administration salvaged the ambitious $2.4 billion casino project after Morgan Stanley decided it was better walk away from its $1.3 billion investment in 2010 than move forward. The casino’s CEO and partial owner, Kevin DeSanctis, was then forced to scramble to find investors to finish construction.

Under the incentive plan, Revel will recover 75 cents out of every new dollar in state revenue it generates. Spread out over 20 years, the total incentive package is capped at $261 million, but the final tally could be much less if the casino is unsuccessful.

“It’s like giving away the sleeves of your vest,” Timothy J. Lizura, the chief operating officer for the state Economic Development Authority, said. ” If they don’t generate any new revenue, we don’t give any back. If they do, then we keep 25 percent. It’s virtually riskless for the state.”

The governor is also betting that the resort will produce the first bump in state casino tax revenue since 2006. He’s predicting casino revenues to grow by 14 percent — or $38 million — in the current $31.7 billion budget signed in June. But overall revenues saw a 10 percent dip last month.

Christie spokesman Michael Drewniak said, “We are not buying into this naysayer approach to redevelopment in Atlantic City. We understand the concern, but it’s still a very difficult environment. Everyone, on both sides of the aisle, recognized the issues and were not willing to give up on Atlantic City.”