Previously, we saw the so-called do nothing Hoover do far too much, sowing the seeds of the New Deal and making the depression Great. The example of 1920-21 had been forgotten. Eight years of FDR experimentation included the 1937-38 ‘recession within a depression’, and some recovery.

Did the Great Depression End in 1940?

The conscription act certainly improved the employment statistics. Meanwhile, the tocsin of European war grew louder. This offered new policy opportunities but also internal conflict. A Neutrality Act had been in place and often ignored. Is there, though, any difference between the WPA and “training and service”?

At any rate, England was already in the war, one result of the mutual assistance treaty with Poland, August 25, 1939. A week later, the Nazis invade Poland. Two days after, Britain, France, Australia, and New Zealand declare war on Germany. America proclaims neutralist on September 5. By the end of the month, the Nazis and Soviets were slicing and dicing Poland.

Dateline, May 26, 1940, the evacuation of Allied troops from Dunkirk begins. Two weeks later is the start of the Battle of Britain. There was worse to come in the next months.

August 9, 1941 – Churchill arrives off the coast of Newfoundland on the HMS Prince of Wales for his first meeting with FDR, on the USS Augusta. Churchill hopes for a U.S. Declaration of war on Germany. What he gets is the Atlantic Charter, first titled the “Joint Declaration by the President and the Prime Minister” of which no signed copy exists. Even though a film crew was on hand, the equipment failed. Twice. Churchill first used the term ‘Atlantic Charter’ on August 24 in Parliament, describing not a blueprint but hopeful goals for the post-war period.

What Churchill did get was more Lend-Lease.

Back in December, 1940, FDR had suggested the U.S. Should sell munitions and so on to Britain and Canada. Opinion in the U.S.was already sharply dividied. Three month earlier, the America First Committee had formed, a non-interventionists group that peaked at 800,000 paid members and folded after Pearl Harbor.

Although the selling scheme was shot down, the Lend-Lease idea floated in early 1941 gained favor with a majority of the people – they believed it would keep American out of the war. FDR signed the Lend-Lease bill on March 11, 1941 and improvements to aid China and Russia were added. Britain got $1 billion in aid by October.

Prior to this, Britain had been selling assets and working on a ‘gold-and-carry’ principle and was running out of gold. The earlier 50 USN destroyers for basing privileges had helped some. That agreement also initiated the building of Liberty Ships.

Also back in 1940, there was another ploy. FDR proposed sending B-17 bombers and crews to Britain for testing. The Department of Justice reckoned it was illegal but recognized British orders that had not been fulfilled. General George Marshall certified that the new bombers were not essential and the deal was done. The bombers were flown to Britain with American crews.

After the loss of the HMS Hood to the Bismarck in May, 1941, the latter’s escape was short-lived: first it was sighted by the U.S. Coast Guard cutter Modoc and radio reported to the British. This information soon assisted a Catalina aircraft piloted by a U.S. Naval reserve ensign who radioed the location and heading to the Admiralty. British warships pursued and went for the kill. Some 2,200 dead, 110 captured. A cat survived. The British had three casualties from friendly fire.

Meanwhile, on the high seas, the German U-boat packs were menacing shipping. As a courtesy, U.S. Naval ships were sent to shepherd the merchant vessels. Up until 1941, America had only the naval fleet at the West Coast.

Various units were detached to become the Atlantic Fleet. The shipping lanes were declared a security zone, then the greater Atlantic as a Neutrality Zone, by invoking the Monroe Doctrine. But submarines make mistakes, especially when viewing at periscope depth. In June, 1941 the U.S.merchant ship Robin Moor was torpedoed; most of the crew survived. A formal apology from Germany was met by FDR freezing German assets in the U.S. and sending consular officials home.

On September 4, the USS Greer (DD-145) had received a radio message from a British aircraft about a German submarine. The Greer followed, reporting updated location for hours, which assisted attacks from British planes repeatedly. Finally, the U-boat (U-652) fired a torpedo which missed. The Greer countered with depth charges, lost the target but searched without result for three more hours.

FDR had a fireside speech about the incident. The Senate demanded an inquiry and asked for the Greer’s log. They never got it.

In any case, what passed for neutrality ended with the attack on Pearl Harbor.

*

To answer the question of this section, one must look for prosperity. Unemployment had peaked at 19% in the recession within the depression – at 17.2% in 1939 but was still at 15% in 1940.

From there to 1944, the curve drops steadily down to 2.4%, a combination of the selective service act and the many Rosie the Riveters and their peers. Forty percent of the labor force were either in the military or engaged in war work.

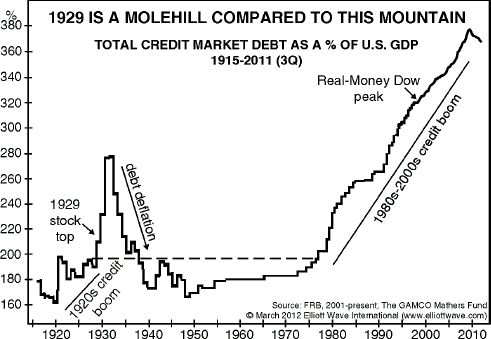

And GDP peaked that year – with gross public debt at 120% of GDP. War is expensive. So, was Main Street prosperous? It didn’t look like it and it didn’t feel like it. Wartime rationing had its bite on the domestic public; so did supply and demand. If it wasn’t rationed, it was less readily available and cost more. Personal income taxes rose to 91 percent (and later increased to 94%); corporate excess profits tax hit 91%.

On Wall Street, the Dow did not reach its 1929 level until 1954.

Washington, D.C. Invaded!

The Brits invaded the Capitol in 1940. Unlike 1814, they didn’t set fire to the White House; indeed, they were welcomed with open arms by President Roosevelt. Churchill had sent his favorite Canadian, William Stephenson, to head the British Security Coordination. This outfit and others planned a systematic propaganda campaign to “do all that was not being done and could not be done by overt means”.

Aside from propaganda and political subversion, they would also assist the new American intelligence unit, the OSS – and ensure an unprecedented fourth term for FDR.

None better to impress the American public than a handsome war hero, Roald Dahl, whose near-fatal crash put an end to his flying. Assigned in a minor diplomatic position, he befriend Charles Marsh, an influential newspaper tycoon who had moved to D.C. With high-level business and political contacts, as well as household names of journalism, the pair elevated Dahl into an intelligence elite agent. Others were added to the team: Ian Fleming, for one.

“I have in my possession a secret map made in Germany by Hitler’s government – by the planners of the new world. It is a map of South America and a part of Central America as Hitler proposes to reorganize it.

“That map, my friends, makes clear the Nazi design not only against South America but the United States as well.”

FDR Navy Day radio speech, March 11, 1941

Be very afraid – Nazis in your backyard! A work of art, that map. Here’s the thing: one of Stephenson’s proteges, Ivar Bryce – Ian Fleming’s Eton classmate and his closest friend – came up with the idea. His draft map went to Canada, BSC’s technical arm at Station M. Forty-eight hours later, an authentic-looking German map, even worn and discolored from use, arrived on Stephenson’s desk. Whether by guile or with a wink, the bogus map was given to Donovan, who took it to FDR. Plausible denialability, in any case.

America First and other isolationists” didn’t stand a chance. That, and countless other dirty tricks were played on the American people when Britannia waived the rules. But there was home-grown help: Walter Winchell, Drew Pearson, Walter Lippmann and other stenographers dutifully relayed the ‘facts’ to the public. American dramatist Robert Sherwood who did propaganda work for Donovan’s OSS, later said:

“If the isolationists had known the full extent of the secret alliance between the U.S. And Britain, their demands for the president’s impeachment would have rumbled like thunder across the land.”

Let God save the King! had been the slogan of a fair number of Americans, mindful of WW1. But Pearl Harbor was a game changer. There had been a hint from Proclamation 2487 on May 27, 1941 “that an unlimited national emergency confronts this country … “

December 8, 1941 – “The country seemed to remember again what it always knew: that the adventurer was the force that pushed the country forward. It was the adventurer’s America too that the soldier would shortly be defending. And no one wanted to serve more than the Forgotten Man.”

Amity Shlaes, “The Forgotten Man” (2007)

The War Years

January 1, 1942 – the Declaration of the United Nations was signed by 26 Allied countries.

On the 26th, the first American forces officially arrived in Great Britain.

February 19, 1942 – FDR signs Executive Order 9066 authorizing Japanese-American internment. The Census Bureau assisted locating those of Japanese ancestry from their records in 1944. (The Supreme Court asserted the constitutionality of the internment. Little did they know that FDR appointee Charles Fahy withheld the Office of Naval Intelligence report concluding Japanese-Americans on the West Coast posed no military threat.)

The FDR administration is a study in evolution: in the early years, the plan was to demonize business. Later, New Deal 2.0 instituted the idea of cartelization. And then, co-opting business for war was natural. Some might conclude this was the building of the military-industrial complex.

In March, 1942, the Federal Reserve published a “Pay-as-you-go Income Tax plan”. Social Security had initiated withholding in 1937. Now, the income tax would take another upfront bite. The problem that created was that, before, income tax was paid the following year in one hit. A double dip would be impossible for most people, so the Congress came up with a modified plan cancelling either the 1942 or 1943 amount by 75% – the main thing was to implement this ‘temporary’ scheme.

And there was more – April 27, 1942, FDR tells Congress: “No American citizen ought to have a net income, after he has paid his taxes, of more than 25,000 a year. The Treasury Department issued a memorandum to Congress wanting a 100 percent tax on incomes over $25,000. (And people whine about a health insurance mandate today.)

October 3, 1942, FDR executive order 9250 “providing for the stabilization of the economy” to implement such a plan. Does this look like prosperity?

The rise of withholding tax created a dramatic expansion of the IRS. This was all a ‘temporary’ wartime measure …

March 18, 1942 – the War Relocation Authoritywas initiated. WRA hired Dorothea Lange and other photographers to document the Japanese relocation effort. About 13,000 photographs were produced – and impounded for many years … (Shlaes, pg 387)

FDR issued executive orders from 9017 in 1942 to 9508 in 1944. So much history with social and economic impact. Executive Order 9300 on Subversive Activities by Federal Employees. February 5, 1943, one interesting example of many.

Following the money, though, shows how completely the economy was impacted by necessity … from 1940s defence spending as 17.53% of federal spending to 1945s 89.49% record.

Taxes provided some $136.8 billion to pay for part of the war. The other $167.2 billion came from Treasury bonds and “war bonds” the latter often by payroll deduction. Banks also indulged in Treasury bonds and paper, accrusing $24 billion by the end of World War Two. The 2.9% interest on the ten year war bonds, though, were after the maturity and never compensated for the rise in consumer prices over the period. So it goes.

Overall, Robert Higgs (1992) calculated that the national living standard varied through the war years from level to slightly declining.

Still, it wasn’t all doom and gloom. Civilian employment had increased from the 1940 statistic by 13.4% in 1944 and unemployment was but 0.7% of the population. Some 10 million women worked outside the home by war’s end. Two million women had been involved in war work.

The Post-war Years

Actually, the major monetary event preceding peacetime was the 1944 Bretton Woods Conference. Formalizing rules for currency conversion and esablishing the International Monetary Fund and the International Bank for Reconstruction and Development (now part of the World Bank) provided an international monetary order.

The experts of the day looked past August 15, 1945. Emperor Hirohito’s surrender of Japan by radio broadcast at noon and General Order No. 1 signed by President Truman on August 17. They forecast 1946 in Chicken Little’s words, or maybe they mistook Randolph Bourne’s 1918 essay as a policy.

Defence spending in 1946 was still at 77.3% of federal spending. It halved by 1947 and was still at 32.2% in 1950. Some economists had predicted a slide back into depression with the return of servicemen and women. The #13 billion Marshall Plan and the $1.8 billion for Japan reconstruction helped a lot. It also built in a trading potential mindful of America’s import and export requirements. Building your markets, perhaps. Not exactly the ‘broken window’ fallacy’.

There was the G.I. Bill – access to suburban housing, vocational training, college education, and private cars available again. And peacetime consumer production certainly ramped up. Innovations of the 1930s were readily available to a new generation establishing homes. Post-war implementation of wartime invention added new ideas for commerce and prosperity.

The initial post-war outcome proved the experts wrong. Nonetheless, the recession of 1948-49 arrived, a confluence of Truman’s economic reforms and monetary tightening by the Federal Reserve. This downturn began in November, 1948 and only last eleven months. Unemployment peaked around 7.9% and the wholesale price index was down by 12 points. GDP had fallen by 1.7%, and Chicken Little’s sky shone even more brightly in 1950.

GNP had been $200 billion in 1940, rose to $300 billion by 1950 and surpassed $500 billion in 1960 during those “baby boom” years.

The growth of production of consumer goods, affordable low-cost mortgages and other benefits for returning military and general post-war euphoria led to a rising middle class. The overall work force was changing, too. During the 50s, services jobs grew to equal and then surpass goods production. The farm sector over-productivity’ led to decline of small farms as Big Agra grew. The decline of the farm sector from 1947 at 7.9 millions continued for generations. By 1956, there were more white-collar workers than blue.

The availability of personal automobiles, demand for single-family homes, and the rise of suburbia began and continued. Only eight shopping centers existed at war’e end and grew to 3,840 in 1960.

As individuals left the big cities for suburbia, so, too, industries fled Metropolis for the Sun Belt. Even air-conditioning became a ‘must have’.

And there was the federal highway system to facilitate the migration.

The decade of the 1950s, a time of complacency and conformity, would dramatically change in the 1960s. It was the time of the Second Turning, the High had peaked and cultural revolution was upon America.

In the exciting conclusion to come …

(1).jpg)