“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”― Upton Sinclair – I, Candidate for Governor: And How I Got Licked

“The U.S. financial markets had always been either corrupt or about to be corrupted.” – Michael Lewis, Flash Boys

I finished reading Michael Lewis’ Flash Boys take-down of Wall Street banks, hedge funds, government regulators and high frequency traders last week when I had spare time created by a weeklong denial of service attack on my website. It appears to me technology is being utilized more frequently as a mechanism for malevolence rather than a mechanism for good. The smartest guys in the room are figuring out ways to steal you blind in the financial markets, pilfer your personal information, spy on your electronic communications, and censor your right to free speech by taking away your ability to communicate freely on the internet. After reading Lewis’ maddening tome and experiencing the frustration of an attack that reached 50 million hits per day on my website, I’m reminded of two quotes from the brilliant dystopian visionary Aldous Huxley.

“Technological progress has merely provided us with more efficient means for going backwards.” ― Aldous Huxley – Ends and Means

“You shall know the truth and the truth shall make you mad.” – Aldous Huxley

Technology has been pushed on the masses like a drug by the mega-corporation and mega-media dealers. Just walk down any city street and observe the technologically entranced zombies shuffling along the sidewalks staring blankly at a tiny screen, tapping away on an itsy bitsy keypad as if whatever they are conveying is of vital importance to the future of mankind. # Give me a break. God forbid if we had to go out in public without our iGadget attached to an appendage. We might actually have to use our brain to think. We might be able to look someone in the eye and smile. We might be able to say hello to a stranger. We might have to act like a human being.

Being connected electronically 24 hours per day is not progress. The technology being peddled to the masses by mega-corporations is designed to keep people amused, apathetic, distracted and uninterested in thinking critically. Our society has devolved into a technologically narcissistic, ego driven, submissive, trivial culture, asphyxiating in a sea of irrelevance and driven by greed and need to fulfill our every desire, rather than a technologically proficient, selfless, humble, critical thinking, civil minded society of self-reliant human beings who take responsibility for their own lives and refuse to saddle future generations with the financial consequences of living beyond their means. Our willful ignorance, misuse of technology, and inability to control our impulses and desires will be the ruin of our perverted civilization.

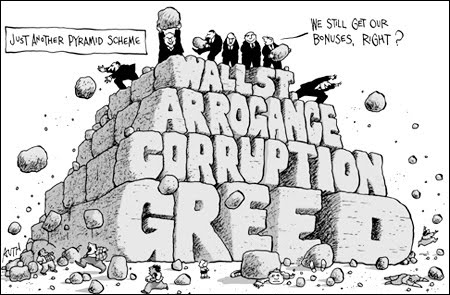

If the masses were capable of critical thinking and questioned the existing paradigm, they would conclude a small cadre of evil men has colluded to hijack the financial, political, and social systems in order to syphon off the nation’s wealth, while controlling the serfs through propaganda and luring them into debt servitude. Those who haven’t been brainwashed by media propaganda or amused to death by technology, are kept in check by thousands of laws, statutes, and regulations, enforced by millions of government bureaucrats and police state thugs. Technology is used by the state as a means of control, surveillance, censorship, and bilking the populace of their wealth. And if you don’t like it, the IRS, DHS, FBI, CIA, BLM, HHS, or some other three letter government agency will harass, arrest, fine, or kill you for not “cooperating”. And while the government is keeping you under their thumb, Wall Street shysters are stealing you blind.

The Truth Shall Make You Mad

“As soon as you realize that you are not able to execute your orders because someone else is able to identify what you are trying to do and race ahead of you to the other exchanges, it’s over. It really just pissed me off that people set out this way to make money from everyone else’s retirement account. I knew who was being screwed, people like my mom and pop, and I became hell-bent on figuring out who was doing the screwing.” – John Schwall – Flash Boys

As I continued reading Flash Boys I got progressively madder as more truth was revealed about the inner workings of Wall Street, the wasting of human intelligence on technological schemes to defraud the public, and the utter level of corruptness in the government agencies supposed to protect the public from the vultures in the financial industry feasting on the carcasses of dupes who still believe the “stocks for the long run” drivel regurgitated incessantly by the bimbos and slime balls on CNBC. The concepts of right and wrong, moral and immoral, honesty and dishonesty, and truth and lies are all purposefully blurred in shades of grey by those in power, in a blatant attempt to maintain and expand their vast wealth, immense power and complete governing control.

Michael Lewis focuses on our warped, rigged financial system, but his insights apply across the board to our entire society. Our economic, financial, political, regulatory, and judicial systems are all rigged. This serves the interests of the Deep State, Invisible Government, Oligarchs, Owners, or whatever other term you choose to describe the obscenely wealthy minority controlling this country. The existing establishment will never willingly change the system because it serves their myopic gluttonous interests.

“The deep problem with the system was a kind of moral inertia. So long as it served the narrow self-interests of everyone inside it, no one on the inside would ever seek to change it, no matter how corrupt or sinister it became.” – Michael Lewis – Flash Boys

Flash Boys is the fourth Michael Lewis book I’ve read. I had previously read Liar’s Poker, The Big Short, and Boomerang. He is a masterful storyteller. He has the ability to humanize complicated financial concepts and cut through the purposeful complexity built into the financial system to reveal the corruption, criminality and moral degradation of Wall Street bankers and Washington DC politicians. He slices through all the spin, misinformation, and mistruths flogged by Wall Street and their paid-off media mouthpieces to reveal everyone on Wall Street to be in on the action when it comes to fleecing their customers (muppets). The stench emanating from the bowels of Wall Street banks, hedge funds, and high frequency trading bucket shops hangs like toxic smog over our bloated fetid crony capitalist corpse of a country. This cast of despicable felonious characters, scalps investors day after day, with the insiders pretending all is well and the man on the street is being protected.

“The reason is that everyone is a bad actor. There’s an ecosystem that has risen up around a broken pipe on Wall Street. You have high-frequency traders who are scalping the market. They pay exchanges for the tools they need to scalp investors; the exchanges pay banks to essentially mishandle the stock orders so high-frequency traders can maximize the take. It’s a system designed to extract taxes from investors.” – Michael Lewis –Wired

The average person believes the stock market is run on free market principles, with willing buyers and sellers paying and receiving the most efficient price with regards to their transactions. The American people have put their trust in gargantuan bureaucratic government agencies, funded with their tax dollars, to protect their interests and fight for their rights in the financial marketplace. They innocently believe a private bank – The Federal Reserve – owned and controlled by the Too Big To Trust Wall Street Mega-Banks, is actually enforcing regulations and looking out for the best interest of the small investor. They evidently haven’t been paying attention for the last fourteen years, as the Federal Reserve has purposefully created bubble after bubble with ridiculously low interest rates, money printing on an epic scale, encouraging complete deregulation of banks, inciting speculation, and ignoring criminal behavior by their Wall Street owners.

After reading Lewis’ exposes about these Wall Street scumbags, you realize Scorsese’s seemingly over the top portrayal of these people in Wolves of Wall Street is accurate. Nothing has changed since Lewis worked at Salomon Brothers in the 1980’s. The people inhabiting that culture are unscrupulous, greedy, obtuse, ignorant, and intent upon preying on the weaknesses of their “clients”, who they hold in contempt. They are the wolves and you are sheep. The comforting picture of a stock broker representing your interests on a small commission basis has been replaced by stock exchanges colluding with Wall Street banks, hedge funds and high frequency traders to fleece mom and pop out of hundreds of billions on an annual basis using their super-fast computers located within the stock exchanges. The people who know the truth have no interest in drawing the new picture because their massive paychecks depend upon not drawing the picture.

You can tell how accurate a portrayal is by the reaction of those being portrayed. Flash Boys and the subsequent interview of Lewis by 60 Minutes resulted in a broad based assault by Wall Street bankers, HFT dirt bags, corrupt stock exchange CEOs, SEC lackeys, Federal Reserve Chairwomen, bought off politicians, faux financial journalists, sellouts like Buffett, and of course the mouthpieces of Wall Street on CNBC. The oligarchs benefitting immensely from the HFT scams, Dark Pool schemes, and Stock Exchange pay to play swindles, attempted to ambush the good guys (Brad Katsuyama and Michael Lewis) on CNBC, the captured media pawn of the Wall Street ruling elite.

CNBC stacked the deck against the good guys with the President of the BATS exchange, William O’Brien, given the task of shouting the loudest in an attempt to discredit the factual assertions made in the book. The BATS exchange was founded by high frequency traders and designed to foster the predatory schemes of high frequency trading firms who paid the exchange for the privilege of swindling investors. He went berserk on-air, accusing Brad Katsuyama of lying and denying that his firm purposefully allowed high frequency traders to front run slower orders from regular investors. I guess he thought rage, fury, screaming and false accusations would convince the hoi polloi of his innocence. He was wrong. The traders on the NYSE and in trading firms across Wall Street stopped trading to watch the contest on their screens. They would cheer every time Brad Katsuyama calmly responded with truth based facts.

Michael Lewis described the encounter shortly thereafter in an interview:

“The substantial shocker from this encounter is that Katsuyama tried to get O’Brien to admit that the BATS Exchange uses one very slow data feed to give investors the prices in the market, while selling, for vast sums of money, a faster feed to high-frequency traders, the effect being that the high-frequency trader knows the prices in the exchange before your order. So he has the privilege of trading against you at an old price if he wants to. And O’Brien says no that’s not true. He lied, on national television, about a central fact about his business.” – Michael Lewis –Wired

Under threat of prosecution, the BATS exchange had to admit its esteemed President blatantly lied on national TV. That seems par for the course when it comes to Wall Street executives. Deceitfulness, duplicity, and evasiveness are crucial requirements for the psychopaths occupying the corner offices in this warped world of high finance. The Wall Street Journal reluctantly revealed the truth:

BATS Global Markets Inc., under pressure from the New York Attorney General’s office, corrected statements made by a senior executive during a televised interview this week about how its exchanges work.

BATS President William O’Brien, during a CNBC interview Tuesday, said BATS’s Direct Edge exchanges use high-speed data feeds to price stock trades. Thursday, the exchange operator said two of its exchanges, EDGA and EGX, use a slower feed, known as the Securities Information Processor, to price trades.

The distinction matters because high-speed traders can use powerful computers and superfast links between markets to outpace traders and trading venues that rely on slower market data, such as the SIP.

Would the BATS Exchange have revealed the truth if they had not been pressured by the New York Attorney General to do so? Not bloody likely. Wall Street never admits guilt for any of its crimes, wrongdoings, misconduct, deceit or deceptions. They pay $1 billion in fines to their government co-conspirators as a public relations ploy, without admitting guilt and after reaping $10 billion of criminally generated profits. Not a bad ROI. The principles of right versus wrong, moral versus immoral, honesty versus dishonesty, and clarity versus opacity are willfully evaded by the titans of Wall Street and create no dilemmas for these greed driven psychopaths. Money and power are their drugs and the Federal Reserve is their dealer.

Michael Lewis books strike a chord with the public because he chooses a good guy hero his audience can empathize with. He played the sympathetic character in Liar’sPoker. Michael Burry, the brilliant Asperger’s Syndrome suffering investment genius, plays the role in The Big Short. And Brad Katsuyama, the mild mannered good hearted hobbit-like Canadian, takes on the evil forces of Mordor in Flash Boys. These characters all have something in common. They don’t fit in. They question the existing paradigm. They refuse to give in to the depraved culture permeating Wall Street. They exhibit an inner moral strength that enables them to resist the temptation of ill-gotten riches. And they don’t surrender their principles for a buck. This passage gives you a glimpse into the soul of Brad Katsuyama:

“In America, even the homeless were profligate. Back in Toronto, after a big bank dinner, Brad would gather the leftovers into covered tin trays and carry them out to a homeless guy he saw every day on his way to work. The guy was always appreciative. When the bank moved him to New York, he saw more homeless people in a day than he saw back home in a year. When no one was watching, he’d pack up the king’s banquet of untouched leftovers after the NY lunches and walk it down to the people on the streets. “They just looked at me like, ‘What the fuck is this guy doing?’” he said. “I stopped doing it because it didn’t feel like anyone gave a shit.” – Michael Lewis – Flash Boys

The apologists for the corrupt establishment attempted to trash Lewis and Katsuyama by contending the market has always been rigged and manipulated, therefore, the HFT embezzlement is just business as usual. Warren Buffett, king of oligarchs and apologist for the Wall Street billionaire club, assures the peasants the financial markets are fairer than ever. If Uncle Warren says it’s so to his girl Becky Quick on CNBC, how can anyone doubt him? It’s as if the supposedly mathematical genius billionaire forgot everything he learned in business school.

There is $21 trillion worth of U.S. stocks traded every year. Based upon Katsuyama’s analysis of how much high frequency traders, Wall Street dark pools, and the stock exchanges selling access were skimming on virtually every transaction, he estimated at least $160 million per day was being stolen from stock investors. That comes to a cool $40 billion per year, at a minimum. High frequency trading accounted for 25% of all stock trades in 2005. By 2008 high frequency traders accounted for 65% of all trades. They now account for in excess of 80% of all trading. The Ivy League educated Wall Street elite insist this extreme level of computer generated trading provides liquidity and efficiency for the markets. In reality, the actual trading results of the HFT firms, hedge funds and Wall Street TBTF banks prove the game is rigged. JP Morgan experienced ZERO trading loss days in 2013. Goldman Sachs, Morgan Stanley and most of the mega-banks have had virtually perfect daily trading results since 2010. If they are all winning, who is losing? Guess. Lewis provides further evidence of “investing” perfection:

“In early 2013, one of the largest high-frequency traders, Virtu Financial, publicly boasted that in five and a half years of trading it had experienced just one day when it hadn’t made money, and that the loss was caused by “human error.” In 2008, Dave Cummings, the CEO of a high-frequency trading firm called Tradebot, told university students that his firm had gone four years without a single day of trading losses. This sort of performance is possible only if you have a huge informational advantage.” – Michael Lewis – Flash Boys

Buffett, the financial “journalists” on CNBC, and all of the defenders of the Wall Street criminal cabal must have been asleep during their Stat class in college. The statistical probability of going four years or even four weeks without a losing trading day is as close to zero as you can get, unless the game is rigged and you are cheating. These results were not accomplished due to the brilliance of Wall Street big hanging dicks and their oversized brains. They were accomplished by front running stock market orders, bribing stock exchanges for first access, gaming the system with more powerful computers, ripping off clients in shadowy dark pools, and keeping the SEC at bay with promises of jobs and riches if they look the other way. This was all done under the veil of hyper-complexity designed to obscure, confuse, and cover-up the truth from unsuspecting investors.

And it is all done “legally” under the auspices of Regulation NMS, established by the SEC in 2007, to foster both competition among individual markets and competition among individual orders, in order to promote efficient and fair price formation across securities markets. As with almost every government regulation, law, or diktat, the new method of “protecting” the sheeple created fresh ways to fleece the sheeple by those who wrote the regulation. See Dodd-Frank and the Affordable Care Act. I don’t need a law or regulation to tell me the difference between right and wrong.

When obnoxiously wealthy pricks with the ability to bribe stock exchanges to place their trading computers on the floor of the exchange and financially induce the Wall Street banks to funnel trades through their dark pools in order to know what is happening a nanosecond before everyone else, and use this information to front run unknowing investors to generate risk free profits, it’s wrong. It really is black and white. I don’t care that it is supposedly “legal”. By complying with Regulation NMS the smart order routers of institutional investor firms like Vanguard, Fidelity and Schwab simply funneled naïve investors into various snares laid for them by the unscrupulous high frequency traders. The bad guys always win and the good guys always lose on Wall Street. And no one does anything because they are all on the take. Lewis puts it in terms the average person can understand.

“It was riskless, larcenous, and legal – made so by Reg NMS. The way Brad had described it, it was as if only one gambler were permitted to know the scores of last week’s NFL games, with no one else aware of his knowledge. He places bets in the casino on every game and waits for other gamblers to take the other side of those bets. There’s no guarantee that anyone will do so; but if they do, he’s certain to win.” – Michael Lewis – Flash Boys

If you aren’t mad yet, you will be after I go into the details of the regulatory capture, obscure deep pools within the bowels of the Too Big To Trust Banks, misuse of technology to defraud the public, and purposeful complexity built into the financial system to confuse and mislead the investing populace. I’ll tackle that in Part Two of this article.

At this point, I don’t believe ANY numbers from ANY official source. As the late Mike Ruppert put it, we’ve “Crossed the Rubicon”.

Companies as well as Countries can make numbers say whatever they want. As a room full of car dealers friends once admitted in a meeting when I asked the “how many miles are on it” question-their response “how many miles do you want to be on it”.

That about sums it up for the U.S. government and Wall St.

See what ZH posted today about 20+ stock all fast crashing AT THE EXACT SAME TIME, to the freaking second.

At 15:49:41 to be exact.

Here’s the link.

http://www.zerohedge.com/news/2014-05-13/there-anything-wrong-these-charts

Just what are the freaking odds this was a random event?

Fuck it, I’m off to Vegas in a few weeks. I have better odds of winning there and at least in Vegas I KNOW I’m dealing with criminals.

Lewis is indeed an incredible writer. If you can’t find the time to read, get the books in audiobook format (sometimes your library may have it), download it on to your device and listen while doing something productive, but tedious like cooking, gardening, walking, etc.

The real point is to get your $ out of Wall Street’s hands and back into your local community by “investing” in friend’s mortgages, local businesses, etc. Michael Schuman who is the grand master of local investing lays it all out. Local investing delivers better returns too. He’s worth bringing in as a speaker, but you can get his books.

The definition of a big that’s too big to fail: it has more than one branch.

i think that we have already lost the battle,but i am deeply impressed by your refusal to just lay down.you represent what the core of america is all about .thank you

“Wall Street” is just the modern incarnation of capital markets which were developed out of Medici Banking. The system has always been corrupt, Capitalism is a Ponzi based on debt. thus debt has been spiralling ever upward since this period.

Capitalism is a sham run by a a few powerful people who control the capital markets, There has never in all of recorded history been any such thing as a “Free Market”. this is all propaganda which Libertarians buy into because they don’t have a real good grasp of how the monetary system really works. In the words of Henry Ford:

“:It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

Industrialisation cannot pay its own way, it is a consumption paradigm based on waste. It is a chimera that Capitalists sold to people who all bought into it quite nicely, because it sure is nice to be able to Happy Motor around all the time and have electric lights that flip on at a switch.

This paradigm is coming to a close now, it is shutting down in Greece and Ukraine, and will shut down too in your neighborhood. Capitalists are essentially Gangsters, as Alfonse Capone observed way back in the 1930s.

{img [/quote]

[/quote]

Generations of people since the beginnning of the industrial revolution hae been succkered into the destructive Ronzi run by Capitalists. They are the ultimate Evil on the face of the Earth.

RE

Bah. fucked up with the Capone embed.

[img [/img]

[/img]

Another fine piece of writing admin.The truth is obvious .The more people involved in the racket of government ,the less likely to in be involved in policing the corrupt.

Wholesale corruption is explicitly borne by the exponential growth government .No doubt about it..

Turpin is 100& correct.The battle is lost, and the aftermath of defeat has just begun. Labeling the free fall of the American standard of living as austerity will be akin to describing a magnitude 10 earthquake as a slight tremor.

An evil Seller sells a bunch of nasty shit to a Buyer. Who’s the real dumb-ass? The Seller, or the Buyer?

Don’t wanna get fucked? Don’t play the game.

I own zero stocks, and that’s all I have to say.

Thanks Admin, I just ordered his book from your Amazon link. Wall Street, Banks, IRS, FED and every other govt agency is corrupt. Congress buys off over 50% of “Amerikuns” which we call the FSA. The FSA will never vote to stop their “benefits”. The FSA outnumber the folks that still have a job so the congress critters that provide said “benefits” get re-elected. Those of us that work have a good portion of our money stolen by the govt, stolen from our savings and retirements by the banisters and Wall St, and what’s left is being eaten away by inflation that Janet says doesn’t exist. We are truly fucked!

Admin, mission accomplished–I am mad (both mentally and emotionally!) by all the fucked up shit you point out so well in this post.

We all know this is what is going on in Wall Street, and so many other of our institutions (military, education, politics, etc.). But we just keep taking it in the ass.

Here’s the William O’Brien vs. Brad Katsuyama exchange (condensed 4 minute version–original was about 23 minutes). O’Brien lied 11 seconds into this video. Someone should take a baseball bat to his knees.

http://www.youtube.com/watch?v=JLc-g16C7Os

Correction–the lie comes at 46 seconds in, but O’Brien’s toxicity shows throughout.

@RE: I appreciated the history lesson on the origins of Capitalism, and thank you for helping Admin during the DNS attack, but if Capitalism is so bad, what is your alternative? The feudal system? Socialism-Communism? A barter system?

The good is not the enemy of the perfect. Capitalism may have its warts but it is still the best system for most people. The key is PROPER GOVERNMENT OVERSIGHT, heh heh.

The entire system, from HFT traders, to regulators, to banksters, to medicine, acadamia and culminating in the halls of CONgress.

Name ONE federally sponsored/engineered program that the big guys aren’t getting gifts while us peons – those still striving for the f’ing dream – take it hard up the rear.

Yes, some “lucky” souls benefit from the handouts, but on top of EVERY program are scores of PAID-FOR-LIFE federal workers, and some lucky, chosen, bestowed, “capitalist” raking it in.

We hate the victims – those that can’t find jobs that will support a family in this corrupted, polluted, shithole we call America – while continuing to support, idolize and even emulate the vermin that have created it.

I wish I still held hope in my heart that information will lead to involvement, which might lead to real change. But I don’t.

It is completely obvious that those that benefit outweigh those of us that will be wiped out first. We have a long way to go before the destruction starts to wake up the masses that benefit from the status quo.

Good luck all, and thanks Jim

75% of my networth is in stocks. I got interested in 2004 when I did not know what to do with some options I got from my company. I got the options at a certain price and the stock price had doubled and I found it unbelievable that I am sitting on some profits. But then I subscribed for a DEMAT account and converted my options into common stock.

In 2007-2008 there was a massive bull market in India and my solid IT service company shares were not moving fast enough and that was when as a stupid man I sold my solid stocks to buy companies selling dreams (.COM Bubble?).

But then my net worth had fallen by two thirds. I also thought this i all gambling. Then I though why not give it a try. These are companies doing selling real things to real people an making real money. I completely changed my investment philosophy and started buying the real companies rather than the DOT COM types.

Zero debt, high RONW/ROE/ROCE, solid brands and good dividends and a sustainable moat with less government interference..These were the companies I started going after. I joined investment forums to discuss with like minded people and by the grace of God I could recoup all my losses and my networth has grown 8 times since then.

So I feel for investing the strict disciplines are – (1) Strong companies with good products (2) Reasonably good barrier to entry (3) Good ROCE/RONW (4) Low Debt (5) strong brand (6) Decent enough management (7) reasonable dividend yield.

Buying and selling on tips is a sure way to the poorhouse.

The NYSE Has Now Been “Broken” For An Hour

Submitted by Tyler Durden on 05/14/2014 12:38 -0400

At 1138ET, the NYSE reported that its data feed is currently experiencing an issue with the symbol range D through J… and an hour later… it is still broken…

[img [/img]

[/img]

Welcome to the new normal…

hey Admin, I know I will be ridiculed by the armchair quarterbacks on your site, but I am nervous. I think this summer could be what we have all anticipated for a few years now. china’s property market and the price of copper and heading towards disaster.

for what it’s worth. hope you are well.

I am getting that heavy 2007 feeling again and it is uncomfortable.

I’ve been hearing the buzz about this book. I’m glad Lewis wrote it, and I’m glad he is able to back it up….but it only confirms what you’ve said for years now. I’ve written off my losses and moved on. No more fancy financial instruments for me. I still do worry about the effects of deflationary collapse in all asset categories when it finally comes unwound in a year or two. Every prudent person out there has some kind of assets, even if it’s cash. With this kind broken system, no asset category is safe.

” …….. the Russian media is reporting that the Russian Ministry of Finance is getting ready to pull the trigger on a “de-dollarization” plan.”

I wonder how THAT will affect the stock market.

.

http://www.blacklistednews.com/De-Dollarization%3A_Russia_Is_On_The_Verge_Of_Dealing_A_Massive_Blow_To_The_Petrodollar/35204/0/0/0/Y/M.html

The rich and powerful stack the deck with cards that favor their strengths and minimizes the strengths of the competition. It has always been thus and always will be. If you want to be honest, proceed as if everyone is out to screw you and act accordingly. Otherwise just play by their rules.

Oh yeah, don`t try to swim with sharks unless you have to.

“The great danger in today’s world, pervaded as it is by consumerism, is the desolation and anguish born of a complacent yet covetous heart, the feverish pursuit of frivolous pleasures, and a blunted conscience. Whenever our interior life becomes caught up in its own interests and concerns, there is no longer room for others, no place for the poor. God’s voice is no longer heard, the quiet joy of his love is no longer felt, and the desire to do good fades.

A new tyranny is thus born, invisible and often virtual, which unilaterally and relentlessly imposes its own laws and rules…

The world tells us to seek success, power and money: our God tells us to seek humility, service, and love. Prayer, humility, and charity toward all are essential in the Christian life; they are the way to holiness.”

Jorge Mario Bergoglio, Francis I

$160 million a day is closer to $40 billion a year than $4 billion.

Joe

Good catch. I fixed it.

Thanks Admin – that this “high frequency trade” bullshit has not been stopped is truly despicable. I have read that a transaction fee of perhaps $0.01 per share would kill it dead. It would be another tax, but if it would work, at least it would keep the bloodsuckers from front-running.

Alvin Toffler warned us technology would remove our humanity in “Future Shock”, a book I read when I was young. I don’t think anyone knew how correct it would be. The criminals on Wall Street use tech to rob the muppets. “Smart” phones have turned people into zombie-idiots. All the information in the history of the world on the internet, and 99.9% of wall-eyed phone staring imbeciles are on Facebook, updating their status every time they defecate. The more they use their smart phone, the dumber they get. I like the phrase “techno-narcissism”, which is accurate, but somehow fails to accurately describe what has happened. It’s more like “techno-lobotomy”.

Americans are a nation of addicts. Addicted to Facebook, food, drugs, booze, internet, taking selfies, being PC, and a hundred other things. Everything is trivialized, especially politics and the economy, so that people will believe any lie told to them, with a big smile on their faces.

Anyway, capitalism is the solution, not the problem. We haven’t had real capitalism since the Federal Reserve was created, and taxes were implemented. After those two events, the government and the Fed distorted all markets, the economy, business, the meaning of work, saving, and the lives of the average person. The Fed and the government have grown into life-ending parasites, and the host is just about dead. But please, don’t blame capitalism, we haven’t had it here for almost 100 years. Otherwise, a good article. At some point everything has to collapse, so we can start over. The host will die from parasitism. End the Fed and end taxation, return the currency to the gold standard, and watch how fast real capitalism restores the world.

Speaking of techno-narcissism….dumbshits always think they’re smart (the dumber they are, the lower their IQ, the smarter they think they are).

POLL: Only 4% of Americans Think They Have Below Average Intelligence…

Average Americans Think They’re Smarter Than the Average American

Forget being smarter than a fifth-grader. Most Americans think they’re smarter than everyone else in the country.

Fifty-five percent of Americans think that they are smarter than the average American, according to a new survey by YouGov, a research organization that uses online polling. In other words, as YouGov cleverly points out, the average American thinks that he or she is smarter than the average American.

A humble 34 percent of citizens say they are about as smart as everyone else, while a dispirited 4 percent say they are less intelligent than most people.

Men (24 percent) are more likely than women (15 percent) to say they are “much more intelligent” than the average American. White people are more likely to say the same than Hispanic and black people.

So, this many smart people must mean that, on the whole, the United States ranks pretty high in intelligence, right?

Not quite. According to the survey, just 44 percent of Americans say that Americans are “averagely intelligent.” People who make less than $40,000 a year are much more likely to say that their fellow Americans are intelligent, while those who make more than $100,000 are far more likely to say that Americans are unintelligent.

The results are not surprising. Western cultures have a habit of inflating their self-worth, past research has shown. The most competent individuals also tend to underestimate their ability, while incompetent people overestimate it. Not out of arrogance, but of ignorance—the worst performers often don’t get negative feedback. In this survey, 28 percent of high school graduates say they are “slightly more intelligent” than average, while just 1 percent of people with doctoral degrees say they are “much less intelligent.”

http://www.nationaljournal.com/domesticpolicy/average-americans-think-they-re-smarter-than-the-average-american-20140512

“The great danger in today’s world, pervaded as it is by consumerism, is the desolation and anguish born of a complacent yet covetous heart, the feverish pursuit of frivolous pleasures, and a blunted conscience.” From admins post above.

Today, I spent 5 hrs taking a friends car to the shop. The OBDII device [you cars computer connection] said that the heated air fuel mixture sensors weren’t working.

The dealer, Toyota in this case, tech goofoo, told me it was the bank 1 and 2 sensors and that they had to drop the exhaust manifolds to replace them, utter BS, I called him on it, for neither were removed, mechanic said one was ‘frozen’ and required removal of said exhaust manifold. [before ever attempting to remove them]

Ladies, I expect few to understand, but those who do, congrats. What I am speaking of is forced consumerism. Buying services you dont need.

This will become confusing.

So we went back into the dealership and I said “neither of the exhaust manifolds were removed [for the O2 sensors are screwed into them] to replace them.

So… I call the tech service doofoo over and opened the hood and said, neither of these exhaust manifiolds and you charged me labor [some 128$ an hour] and did not remove the manifolds.

The tech told me he did, said the service feck foodoo.

Do they look like they have been removed? I asked.

No. He said. But we use a grid system [Fuck me more core math? I thunk]

He took me inside and punched into his screen that each O2 sensor was ‘gridded’ at 1.2 hours.

I agreed 2.2 hours had passed [been in the dealer for 5.0 at this time]

2.2 hours was, with tax, some 330$ not including parts.

He said ‘our best mechanics need to make money and can only do so when they come in under the hours quoted in the ‘Grid’

Yes, I said, but my car has been here 5.0 hours when he could have been working on someone else, because in fact he did not remove either exhaust manifold.

He said he did, said the tech doofoo.

How much does an exhaust manifold gasket cost? I asked.

20-30 bucks he said.

Well, I said, why isnt the costs of those gaskets on the invoice?

I guess he didnt remove the manifolds he said.

Exactly, I said.

But the “Grid” [ I guess we were playing football at this point] says he is allowed 1.1 hour for each.

I agree, I said, but he didn’t do what he said.

Apparently not he said, but its Toyota policy.

Yes, I agreed, but what did he do during those other hours when he was piddling about?[ I know what I did I walked over to Canes over-priced chicken and ate some because I was quite hungry by this point]

*crickets*

Now, I call this forced consumerism [for the emissions diagnostic checks that you get for free from Auto Zoned, for one, wont tell you the exact problem, this car had 4 O2 sensors]

In effect you get to pay for work undone and for the warranty work of others vehicles.

I consumed a whole lot of shit I didnt need, but by the treachery of dealer only computer diagnostics I consumed [paid], but only got hot air in return.

Remember those O2 sensors I refused to replace in the GMC a couple of years back? Yep, the check engine light is still on and I’ve made it through two more inspections by erasing the codes right before going in. It’ll work until it doesn’t.

Damn those LEDs, they never burn out, do they?

“Why is my stupid ass smart phone so much smarter than the cars computers idiotic codes??”

The thing,GPS, can tell me where to turn, cars come with GPS, shit to tattle on me to insurance companies, but CANNOT tell me what the problem is under the hood that it cries for attention of?

em

Good god, a flying car would surely bankrupt me with its onboard non-diagnostics.

Its like Gates has invaded my vehicle.

Yep, the check engine light is still on and I’ve made it through two more inspections by erasing the codes right before going in. It’ll work until it doesn’t. -Eddie

On newer vehicles you can erase the codes by disconnecting the battery, but the emission system will give a ‘not ready’ when the inspection folks hook to the OBD connection under the dashboard until you go some 100 miles or so to give a ‘ready’ code.

This is a great article. I went to high school and college in the 80’s and am I glad. I was just speaking to a family member about all the kids you see with smart phone in their face 24/7. How can you really be alone with someone?

When I dated in the 80’s it was just me and the girl in the room. Now the guy has to compete with all her friends in the address book of the smartphone all the time for her attention. If I was out with a friend or on a date I felt like an individual and free. Not so for kids today.

Back then you bought a record with photos, lyrics, interviews in the album so you could connect with the band. Now it’s a download of a song or two.

I am so glad I know whats it like to live without all the technology.

As things get more and more consolidated and money more and more tight you will see the sharks start to eat each other. No morals menas no loyalty. When I saw the 60 minutes piece on high frequency trading my first reaction is things are getting tight and they are the first to be thrown under the bus.

Eddie/Kill Bill – if your check engine light comes on try a can of “Sea Foam”–it’s about $8 and is 100% pure petroleum. Most check engine light issues are as yours were–O2 sensors. I’ve used Sea Foam on many occasions and the check engine light goes off within 50 miles of driving. Pour 1/2 into the crankcase the the other half into the gas tank. Great stuff–can be found at most all auto parts stores.

Wall Street has ALWAYS been CORRUPT by Jimbo Quinn now UP on the Diner Blog!

http://www.doomsteaddiner.net/blog/2014/05/15/wall-street-has-always-been-corrupt/

I added the famous call from Ben Lichtenstein in the pit of the S&P 500 in the May 2010 Flash Crash to head up the article. 🙂 I love that audio.

HERE THEY COME TO SELL ‘EM AGAIN!!! 😀

https://www.youtube.com/watch?v=1mC4tu1NhUA

RE

https://www.youtube.com/watch?v=1mC4tu1NhUA

You have outdone yourself! Great read!

Regarding this…

“Michael Lewis focuses on our warped, rigged financial system, but his insights apply across the board to our entire society. Our economic, financial, political, regulatory, and judicial systems are all rigged. This serves the interests of the Deep State, Invisible Government, Oligarchs, Owners, or whatever other term you choose to describe the obscenely wealthy minority controlling this country. The existing establishment will never willingly change the system because it serves their myopic gluttonous interests.”

• Its not just this country. It is a GLOBAL herd thinning.

• To describe the obscenely wealthy minority you need to examine their sociopathic viewpoints and their causative disease — Xtrevilism. Scum bag gluttonous pigs like Buffet, and others, are Xtrevilists, easily recognized by their fat wallets and elitist thinking.

• To change the system, where you have NO SEAT AT THE POLICY TABLE, you have to go outside the system…

http://www.boxthefox.com/articles/xtrevilism%20election%20scam.html

Deception is the strongest political force on the planet.

Dr. Gabor Mate: The Power of Addiction and the Addiction of Power. He speaks a lot about drug addictions (it’s a good listen if anyone is interested, how these things stem from early childhood), but at around the 14 minute mark he speaks about the addiction to wealth and power as well.

“The addiction to power is always about the emptiness that you try and fill from the outside. […]

If you look at the story of Jesus and Buddha, both of them were tempted by the Devil, and one of the things that the Devil offers them is power, earthly power, and they both say no. Why do they say “no”? They say “no” because they have the power inside of themselves. They don’t need it from the outside. And they both say “no” because they don’t want to control people,

Let’s not look to the people in power to change things, because the people in power, I’m afraid to say, are very often some of the emptiest people in the world, and they’re not going to change things for us. We have to find that light within ourselves.”

Remember to be kind to those you love. All of us need to keep up the fight against injustice, but we must also remember to love our families while you’re doing it. Don’t abandon them in the fight, otherwise we have truly lost. Just something my daughter reminded me of.

Admin – another masterpiece! You are up there with the likes of Michael Lewis. Take care of yourself and remember to laugh and hug your children.

“We Americans are not usually thought to be a submissive people, but of course we are. Why else would we allow our country to be destroyed? Why else would we be rewarding its destroyers? Why else would we all — by proxies we have given to greedy corporations and corrupt politicians — be participating in its destruction?

Most of us are still too sane to piss in our own cistern, but we allow others to do so and we reward them for it. We reward them so well, in fact, that those who piss in our cistern are wealthier than the rest of us.”

Wendell Berry

Great article, Admin. Another virtuoso performance of your writing and research skills.

“High frequency trading accounted for 25% of all stock trades in 2005. By 2008 high frequency traders accounted for 65% of all trades. They now account for in excess of 80% of all trading.”

—-Admin in his post

Call me the tortoise in this race, but I don’t care what those fuckers on Wall Street do. I’ve been full tilt in energy and utility power since I retired nearly 7 years ago. I’m not about to roll the dice on risky shit. Averaging about $20K gain a year. Every year. No exceptions. Not too bad in an economy that tanked right about the time I retired.

Maybe the HFT assholes are shaving some money off my gains, maybe not. Can’t do anything about it anyway. I invest in companies that put gas in your car and keep your refrigerator cool.

You may not be able to do anything ABOUT these shitbags, but there are still a few things you can do to PROTECT yourself from their predation. I think I found at least one of them.

SSS, your a good sort of govt worker.

Is their anyway that you can deny benefits seeing as your covered times over?

Now we can add Mozilla/Firefox to the easily corrupted list..

http://www.voxday.blogspot.com/2014/05/why-brendan-eich-had-to-go.html

Why Brendan Eich had to go

It looks rather like the failure of the Mozilla executives to defend CEO Eich from the Gay Mafia campaign being waged against him may have been at least in part due to the desire to remove a major obstacle to DRM being added to Firefox. Consider these three blog posts from three Mozilla figures, including Eich:

“With most competing browsers and the content industry embracing the W3C EME specification, Mozilla has little choice but to implement EME as well so our users can continue to access all content they want to enjoy. Read on for some background on how we got here, and details of our implementation.”

– Mozilla CTO Andreas Gal, 14 May 2014

“Mozilla will be adding a way to integrate Adobe Access DRM technology for video and audio into Firefox, via a common specification called Encrypted Media Extensions (EME).”

– The Mozilla Blog, 14 May 2014

“the W3C willfully underspecifying DRM in HTML5 is quite a different matter from browsers having to support several legacy plugins. Here is a narrow bridge on which to stand and fight — and perhaps fall, but (like Gandalf) live again and prevail in the longer run. If we lose this battle, there will be others where the world needs Mozilla.

“By now it should be clear why we view DRM as bad for users, open source, and alternative browser vendors:

Users: DRM is technically a contradiction, which leads directly to legal restraints against fair use and other user interests (e.g., accessibility).

Open source: Projects such as mozilla.org cannot implement a robust and Hollywood-compliant CDM black box inside the EME API container using open source software.

Alternative browser vendors: CDMs are analogous to ActiveX components from the bad old days: different for each OS and possibly even available only to the OS’s default browser.

“I continue to collaborate with others, including some in Hollywood, on watermarking, not DRM.”

– Brendan Eich, 22 October 2013

Eich stood firmly in the way of Mozilla incorporating DRM into Firefox. Now that he’s gone, and his technological authority with him, Mozilla immediately caved to Hollywood interests. It’s also interesting to note that the justification for Mozilla making this change is given as fear that users will abandon them. That demonstrates that the campaign to #uninstallfirefox was based on a sound principle, even if it was not quite as successful as I would have liked it to be.

As of yesterday, Firefox still represents 21 percent of the traffic here at VP, although it is down from 34 percent historically. But at least 8 percent of the overall traffic, (and nearly a quarter of the former Mozilla traffic), now uses Pale Moon. If you haven’t switched yet, I encourage you to try it out. Perhaps Mozilla’s embrace of DRM will convince you to do so.

Labels: technology

“Is their anyway that you can deny benefits seeing as your covered times over?”

—-Kill Bill @ SSS

Not sure I understand the question.

Most people figured it was this way. About five minutes after they found out what a stock market was.