It seems hard to believe, but your government is purposely recreating the mortgage debacle of 2007 and putting you on the hook for the billions in losses coming down the road. In their frantic effort to generate the appearance of economic recovery they are willing to gamble with taxpayer’s money while luring unsuspecting blue collar folks into buying houses they can’t afford. During the previous housing bubble, greedy Wall Street bankers, deceitful mortgage brokers, and corrupt rating agencies colluded to commit the greatest control fraud in the history of mankind. This time it is your government, aided and abetted by the Federal Reserve, that is actively promoting the lending of money to people incapable of paying it back. And again, you the taxpayer will be on the hook when it predictably blows up.

The FHA, created during the first Great Depression, is supposed to be self-sustaining through mortgage insurance premiums charged to homeowners, just like Fannie, Freddie, Medicare, Social Security, and student loan lending were supposed to be self- sustaining through taxes, fees, and interest. This agency was supposed to promote homeownership for lower income Americans, but has been used by politicians as a tool to capture votes, payoff crony capitalist benefactors, and as a Keynesian stimulus tool designed to kindle a fake housing recovery. They entered the fray at the tail end of the last Fed/Wall Street created housing bubble, insuring a huge number of subprime mortgage loans from 2007 through 2009. The taxpayer has already had to bail out this incompetent, politically motivated, joke of an agency to the tune of $1.7 billion in 2014.

Edward J. Pinto, a former Fannie Mae official, estimates that under standard accounting practices the agency is already insolvent to the tune of $25 billion. Mark to fantasy accounting hasn’t just benefitted the criminal Wall Street cabal, but also the bloated pig government housing agencies – Fannie, Freddie and the FHA. The FHA’s share of new loans with mortgage insurance stood at 16.4% in 2005 and currently stands at 44.3%. This is a ridiculously high level considering the percentage of first time home buyers is near all-time lows and low income buyers have lower real median household income than they had in 2005. Distinguished congresswoman Maxine Waters, who once declared: “We do not have a crisis at Freddie Mac, and particularly Fannie Mae, under the outstanding leadership of Frank Raines.”, prior to them imploding and costing taxpayers $187 billion in losses, thinks the FHA is doing a bang up job. Her financial acumen is unquestioned, so you can expect another bailout in the near future.

“Above all, we must strive to have a healthy, viable FHA that can continue to facilitate homeownership for first-time and low-income home buyers, while standing ready in the unfortunate event of another housing downturn.”

How could politically motivated government apparatchiks insuring subprime mortgages with down payments of 3.5%, using weak underwriting standards, easing restrictions on borrowers with past foreclosures, in a housing market poised to drop by 20% when this next Fed/Wall Street housing bubble pops possibly go wrong? The entire faux housing recovery, which has driven average home prices up 30% since 2012, has been driven on the high end by The Wall Street hedge fund buy foreclosures in bulk and rent scheme, along with hot money cash from Chinese and Russian oligarchs, while the low end is being propped up by Fannie, Freddie, and the FHA with their brilliant idea to insure 3.5% down payment mortgages to future foreclosure aspirants.

We have the employment to population ratio at 35 year lows. We have had stagnant real wage growth since 2008 as low paying service Obama jobs have replaced higher paying production jobs. We have real median household income at 1989 levels and still 9% below the 2008 peak. We have mortgage applications 56% below the 2005 peak and hovering at 1996 levels. We still have 4 million homeowners underwater in their mortgages. We have housing starts languishing 40% below the long-term average. We have the home ownership rate of 63.8% at quarter of a century lows. We have mortgage rates at all-time lows. And we have home prices soaring far above the inflation rate and wages because the Federal Reserve, in collaboration with the Federal government decided to create another housing bubble (along with stock and bond bubbles) to rectify the disastrous consequences of their last housing bubble.

This is the absolute perfect point in time when the FHA thinks it is necessary for them to lure low income, low IQ, credit challenged dupes into the housing market. Risky mortgages are increasingly being underwritten by thinly capitalized non-banks and guaranteed by the FHA. In 2012 the large Wall Street banks represented 65.4% of FHA-backed loans. That number is now 29.6%, as even the risk seeking Wall Street criminal banks have come to their senses and realize loaning money to people that won’t be able to repay them will end badly – AGAIN. In their place, dodgy mortgage brokers (non-banks) now represent 62.2% of the FHA lending. Of course, once these low life mortgage brokers make the loans, Wall Street will package them, get a AAA rating from their bitches at S&P or Moodys, and then peddle them to yield seeking pension plans and life insurance companies. Sound familiar?

If you thought the FHA was supposed to help young, employed, first time home buyers who have a limited credit history, you would be badly mistaken. There is a reason first time home buyers only make up 29% of all home buyers, near the all-time low. Over history, when the housing market was not being manipulated by warped Federal Reserve monetary policies and government intervention, first time home buyers accounted for 40% to 45% of all home sales. Even with all-time low mortgage rates, courtesy of the Fed’s ZIRP, the lack of jobs, crushing student loan debt, low wages, and over-priced homes has kept traditional young buyers out of the market. But, the FHA’s goal is to convince anyone who can fog a mirror to get into the housing market before it’s too late.

To get some perspective on how the FHA is actively creating the next multi-billion dollar taxpayer bailout, you need to understand FICO credit scoring. Here are the categories:

• Excellent Credit: 781 – 850

• Good Credit: 661-780

• Fair Credit: 601-660

• Poor Credit: 501-600

• Bad Credit: below 500

The average FICO score of all Americans is 687, barely above the Fair Credit level. The average for Americans getting a mortgage is 724, down from 750 in 2012, as the reckless mortgage brokers have taken share from the banks. It is only rational that people with good credit should be the only people borrowing hundreds of thousands of dollars for 30 years. Not in the eyes of the FHA and their politician overseers, who buy votes by doling out free shit to their constituents. Why not houses? You can get an FHA loan with a credit score as low as 500, so long as you have a 10% down payment. And once you hit a 580 credit score, you only need a 3.5% down payment. Credit scores below 600 mean that you have significant derogatory information on your credit report. In other words, you have proven to be a deadbeat. Credit scores below 600 are the result of missing multiple payments on credit cards and auto loans; having multiple collection items or judgments; and potentially having a very recent bankruptcy or foreclosure. Sounds like someone I’d loan money to.

After financial institutions lost hundreds of billions (covered by American taxpayers at the point of a gun through TARP) by peddling low or no down payment mortgages for $500,000 McMansions to deadbeats with no willingness or means of repaying, the percentage of low down payment mortgages rationally plunged from 77% to 60% for first time buyers. Low down payment mortgage loans are a high risk proposition. It wasn’t that long ago when a borrower had to put up 10% to 20%. If you can’t save enough for a 10% down payment then you probably shouldn’t own a house. If your down payment is less than 8%, you are immediately underwater as the costs to sell a home usually total 8% of the selling price. The percentage of first time buyer mortgages with a low down payment mortgage has risen to 66% in the last year and is headed higher, as the FHA is pushing hard on their 3.5% down payment loans.

As a general risk guideline, your monthly mortgage payment, including principal, interest, real estate taxes and homeowners insurance, should not exceed 28% of your gross monthly income. Total debt to income generally cannot exceed 43% of your gross monthly income. These guidelines have worked for decades in assessing whether a borrower can afford a mortgage. Why would an arrogant bureaucratic agency, controlled by politicians like Mel Watt and Maxine Waters, follow standard industry risk standards when they are only gambling with taxpayer funds? The FHA is exempt from the qualified mortgage requirement of a 43% debt-to-income ratio. Many loans have a debt-to-income ratio above 55%. Even worse, the FHA only looks at mortgage payments in their calculation. What do you think the odds are of a borrower with a 580 credit score, making $3,000 per month with a $1,500 monthly mortgage payment, of defaulting? They would be high under normal circumstances, and will be off the charts after the next financial bubble bursts and millions are put out of work again.

People who are serial defaulters with 580 credit scores cannot expect to get the lowest rates. They should expect to see interest rates that are at least three percent higher than interest rates awarded to borrowers with good credit. Even the 3.5% down payment requirement is flexible for the FHA. The FHA is perfectly willing to accept a gift or inheritance as a down payment. So, you could have no savings, a 580 FICO, a 50% debt-to-income ratio and a gift from your parents and that would be sufficient to get you a loan. And it gets better. The transaction can be designed with the buyer paying a higher price but getting a credit for closing costs that covers the 3.5% down payment and other fees. Therefore, a serial deadbeat can purchase a house with a government guarantee without putting up one dime of their own cash. Sounds like a great deal for the taxpayer.

I have personal experience with a current FHA mortgage transaction as my 79 year old widowed mother is in the midst of selling the 900 square foot row home that she has lived in for 58 years in the first ring of suburbs outside of Philadelphia. It was once a vibrant middle class neighborhood of working folk, but has been gradually decaying as the old guard dies off and is replaced by lower class Section 8 tenants. She is selling ten years too late as prices have dropped 30% since 2005. She asked $72,900 and received an offer within two weeks of $66,000, with a $4,000 closing credit. My siblings and I didn’t expect her to get an offer in the 60s, as the dump next door was sold for $30,000 and went Section 8 a couple years ago. Anyone buying this house is destined for another 30% loss over the next ten years. So we told her to take the offer before it was too late.

My brother and I met the realtor at her house after work a couple weeks ago. We sat around the dining room table that had seen so many family gatherings over the last half century and discussed the particulars of the deal and the buyer’s background. It was an enlightening glimpse into the Federal government’s futile attempt to engineer a housing recovery on the backs of hard working tax payers with good credit. The buyer is a 20 something guy living with his parents, with a girlfriend and a young kid. He reportedly makes $29,000 per year. His girlfriend was not on the mortgage application. The only logical explanation is she has bad credit. He is putting 3.5% down and getting an FHA guaranteed mortgage. The $4,000 closing credit will cover his 3.5% down payment and closing costs. He evidently has no money to put down when purchasing this home. Sounds promising.

As a high risk borrower he will be lucky to get a 5.5% rate mortgage. In a world where risk mattered, it should be 7.5%. He should thank Ben and Janet for encouraging this type of mal-investment across the country with their 0% interest rate policy. His monthly cost to own this home would be approximately $800, or about 33% of his monthly gross income. Of course, no one brings home their gross income. The $800 would be about 40% of his take home pay after taxes. He did arrive at the house in a nice car, so it is very likely he has at least one auto loan of $20,000 or more. If he doesn’t have a dime to put down on the house, he is likely acting like a true American and rolling a $10,000 credit card balance at 17% interest. His total debt payments assuming a six year auto loan at 3% and making the minimum payments on his credit card would total at least 55% of his monthly gross income. Lucky for him, the FHA doesn’t worry about his non-mortgage debt payments.

So this guy comes home each month with about $2,000 of income and pays out $1,300 in debt payments, leaving him $700 to pay for health insurance, food, utilities, cable, cell phones, entertainment, and any vices he and his baby momma may have. If this isn’t a recipe for default, nothing is. No bank in their right mind would loan this man $66,000 for 30 years at 5.5%. That’s where the crooked nonbank mortgage companies enter the scene, just as they did when their patron saint Angelo “the tan man” Mozilo was roaming the land doling out billions in subprime mortgages while cashing in his stock options in 2005. Remember back in the glory days from 2002 through 2007 when mortgage company fronts, staffed by used car salesmen, pizza delivery guys, and convicted criminals peddled no-doc, negative amortization, liar loan, subprime slime to every Juan, Bubba and Lakeisha, filling the derivative pipeline for Wall Street to destroy the financial system? They’re back.

These parasites don’t worry about individual risk, financial risk, or systematic risk. They care about upfront fees and their ability to package their toxic subprime mortgages and dump the risk on someone else before it all blows up again. They are willing to issue mortgages to people unlikely to repay because there is a big difference between the risk that faces the company, and the risk that faces the blood sucking founder of the mortgage front. It’s a perfect opportunity for shysters and scumbags. You set up a mortgage company, and take extraordinarily opulent commissions on all loans you book. In this Fed created paradise of low interest rates, investors are desperate for yield. An FHA loan provides the opportunity for an investor to receive a good yield and a guarantee from the Federal government – aka YOU THE TAXPAYER.

The conscienceless CEO and executives of these MBS machines revel in the vast commission revenue as the loans are booked. These companies retain little or no capital on their balance sheets. Instead, they pay dividends to the owners as quickly as possible, before the bottom drops out. When the next Fed induced financial crisis happens the mortgage company will go bankrupt, but the slimy owners will walk away unscathed. These fly by night operations are booking as much business as possible before the music stops playing. When the music stops, the taxpayer will be on the hook again, as the FHA will need a $25 billion to $50 billion bailout. The FHA is flying under the radar, still in the shadow of equally insolvent Fannie and Freddie. Their mission is supposedly to help lower income people achieve the American Dream, but their politically motivated actions today will lead to millions of borrowers experiencing an American Nightmare and taxpayers footing the bill for their crackpot Keynesian scheme, aided and abetted by the Janet Yellen and her Fed cronies.

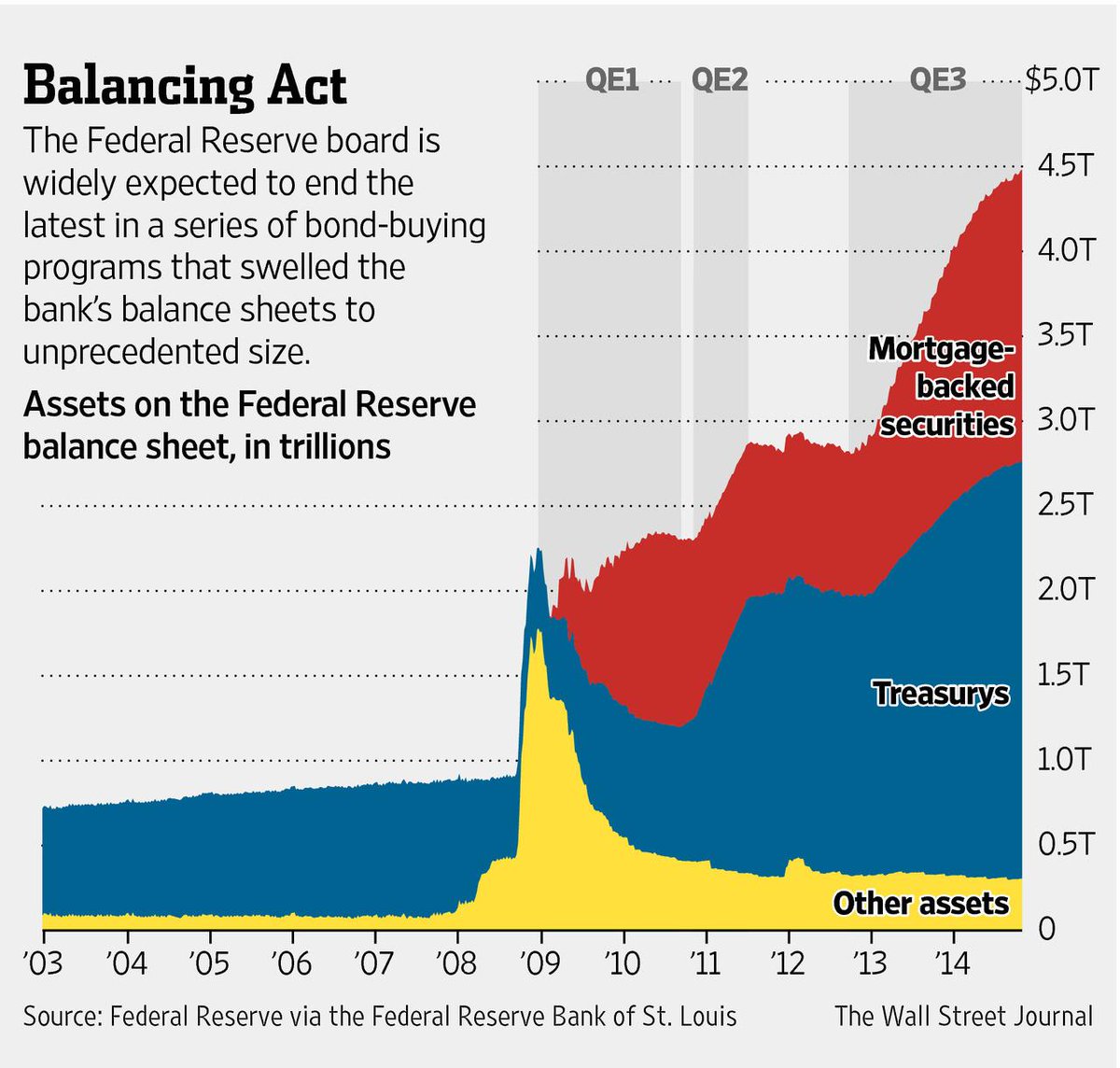

The FHA has $64 billion of liabilities on their balance sheet supported by $3 billion of capital. They are currently accelerating their guarantees to subprime borrowers with 3.5% down mortgages. Fannie and Freddie will purchase mortgages with only 3% down payments. Wall Street issued $1 trillion of mortgage backed securities last year, with the Fed buying 20% of the issuance as part of QE3. If this sounds like a replay of the waning days of the last Fed induced housing bubble, it’s because it is. Both debacles have been fueled by the mal-investment created by an easy money, excessively low interest rate environment, designed to benefit bankers, billionaires, politicians and mega-corporations. The Fed already has $1.7 trillion of Wall Street generated toxic mortgage debt on its bloated balance sheet. By the time this imminent catastrophe runs its course, there will be another trillion of toxic mortgages polluting their insolvent balance sheet.

To paraphrase H.L. Mencken, anyone who wants the government and Federal Reserve to create a housing recovery, deserves to get it good and hard, like a four by four to the side of their head. Subprime mortgages, subprime auto loans, and subprime student loans driven by preposterously low interest rates are the liquefying foundation of this fake economic recovery. Most rational people would agree that loaning money to people who will eventually default is not a good idea. But it is the underpinning of everything the Fed and government apparatchiks have done to keep this farce going a little while longer. It will not end well – Again.

The reason the greedy Wall Street bankers, deceitful mortgage brokers, and corrupt rating agencies colluded to commit the greatest control fraud in the history of mankind the first go round was because Fannie Mae, and Freddie Mac were there to buy this crap thus backstopping the scam. Without the toxic twins there would have been no end game and therefore no scam. The sting doesn’t work without a mark and the twins were the perfect mark.

This time by utilizing the FHA the mortgage brokers are cutting out the wall street middleman, and going straight to the feds. It will have the same ending only this time there won’t be billion dollar settlements propping up the Justice Department.

PAY FOR PERFORMANCE 🙂

Fannie, Freddie chief executives could get pay rise

By Joe Light

Published: May 5, 2015 2:51 p.m. ET

Mel Watt is considering letting the chief executives of Fannie Mae and Freddie Mac get pay rises.

The regulator of Fannie Mae and Freddie Mac is considering raising the pay for the companies’ chief executives over the objections of the U.S. Treasury Department, others within the Obama Administration and some lawmakers.

The raises would be a significant change for the companies, whose chief executives last year earned $600,000 in salary without bonuses. Such a move would show that Melvin Watt, director of the Federal Housing Finance Agency, is concerned about how to maintain steady hands at the companies as they remain in seemingly-perpetual government control.

But a potential pay increase won’t be without critics. Former FHFA Director Edward DeMarco slashed the companies’ chief executives’ pay in 2012 as a response to lawmakers’ concerns. In 2011, before the pay cuts, Fannie Mae’s chief executive earned $5.3 million, while Freddie’s CEO earned $3.8 million. Watt’s move would potentially reverse a significant portion of the cuts.

The directive sent to the boards of Fannie Mae FNMA, -1.37% and Freddie Mac FMCC, -1.07% authorized them to submit a proposals to adjust the companies’ CEOs’ pay, citing “objectives of providing for CEO retention; effective succession planning for the CEO position; and continuity.”

Great piece, Admin. I read somewhere that BBVA bank is offering low/no down payment loans w/o even the PMI.

The endgame for all this is a deflationary collapse in the value out outstanding debt, to be accompanied by a massive “shortage” of money (i.e., people will be defaulting on loans right and left while pulling back their spending to only utter necessities, collapsing vast areas of current economic activity in a reinforcing spiral of sales shortfalls, mass layoffs, sales shortfalls, etc.)

Thinking the taxpayer is on the hook for all this is the same as thinking “future generations” will be paying for the folly of today directly. This is an error, as I see it.

What should occur, instead, is simply that future people will be poorer than they would have been had all this stupidity not been pursued. I don’t think “poorer” will be due to high taxes…taxes cannot be raised much above where they are before people simply stop working because the marginal return of working is too small to bother.

No, “poorer” means just that. It will be more difficult than now to find remunerative work, and the labyrinthine welfare system’s payouts will shrink dramatically with tax revenues. People will be poorer on average.

I thought using a seller credit for, or borrowing the downpayment was not allowed on FHA loans?

Your buyer’s P&I Payment is $375 at $66,000; maybe PITI is $500/Mo. – guessing that is less than rent?

QQQBall

He is getting an FHA 3.5% down payment loan and getting a $4,000 seller credit, so it must be allowed now.

Property taxes are $4,500 per year.

I think they should get their pay raises. Any idea how hard it is to blow through billions of taxpayer dollars on shoddy mortgages? Do you know how many times you have to use the “Approved” stamp. You’re talking extreme physical exertion and exposure to toxic fumes emanating from the stamp pad. Only a special breed can rise to that level of incompetence and therefore needs to be properly compensated.

How do you expect the FHA to shovel the money out the door if the buyer has to write a check? I wonder if he will be in there long enough to actually make a property tax payment. That will be on the taxpayers as well.

Skinny

We need to discuss the housing market over a Guinness.

Quantitative Easing Is A Squalid Little Lie That Appeals To Economists With No Grasp Of History

Submitted by Tim Price via Sovereign Man blog,

There is one thing riskier than investing in a free market: investing in a rigged market when you think the central bank has your back.

At some point, the free market returns with a vengeance, like a coiled spring made out of pure risk. That time may be coming soon.

Last week, German government 10-year bond yields suddenly spiked from just 8 basis points to 37 basis points.

Now, a 29 basis point (0.29%) jump may not seem like much, but with yields so slender, a move of that magnitude is easily enough to put a few leveraged funds out of business.

Bonds have never been more expensive in human history, and yet their supply has never been higher.

10-year US Treasuries yield just 2.1%. 10-year UK Gilts yield 1.84%. 10-year German government bonds now yield 0.37%. And that bug-in-search-of-a-windshield 10-year Japanese bonds yield 0.32%.

Bloomberg’s William Pesek highlights the tortured logic plaguing Bank of Japan Governor Haruhiko Kuroda as he attempts to escape from the corner of the bond market he has painted himself into:

“[Japan] defies the basic tenets of economics for the nation with the largest total debt, largest ratio of geriatrics and low rates of immigration to have lower bond yields than countries like Singapore, Sweden or Switzerland.”

When one of the world’s government bond markets finally blows up (Japan still looks like the primary candidate, but stranger things have happened), economists will scratch their heads and wonder where it all went wrong.

Wiser souls will wonder how economists could ever have thought that money printing was the answer to anything.

In the introduction Schuettinger and Butler’s outstanding book Forty Centuries of Wage and Price Controls,” David Meiselman writes:

“Despite the clear lessons of history, many governments and public officials still hold the erroneous belief that price controls can and do control inflation. They thereby pursue monetary and fiscal policies that cause inflation, convinced that the inevitable cannot happen.

“When the inevitable does happen, public policy fails and hopes are dashed. Blunders mount, and faith in governments and government officials whose policies caused the mess declines. Political and economic freedoms are impaired and general civility suffers.”

Quantitative easing is a squalid little lie. It appeals to economists with no grasp of history. It pretends that too much debt can be simply resolved through futile attempts at price controls and money printing.

The practical outcome of QE is that it turns the bond market into a no-go area for any rational investor.

We are now in the terminal stages of QE, during which the practical limitations of this fatuous and discredited policy are being revealed.

When you devalue money and distort the supposed risk-free rate, you devalue every aspect of the capital structure, and of society itself.

I think he meant bonds have never been cheaper but I’m fine with settling it over a pint.

It is like offering a new car at half price to an unemployed homeless person. The reality of our economy may get in the way.

Dear Administrator,

Before I comment let me say that I love your blog. I read it and share it all of the time.

QQQball was correct. The 3.5% down payment can not come from the seller. The 3.5% down payment must come from the borrower’s own funds or it must be gifted to him from someone he has an established relationship with. The seller CAN NOT pay for the down payment. Also the limit on seller credits is 6% so you could only give this buyer $3960 in seller credits. Perhaps you rounded up.

I ‘d love to know where you came up with the $800/month payment and the amount of property taxes, and the amount of property taxes. I looked up Philadelphia’s property tax rate and it’s 1.34% of the assessed value. You said the home was in the suburbs of Philadelphia. The suburbs generally have lower property tax rates than the city. I know Pennsylvania has school district taxes which are added to the municipality’s property taxes, but at most they would be 2% of the assessed value. Unless your assessed value is over $200,000 there is no way the property taxes are $4500. If the assessed value is that high you can file to get your property taxes lower.

If I base property taxes on 2.5% of the sales price, then I come up with a total monthly payment including principle, interest, mortgage insurance, property taxes and homeowner’s insurance of around $550/month. That is under 23% of his gross income. Well below the 28% of gross income you mentioned.

Also you said, “the FHA doesn’t worry about his non-mortgage debt payments.” That is just not true. All debt payments have to be considered. Student loans, car loans, revolving debt like credit cards are considered. There are two debt to income ratios related to mortgage lending one is known as the front end ratio or housing ratio, and the other is total debt ratio or back end ratio. Historically like you said it has been 28/43.

We don’t know what other debts the buyer of your mother’s home had, but unless they are over $500/month he falls within those historical guidelines.

I don’t think the example you used is close to the abuses of the sub-prime or Alt A mortgages of the last decade. If you had a decent credit score you could get 100% financing on a $500,000 home despite making less than $50,000.

There are bad loan being made out there, but before you run a blog like this again I think you should have researched it better or ran it by someone who works in the industry. I have given information to both Mish and Denninger for their blogs, and I’d be happy to help.

Admin: “Property taxes are $4,500 per year.”

Are you shitting me? For a $66,000 house? What is the house appraised at by the city?

That’s about what I pay in property taxes for my home assessed at $440,000 in Fairfax County, VA.

I figure we have about 20-30 million new immigrants since the last housing bust in 2008, so all that the lenders need to do is bring back liar loans and house sales will go to the moon!

/sarc off

The important thing is that the banks – which must, presumably, have videos of our politicians, judges, and key bureaucrats, molesting children – don’t suffer the consequences of their criminality, stupidity, and incompetence.

No one around here is doing FHA. It’s all USDA if they aren’t prime conventional. Can still get 100% and a taxpayer backstop. I imagine they will be taking a nosedive soon as well.

Matt Foley

I do my mother’s taxes and have the tax bills in my possession. Her total real estate, school and municipal taxes total $4,500.

The principal, interest, PMI, taxes and homeowners insurance for this purchase will be $800 per month.

Those are the facts. I was not using this actual example as proof of the worst that is going on. It is anecdotal of something I am experiencing.

The agreement of sale is for $66,000 with a seller credit of approximately $4,000. Thanks for correcting my $40 error. Very helpful.

So you are telling me this dude can’t get a gift of $2,300 from his mother to put up as his down payment, close on the house, then use the $4,000 cash he gets back at closing to repay his mommy?

Admin, those taxes are outrageous for that valuation.

Westcoaster

Why do you think I tried to make her move ten years ago when she could have gotten $95,000 for the place. Old folks don’t listen to reason until it is too late. Renting is a far smarter financial option for her.

Very sad your mum is having to leave her home of 58 years.

I know it’s probably financially best, but this kind of leaving can be a real breaking point for older people. Sometimes they really never get over leaving their homes, no matter that it was the best choice to be made.

I hope she makes the adjustment. Many don’t.

I know you’ll take good care of her.

Admin, your mom’s $4,000 contribution can only go toward the buyer’s closing costs. It can’t legally go directly to the buyer. So if he’s going to pay back the gift, he’ll have to do it the old fashioned way – a cash advance on a credit card or rob a liquor store.

Iska

The buyer’s closing costs, excluding the down payment, will be far less than the $4,000. What happens to the excess? The seller has the 8% of closing costs.

Administrator says:

Westcoaster

Why do you think I tried to make her move ten years ago when she could have gotten $95,000 for the place. Old folks don’t listen to reason until it is too late. Renting is a far smarter financial option for her.

________________________________

$95,000 for a 900 sq. ft. rowhouse in a dying rustbelt city? I’d take that in a hearbeat.

I live outside San Francisco, but I have invested in 3 bungalows in southeast Rockford, Ill. The most recent one I bought for $12,500, put $65,000 in to totally renovate it, and probably can only get $50,000 for it if I was to sell today. I am renting it out for $775. RE taxes are $1800 a year. Terrible investment now but everything is relative. When the SHTF I have the option move into one of the houses and I won’t have to worry about it being in a fixer upper since all the work has been done . Currently I am renting a 2 BR close to San Francisco Airport for $2600 a month, but one bedrooms in SF proper are $3120 a month. I would much rather roll the dice with Rockford houses than SF, despite the fact that SF has plenty of jobs. I cannot believe that such rent levels can be sustained in any meaningful “correction”, let alone a crash.

In my view, in the ultimate global wipeout, SF will be thumped much worse than Chicago, as all the hot money going into pie-in-the-sky startups will vanish. There will be many middle class people who will have their savings wiped out and will be looking for a very low rent decent property to rent to rebuild their lives, so I would rather have very cheap places to offer rather than trying to rent out a home that cost me, say, $200K, let alone the million dollar bungalows you see commonly in the SF Bay Area.

According to RealtyTrac, Among the 25 MOST affordable counties in the country, 2015 fair market rent on a three-bedroom property will require 26 percent of median household income on average. Mind you, the upper limit you should spend on rent is usually supposed to be 30%, but even in the most affordable communities the average is now close to that rule of thumb upper limit. The whole housing market would be subjected to a major reset in the event of a crash, and the best place to be is to have invested the least amount of money in each unit you own, as housing increasingly is viewed as a roof over your head rather than a statement of your ‘lifestyle’.

Supporting high or higher real estate prices creates conditions of life that make lifes impossible in the light of the labor market and wage rates. It also limits the birth rate due to financial concerns putting a stop on or restricting reproduction. That is against The UN convention on Genocide article 2 section c and d. It is time for real estate prices and debts to be expunged. It is also time for combining incomes for home ownership and all prices in excess of 3 years pay to be illegal in order to fight genocide and social injustice. Real estate is only a place to live, it is not an investment.

I wonder whose interests Mel Watt is looking after:

“While some observers consider Watt’s appointment a significant lurch to the left compared to DeMarco, (he was among those named by the Democratic Socialists of America as a member of their caucus in 2009), Watt himself has raised a tremendous amount of money from banking and real estate-related corporations and trade associations. One report from the Sunlight Foundation found that for 2009, Watt had received some 45 percent of his total campaign funds from donors in the finance and real estate sector.”

THE BRILLIANCE OF AN FHA SUPPORTER

“We don’t need to be having something like sequestration that’s going to cause these job losses — over 170 million jobs that could be lost.” – – Maxine Waters,

“It’s time for the bully pulpit of the White House to bring the gangstas in, put them around the table and let them know that if they don’t come up with loan modifications and keep people in their homes that they’ve worked so hard for, we’re gonna tax them out of business.” – – Maxine Waters,

I have never missed a payment on anything and have an above average credit score. Went to my credit union which was actually a good deal years ago when I did a mortgage. I was disgusted to learn it would cost about $1000 to see if I even qualify for the lower interest rate and part of that expense was because of the federal law saying it had to be a ‘certified’ appraisal like that means anything. So yes, the law was written for the deadbeats and not responsible owners.

If there aren’t enough legitimate buyer costs to use up what the seller had agreed in the purchase agreement to pay, then there are a few possibilities:

1) they put the entire credit on the settlement statement, the excess is deemed an “inducement” (sales concession), the buyer doesn’t have their required minimum investment, their loan amount would have to be shrunk commensurately and re-underwritten (probably at the last minute which would be a complete cluster fuck, causing a delayed closing).

2) the seller is pressured to pay the excess contribution to the buyer “under the table” (not reflected on the settlement statement) which is fraud on the part of the buyer and the seller.

3) I order to avoid #1 and #2, the seller only pays those buyer closing costs that actually exist, even if that leaves part of the agreed upon $4,000 in her pocket.

If the buyer has a loan officer who’s not an idiot, they’ll figure out the problem ahead of time and find a way to legitimately use up all of the seller contribution (like buying the interest rate down a little), but if the buyer just walked into the local credit union, #3 is the most likely outcome (which would be best for your mom).

Iska

I have a feeling the whole thing will fall through at the last minute. Shouldn’t my mom’s real estate agent know this shit?

I told my folks to move out in 2005 when they could have probably got $350k for their home. At the time my dad was still quite mobile and wasn’t going to consider becoming a renter and complained that selling at the peak also meant buying somewhere else at the peak. Fair enough, end of discussion.

Fast forward 10 years and probably $30k in home improvements inc. new furnace/AC. Currently they could probably get $250k for the place. Property taxes are about $2100/yr.

So – $100k in lost equity + $30k invested + $21k in taxes = $151k over the past 10 years they’d theoretically have if they sold then. Well over 120 months thats only $1258/mo for rent. When I do the math that way mom & dad can live in that house till the day they die for all I care. Rents in this town are insane unless you live in a crack shack and I’m not putting my folks in a shit hole. Under $1500/mo doesn’t get anything worth a damn.

Was meeting a client last week, new apartment tower downtown trying to cater to 20-somethings and empty nesters. Two bedroom apartment on level 2 of 20+ that was just above a restaurant had an ask of $3000/mo. Granted it was “downtown” and a higher end place but this is an apartment. Same building had penthouse units asking $6k/mo.

We are in 2005-06 all over again not because everyone has gone real-estate crazy, it’s because it’s more affordable to pay a mortgage, property taxes, home maintenance than to rent a fucking apartment. This will not end well.

I wouldn’t expect your mom’s agent to know all of the underwriting rules, but if they’re a decent agent, they should have a good go-to loan officer who would point out that the seller “contribution” can’t exceed the lower of 6% of the sale price or actual costs. It appears that either the agent knew to limit your mom’s contribution to 6% (which they did) or the agent was correctly advised (by their trusted loan officer)) to limit it to 6%. So, somebody knows what they’re doing. My guess is that the buyer’s loan officer will figure out some way to legitimately use up the entire $3,960. If nothing else, it can be applied to FHA’s upfront mortgage insurance premium (about $1,100) – which most buyers finance. Now that I’ve thought about it more carefully, it sounds like it’s on track & should close fine. The buyer just has to scratch up the 3.5% down payment via gift from a relative.

Once you package all these guaranteed FHA subprime mortgages together, they’ll be as investment worthy as diseased cows.

[img [/img]

[/img]

Don’t you think there are a couple of differences now from when Lewis wrote The Big Short: (1) Banks are required to carry higher percentage of portfolio loans (in house). (2) Downstream markets (e.g. banks, bonds,) have dried up since they can’t get re-insurance (credit default swaps), and since again, after the fact, big insurance/ banks are now regulated as to how much of this liability they can carry in relation to their reserves.

The article points out that the non-banks are the problem now. It’s these shysters who are supplying the subprime drug fix now, guaranteed by YOU. It is different this time, but it isn’t better or less risky.

As described by Lewis in The Big Short, the MBS market had a ready group of foreign bond buyers in which the securites were insured by AIG. Do you see the same backstop in place today?

Wall Street issued $1 trillion of MBS in 2014. Someone is buying them – pension funds, life insurance companies, mutual funds. What is your point? Are you saying that loaning money to people who can’t repay will work this time?

Please clarify your position.

“Aquapura says:

I told my folks to move out in 2005 when they could have probably got $350k for their home. At the time my dad was still quite mobile and wasn’t going to consider becoming a renter”

–

I wish my folks had sold and rented too. Instead the state seized the title to their little house for long term Alzheimer’s care paid for by Medicaid.

That Medicaid money went straight into the pockets of a investor owned nursing home.

Government: middle-manning your money into the pockets of the corporations, and taking a skim off the top.

There’s nothing to worry about people it’s all good news, except for the bad news!!

There Will Be No 25-Year Depression.

Good and Bad News

Today, we have bad news and good news. The good news is that there will be no 25-year recession. Nor will there be a depression that will last the rest of our lifetimes.

The bad news: It will be much worse than that. On Monday, the Dow rose another 43 points. Gold seems to be working its way back to the $1,200 level, where it feels most comfortable.

“A long depression” has been much discussed in the financial press. Several economists are predicting many years of sluggish or negative growth. It is the obvious consequence of several overlapping trends and existing conditions.

http://www.zerohedge.com/news/2015-05-06/there-will-be-no-25-year-depression

[img [/img]

[/img]

fazsha says: In my view, in the ultimate global wipeout, SF will be thumped much worse than Chicago,

Dude when the dollar collapses there will be no large Metropolitan areas. Starving hungry people will over run and burn high population centers to the fucking ground. People like you pretend law and order will hold. Why? That’s all you’ve ever known, normalcy bias, it’s a deadly disease.

This is what Yellen addressed yesterday:

Nonbank lending rose to 37.5 percent of the market during 2014, up from 14 percent in 2011, according to publication Inside Mortgage Finance.

Meanwhile, if you bring cash to the table for a short sale, Chase bank lets you sit for over a month.

dc.sunsets says: “The endgame for all this is a deflationary collapse in the value out outstanding debt,”

Does that suggest that having cash would be a good thing? Even though debt gets deflated, you still have to pay the debt, or be forclosed on. The number of good jobs is also deflating, so it’s hard to make much money for most people. A person with cash could get some good buys on all kinds of things if deflation really kicks in. This could include land, houses, heavy equipment, cars etc.

This is all very interesting. Admin and other are very good at explaining what’s going on. My thought is who benefits. How can making 0% down loans for housing raise the economy and and provide the necessary jobs, income and increase the real GDP, less inflation and restore the economy to real growth? The FED say that ‘s their mandate, more jobs and an expanding economy.

I read where in 2013 Blackstone Investment poured 3 billion into property. Also, the banks providing this credit along with Fannie May and Freddie Mac are not going to be holding on to this ‘Old Maid’ and banks are going to package it and get it off their books. Can the banks do this? What about ratings? Are banks and rating companies even trustworthy? How many REOs are out there and not placed on the market in the hopes that RE prices will go up, and then they can sell? Maybe this is an attempt to clean out the inventory of illiquid assets on the part of the bank and private investment groups and put the bad debt into an dark institution, and then Freddie and Fannie will end up holding these mortgages, which will be default upon when jobs disappear.

As I see it, the government is sucking the last bit of liquidity out of the public purse. People will be making down payments and monthly payments on something that they will never own. I expect many more foreclosures when the depression fully hits. I expect to see laws like in Japan, where a bankruptcy and foreclosure results in a loss of your house, but not in the elimination of your debt.

I read recently, that debt is going to be the means to control the people. If that is true then all debt must be like student debt where it is impossible to declare bankruptcy and get out from under it.

This tactic is used by the IMF in their dealings with 3rd world counties. Perpetual debt. Greece is saying were not going to pay I say to the debt burdened to relinquish your debt obligation and go tell these parasites that created paper money out of thin air to take a hike. Like Iceland did..

I always believed in these times, you must be completely out of debt or indebted up to your eye balls with nothing to lose by defaulting and everything to gain.

There are niche markets in real estate where prices are rising and asset prices are rising for the 1%, but for the other 99% there was a decline in market value. (graphs that I have seen)

Would I tell my kids to buy a house? No! We are in a unstable economy and an unstable housing market. The myth of a housing being an investment has gone the way of the dodo bird. Look at the number of people with reverse mortgages to maintain their comfort zone. They are going to leave this world like they came into it, flat broke. Nothing will be built and left to their children.

This is the way your fearless leaders planned it. It is the ‘Company Store’. No economic freedom equates to slavery.

Jim, if you’re in the mood, what are the millage rates in philly that can give you a 4500 dollar tax bill on a 66 thousand dollar house? I thought we had it bad.

I have friends in California that own apartments. I tell them that they will be the providers of housing of last resort. When the state can no longer provide housing subsidies, they will pass a law, saying that if the renter can’t pay the rent, you can’t kick’em out but you still have to maintain the building.

The effect is to socialize your capital. Expect it from Jerry Brown, the government freeloader with 10 pensions. These liberal progressive sure take care of themselves.

Good information but y’all really need an editor. The writing isn’t the worst I’ve seen, but it’s far from the middle of the pack. On the low end.

@Janaki, Admin is busy right now, so I’ll jump in.

He does this on his own time, after the job that pays his bills, the vast majority of us that read and stay here come for the INFORMATION, not the grammar or professional graphics and editing.

You crack me up. Do you drop by the AP, or Reuters and tell them the same? Because they have huge staffs full of editors and Admin has a day job and a family.

Good thing that when the things he tells us about happen they will only affect those of us that don’t care about grammar. You should be just fine.

Ever hear the one about deck chairs and the Titanic? Maybe you should acquaint/reacquaint yourself with it.

I dont know about other counties, but here in Rockwall county, Texas, you can freeze the property tax if your name is on the deed and 65 +