I stopped trying to predict markets back in 2008 when the Federal Reserve, Treasury Department, Wall Street bankers, and their propaganda peddling media mouthpieces colluded to rig the markets to benefit the elite establishment players while screwing average Americans. I haven’t owned any stocks to speak of since 2006. I missed the the final blow-off, the 50% crash, and the subsequent engineered new bubble. But that doesn’t stop me from assessing our true economic situation, market valuations, and historical comparisons in order to prove the irrationality and idiocy of the current narrative.

The proof of this market being rigged and not based upon valuations, corporate earnings, discounted cash flows, or anything related to free market capitalism, was the reaction to Trump’s upset victory. The narrative was status quo Hillary was good for markets and Trump’s anti-establishment rhetoric would unnerve the markets. When the Dow futures plummeted by 800 points on election night, left wingers like Krugman cackled and predicted imminent collapse. The collapse lasted about 30 minutes, as the Dow recovered all 800 points and has subsequently advanced another 1,500 points since election day. Krugman’s predictive abilities proven stellar once again.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

It’s almost as if the Deep State oligarchs and their Wall Street co-conspirators are declaring to the world they are still running this show. Despite deteriorating economic conditions, skyrocketing debt, stagnant wages, and bubbles in the stock, bond, and real estate markets, the narrative being spun is a glorious future of tax cuts, less regulations, jobs coming back to America, and GDP growth so high, it will easily pay for all the tax cuts and spending increases. You would think those high frequency trading machines, programmed by Ivy League MBA geniuses, would be smart enough to determine when markets are extremely overvalued as fundamentals are deteriorating.

Something is not making sense. During the debates Trump declared on more than one occasion the stock market was in a bubble. It is now 2,000 points higher and he is proclaiming its advancement as an endorsement of his plan to drastically cut taxes, spend trillions, and Make America Great Again. The financial media, which despised Trump six weeks ago, is now peddling an economic recovery, soaring future corporate profits, and a stock market poised to blast through 20,000 to higher and higher all-time highs. I think that would be swell, but let’s examine a few facts before putting our life savings in Twitter and Fakebook stock.

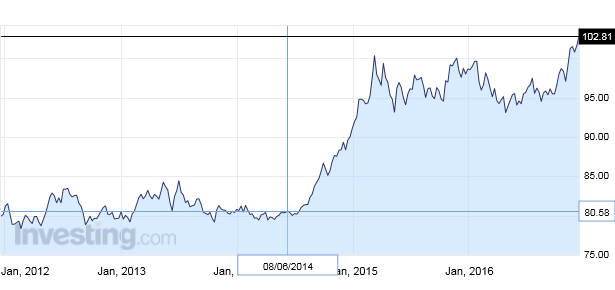

As proof that Wall Street despises Main Street, when oil prices rise this is seen as a huge positive by the criminal bankers, as they see oil as an investment to be manipulated for profits. Falling oil and gas prices benefit everyday Americans trying to balance their monthly budgets. The drop in gas prices from $3.70 per gallon in mid 2014 to $1.70 per gallon in early 2016 helped average Americans save enough to partially offset soaring Obamacare costs, rising rents and stagnant wages. But Wall Street and their corporate media talking heads have cheered the 33% increase in gasoline and the 85% increase in oil since February. Just as with TARP, what is good for Wall Street is not good for Main Street.

The Fed narrative of no inflation, supported by the sliced, diced, manipulated, massaged, hedonically and seasonally adjusted drivel produced by the government drones at the BLS, has benefited from the almost two year decline in gas and oil prices. That is now reversing itself, as gasoline prices have risen at an annualized rate of 20% over the last three months. It is poised to rise by 30% to 40% year over year in the next few months. Even the Deep State government bureaucrats are having trouble disguising raging inflation in expenses affecting average Americans on a daily basis.

Yellen and her fellow Ivy League academic puppets continue to flog the 2% inflation mantra, as if these theorists have any clue what the “ideal” rate of inflation should be. Even the manipulated core CPI has been running above 2% for all of 2016. Have you heard any captured media pundit report that CPI has been running at an annualized rate of 3.6% over the last three months? The Fed engineered housing bubble 2.0 has even driven the man made owners equivalent rent calculation up to a 3.5% annual rate. The Fed’s latest bubble blowing adventure has also driven the home ownership rate to a 50 year low. So much for Bush’s ownership society dream.

Rental society seems more likely, especially for student debt burdened millennials working their Obama jobs at Shake Shack. The Fed induced housing bubble, designed to sure up insolvent Wall Street bank balance sheets, has priced out millions of Americans and driven rents sky high, especially in metropolitan areas like NYC, SF, DC, and Chicago. The BLS’ manipulated data shows an annual increase of 3.9%, while in desirable areas, rents are rising by double digits.

The truly hysterical drivel spewed by the BLS drones is that medical care costs are only rising at a 4% annual rate and only account for 8.4% of a family’s annual costs. The gyrations and hedonistic seasonal adjustments they must make to somehow configure 20% to 50% increases in premiums, doubling of co-pays, and $6,000 deductibles into a 4% annual increase must be a wonder to behold as they plug their fake variables into their excel spreadsheets. Anyone living in the real world, outside of the Imperial Capital, knows their annual living expenses are rising by at least 5% to 10%.

As Obama takes his victory tour, taking credit for the stupendous jobs recovery, the deplorables in middle America know their real wages have barely budged during the entire Obama recovery. If the unemployment rate was really 4.6%, would real wages be growing at less than 1%? NO. They would be growing at 3% and the Fed Funds rate would be at 3%, not .50%. With the labor participation rate at a thirty year low of 62.7%, a record number of Boomers having to work to survive, and 124 million full time employees supporting 102 million non-working Americans, you might have the real reason Trump won the election.

The false narrative propagated by the captured mainstream media propagandists has been the labor force participation rate falling is strictly due to Boomers retiring. Despite data proving the median Boomer household has less than $20,000 saved for retirement, the talking heads and brainless bimbos on CNBC and other corporate media outlets continue to purposely mislead the public with misinformation about Boomers retiring to live lives of luxury and endless vacations.

Meanwhile, the only demographic showing dramatic increases in labor participation are the old fogies who forgot to save. How do the pundit propagandists explain the decline in participation by 25 to 54 year olds in their prime working years? Are they busy finding themselves? Did they hit the lottery?

No matter how long Obama’s nose grows trying to convince the ignorant masses he has presided over the best economy in decades, inconvenient facts keep getting in the way. When real median household income is lower than it was in 2000, and not materially higher than it was in 1989, you might have economic stagnation. When you take into consideration the systematic under-reporting of inflation over this time frame, the real numbers are far worse than those portrayed in the chart.

Obama hoots about all the jobs added during his reign of error, but fails to mention that 94% of all jobs added since 2004 were either temporary or independent contractor jobs. Low wage, part-time, no benefits, Obama jobs don’t pay the bills. That’s why a record number of Americans have to work multiple jobs to survive.

The narrative about an improving economy, thriving jobs market, and glorious future is bullshit. I know it. You know it. And your establishment puppeteers know it. But only “fake news” sites would dare reveal these inconvenient truths. The willfully ignorant public doesn’t want to know the truth, because that would require critical thinking and making tough choices.

If the unemployment rate is really 4.6% and GDP is really growing, why are retail sales in the dumper, even with auto makers giving their cars away at 0% interest for six years if you can sign an X on a loan document? At the same time, the establishment reports soaring consumer confidence, while consumers don’t act confident at all. Do you believe these propaganda surveys or your own eyes.

This Christmas (we’re allowed to use that word again now that Trump is on his way) shopping season is going to be atrocious. Retail sales over the last three months have grown at a pitiful 1.5%. If you adjust that for a true inflation rate of 5% or so, real retail sales are in decline. The bricks and mortar retailers are dying, as Amazon and other on-line outlets eat their lunch. The store closing announcements in February should be robust. More ghost malls coming to a neighborhood near you.

One of the strongest areas of spending during the Obama recovery has been restaurants and bars, as the obese masses have gorged themselves while drowning their low wage sorrows in craft beers. But now, average Americans are so tapped out they can’t even afford the unlimited breadsticks at Olive Garden or the all you can eat crab legs at Red Lobster anymore.

Restaurant sales have been in a downward trend for two years and have recently gone negative year over year. Where are all the new Obama jobs for heavily indebted college graduates going to come from if there are less retail clerks, waitresses and bartenders needed in this booming economy?

A critical thinking individual may be wondering how retail spending could even be positive if real household income is still below 2008 levels. You can thank the Fed, your $800 billion TARP contribution to Wall Street bankers, and millions of delusional borrowers lured back into spending money they don’t have for things they don’t need.

Credit card debt is now approaching $1 trillion again for the first time since 2008. At least the Wall Street banks have repaid the favor of TARP and 0% borrowing rates from the Fed, by only charging 14% on credit card balances and racking up billions in late fees if the bill is paid one day late. They are true patriots.

The real reason for the 25% increase in credit card debt since 2010 is because a huge number of households are surviving on their credit cards. You now can pay your electric, gas, water, sewer, phone, real estate taxes, and Federal taxes with a credit card. Of course, there is a 3% to 5% “processing fee” for your friendly Wall Street banker. Again, what a great bunch of guys. This desperate way of life can go on for quite some time, but will end abruptly when the next financial crisis hits. Wall Street bankers will cut credit lines and millions will go bankrupt and lose their homes again.

This faux economic recovery has been financed by subprime student and auto loans. Both loan bubbles are the result of the Obama administration’s disregard for credit risk or desire for having the loans repaid. The $1.4 trillion of student loan debt on the shoulders of taxpayers is a disaster in process. Over 25% of this debt is effectively in default. The taxpayer bailout will exceed $500 billion.

While the government still controlled Ally Financial (aka GMAC, aka Ditech) they started doling out subprime auto loans like candy, forcing the other lenders to follow suit. Now, every Tom, Dick and Laquisha in America is driving a new vehicle and auto loan delinquencies are skyrocketing. The record number of leases are now coming due. The six and seven year auto loans are leaving millions underwater on their loans when they try to trade in for a new car. This is all coming to a head, just as it did in 2008.

So, any unbiased assessment of our economic situation clearly paints a pretty bleak picture. Unwarranted confidence and false narratives spun by media pundits does not put bread on the table or pay your health insurance premiums. This brings us to the irrationality of financial markets and the implications when reality pops the delusional bubbles keeping hope alive.

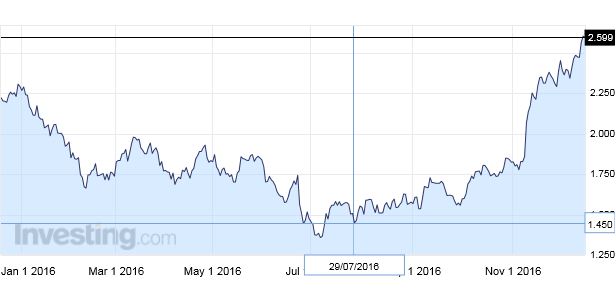

The Fed finally raised rates by .25% last week, about three years too late. The bond market is now leading Yellen. She’s a follower at this point. The bond market knows real inflation is here and Trump’s articulated plans would lead to more inflation. That’s why the 10 year Treasury has risen from 1.3% in July to almost 2.6% today. For the math challenged, that’s a double in six months.

The implications of this increase are yuuge. The 1% surge in mortgage rates has effectively ended the refinancing business and will put a stake in the heart of an already faltering housing market. There is nothing like all-time high prices combined with rapidly rising interest rates to pop housing bubble 2.0.

Obama and the Federal government have lucked out while doubling the national debt in the last eight years. By financing the debt with short term bonds, the interest on the national debt of $432 billion is virtually the same as it was in 2007 before the debt orgy really got underway. A 1% rise in rates across the curve will result in a 50% increase in interest expense and $230 billion instantly added to the annual deficit. If interest rates rose back to 2008 levels, the annual interest would double to $900 billion. And this is before taking into account Trump’s tax cuts and spending increases. There is no way out when your debt is $20 trillion and you add $4 billion per day.

Trump’s plan to Make America Great Again is to bring manufacturing jobs back to America. The USD is now the strongest it’s been since 2002. Why would a manufacturer utilizing low wages in the Far East and benefiting from the strong dollar by selling their products into the US, decide to pay US level wage rates and have to compete in world markets with the anchor of a record high USD around their necks?

In case the brilliant stock analysts on Wall Street hadn’t noticed, the international conglomerates, which make up most of the S&P 500, will have to translate their international profits back into the US with the dollar at fourteen year highs. Corporate earnings, which have been artificially boosted by record low interest rates, a weak dollar and stock buybacks, will continue their downward trend as rates rise, the dollar soars and buybacks dissipate. A perfect formula for record highs. Right?

This brings us back to the stock market. There isn’t a doubt in my mind the Wall Street shysters and their HFT supercomputers will achieve their goal of Dow 20,000 in the next few days. It’s a given. This is all part of the marketing plan. CNBC will have party balloons and streamers. Jim Cramer and Steve Liesman will breathlessly expound upon our glorious future and make up a believable rationale for the Trump rally – lower corporate and individual tax rates, along with ramped up government spending is just the ticket.

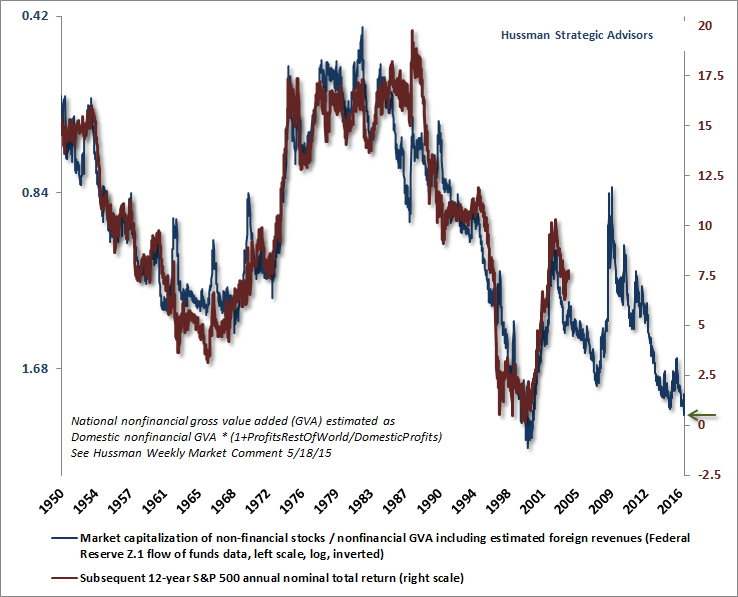

What they will not tell you about is the extreme overvaluation of stocks based upon just about every historical measure used for the last century. The well regarded, non-adjusted, historically accurate predictor of market crashes, Shiller PE Ratio has only been this high in 1929, 2000, and 2007. We all know what happened next. With earnings headed lower and stock prices at all-time highs, this will surely end well. Unless, of course, it’s different this time. Maybe we have a new Trump paradigm.

The pundits who dismiss the Shiller PE ratio as antiquated will also dismiss the other dozen or so metrics showing the stock market extremely overvalued. Wall Street, their media mouthpieces, and establishment hacks have a job to do – and that is to lure millions of useful idiots into the market just before they pull the rug out. Two brutal lessons in the last sixteen years wasn’t enough. Lemming investors need to be hit up the side of their heads with a baseball bat for the third time. Maybe they’ll learn this time. But, I doubt it.

No matter how you cut it, stocks are currently valued to deliver nominal returns of 0% (negative real returns) over the next twelve years, with the high likelihood of a 30% to 50% crash in the foreseeable future. That isn’t an opinion. It is based upon historically accurate valuation methods that have been used for decades. In the short term anything is possible. Maybe even valuations on par with the dot-com bubble are possible. Of course, the NASDAQ fell 80% shortly thereafter, so we’ve got that going for us.

As I’ve said previously, I have no dog in this hunt. I don’t trust these rigged markets or the Wall Street shysters rigging them. Once the magical 20,000 is achieved and Trump takes office in January, all bets are off. The establishment is pretending to play nice with Trump, but there is nothing like a 20% crash over a two week period to show him who’s really the boss. I’m not predicting anything, but it sure looks like something wicked this way comes.

As an old man, I can tell you this; you can believe it or not, it’s of no consequence to me. The “Markets” have been rigged since 1981 when the COMEX arbitrarily changed the rules on the Hunt brothers and bankrupted them. This will collapse. In my lifetime, probably not. But if you’re a young person, buy gold. It WILL come apart in your lifetime. PRESERVE YOUR WEALTH.

If you’re young you have time to buy and pay off productive real estate, better than gold since it produces income all the while no matter what the price of it does.

If I had it to do over again, this is the way I would go.

But I’m old now and don’t expect to see the current status of things change before I die.

Opportunities are for the young, regrets are for the old who didn’t take advantage of them while they were young.

A good thing about productive real estate is that the government has little incentive to take it from you because it is to hard to maintain.

Are you kidding? They are going to tax the meat out of real estate like Rome did before it imploded. Taxes got so high on real estate that many abandoned their properties and left. The population of Rome went from 2 million to 100K and it took 1700 years for the population to get back to 2 million (during the 1980’s).

People moved to beyond the TAX line (which was called suburbia). And yes, that is where the word SUBURBS (outside the city) comes from. There’s a massive debt default coming globally and history shows, there’s no where to hide. The last place the Gov’t confiscates is from Corporations. That’s why the Dow is about to hit 20000 — because big money knows its the last place Gov’t will raid. And by the way — that’s the real explanation for the Dow’s performance and why it just keeps going up.

And as far as gold you might ask ?

It will only have its day when we crash and burn. And for that matter, I wouldn’t put it past the GOONS that they are manipulating it lower towards $700-850 to get it nice and cheap for when they confiscate it like they did in 1933. At that time the incoming president elect ran on a campaign in which he said he would never touch gold.

Two weeks into his presidency he made it illegal to own. Prepare yourself as odds favor this system of things goes belly up circa 2017-2018.

inflation of value will take it away from you. Your taxes on it will rise till you can’t pay it. Buy gold too that will rise with inflation and you can pay to keep the land

For gold to rise in value we would need inflation. For inflation to become entrenched doesn’t seem possible with the amount of private debt out there. For as soon as you start inflating prices the stretched consumers go into default.

On the other side;

In a deflationary pattern gold goes down because there isn’t any cash or credit around to buy it with.

All that has to happen for goal to soar is for Goldman Sachs to take their foot off it’s neck and let it rise to it’s real value, which would be a major problem for them, since they have sold every real ounce of gold that they have 200 times on paper.

Simple math tells the tale: $1100×200=?

Weather we are old or not we can be wise with our money. That is one of our countries problems we didn’t teach our kids to be responsible with their money. We are all a bunch of debtors and slaves. I have lived by the Lord’s word for decades and have the freedom to not be a slave for the man.

They had a guy that was sentenced to one year in prison for all of this insider trading with a long list of things and you say ONE YEAR!!

That is a great read Jim. All I can say is Amen.

“We are all a bunch of debtors and slaves. I have lived by the Lord’s word for decades and have the freedom to not be a slave for the man.”

Eh? a bit contradictory. First you say (in we) you are a slave and then you say you have freedom not to be the slave for the man. How does the Lord’s word stop you from paying income tax and being a slave – I would very much like to know – thank you.

Awesome article admin, a bit long, but I took a detour to view the top 10 pokies so a little doom and gloom mixed in with hard nips. Charlize Theron….

The PTB’s are on their last desperation trail to crash the paper PM price. I am waiting for the 1Q17 action by the ESF/JPY/IMF stooges to make their final bid to crash the paper price to collect more physical. They are desperate and will hand me the best buy op of the last 2 years. I think the disconnect is coming soon. Rates are rising, the BRICS, PIIGS, et al are in rebellion against the USFED/ECB. The bond vigilantes are out there, the game is much closer to collapse. The PTB will sabotage the new DT admin as much as they can. The world is turning like it always has. The “Big Reset” is coming soon. When the SHITF, I am getting < 1/2" groups with plenty of reserves.

Something else to consider is that the stock market has been the recipient of all the 401K and IRA retirement savings accounts as well as pension fund contributions ( for those who still have defined benefit pensions). That is going to go into reverse as the baby boom retires. In fact, you have to start withdrawing from your IRA at 69.5 years.

Since it will be the wealthiest cohort of baby boomers who will be cashing out of the market somebody is going to have be buying their shares. Its not likely corporate buybacks continue nor will debt burdened millenials and Generation Xer’s be buying their father’s and grandfathers stock portfolios on their pauperized paychecks!

Correction: RMD @70.5

If you had been paying attention you’d know what is going on with the public pensions. Dallas-Fort Worth have closed exiting theirs down, Illinois, NJ and NY City are close to insolvent. CA is asking to lower it’s expected returns to 7% which isn’t eenough but even that will put some CA public entities close to the edge.

Add in raising interest rates

I think the out flows are going to be tremendous as this all becomes better known

The bottom line you cannot have the worlds largest economy and stock market based on the fickle and notoriously changing tech sector. these companies like Facebook and Twitter with their billions in sales and only 1,000 punk employees are here today and gone tomorrow. Remember Napster, Commodore, etc? A rock hard sustainable economy would be built with the likes of GE, Citi, etc. but these companies are shadows of their former selves now just glorified hedges, I am in the stock market through my IRA’s and 401 only and would not risk any more than what is on the table currently. Anyone buying in now is the doop. Out.

Well done, thank you, the most powerful point for me was the reminder of rising interest and its effect on federal debt payment.

Yes something wicked comes, an event 80 years in the making…

Only you can write about this stuff and make it as engaging as a John le Carre novel. This story has no chance for a happy ending.

Hope it goes viral and that all of the cynical Nomads now in their middle-aged years will heed the call to prepare.

Winter is here. A wicked blizzard cometh.

Those who have swallowed the lies will soon have nothing to keep them warm; except maybe, old newspapers. Those whose eyes are open now see the storm on the horizon and will watch as fake news delivers real consequences.

I like your writing style, Jim. Good research too and you’re probably right.

This era of credit induced euphoria is over. They have run it to the end of its cycle. The waypoint signaling the end is the lack of official rate increases. No one will buy the “asset” securing the debt en masse.

There is one way out of this that would not cause chaos. I’ve said it before and I’ll do it again. The Treasury must begin issuing debt free money again per the obligations of its charter. It DOES NOT matter what form it takes. It just has to be debt free. As it is right now there is very little or no effective way to pay debt off. Debt is created to discharge debt. So the nominal total debt just gets larger. Until real treasury money is created that debt will only grow.

The fact that the DOW is nearing 20k is the telltale sign of the increasing debt load (debt = “credit money”). If real treasury issued money was issued and extinguished debt, that DJIA might only be 10k or 1k or 100pts. It is a reflection of the quantity of money/debt in the system.

In the 1930’s the DJIA was in the double digits/ low triple digits. Gold was extinguished and it began its rise to over 500pts. At about that time Silver was extinguished, followed shortly thereafter by the international gold standard and greenbacks. The DJIA then doubled to about 1k and bumped along until the early 80’s. Now unrestrained, the now mostly credit based monetary system began its atmospheric rise to today. Gobbling up and spewing shit money on nearly every nation on the planet.

Well, we’re fresh out of suckers. A structural change has to occur. Will monetary reform begin organically/peaceful like or via war/chaos?

If the bankers get their way it will be the latter.

WOW ! OK, WHAT IS DEBT – FREE MONEY ?

DEFINITELY NOT PAPER OR PAPER WITH A PROMISE FROM THE POLITICIANS TO REDEEM IN ANYTHING …

BEEN THERE …. DONE THAT !

something wicked this way came………..

Another impeccable analysis by Mr. Q, but…

The “but” for me goes back to ’95 and an equally impeccable analysis (imho) by Robert Prechter in his book “The Crest of the Tidal Wave”. As someone who worked at the time as an equities trader with a tech analysis background but a healthy appreciation of the Graham and Dodd valuation models, Prechter’s book set me to begin thinking very seriously that it was time to say goodbye and get out of Dodge, which I did a few years later, when valuations were getting nuttier and nuttier. And yet after the eventual blowout, it all came back, just as it has after the ’08 blowout, in spite of the fact that for all practical purposes it’s impossible to “invest” any more; all one can do is speculate and that’s a rigged game if ever there was one.

Perhaps if I’d stayed in the game I’d have accumulated more chips, the virtual tokens called money, but I have no regrets about having cashed out and purchased some fertile land in a very temperate climate in a rural area, built a wholly-owned super-insulated, low maintenance house, then another for my son and family on the same property, slowly but surely leading toward the establishment of a debt-free water systems business and a simple, somewhat austere but comfortable life for myself in semi-but-growing retirement.

Will the whole financial house of cards come tumbling down? I don’t know, given that I’ve repeatedly seen it remain standing one teeter-totter after another over the past 45 years during which I paid attention to markets. Mathematical analysis certainly indicates that it must, but…

You forget it’s not going to be all carrots from here on out. Trump likes sticks, too. “Why would a manufacturer utilizing low wages in the Far East and benefiting from the strong dollar by selling their products into the US, decide to pay US level wage rates and have to compete in world markets with the anchor of a record high USD around their necks?” Uh, tarrifs, that’s why. And he doesn’t need congress to impose them.

I hope you like a 30% increase in your product costs, raging inflation, and 6% interest rates. Maff is hard when you have a narrative to spin.

I’m not afraid of any of that. But tarrifs are coming, so we will see how it works out. Worked fine until 1992, fell apart pretty quick once we scrapped them

Star- Other than steel, of which beneficial tariffs do you refer? Steel is one thing, everything from shoes to food is another. Make your case as to why Admin is not correct and you are not (afraid).

No offense, Bea, but I’m not going to bother. Look up any of my posts from last year, “maff” ” dream a new dream” “fruit company”. I don’t want to argue this shit. I know what Trump intends to do, sit back, let’s see how it works. I think it will turn out great. In the short term, he intends to use both dimocrat (government spending) and repug (tax and regulation cut) stimulus strategies similtaniously. Combine that with some immigration enforcment, debt destruction, and border tarrifs while incentivizing US productive capacity (which is enormous), I don’t think you will be nearly as anxious a year from now.

Bea, I do have one example of how breaking away from dogma can be benificial. Trump met with the CEO’s of Lockheed and Boeing the other day. Boeing’s guy came out and chatted with the press. The woman who runs Lockheed hasn’t been seen since. I’m sure she went to that meeting secure that between the sunk costs, and the pork spread around, the F35 was untouchable, and the gravy train would continue into infinity for Lockheed. I’ll bet she was informed that assumption was incorrect, judging by Lockheeds stock the last couple of days. Strength matters. Skills matter. No?

Star- Merry Christmas to you and yours. You are a good guy and the most positive of all the TBP community. I would be thrilled if it all turned out the way you see things down the road. High cotton beats shit sandwich any day.

From your keyboard to Trump’s ears, “debt destruction” in particular. National monetary sovereignty, yeah! But I’m not holding my breath. Long gone form the US, I still (perhaps naively) believe it has the capacity to rebuild its industrial base, because if it doesn’t…

Here guys, it ain’t that hard. Our last three presidents have been a grifter, a dumbass, and a petty marxist. Put a grown man back in charge, and amazing things can happen. http://www.zerohedge.com/news/2016-12-23/trump-wins-again-lockheed-ceo-gives-personal-commitment-cut-f-35-costs-aggressively. And Bea, Merry Christmas. Let’s have some fun knocking heads in 2017.

I HOPE YOU ARE CORRECT !

Tariffs fund the government at the expense of the sheeple. The only thing that can make America competitive and perhaps someday great is to downsize government. A 50 percent cut would not be nearly enough. And yes there will be blood. Government can never make a country great. Only freedom can do that and government is the exact opposite of freedom.

Please, Dan. You’ve been brainwashed

A new coaster in retail stores, here in manila, states **may your way of life someday be as awesome as u pretend it is on FAKEBOOK**…

& re FRA, i strongly suggest that the fra group check out the theoutlying islands of the Phillipines. AWESOME!, thank god I married

A really brilliant chem. Egr from here!!! Wonderful!!! Will never ever return to the USSA….trs expat…

GREAT POST ….

SLIGHT ERROR IN WORD USAGE …

YOU USED ” SURE ” INSTEAD OF ” SHORE ” ….

” SHORE UP ” RATHER THAN ” SURE UP “

Except that with the American consumer tapped out and 94% of the world’s population living elsewhere, the US consumer market isn’t where I’d be looking to grow my company. The rest of the world needs portable electronics to get onto VKontakte.

The biggest news of 2016 is the market not Yellin is driving the interest rates higher. She waited too long. Now the grown-ups have decided to take charge. Those folks at Fed can print fiat all they want but those who purchased the Bonds with real stuff are demanding a real return. One need only look to the Chinese, Saudi and Russians who are divesting of T-bills. The shell game of Thimblerig that is running out of suckers to play.

Once again well done Admin! Article laid it all out to see and spared much of the bullshit and hyperbole that some other experts seem too eager to use in explaining all this to the unwashed like me.

TPTB strategized against us and we have continued to be played. With Trump, we’ll see our economy pump up a bit more before it bursts. TPTB needs a wiping-of-the-slate. And TPTB wants the collapse to be blamed on Trump and the nasty Republicans. They’re setting it up and most of the ignorants will fall for that narrative.

Trump (who I voted for and still support) has not indicated that a return to American-made manufacturing will be performed with robotic technology. Many of the blue collar jobs that Americans are hoping for will not be returning because it’s simply not cost-effective when compared to the start-up/maintenance of robotics. And the chance that unemployed blue collar workers retrain in the robotic/IT field are slim. So the unemployment rate of the blue collar workers won’t change much unless Trump et al can determine how best to utilize (and retrain) this group of American workers. Perhaps many will become employed through Trump’s proposed infrastructure development. Unfortunately those jobs are not life-long, which leads to the dilemma that workers face: many occupations change during the course of a worker’s life and few are prepared to transition to another type of work.

America’s Industrial Age ended and the transition to the Computer Age has not been smooth. Few prepared for this era of rapid change but it’s an issue that will continue.

Immigration needs to be severely cut back as the impact on our national expenditures and employment prove this to not be in our best national interest. We have too many people ‘not working’ to support. Also, I hope Trump will end the H1B Visas that the Silicon Valley claims that they must have for their ‘advanced computer science’ jobs. Putting more Americans to work in this field would certainly help a segment of our unemployed. But to import foreign workers to fit the needs of corporate-America only serves to harm our American work force even more.

Good piece — a concise end-of-year review on ‘we are so screwed’.

TPTB doesn’t care who takes the blame they just want as much slop from the trough that they can lay their snouts on.

You can suck Trump’s nuts all you want but he’s delusional if he thinks he can do a fraction of what he claims to “want to do”. I personally don’t know what he wants to do because he flip flops every tweet which can be multiple times per day. Having lived through the hell of 2000 and the aftermath of the 2008 fleecing, I can only ponder what our masters have in store for us when I look at Trump’s cabinet choices. I can assure you of one thing, the team he has assembled hasn’t seen Main Street since they sucked on their mama’s titties. As the article points out rising interest rates, the debt / deficit, and proposed tax cuts is a recipe for disaster. The entire economy is beginning to head butt reality that has been prolonged through ZIRP, QE, and subprime rates for as long as possible.

The road that the proverbial “can” being kicked down grows short.

WAR TIME MANTRA …. LESS TROOPS EQUALS MORE CHOW !!!

Great article James! I’m going out today to buy mutual funds and bonds!

Curious note on the housing market, even with the low rates, supply has been way down. People are unable to upgrade to better housing. Supply being down has been what’s sustained the high prices for so long. Most houses in our area are still moving quickly, unless they are in an area where the gubmint has raises school taxes so high that they are unaffordable at any price.

Checked out a condo (glorified apartment) the other day out of curiosity. 117k, but carried a 6k annual nut between condo fees and taxes. It will never sell.

6k in taxes and fees is crazy on something selling for just a bit north of 100k. Just renting from the government at those prices.

6k ought to just about cover your annual expense on a 100k house with 20% down. Keep your powder dry, Mike. Big change coming.

The question is not if the dominos will fall, but when.

Pre 2000 and 2008 I attempted to explain how the stock market is operating with no basis in reality for PE ratios and share value and if you are going to play in that market get in and out at a timing of your choosing take your money off the table and move on ! You cannot catch a falling knife ! I was laughed at when I dumped my tech stocks and yes they increased another 5 to15% and then noise dived like a lawn dart !

In this current run up my wife questioned about investing and I said sure we should sell the rest of our shares convert to cash pay our tax buy a wood burning stove , long term food stores water filtration and more ammunition ! Again I have been laughed at , as if the bottom is not about to fall out any second !

Something Wicked definetly this way comes !?

“purchase through the TBP link and reducing their profits by 6%.”

What does TBP stand for? Please expand this advice….I’d really love to reduce their profit by 6% !!!!

TBP stands for The Burning Platform. If you make a purchase on Amazon through my button, I’ll get 6% of the purchase amount. If you made the purchase through their generic link, they would keep an extra 6%. So, you can screw billionaire Jeff Bezos out of 6% by using my button.

Excellent paper on the topic Mr. Quinn,

The facts plus history speak for themselves…and we will experience

failures. People can look to Europe and elsewhere to see what corruption

and socialism have done to societies.

Some smarties say, good, we will “crash” and therefore have the ability to

“rebuild” as is sorely needed. The trick is to get there minus private central

banks. Sure, people will die, starve, mini wars, cities in ruin…but that is part

of the “process.” Other smarties say, we will crash, become a 3rd world by

living standards, there will be constant strife as the “have nots” will go crazy

killing and stealing their way to survival. And, of course, as the “bankers”

do not want to be blamed, a war to distract from them (blame others) will

ensue. Or, maybe “they” (USA and allies) will just EMP the country and let

it all sort out over time. The smarties are saying the same thing essentially,

but some are selling gold and silver or bit coin, as the means to “save oneself.”

Now there is mention of yet another “trade treaty” (secret of course) that is

more horrid than all the others. Bix Wier talks about that one.

Lovely scenarios and predictions, no?

So, what to do? I don’t know. Get out of the way, be out of debt, look poor

(not hard to do) and have some resources but do not flaunt a thing.

In the meantime try to embrace family during this holiday season and DO NOT

argue with people about political topics. Pointless and futile. People that are

smarties, hopefully know not to do that.

Merry Christmas,

Suzanna

We all got it comin’ kid.

Stephen King writes children’s stories compared to James Quinn.

Being real makes Quinn even more frightening.

The t.v. told me everything was good and not to worry.

It is hard to deny math but on the other hand I live with a 4 yr old that can’t count past 10, can’t add, or subtract and the little fucker still survives.

Sounds like a do-over!

Grow!! Grow!!! GROW!!! We need this damned economy to grow more than 1%-2% a year, dammit! Endless growth forever and ever … because prosperity. Amen.

Yet, the American consumer is hundreds of billions of dollars in debt. We mock folks who buy shit they don’t need with money they don’t have. Many here preach a simpler lifestyle, … rightfully so, but that means spending/consuming LESS.

How do I reconcile the above points? I can’t. I guess economics/finance will always be above my pay grade.

Your brain can process so much endorphins before it runs out. Then you get a downer. Opiates such as vicodin can substitute but you start draining the body supply, the brain needs more junk just to achieve a numbing effect.

The world right now is awash in opiates called currency. Dollars are pushing on the string of manufacturing. There are two paths you can go by, but in the long run there’s still time to change the road you’re on.

Printing more cash isn’t going to do much good anymore than taking more heroin. Until wages decline, manufacturing will not return to profitability. It is an undeniable reality that illegals keep coming into the country and somehow manage to survive. They accept lower pay. Americans are on the ropes because they insist on $15 an hour for bitch jobs, the kind of jobs usually done by teens back in the day when teens actually went out and worked.

I hate to think of leaving my cushy lifestyle behind, sipping coffee and posting comments on a blog but there are illegals working two jobs even if they are part-time. The only other person I know working that hard lives in NJ. He might do good flipping houses, he’s got the old spirit that once made Merica great. Without it there will not be another great America, no matter what Trump says.

Maybe you never heard, after Obama got elected, Hispanics were eager to collect on his immigration reform promises. He told them that it wasn’t going to be that easy, they had to go out and earn it with marches and demonstrations to get congress to act.

Wait a while before asking Trump about his promise to make America great again and you might hear the same shit; you have to do it yourself. He will gladly be your leader but you have to do the fighting.

Try not to get worried, try not to turn on to, problems that upset you …. oh, don’t you know everything’s alright, yes everything’s fine. And we want you to sleep well tonight, let the world turn without you tonight

Russian people didn’t die when the Soviet Union ended. Neither will American people when the USA dies. Everything will be alright. Really.

I try to explain it like this. Who are the people who actually have input into your life? The people you interact with daily and weekly, right? Well, those stupid fucks in D.C. could evaporate tomorrow and as long as the people you interact with honor their social contract with YOU by acting like civilized human beings, then the animalistic cockroaches will devour each other down to a manageable level. Then the do-gooder-wannabes will elect another pack of thieves to tell us all how to live and either we remind them who is in charge or we end up exactly at the same place.

As for me and my house, Stuck? We will be just fucking fine.

[img] [/img]

[/img]

Hello, Maggie!

Glad it’s all going well on Green Acres. Merry Christmas to you and yours! You’re spot on with your “social contract” comment! We rural refugees will survive, come what may, even, I believe, back up there in the USA. Small is beautiful.

Don’t worry folks Boat Guy is on the fringe of one population center and my neighbors and I have the high ground and a fuck ton of ammo so what gets by us to rural America I am sure you folks can handle MERRY CHRISTMAS TO ALL AND HAPPY HANNAKA AND NEW YEAR oh and eat shit quanza

I know everything is not all right but thanks for a great four minutes!

Stuckeroo, was it Vodka who said Superstar was all tongue in cheek? Read the lines and see that the whole play is anti-Christ in excelsis.

Jesus’ response to ‘What’s the buzz?’ is highly suspect, in fact, it makes him sound ignorant of things. In this scene, Mary Magdalene tells Jesus to forget all about the world and go to sleep. Surre…

The whole point of the movie is couched in Judas’ song, ‘Jaded mandarin’.

The songs are catchy but then again so were the songs in the parody of Fifty Shades. I could feel the horns sprouting on my head as I listened to a lively rendition of a song with the profound lyrics: I fuck! (chorus, he fuucks..)

Nothing more fun, than ripping the cataracts off the unblinking masses. Well said.

So where should I invest my tax-deferred retirement money? I’m 46 and will probably be working 14 more years.

Invest in your kids if you’ve got ’em and they’re geared toward being productive, sez I. As for the bucks you have to put aside for yourself, well, lots of parameters in play, but I’d go with (went with) wholly owned land and housing if possible, some sort of post-retirement productive tangible, and if you must stick with financial “investments”, depending upon the amount of capital available, a Fed-connected managed fund (e.g. Cumberland) or “cross yourself and face the wall, dreams will help you not at all” (Thomas Pynchon), because what’s next on the menu is anybody’s guess. Scale down, invest in yourself and your posterity and prepare for the worst while still hoping for if not the best, at least a level of comfort that suits you.

Fat chance you will retire at 60 unless you are the chosen few regardless of where you invest always be watchful and take any gains and move your funds on a regular basis quarterly at the short term but always keep your eye on the ball let someone else make that last 5 or 10% you cannot catch a falling knife

Home Affordability Drops To 8-Year Lows As Mortgage Rates Surge

by Tyler Durden

Dec 22, 2016 2:46 PM

One week after Freddie Mac chief economist Sean Becketti warned that “if rates continue their upward trend, expect mortgage activity to be significantly subdued in 2017″, mortgage rates continued their upward trend. According to the latest update from the mortgage giant, the 30-year fixed reached 31-month highs, touching level not seen since April 2014 in the week after the Fed hiked its interest rate for the second time in the past decade.

The average rate for a 30-year fixed mortgage was 4.3%, up from 4.16% last week, Freddie Mac said in a statement Thursday. The average 15-year rate climbed to 3.52%, the highest since January 2014, from 3.37%.

Mortgage rates have surged since October, when the 30 Year fixed was offered at 3.40%, tracking a jump in Treasury yields on expectations of rising inflation.

Freddie Mac’s chief economist Becketti was more sanguine after last week’s unexpected warning, saying that “a week after the only rate hike of 2016, the mortgage industry digested the Fed’s decision. Following Yellen’s speech last Wednesday, the 10-year Treasury yield rose approximately 10 basis points. The 30-year mortgage rate rose 14 basis points to 4.30 percent, reaching highs we have not seen since April 2014.”

So what does this surge in yields mean? According to a separate analysis released by RealtyTrac, home affordability in the fourth quarter tumbled to the lowest level since the financial crisis, Q4 2008. In a nutshell the report found that:

29% of Local Markets Less Affordable Than Historic Norms, Highest Since Q3 2009;

Annual Home Price Appreciation Outpaced Wage Growth in 81 Percent of Markets;

Affordability Index Improved From Year Ago in 18 Percent of Markets;

Here are the details.

According to the quarterly RealtyTrac report, 29% of U.S. county housing markets were less affordable than their historic affordability averages in the fourth quarter, up from 24 percent of markets in the previous quarter and up from 13 percent of markets a year ago to the highest share since Q3 2009 — when 47 percent of markets were less affordable than their historic affordability averages.

Nationally the affordability index in the fourth quarter was 103, down from 108 in the previous quarter and down from 116 a year ago to the lowest level since Q4 2008, when the national home affordability index was 102.

The report analyzed median home prices derived from publicly recorded sales deed data collected by ATTOM Data Solutions and average wage data from the U.S. Bureau of Labor Statistics in 447 U.S. counties with a combined population of more than 184 million. The affordability index is based on the percentage of average wages needed to make monthly house payments on a median-priced home with a 30-year fixed rate and a 3 percent down payment — including property taxes and insurance. An index of 100 indicates market affordability on par with historical norms while above 100 indicates more affordable than historic norms and below 100 indicates less affordable than historic norms.

Counties in New York, Dallas, San Francisco less affordable than their historic norms

Out of the 447 counties analyzed in the report, 130 counties (29 percent) had an affordability index below 100, indicating they are less affordable than their historic norms.

Counties with the lowest affordability index in Q4 2016 were Cumberland County, Tennessee in the Crossville metro area (58); Genesee County, Michigan in the Flint metro area (77); Denver County, Colorado (79); Adams County, Colorado in the Denver metro area (81); and Wilson County, Tennessee in the Nashville metro area (83).

The most populated counties that were less affordable than their historic norms in Q4 2016 included Kings County (Brooklyn), New York (affordability index of 91); Dallas County, Texas (91); Queens County, New York (95); Tarrant County, Texas, also in the Dallas metro area (93); and Alameda County, California, in the San Francisco metro area (93).

The most populated counties that were less affordable than their historic norms in Q4 2016 included Kings County (Brooklyn), New York (affordability index of 91); Dallas County, Texas (91); Queens County, New York (95); Tarrant County, Texas, also in the Dallas metro area (93); and Alameda County, California, in the San Francisco metro area (93).

Home price growth outpaced wage growth in 81 percent of counties.

Annual home price growth outpaced annual wage growth in 363 of 447 counties (81 percent) analyzed in the report, up from 77 percent of counties in the previous quarter and up from 57 percent of counties a year ago.

Since bottoming out in Q1 2012, the national median home price has increased 60 percent while average weekly wages have increased just 1 percent during that same timeframe.

The most populated counties where home price growth outpaced wage growth were Los Angeles County, California; Harris County, Texas, in the Houston metro area; Maricopa County, Arizona in the Phoenix metro area; San Diego County, California; Orange County, California; Miami-Dade County, Florida; Kings County, New York; and Dallas County, Texas.

Counties with the strongest annual growth in average weekly wages were Woodbury County, Iowa in the Sioux City metro area (15 percent); Maury County, Tennessee in the Nashville metro area (14 percent); Iredell County, North Carolina in the Charlotte metro area (11 percent); Walton County, Georgia in the Atlanta metro area (9 percent); Elkhart County, Indiana in the Elkhart metro area (8 percent); and King County, Washington, in the Seattle metro area (8 percent).

In conclusion, “Rapid home price appreciation and tepid wage growth have combined to erode home affordability during this housing recovery, and the recent uptick in mortgage rates only accelerated that trend in the fourth quarter,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “The prospect of further interest rate hikes in 2017 will likely cause further deterioration of home affordability next year. Absent a strong resurgence in wage growth, that will put downward pressure on home price appreciation in many local markets.”

So all the US economy needs is a burst in wage growth. Good luck.

Awesome well written and true. I see it here in NJ and when I talk about it I am put down by friends and family calling me a negative person. This economy is bullshit except for the elite. Also I actually am very depressed trying to figure out this stock market for the past 8-10 years. One month you read about a crash, the next is how grand things are. Since Day trading the scam words, I lost most of all my net worth( about 650,000). I have been most certainly scammed by the USA government, federal reserve, cnbc and all other fairy tellers alike. When fake money is printed based on nothing, you know damn the system is well its corrupt. The art of the Goldman Sachs clan I bet as well as other insiders. American hard workers stuck holding as bagholders of debt

I knew the mortgage rates would rise, so I refinanced down to 3.65% in August. Saved $500 a month, which goes directly into my savings account.

Well, Merry Fuckin’ Christmas, Jim Quinn style!

I keep goin’ round in ever-frustrating circles. Of course, the Markets are overblown, overbought and overfull of grade-A bullshit…but that was true last year and the year before and before that, etc. Of course, $20 fuckin trillion dollars of debt is WAY too much, but I heard the same thing when it was 3 trillion, then 6, then 10, then 15. Of course, 0% interest is a ridiculous concept–outstripped in stupidity only by NEGATIVE fucking rates–yet we’ve had them for years and the system still spins. Of course, exponential curves collapse exponentially–the magic eyedropper, a penny doubled every day for a month, I know all the fuckin’ analogies and even understand the math behind them–but I’ve been on pins and needles for five fuckin’ years (and I’m a short-timer) waiting for the inflection and…nothin’ but more of the same ole bullshit. I even know that Rome wasn’t built in a day and didn’t collapse in a day…but fuck, what if this fuckin collapse happens two days after I die of fuckin stress from worrying about the fuckin’ collapse? Sounds about fuckin’ right.

The system is fucked beyond repair–hell, beyond BELIEF–but it just goes on day after fuckin day with no end in sight. Dead canaries everywhere, but we can all still get half-caff, foamy, cinnamon dusted Lattes every other fuckin’ block with our fuckin’ personal mind-controllin’, propaganda-spewin’, self-spyin’ iDiot devices.

How does that make any fuckin’ sense?

Anyway, just ranting. Merry Fuckin’ Christmas to all and a Happy New Fuckin’ Year!!!

“How does that make any fuckin’ sense?”

It doesn’t, but that’s what’s on the plate. Eat hearty and keep your powder dry. Meanwhile, as they say in Chinese restaurants, ENJOY!

Now that is an epic rant worthy of the TBP hall of fame. I miss your regular commentary.

Thanks Admin. I’m still around, just haven’t been posting much. Under more scrutiny at work, haven’t felt like I had anything to say and…Oh yeah, after years of increasingly devastating disappointments my wife and I had a baby girl in July so I’ve been a bit busy. ?

Congrats DRUD! And Merry Christmas……

Thanks Bea. Merry Christmas!

Baby pictures are always welcome, provided there are no nipples shown.

Daddy gets the other boob. It’s one of the perks of being the dad.

Now that is a reason to celebrate. Congratulations. Don’t ever let her read TBP. It will scar her for life.

Nice rant, DRUD.

The only way Trump might bring manufacturing jobs back to the U.S. considering everything Jim.Q so eloquently stated above is through free trade zones or export-processing zones that are already popping up around the U.S.

Many of these zones act outside U.S. regulatory framework when it comes to wages, worker safety and rights and environmental impact!

However, these tactics, used against developing nations to erode soveriegnty and create spheres of influence for corporations, intelligence agencies, individuals and nations, WILL NOT provide a living wage.

The MSM narrative being peddled for public consumption is that robots will be to blame for job losses to.come. Not FED policy that seems to be devaluing our currency ever since the Bretton Woods agreement and the U.S. Dollar being converted to a fiat currency, this same policy that encourages the masses to demand for a $15 minimum wage to.combat rising prices of things valued in Dollars and.which will invariably lead to the automation of many retail and service industry jobs!

Then the impetus to provide a universal basic income to citizens who are part of and go long with the control.system being built around them will be paid for just taking up space and being a good lil follower!

Just look at what Elon Musk said:

There is a pretty good chance we end up with a universal basic income, or something like that, due to automation,” says Musk to CNBC. “Yeah, I am not sure what else one would do. I think that is what would happen.”

http://www.cnbc.com/2016/11/04/elon-musk-robots-will-take-your-jobs-government-will-have-to-pay-your-wage.html

For all you ThE DONALD supporters still.out there who believe he has your and my best interest in mind…

Wasnt Musk present at Trumps tech guru meeting the other day?

Elon Musk? So how the hell will someone on this “universal basic income” afford one of his shitty, government-subsidized, overpriced Tesla cars?

Cmon Rise Against,

Use your imagination! You said the answer in your question…Get the government to subsidize payments on behalf of the citizen!

Or

Create public demand that owning a Tesla is a right of citizenship just as apparently the right to an education supposedly is!

Jim, probably more a post than a comment, or a comment linking to a previous post: would you consider a post on how you invest what fiat bucks you pulled out of the Wall Street Casino and the philosophy? I get beans bullets and bandaids, but for sums beyond this…what do you do? For instance, would you advocate paying off a 30 year fixed rate mortgage given your inflation expectations or no? I can see both the ‘pay off debt’ position as well as the ‘long fixed rate mortgage is one of the only ways plebs can set themselves up to benefit from inflation’ position.

Precious metals may retain value, but are not an ‘investment’ so much as a way to move purchasing power through time. You can consume them later, but no matter how big your dragon horde…it never gets one gram bigger except by you adding to it. If one wants to transition from living off of the sweat of their brow to living off of the earnings from deferring the consumption of the sweat off their brow…can it be done, and if so how? Thank you in advance for your thoughts, consideration and great blog and community.

I’ve been steadily paying down my home equity line I used to purchase three used cars over the last couple years. Now I’ll move on to paying down my mortgage and paying for two kids in college next year. I haven’t bought much gold or silver in the last few years. Being debt free is my goal.

Debt free is the best investment you can make right now.

Freedom’s just another word for nothin’ left to lose

Nothin’, don’t mean nothin’ hon’ if it ain’t free, no no

shit I had to upvote you sir

whatever just a cook )))))))))))

EC all over the lyrics today. A little zep, a little JJ.

IF I OWE THE BANK A HUNDRED DOLLARS, I CAN’T SLEEP …

IF I OWE THE BANK A HUNDRED THOUSAND DOLLARS, THE BANKER CAN’T SLEEP …

INFLATION IS HOW THE POLITICIANS STEAL FROM THE SHEEPLE …

THEY DON’T NOTICE THE TINY HITS …

Thank you.

Nick and I tell ourselves that making sure our son graduates from engineering school debt-free is the best “inheritance” we can give him. Then, we are going to go on cruise ships twice a year during the coldest and hottest season, settling my cousin’s daughter into my home to babysit my animals with extreme limitations on parties held in our absence. Thus, we shall make sure we spend all the fiat dollahs we saved all our lives so we will be eligible to join the FSA.

On the other hand, I guess I better drain the pond and see if I can find any of the stuff I lost when the boat sank so we can do that and still pay taxes. Wouldn’t want the feds to Ruby Ridge anybody.

I recommend this website because they post such great articles.

http://www.zerohedge.com/news/2016-12-22/something-wicked-way-comes

They have great taste.

You’re very good at taking pictures of other peoples charts and coming to the wrong conclusion. I’m impressed.

Fuck you douchebag.

Regale us with your wisdom you fuckwad.

How come nobody takes you up on that anymore? When will there be another shitfest?

Don’t get too lathered up. We’re probably due for a nasty correction. Give it 18 months, tops, and then business as usual will most probably resume from a lower level. We are in the middle of a growth wave, folks. TEOTWAWKI is nowhere in sight.

Somebody above mentioned Prechter — we appear to be in what Elliott called a ‘fifth wave’. Fifth waves are weaker and uneven. Make no mistake, though — it’s still trending up…

I love how callous of an analysis when using words like nasty correction,

What does a nasty correction look like? Purely from a statistical inhumane, albeit, mathematical anal-ysis we trivialize the human cost of a nasty correction!

This go around could very well be business as usual 18 months later for Walll st., but if your vision can pierce through the dense and constant fog of bullshit on the boob tube and the jumble o tubes we call the internet, you will know that irreperable harm will have been afflicted upon Main St. And it will continue well past 18 months…

Further erosion of public trust during this next “correction” , coupled with the programming of the masses through pop culture, predictive programming methods will provide the masses with examples of how to behave in specific situations….think Black Friday @ Wal mart the first day of a Zombie Apocalypse!!

It was I who mentioned Prechter, all of whose (earlier) books I still have. Back in the day (80s), he was a great trader, but that day waned and drew to a close when the black box quants delivered the equities markets to the near-total control of the majors, decimalizing spreads that used to be in teenies and steenths on the level-II-and-III inside and eighths for the “civilians”. Elliott Wave Theory is elegant math, but with respect to market speculation now as useful as tits on a boar, as the saying goes; Fibonacci fans may still be useful indicators, but when all is said and done, pray for the day that c-dees earn six percent down at the local credit union.

[img [/img]

[/img]

I could not agree more with this analysis of the true economic situation in the US and throughout the western world. Every market – equity, commodity, bond and real estate – is little more than a vast system of theft and plunder of the American people. All markets have been rigged by the Deep State which has infiltrated and now controls the US Government, banking and financial institutions, security and other government agencies such as BLS and NIST, justice (sic) system, educational system, main stream media…and many foundations, think tanks, CFR, Bilderberg Group, Trilateral Commission, and other agencies of subversion and control. The tentacles of the Deep State penetrate just about every aspect of our daily lives making it almost impossible for Trump or anyone else to extricate the US and other western nations from this global control network. However, from speeches given during the presidential campaign, Trump and the people around him are very aware that the US has been taken over by the Deep State. From where I stand, the only solution is a massive purge of all infiltrated agencies of the United States after his cabinet is firmly in place. This would entail a declaration of Marshall Law, a short term suspension of the Constitution, the indictment and arrest of all members of the Deep State and their agents in the US, and the confiscation of the trillions of dollars stolen from the American people. Trump would need to explain to the American people why this was necessary and obtain their support. And after the US has been purged of traitors, gangsters, criminals, thieves and murderers and the Constitutional Republic reestablished, the next stage would be to use US economic and military power to purge the Deep State from all western nations starting with the House of Rothschild in the City of London which is the epicenter of global control followed by the Bank of International Settlements (BIS) in Switzerland. I realize that this is a radical step but I can see no other solution considering the level of control and the power of the Deep State. Make no mistake, we are in a war of survival as a free, independent and sovereign people.

It is very possible the Midwest is the truest reflection of truth than other areas of the country. The fact is the real economy is neither vibrant or healthy and the troubling current trends should give us pause. The truth is most Americans only get to smell the feast and have no seat at the table when the Wall Street elite dine. Today small business is having its clock cleaned by big businesses backed by Wall Street money, coupled with the cost of complying with new government regulations.

Those in power tend to warp and skew both numbers and future projections in a self-serving way. A combination of low-interest rates, government spending, and easy money coupled with massive stock buybacks have given many people a false impression all is well, but looking at the numbers and beyond it becomes clear something is dreadfully wrong. The article below delves deeper into this subject.

http://brucewilds.blogspot.com/2016/02/the-real-economy-beyond-our-financial.html

You seem to lay all this at Prez O’s feet. Given the pooh sandwich served to Obama in 2008 and all the “cooperation” he’s had from Congress – what would you have had him do differently?

All I heard in ’08 from the “experts” was it would take 10 years to recover. Ta DA !!! It has been eight years and here in Miami there are plenty who are still upside-down while Miami’s skyline is booming with cranes. As a roofing contractor I can tell you the rich folks are building like crazy – renovations and new MacMansions everywhere.

Anyway, the 1% are poised for another feast and Trump has his patsy. Obama has been artfully set up to take the blame.

Good article. Problem is, when one can list off so many negatives off the top of your head, mit is characteristic of a bottom ie. Something good is coming.

What’s goin on? It’s been a rough few months so I ain’t had time ter come on here and explain ter the needy turds (wassup Mags) what the hell happened in November when Donald T was erlected president, cuz I been readin all kinds er shit and I have uh extremely sophistercated perspective on all this political bullshit goin down, but when yer got certified halitosis breathin mongreloids spewin retardations (Maggie) all over this awesome porno site (good gawd Jimmy Q, did yer see them hooters on that girl in the sidebar? Almost makes me want ter git down git down with one uh them carpet munchin lezzies).

Anyways, I’ll git back on here later and tell yer all about it, but fer now I’m about ter pass out fer various reasons. Good ter be back! Can someone please forward me links ter all Hardscramble’s shit so I can start reamin his pompous anus a new diameter? Good gawd that man could rite an enormous book all about his very own awesomness. Yo I’m out.

The boob quality has improved since the election. But then, I’m no purist. I was shopping at Sears and the cashier was this chunky white girl with a pretty, albeit plain face, but man, those hooters – no, they were bigguns. You could see the top of the love muffins, with waves that remind me of the ocean, her every movement creating a seismic reading on the white surface of those orbs, each one bigger than my head. I was enthralled. I forgot about my ex-gf, what a loser, she never had these all-day suckers.

Oh, you wanted to know about HF. There’s the farmer’s bucket, a lovely little tale of what may be his attempt at birth of a nation (without the KKK).

Oh mah gawd beaner, I figured yer’d be back in mexico already eatin moldy beans outer yer tias’s crock pot and drinkin fermented donkey piss and havin sex with yer cousins and diggin ditches as uh hobby and torturin all the Jesusses in yer enemy cartels and all that kinder shit. But since yer still online I deduce yer still stateside so good gawd yer ass is gonner git real puckered oncet Donald T takes the throne and kicks ever brown persons whole life right in the balls.

Sir Iska said we would have DT’s portrait on our wall. The media says 1/3 Hispanics voters voted for Trump. I can’t claim influence but I suspect they agreed with me, the Democrats had 8 years to do something and they couldn’t lift a finger even with a majority. Oh, but they sure can paint the White House in rainbow colors.

Shitballs uh mercy yer gawd dammed migratory person of color. What sort of self loathing masochistic tamale would vote fer the guy that’s about ter kick yer anus back to Mexishithole? Have some self respect! Hillary would uh kept yer people snug in the warmth uh her pungent cooter (I’m speaking metaphors here) fer 4 er 8 years and Donald T is about ter drop uh turd dead center on yer dreams fer uh better life. I don’t git it.

Haven’t seen you on the live free or die post.

“I ain’t had time ter come on here and explain ter the needy turds [just] what the hell happened in November when Donald T was erlected president, cuz I been readin all kinds er shit and I have uh extremely sophistercated perspective on all this political bullshit goin down…” – Billah’s wife

Where have you gone, ole be devil you?

Our nation turns its lonely eyes to you.

Wu wu wu

All I hear is the loud,loud, snoring from the sleep walkers.

Inflation is never a problem for USA, all they have to do is change the way its calculated to make it disappear,as was done under Clinton. Easy solution

Buy commodities right after the coming USDX spike.

Having documented pallets of cooper, aluminum, zinc , and nickel

ingots in the barn could turn the recycling center

into an ATM when the dollar dies, and the new system

(what ever that is) comes on line.

Buy chicken feed too… 5 pounds of feed produces

a dozen eggs… a way to trade feed for eggs without

having the chickens, and being awakened

at 4 am by roosters.

I paid off my mortgage, my cars, and all my debts in July of

2009… it’s been quite amusing to watch this unfold from

the sidelines.