We heard from several central banks in the last few days, and what they had to say was just one more reminder that we are in a Hill Street Blues financial world. So, hey, let’s be careful out there—-and then some!

The Fed’s policy statement Wednesday, for example, was mainly just another trite economic weather report which could have been written after watching CNBC with the sound turned off. But the statement did hint that maybe 78 months of ZIRP won’t be enough, after all. Having stripped out all calendar references relative to the timing of its upcoming monetary body slam, whereupon Wall Street gamblers will be be charged the apparently usurious sum of 25 bps for their poker chips, it hinted at another reason for delaying the dreaded day:

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation.

That’s right. If they don’t see enough inflation soon, they will keep Wall Street rampaging at the zero bound even beyond June. It is no longer worth mentioning that there is not a shred of evidence that the US economy would grow faster at a 2.0% CPI inflation rate versus the actual rate of 1.0% recorded over the last three years.

Stated differently, exactly how is it that the tiny dip in the CPI owning to cheaper gasoline during the second half of 2014 once again delayed the promised nirvana of “escape velocity” for the fifth year running? Indeed, the very same Keynesian economists who insisted that the oil price collapse would cause consumer spending to surge are now urging the Fed to delay raising rates because inflation is too low and the US economy has once again stalled-out.

Nor is it worthwhile to mention that the slight CPI dip shown above reflects the oil price plunge working its way through the price chain and that this short-term price shock is already abating, as reflected in the CPI upturn in March. Indeed, if you look at the Fed’s preferred index, the PCE deflator less food and energy, it has been as smooth as the skin on a baby’s bottom for years. So there is no evidence of a step-change toward some kind of drastic deflation that can possibly justify dithering even longer on the rate issue.

In fact, the trend rate of annual change in the PCE-ex food and energy index has been 1.7% since the year 2000, and it has continued to post within a hair of that during the most recent three years. To wit, the annual increase was 1.4% during the year ending in March 2015 compared to 1.3% during the year before that and 1.4 percent during the LTM period ending in March 2013.

So there just plain ain’t no deflation crisis, nor any change of CPI trend other than the oil plunge, which ironically was caused by the central banks themselves. They accomplished this, first, by inflating a global boom that exaggerated the sustainable demand for oil; and then by generating a panicked scramble for yield among money mangers that led to $500 billion of cheap debt flowing down the well bores in the shale patch, and a resulting flood of excess supply on the world petroleum market.

So what the Fed is doing is simply further inflating the financial bubble on the self-serving theory that asset inflation doesn’t count. Well, it seems only yesterday that the Fed’s “maximum employment” objective was bushwhacked by the 2008 bubble meltdown on Wall Street and the Great Recession which followed.

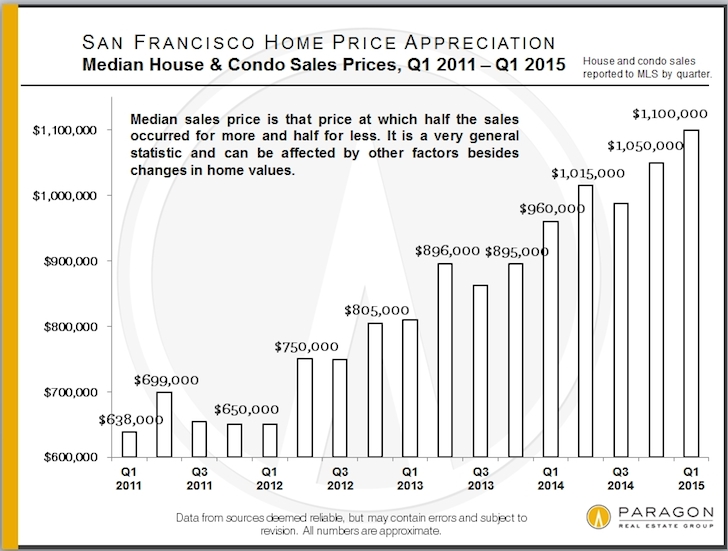

Yet the inhabitants of the Eccles Building stubbornly insist that there are no worrisome bubbles yet evident. Well, here’s one from Janet Yellen’s own backyard courtesy of Dr. Housing Bubble. The median house price in San Francisco is now $1.1 million, and it has been stair-stepping higher like clockwork during each of the Fed’s QE money printing phases.

Indeed, if you had been idling your time in a median priced condo in San Francisco for the past 48 months you could have cashed out this winter at a 72% gain. That’s a $462,000 profit for standing around the basket during the Fed’s monumental money printing campaign.

And yet this is about much more than windfalls to existing property owners who have been smart enough to sell before the next crash. The insane appreciation shown below is only symptomatic of what is happening in the entire US economy.

That is to say, for every instance of windfall gains there are associated disruptions, deformations and malinvestments that reduce societal equity today and generate dead-weight economic losses tomorrow. Tens of thousands of working income families have been flushed out of San Francisco for no good reason; they just can’t afford the soaring rents. Likewise, its commercial landscape is teeming was “cash burn” startups that in due course will vacate their posh office suites and leave busted leases behind when the VC cash dries up.

That’s what bubbles do, and San Francisco has proved that more than once in the present era of central bank driven financial inflation.

There is no mystery, of course, as to where the buying power that propelled this price explosion came from. San Francisco is ground zero for the social media and biotech bubbles.

The cascades of cash which have tumbled out of these bubbles are mind-boggling. The billions of venture capital flowing into these sectors support booming start-up payrolls, mushrooming networks of vendor support services and prodigious on-line advertising outlays. The latter generate more of the same in the next tier of startups which burn the advertising revenues that were funded by their “advertising customers” VC cash. And when this pipeline of start-ups is eventually pushed into the delirious IPO markets, the brokerage accounts of the selling entrepreneurs are suddenly flush with cash and stock—-all the better to collateralize jumbo loans to buy condos, townhouses and lofts and renovate them in style.

Needless to say, this is not capitalist creation at work—–even though venture capital risk-taking and homeruns for inventors and innovators are the sum and substance of real prosperity and growth. What is wrong here is not the process or even some of the outcomes likes Apple and Google.

The evil lies in the context in which today’s venture capitalism is being played out. Namely, an artificial financial casino fostered by central bank falsification of prices and valuations—a milieu where blind greed and mindless start-up activity run wild without the disciplining forces of honest and free capital markets.

There could be no better illustration of this deformation than the flaming valuation mania in the biotech sector. Yes, there are plenty of interesting breakthroughs happening in the biotech world these days, but that has been true for more than a decade. It does not begin to explain how the biotech index soared by 6X since the March 2009 bottom and by nearly 300% just in the last 48 months depicted in the housing graph above.

Here’s actually why. At its peak a few weeks ago, the NASDAQ biotech index of 150 companies was valued at nearly $1.1 trillion. Yet the LTM net income of the entire group was only $21 billion, meaning that the index was trading at 50X profits.

And that wasn’t the half of it. Among these 150 biotechs there were just 25 companies that had any profits at all. This latter group included big cap giants like Gilead, Amgen, Shire, Biogen, Celgene and 20 others, which among them had $30.5 billion of net income and accounted for $780 billion of the total index market cap. At the implied PE multiple of 26X, even these profitable companies were valued at pretty sporty levels.

But there’s no denying the bubble mania when it comes to the remaining 125 companies in the index. These companies were valued at $280 billion, but posted aggregate losses of nearly $10 billion in the most recent LTM reporting period.

So, yes, there is a stupendous bubble in biotech. In this instance, it amounts to well more than one-quarter trillion dollars of bottled air. Its a direct result of six years of free ZIRP money to the carry trade gamblers and Wall Street’s self-evident confidence that the Fed is petrified of a hissy fit and will not hesitate to keep the juice flowing indefinitely—– even if it’s called a 25 bps increase in the money market rate, eventually.

As to the social media stocks, the mania is even more extreme. This week three of the high flyers—–LinkedIn, Twitter and Yelp—-took a pasting because their gussied up “ex-items” results did not meet expectations and their forward guidance had a whiff of confession that beanstalks don’t grow to the sky, after all.

But the real numbers are downright lunatic, and notwithstanding $20 billion of combined market cap loss in the last few weeks, their valuations remain in the realm of rank speculation. To wit, at their recent stock price peaks, the combined market cap of these three social media high flyers was $75 billion. Not surprisingly, in 2014 they had a combined loss of nearly $600 million, which will only get worse on an LTM basis after the further Q1 deterioration just reported.

Moreover, during the 3-5 years for which there are filed financial statements, in fact, the three amigos have chalked up $1.6 billion in net losses. Needless to say, that makes sense only in a bubble context. The three went public during 2011-2013 as the Fed latest party started to roar, and initially were valued at about $30 billion based on virtually no revenues and deep losses. And as the losses mushroomed in the interim, their combined valuation, naturally, more than doubled!

In fact, of course, these social media companies may or may not have a future as operating businesses, but as financial enterprises they are the very embodiment of the “cash burning machines” that have fueled the false economy of San Francisco and similar bubble finance precincts from Los Angeles to Boston and Wall Street.

During 2014, the three social media high flyers burned nearly $3 billion in cash as measured by cash from operations less investments in CapEx and acquisitions. That cash burn doubles to nearly $6 billion during their brief lifetimes as SEC filers.

Only in a central bank fueled casino is a $6 billion cash burn worth $75 billion of market cap. That is, until it isn’t.

Self-evidently, the monetary politburo is completely lost. The escape velocity that it promised is now fast turning into a flat-line at best. Based on the Atlanta Fed’s Nowcast—which was dead on during Q1, first half GDP growth will post at less than 1%, and that’s if the mountain of inventory build-up in recent quarters does not succumb to panicked liquidation orders from the C-suites in the face of an unexpected “black swan” event in the casinos.

Perhaps it is time for the monetary politburo to throw in the towel, and admit it is clueless. If it should ever be so inclined, Pater Tenebrarum has composed a brilliantly fitting statement:

“In spite of lots of “incoming information”, we still haven’t the foggiest clue what we are doing or what any of it means. We’re all praying that this sucker doesn’t blow up into our faces before we’ve sailed off into retirement. As to us ever shrinking the balance sheet again or actually doing something that might be remotely reminiscent of tightening, forget it dude. Do you think we want to be blamed for another crash?”

Yet in the central bank fueled bubble category, the Fed has plenty of company around the world. Below is pictured an even bigger one—–that is, Mario Draghi’s sovereign bond bubble.

The fact is, inflation has already bottomed in Europe, and it never was rational to price 10-year bonds based on the inflation run-rate of the last 90 days. Nevertheless, the 10-year German bund soared just two weeks ago to a bubble peak yield of 5 bps! In the last several days, however, it has “corrected” to 35 bps because some big time bond managers finally said “enough” and declared the German bund the short of a lifetime.

It surely is, and so is the entire $100 trillion bond market of the world—including sovereigns, corporates and junk. The central banks have not repealed the law of supply and demand. But what they have done is expand their balance sheets from around $6 trillion before the 2008 financial crisis to upwards of $21 trillion today.

Folks, that’s the fattest bid in human history. By scooping up $15 trillion of public debt and other securities with credits conjured from thin air, the central banks have given rise to price falsification on a monumental and planetary scale.

This week Draghi said its all working because the year/year CPI in Europe came in at zero after registering a hairline negative during the precious four months. Can he spell “oil”? Does he have a clue that his “whatever it takes” ukase and $1.2 trillion QE campaign has generated a front-runners buying frenzy like never before—– but also one which could turn on a dime, as occurred in the German bund market this week?

If Europe had a Sergeant Phil Easterhaus, he would now be issuing a more bracing reminder than merely to be “careful” In fact, the $2 trillion of Eurozone sovereign debt now trading at subzero rates will soon enough comprise the subprime bonfires of the next crash.

German 10-Year Bund Yield

Travel a little north of Frankfurt and you get more of the same. This week Sweden’s exchange rate momentarily rallied because the central bank took a breather and did not lower its policy rate from (0.25%) to (0.4%). Really? The currency market gamblers were actually buying a two-bit currency that its issuer has pledged to destroy because Sweden doesn’t have enough inflation?

Well, does this look like a country that has been parched for lack of inflation? The graph shows that Sweden’s consumer price level has risen by 22% since the turn of the century. Do the apparatchiks at the Riksbank actually believed that Sweden’s over-taxed citizenry has been harmed by the slight flattening of the inflation trend in recent years, which has allowed their stagnating wages to at least retain their purchasing power?

There is danger out there, indeed.

But no survey would be complete without an update on the dangerous lunacy emanating from the central bank of Japan. Having achieved exactly zero inflation since the launch of his bond buying spree in March 2013, Kuroda reiterated once again that his monetary Kamikaze campaign knows no limits:

“The price trend is steadily improving and is expected to keep doing so,” Kuroda said at a press briefing after the decision….but reiterated he won’t hesitate to act (i.e. print even more yen) if the 2 percent target proves hard to reach.

Faced with a flood of yen, not surprisingly the central bank of South Korea has also cut is policy rate several times in the last few months and is now on a bee-line from its current 1.75% level to the zero bound.

And not to be daunted by its existing $28 trillion pyramid of debt, the People’s Printing Press of China this week announced that it would be taking a leaf from the ECB’s play book. That is, it would soon launch a large campaign to fund China’s bankrupt local governments with newly printed cash via direct loans against the so-called “collateral” of newly issued local government bonds—-the proceeds of which are being used to pay off the banks and the shadow lenders, alike.

The Ponzi is breathtaking. Upwards of 40% of local government revenue in China is derived from selling land at massively inflated prices to feed China’s credit driven construction binge. Now the due bill is coming in on these white elephants and the local governments, which built endless highways, bridges, airports and high rises, cannot even remotely service the $3 trillion of debt they incurred in minting “GDP” in line with Beijing’s quotas.

Never mind. The suzerains in Beijing are fixing to crank up the printing presses for another blistering round of credit fueled prosperity.

Surely, the red capitalism bubble in China is ground zero for the next financial conflagration. But when it happens, even Sgt. Easterhaus would surely lose his cool and flee the station.

He hit it out of the park on the truthiness scale with this one, IMHO:

“The evil lies in the context in which today’s venture capitalism is being played out. Namely, an artificial financial casino fostered by central bank falsification of prices and valuations—a milieu where blind greed and mindless start-up activity run wild without the disciplining forces of honest and free capital markets.”

What IS the true value of anything?

Yes, it’s a full-out Ponzi scheme.

No, it’s no a bubble filled with air…. I prefer the Hindenburg metaphor, so as they push this behemoth floating abstraction of an economy higher, I figure it’s with HYDROGEN, the stuff that explodes with the tiniest spark.