It was a bad day in the market. It was down 2%. That’s nothing in the big picture. The market is up 300% since 2009. A 2% move shouldn’t be a problem in a normal market. But, we have an extremely overvalued abnormal market, propped up by excessive levels of debt and hundreds of billions in corporate stock buybacks. These CEO titans of industry are driven by greed and personal ambition. They aren’t smart enough to grow their businesses, so they have bought back their stock at record high prices in order to boost Earnings Per Share and their own stock based compensation packages.

They did the exact same thing in 2007, just before the last crash. These spineless Ivy League educated whores always buy high and sell low. In 2009, when their stocks were selling at bargain prices, they bought nothing. They are gutless front runners with no vision, leadership skills, or sense of morality. With markets in turmoil, these slimy snakes will hesitate to buy back their stock. Fear will overtake their greed. This form of liquidity for the stock market will dry up in an instant.

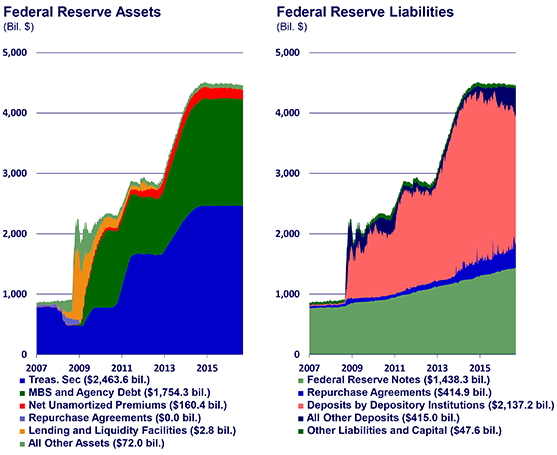

The Fed’s QE1, QE2, and QE3 were the primary driver of the stock market for the last five years. The rise in the Fed’s balance sheet from $900 billion to $4.5 trillion tracked the rise in the S&P 500 perfectly. I wonder why? Since October, the Fed stopped buying toxic mortgage assets, and its balance sheet has stayed at $4.5 trillion. In a shocking development, the stock market also went flat since November. With ZIRP supposedly ending in September, the endless liquidity and free lunch for Wall Street is over.

And now we have the final nail in the bull market coffin. The Wall Street lemmings have all piled into the market, believing the Fed has their back and stock markets only go up. Please closely examine the chart below. Margin debt isn’t just high, it is off the charts high. It makes 2000 and 2007 look like minor league events.

The investing geniuses who don’t believe in bear markets have borrowed over $500 BILLION against their existing stock holdings. This is the tinder for the coming wildfire. The way it works in the real world is – the market drops 2% to 4%. At the end of the day the margin lender assesses the position of their borrowers. If their collateral (stock holdings) has fallen below an allowable level, they make a margin call. The borrower must come up with cash immediately. Since they are hocked up to their eyeballs, they are forced to sell stock the next day to meet their margin call. The selling creates its own momentum. The selling accelerates and before long you have a crash in progress. It might not happen this week, but it will happen, just as a lightening strike ignites old dry tinder and creates a massive uncontrollable wildfire.

With margin debt at epic levels, the margin calls will be epic. Panic will set in quickly. All of the stock market geniuses will be trying to get out the same door at the same time. Bodies will be piled high at the exits. The 2% decline will not provoke the panic, but another plunge in the 3% to 5% range will create a waterfall effect. We are on the edge of panic. Can Yellen and her central banker cohorts keep the inevitable from happening? We’ll see.

Tomorrow could be fun!

Bring it on bitchez

This is long overdue, I think we are all ready for this motherfucker to burn.

In just a few hours Greece won’t be making their IMF loan payment, in effect defaulting. But, Brussels along with the IMF, the ECB, and any other central bank won’t be calling it a “default”.

Why not you ask?

Because of the amount of derivatives that have been written and sold using Greek debt as the underlying. The Greek sovereign debt is $350 – $400 billion, but the notional amount of derivatives is somewhere around $3 trillion!

Now if the failure of the Greek debt is pronounced officially as a “default, then the derivative credit default swap holders must be paid the complete notional amount.

So? Who’s got $3 trillion bucks on hand? When all global collateral has been re-hypothecated many times over. Its a bigga badda boom!

drpanicops?

No matter how long or how intensely you manipulate things, reality eventually catches up and rules the day.

There is always a day of reckoning, no exceptions.

Silver? Gold?

Making money in a down market is, in my experience, very challenging.

When everyone sees what’s coming, it doesn’t come that way.

When everyone is complacent, that’s when markets fall, or even plunge.

Right now people are fearful. It’s confusing the hell out of me.

http://www.zerohedge.com/news/2015-06-30/2015-all-sp-500-free-cash-flow-will-go-back-shareholders

Here’s what technical analysts are watching after the year’s biggest selloff

By Victor Reklaitis

Published: June 30, 2015 10:02 a.m. ET

One chart watcher says the stock market’s slide “could turn nasty” if the S&P 500 can’t hold above 2,040, while another emphasizes that investors shouldn’t expect a quick rebound.

That’s after the benchmark SPX, +0.41% SPY, +0.41% on Monday suffered its biggest one-day drop so far this year, finishing down 2.1%.

Jeffrey Saut, chief investment strategist at Raymond James, has his eye on 2,040 and stresses that the Dow DJIA, +0.36% has seen bigger damage. He writes in a note early Tuesday:

“[T]his decline could turn nasty if the S&P 500…doesn’t find support between 2040 and 2070. And while the SPX stayed above its 200-day moving average at 2053.51, the Dow Industrials…did not.…I would not trust this first bounce, believing last week’s ‘call’ for down into the July 4th holiday still makes sense.”

Frank Cappelleri, technical analyst at Instinet, also isn’t expecting a bounceback in the near term, writing in a note:

“Rarely are days like yesterday (and their contributing factors) easily forgotten. And a major reason is because of the carnage inflicted on the charts.…The bottom line is that the previously tentative uptrend is now broken and the leading areas were the hardest hit (Financials, Consumer Discretionary, Small Caps, etc.). We’ve seen the market come back strongly after large declines like yesterday, but it frequently doesn’t happen right away.”

Anybody see that Chicago borrowed $1Billion in bonds a few days ago to make a $600 Million teacher pension payment due today?

More debt to solve a debt problem, always a smart move, bond investors should be very afraid.

Support between 2040 and 2070 is what “EVERYONE” is watching…so signals from it will likely be confusing. It’s also likely that lots of sell-stops are hovering a little below 2040 and Mr. Market absolutely LOVES to go down to trigger everyone’s stops and then reverse.

My preferred scenario is another wave of selling, break 2040 a little (enough to trigger stops) and then rally…back toward the exponential moving averages on a daily basis that I like to watch (the 13 and 26 period EMA’s.)

If this actually happens, and the rally peters out near the EMA’s (and the EMA’s are in a bearish configuration, as I’d expect them to be) then I’ll put a pretty solid short position into play (although not betting the farm, I lost a boatload of money in the past doing that so now I only play with small change.)

For what it’s worth, the DAILY trend is now down at the moment. The weekly trend is still up, and stocks have bottomed and rallied back three times in the past 2 years from exactly this situation.

Will this be the One That’s Different? I think so, but I lost money last year “thinking so.”

Its the “Black Swan” that nobody is watching.

Puerto Rico.

The derivatives that have been written up and sold using the Puerto Rican muni bonds as the underlying are sinking. The CFO’s and CEO’s in the board rooms of the companies that are the counterparties of these weapons of mass financial destruction, are crapping their drawers!

These off-balance sheet, opaque financial structures called “Variable Interest Entities” (VIE’s) are underwritten by thinly capitalized companies, that carry 10 times as much counterparty risk. Meanwhile their stock prices on the markets have crashed by up to 25%!

Another bigga badda boom!

These VIE’s are beginning to explode like frags!

@Outlooking – I read about Peurto Rico’s threatened default for the very first time today! I try to keep my ear to the ground in alternative media and yet nothing about this until now. Greece has been in the headlines for 3+ years, and up till this week has been a lot of sound and fury. Peurto Rico may be the real deal. It seems this pot is finally boiling, will all the frogs get cooked?

French Economy In “Dire Straits”, “Worse Than Anyone Can Imagine”, Leaked NSA Cable Reveals;

here —- http://www.zerohedge.com/news/2015-06-29/french-economy-dire-straits-worse-anyone-can-imagine-leaked-nsa-cable-reveals

.

Bond Insurers Crash, Hit by Puerto Rico’s Default Shrapnel

here —-

An F-16D (1990) beats the snot out of the trillion dollar F-35 in a dog-fight.

=========================================================

A test pilot has some very, very bad news about the F-35 Joint Strike Fighter. The pricey new stealth jet can’t turn or climb fast enough to hit an enemy plane during a dogfight or to dodge the enemy’s own gunfire, the pilot reported following a day of mock air battles back in January.

“The F-35 was at a distinct energy disadvantage,” the unnamed pilot wrote in a scathing five-page brief that War Is Boring has obtained. The brief is unclassified but is labeled “for official use only.”

The test pilot’s report is the latest evidence of fundamental problems with the design of the F-35 — which, at a total program cost of more than a trillion dollars, is history’s most expensive weapon.

The U.S. Air Force, Navy and Marine Corps — not to mention the air forces and navies of more than a dozen U.S. allies — are counting on the Lockheed Martin-made JSF to replace many if not most of their current fighter jets.

And that means that, within a few decades, American and allied aviators will fly into battle in an inferior fighter — one that could get them killed … and cost the United States control of the air.

The fateful test took place on Jan. 14, 2015, apparently within the Sea Test Range over the Pacific Ocean near Edwards Air Force Base in California. The single-seat F-35A with the designation “AF-02” — one of the older JSFs in the Air Force — took off alongside a two-seat F-16D Block 40, one of the types of planes the F-35 is supposed to replace.

The two jets would be playing the roles of opposing fighters in a pretend air battle, which the Air Force organized specifically to test out the F-35’s prowess as a close-range dogfighter in an air-to-air tangle involving high “angles of attack,” or AoA, and “aggressive stick/pedal inputs.”

In other words, the F-35 pilot would fly his jet hard, turning and maneuvering in order to “shoot down” the F-16, whose pilot would be doing his own best to evade and kill the F-35.

“The evaluation focused on the overall effectiveness of the aircraft in performing various specified maneuvers in a dynamic environment,” the F-35 tester wrote. “This consisted of traditional Basic Fighter Maneuvers in offensive, defensive and neutral setups at altitudes ranging from 10,000 to 30,000 feet.”

https://medium.com/war-is-boring/test-pilot-admits-the-f-35-can-t-dogfight-cdb9d11a875

Yeah, muthafucka!!! Bring on dem nasty Russkies!!!

Is it too early for Panic Sex?

My pecker is starting to panic. Per Michael Snyder …

=========================================

1. On Monday, the Dow fell by 350 points. That was the biggest one day decline that we have seen in two years.

2. In Europe, stocks got absolutely smashed. Germany’s DAX index dropped 3.6 percent, and France’s CAC 40 was down 3.7 percent.

3. After Greece, Italy is considered to be the most financially troubled nation in the eurozone, and on Monday Italian stocks were down more than 5 percent.

4. Greek stocks were down an astounding 18 percent on Monday.

5. As the week began, we witnessed the largest one day increase in European bond spreads that we have seen in seven years.

6. Chinese stocks have already met the official definition of being in a “bear market” – the Shanghai Composite is already down more than 20 percent from the high earlier this year.

7. Overall, this Chinese stock market crash is the worst that we have witnessed in 19 years.

8. On Monday, Standard & Poor’s slashed Greece’s credit rating once again and publicly stated that it believes that Greece now has a 50 percent chance of leaving the euro.

9. On Tuesday, Greece is scheduled to make a 1.6 billion euro loan repayment. One Greek official has already stated that this is not going to happen.

10. Greek banks have been totally shut down, and a daily cash withdrawal limit of60 euros has been established. Nobody knows when this limit will be lifted.

11. Yields on 10 year Greek government bonds have shot past 15 percent.

12. U.S. investors are far more exposed to Greece than most people realize. The New York Times explains…

But the question of what happens when the markets do open is particularly acute for the hedge fund investors — including luminaries like David Einhorn and John Paulson — who have collectively poured more than 10 billion euros, or $11 billion, into Greek government bonds, bank stocks and a slew of other investments.

Through the weekend, Nicholas L. Papapolitis, a corporate lawyer here, was working round the clock comforting and cajoling his frantic hedge fund clients.

“People are freaking out,” said Mr. Papapolitis, 32, his eyes red and his voice hoarse. “They have made some really big bets on Greece.”

13. The Governor of Puerto Rico has announced that the debts that the small island has accumulated are “not payable“.

14. Overall, the government of Puerto Rico owes approximately 72 billion dollars to the rest of the world. Without debt restructuring, it is inevitable that Puerto Rico will default. In fact, CNN says that it could happen by the end of this summer.

15. Ukraine has just announced that it may “suspend debt payments” if their creditors do not agree to take a 40 percent “haircut”.

16. This week the Bank for International Settlements has just come out with a new report that says that central banks around the world are “defenseless” to stop the next major global financial crisis.

Moar Pecker Panic!!!

===================

Nightmare Scenarios: A Water-Starved Wasteland with Nuclear Weapons

BACK in 2011, the American actor George Clooney recalled asking Barack Obama to identify the one thing that kept him up at night.

“Pakistan,” replied the US president.

Obama did not elaborate. We can assume, however, that he was alluding to the various nightmare scenarios that spooked Washington officialdom back then, including loose nukes and state disintegration.

Today, Pakistan should still be keeping President Obama up at night — but not because of those aforementioned fears, which have always been purely hypothetical and somewhat fanciful. Instead, what should be causing sleepless nights for Obama — and concerned humanity overall — is water scarcity. It is a nightmare scenario that is all too real, and all but inevitable, for Pakistan.

A new IMF report throws the severity of Pakistan’s water crisis into sharp relief. Pakistan has the world’s fourth highest rate of water use. Its water intensity rate — the amount of water, in cubic metres, used per unit of GDP — is the world’s highest. This suggests that no country’s economy is more water-intensive than Pakistan’s.

This aggressive water consumption portends catastrophic consequences. According to the IMF, Pakistan is already the third most water-stressed country in the world. Its per capita annual water availability is 1,017 cubic metres — perilously close to the scarcity threshold of 1,000 cubic metres.

Back in 2009, Pakistan’s water availability was about 1,500 cubic metres. According to projections from a study I produced that year, called Running on Empty, Pakistan would not become water scarce until 2035. Instead, thanks to lightning-fast consumption rates, Pakistan is nearly water-scarce today.

And yet it gets worse.

New Nasa satellite data of the world’s underground aquifers reveal rapidly depleting groundwater tables. The aquifer in the Indus Basin — whose rivers and tributaries constitute Pakistan’s chief water source — is the second most stressed in the world (this means rapid depletion with little or no sign of recharge). This shouldn’t be surprising; even seven years ago, groundwater tables in parts of Lahore had fallen by up to 65 feet (20 metres) over a five-year period.

Groundwater is water security’s last resort — it is what we tap into when surface supplies run dry. And yet in Pakistan, this safety net is fraying. The country’s water security blanket is in danger of being yanked away. In sum, Pakistan is voraciously consuming water even as water tables are plummeting precipitously. So what to do?

The same solutions have been trotted out for years, many of them problematic. Build more large dams? Expensive and controversial. Demand that India stop obstructing downstream river flows? Impractical. Poor water governance, rapid population growth, and climate change effects — not upper riparian machinations — are the reasons for Pakistan’s water crisis.

The most reasonable recommendation is simply to use existing resources more judiciously. However, people won’t be willing to conserve unless they have a strong incentive to do so. Fortunately, there is an obvious way to generate that incentive — charge consumers a realistic price for their water. To that end, the IMF report wisely calls for water pricing reform. This might be the best way to ease the water crisis before it spirals completely out of control.

In Pakistan, as the report states, public water utilities tend to set prices below cost recovery levels. Irrigation water charges recover less than a quarter of annual operating and maintenance costs. On the whole, agriculture is largely untaxed — and yet more than 90pc of Pakistan’s water resources are allocated to that sector.

By charging more for water (ideally using a pricing scale tied to income level), not only would consumers presumably use it more judiciously, but the government would also gain desperately needed revenue. And this revenue would enable Pakistan to pay for badly needed repairs. Water expert Simi Kamal has estimated that repairing and maintaining the country’s existing canal systems would free up about 75 million acre feet of water — close to the 83 MAF water shortfall that the IMF projects Pakistan will face in the coming years.

This additional revenue could also be used to repair Pakistan’s dilapidated large dams. Tarbela has lost nearly 30pc of its storage capacity since the late 1970s. Pakistan’s total dam storage constitutes only 30 days of average demand (the figure is 220 days in India). Revenue-generating water pricing reforms would also provide Pakistan with funding to invest in new infrastructure, water-conserving technologies, and — perhaps most importantly — programmes that help the poor pay for and access water.

Admittedly, all this makes for a very tall order. It presumes that leaders can muster sufficient political will to implement pricing reforms, and that consumers have the ability and desire to pay more for water.

Additionally, pricing reform is no silver bullet for the water crisis. It won’t address Pakistan’s troubling land ownership policies, which ensure that the landless struggle to access water (land ownership, it has been said, is a proxy for water rights). It won’t make Pakistan’s water any cleaner; dirty water kills more than 600 Pakistani children a day. And it won’t reduce the bloat in Pakistan’s water sector bureaucracy, which makes water policymaking highly inefficient.

And yet unless Pakistan miraculously manages to halt the effects of climate change or to make billions upon billions of cubic metres of water appear out of thin air, there really is no other choice. Particularly because of what may lie in store down the road.

Back in 2009, the Running on Empty study projected that by 2025, Pakistan’s water shortfall could be five times the amount of water that could then be stored throughout the Indus River system’s vast reservoirs. It estimated that the shortfall in 2025 would comprise almost two thirds of the entire Indus River system’s current annual average flow.

Based on the IMF’s new estimates, it’s likely that these projections would be even more alarming if calculated again today. In effect, in the absence of immediate action, Pakistan could face the not-too-distant prospect of becoming a water-starved wasteland.

And that’s a thought that should be keeping us all up at night.

The Narrative is all that matters.

Stocks & other assets climbed the mania on the back of a complete evaporation of worry.

1. Central banks can and will backstop markets.

2. Leverage is your friend.

3. Everyone’s IOU is as good as gold, especially those backed by taxing power.

This Narrative **MAY** be inverting.

If it is, there’s a gaping chasm below current prices, one that will not be traveled in an orderly fashion.

OTOH, there is no certainty until it’s all in the rear view mirror.

Interesting stuff, stucky, but let me toss in a couple of caveats. An f35 dogfighting an f16 is a porsche dogfighting a station wagon. An f35 weighs double what an f16 weighs. And it doesn’t seem like we will ever see the end of making the case that all we have to do to acheive nirvana, is tax the living shit out of water or air. Fuck that.

The F35 is a jobs program for middle class americans.

“Combat” aircraft haven’t had a dogfight using cannons since…what? Korea?

Remote-controlled planes can easily carry air-to-air missiles and are already providing “close air support” (and I’m sure killing just as many US soldiers and Marines as usual.)

The F35 program is transparently a monstrous boondoggle, but so are most of the nuclear submarines, surface ships, and everything else the military-industrial-congressional-complex produces.

Soon, under Obamacare the medical device, medical insurance and pharma industries will occupy the same level of suckling-the-tits on Uncle Sam as the MICC.

The USA’s system is just a vast circle of people robbing the guy in front of him.

Also stucky, why would you give a rats ass about pakistan, or the IMF, who authored that report. Billy tore apart kookoda for the same shit yesterday. It’s time to worry about america. That’s why you will end up voting bernie or trump.

starfcker

You’re either retarded or just yanking my chain. I shall assume the latter.

I don’t give a fuck about the Paki’s. Except … I had no idea that Oreo is so concerned about them. Neither did I know what dire straights they are in. Also, they have nukes, and if they feel they have to use them … against India, or anyone else … well, that’s pretty bad as I suspect any nuke outbreak anywhere in the world for whatever reason will eventually turn into an all-out shit-fest involving Russia and the USA!USA!USA!.

And since this thread is about PANIC I just thought I’d add a few more things to panic about.

As far as me voting for Trump or Bernie …. you ARE retarded!! 🙂

Stuck, not yanking your chain. But you are only giving me one other option. Hmmmm. Not real pleased with that one. I see the other posts you have put up to liven the day, no need to get bogged down here. Carry on.

Completely off topic…

Admin, I know you like music and Pink Floyd.

Are you aware of the 432 vs 440 Hz difference?

http://www.collective-evolution.com/2013/12/21/heres-why-you-should-convert-your-music-to-432hz/

“Most music worldwide has been tuned to A=440 Hz since the International Standards Organization (ISO) promoted it in 1953. However, when looking at the vibratory nature of the universe, it’s possible that this pitch is disharmonious with the natural resonance of nature and may generate negative effects on human behavior and consciousness.”

“Some theories (although unproven) even suggest that the Nazi regime had been in favor of adopting this pitch as standard after conducting scientific research to determine which range of frequencies best induce fear and aggression. Whether or not the conspiracy is factual, interesting studies have pointed towards the benefits of tuning music to A=432 Hz instead.”

“432 Hz is said to be mathematically consistent with the patterns of the universe. It is said that 432 Hz vibrates with the universe’s golden mean PHI and unifies the properties of light, time, space, matter, gravity and magnetism with biology, the DNA code, and consciousness. When our atoms and DNA start to resonate in harmony with the spiralling pattern of nature, our sense of connection to nature is said to be magnified. The number 432 is also reflected in ratios of the sun, Earth, and moon, as well as the precession of the equinoxes, the Great Pyramid of Egypt, Stonehenge, and the Sri Yantra, among many other sacred sites.”

http://omega432.com/432-music/the-importance-of-432hz-music

[img [/img]

[/img]

https://www.youtube.com/watch?v=qgNZ7LMFijw

Back to your regular scheduled programming…Margin Call movie clip:

http://www.wired.com/2015/06/wildly-expensive-f-35-jet-makes-first-ski-jump-launch/

There are only TWO categories of people that are STILL holding significant investments in the U.S. stock market system. They are known as the MASOCHISTS and the MENTALLY DERANGED.

RIS strongly recommends going balls-deep into commodities!