Why the Federal Government is running on S-C-A-R-E-D.

Let me ask you a simple question.. Well, maybe one and a half. Have you ever heard of inflation? Know what it is? Why, sure you think you do!

Simply put, it too much money chasing too few things. That “few” is a subjective determination by each individual and business. Now the Fed sloshes out too much money and the Chinese make too many things already but we still appear to yearn for more of both. Have you heard of the terms inflation “push” and wage “pull”???

They both stem from the same source only the vast majority of people in this country don’t understand either one or at the most, one of them. Generally, J.Q. Public refer to only prices of goods of any sort from peanuts to homes and services.

The Fed “prints” the money mostly to pay interest on Government debt and feed the FSA in one way or another which is spread all through our society in every manner of give away you can imagine from Obummercare, the military to food stamps and pretty much everything else you can think of. Citizens of Florida, for example, send all manner of tax money to the Feds, the Feds then skim off about 50% to support their ever growing nanny Departments and Agencies and to line their own pockets. Then the Feds send the 50% that’s left back to the States to pave road, spray mosquitoes or whatever – all in all, about 50%% of the 50% of the money returned to the States is wasted by State bureaucrats and various State Departments so it turns out that about 25% of the money we sent the Federal Government, by the time it gets back to the State, is actually used for constructive purposes.

Why the Hell doesn’t the Governors and Legislators of the States try and see to it that their citizens send less to the Feds and more to the States so that a far larger percentage of our tithe can be used for projects that benefit the citizens of the States? I know, I know, they don’t give a royal stinky shit about you and me – the whole idea of sending money to the Feds and the States is to keep those bureaucrats fat and happy and in our hair every chance they get while they do the absolute minimum to hold down the riots and protests.

Now the people that live in those all those baskets into which the money falls, all go out and send it to China with a certain fallout here in used-to-be-America. Pretty soon prices start to climb because an excess of demand (called “gimme” NOW and borrow to do it on any level but mostly the Fed) results in inflation ”push”. Prices go up or quantities are reduced but prices stay the same, either one is a sign of inflation because that sneaky debt that the Fed and people run up for the “gimme” is exactly the same as Fed printed phony money in its’ effect on the economy, your wallet and mine.

This, for emphasis, is called inflation “push”.

So as prices rise or products shrink – who cares – same cause, people soon start to grump and howl for higher wages and income. And little at a time, they get it – who gets it first depends on who which pressure group counts most in both Government and the private economy. (Governments, both Federal and State always come first!! Believe it!)

If you don’t believe it, compare the wages of Federal and State employees (not even counting the politicians who come before first) to those of the quasi-private economy.

As wages start to rise or “gimme” money increases, then what? That’s called wage “pull” regardless of whether it is real earned money at a higher rate or more give-aways or more debt..

Any one of these will result in rising prices or decreased quantity or decreased quality of goods and services.

The solution, of course, is to stop the give-aways and jack up interest rates until the cost of borrowing money is too high for both business and consumer to borrow it and – BANG – recession! Only in our case, thanks to the idiots (or crooks and cunning thieves) who are running the operation have placed us in a position now that if they cause a recession, it will very rapidly turn into a depression which is exactly what we need to iron out the kinks from top to way too far below the bottom and exactly what they don’t want because by now, when TSHTF all hell will break loose.

In 1974, when Paul Volker (the last Federal Reserve Chairman with balls – oops!! Not PC, sorry!) put an abrupt end to an over-enthusiastic economy by raising Federal Funds rates as high as around 20%. The Fed Funds Rate is, broadly defined, the rate of interest it costs banks to borrow from the Fed and each other. Interest rates peaked out at a little over 14% for the general population but I’m not sure of the accuracy of the source for that one.. At any rate, that action of raising interest rates put us in a very fast recession, inefficient businesses folded, banks went belly up and then when the mal-investment and excess debt were cleared away, we pulled out of the recession quick as a flash and have been in a debt/money boom ever since with a few bumps along the way.

Unfortunately, this time around, no one had the balls (or ovaries) to shut down the gumball machine before it went beserk and instead of a sharp recession that we could recover from quite nicely, it will very likely be a depression that results. That will put our used to be America in bankruptcy. That, in turn, may very well put us into a Weimar (look it up) situation, where you take a $22-trillion dollar bill to buy a loaf of bread, all loans are defaulted on by writing worthless checks and we all know how the Weimar Republic turned out, don’t we. (I’ll spell it out: Hitler and WWII).

That is what terrifies the current crop of crooked, stupid and desperate people running the debt/money machines now fear deeply and why they keep on keeping on in hopes they will be dead or out of office before the poop is smeared among the fan blades.

To sum up, we have very likely lived through real peak prosperity and without a Fairy Godperson (PC, you know), we are truly in the soup. I hope we like the taste of it..

MA

note: Old Muck now has an address: [email protected]

Feel free to write if you want to. I promise to read every one and learn therefrom but I don’t promise to answer.

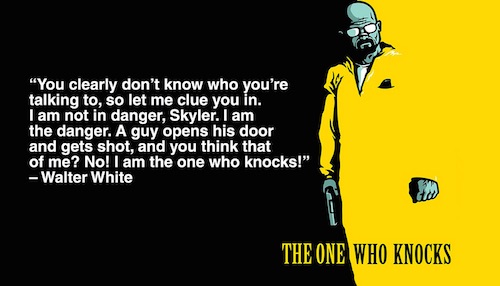

“Scared”? “Terrified”? Hardly…the powers that be are anything but scared and terrified. Just like Walter White in Breaking Bad, THEY are the ones who knock on the door.

[img [/img]

[/img]

@Rise Up: We’ll see who panics when TSHTF. How did you like the military police action at UCLA the other day for _one_ shooter. You suppose they are training for the fun of it?

Wait and see..

MA

Muck,

Inflation does not hurt TPTB, it is a cost (more like a tax) that is felt most at the bottom of a trickle down “economy”. The oligarchs print money from thin air and they have access to it first and are able to purchase assets with it. As the extra money created from nothing filters down through the economy to the common serf is when inflation begins kicking in and hence that money is worth less when it gets at the bottom.

Inflation is not a flaw of money printing – it is a key feature.

I see inflation in almost everything i buy.I wonder about all the people who still say they support Democrats. Hillary Clinton? REALLY!

@Tic Toc: Inflation through the expansion of the money supply through either printing it with no backing or through debt _always_ benefits those who get to use it first and you are quite right to point that out.

Whether it will hurt the Elite of this company when the credit collapse happens (and it will), they will be the first target of revenge and retaliation. Unless they flee the country – which may happen here and there, I suspect there will large losses up and down the economic scale.

The lower rungs of the population i.e. those will few assets will be stripped first, following by what’s left of the middle class and then onward and upward into assets of the Elite. No one escapes a credit crunch and there is no way possible to exit a credit crunch in a graceful manner.

The collapse will start slowly and suddenly collapse in a rubble of defaulted debt instruments, derivatives, bonds, and a major domino failure of banks as when one fails, it defaults on debts owed to the Fed and other banks. Those banks then fail and on it goes. Counter-party derivative holders that hold bets against failure of banks will immediately default when Federal bailouts can no longer happen or make things worse.

If the Feds go to a “bail-in”, confiscating citizens funds in banks and savings accounts I doubt very seriously it will go as it did in Cypress. There are a lot of people who will not take kindly to such confiscation of their hard earned money and banks that follow orders and simply transfer depositors funds to the Fed will burn and burn and burn.. Chaos will swell and police forces cannot handle such uprisings without killing their neighbors and friends and will likely stand down. Armed forces who go into big cities will cause the most deaths as they “follow orders” and shoot to kill when ordered to do so unless some soldiers with principal decline to slaughter those people who are Americans merely fighting for what was theirs.

You would never guess that they are fearful, they keep on doing the same over and over. There are no separations of power any longer, it is just the executive branch and its’ vast bureaucracy. When bureaucrats are afraid to show up to work you will know that the gig will soon be up. It is not if, but when!

Thanks Muck. Wish I knew more about the stuff. Gonna have to study up.

They (whoever ‘They” are) are almost sure that the time is right for the big global scam. When they havethe EU, DC, and Bejing all on the same page, tooting the same notes, the curtain will rise on the next act.

First will be an end to printed currencies, which will be embraced right up untilit is not. Then the real fun will start.The endless innovation of humans who want to make a real buck and the limitless desire of humans to pay less for things will overwhelm the greatest forces the various Establishments can bring to bear. The market will win,it always does.

Oh yes, there will be blood.

@LLPOH: You old dog, you need to read up on the principals of economics many be – have you read “Human Action” by Von Mises?? If not, it the equivalent of a graduate course in exactly what the title says – human action – and is a great primer for further education.. It’ll take several months to wade through it but you’ll start enjoying it as you read and wish you’d read it 40 years ago!

Besides, you need to find a web site with Aussy data and see how far in the hole they are and what’s their debt position. You can write Muck About directly at [email protected] and we can communicate privately if you wish..

@Ouirphuqd: They are fearful – bet on it. Their biggest problem is raping and skimming as much wealth (land, real hard assets) before the bottom falls out. Even the elite will go down in the final end of our beautiful America because there will be no place to hide financially, the way our financial system is glued together with digits, tape, glue and lies.

Like today – BLS bullshit report – unemployment at 4.7% only because a half million people quit look ing for work and are no longer counted as unemployed. I call bullshit on the whole rotten system of twisting numbers to fit what they want. I want _REAL_ data, not garbage,either there are two sets of books in Washington, one with true dat and one with what the foist on the Public or we are truly lost if they use the twisted data to really make decisions.

We’re truly lost anyhow – only time to wait and let it collapse – but the pain of the transition to a new Amerika will be painful and costly in blood, sweat and tears.

MA

they will be the first target of revenge and retaliation

@Suzanna: I suspect you will be right. However, the anger and fear will be more wide spread among the under classes and is bound to overflow onto the general public – including themselves.

MA