Guest Post by John P. Hussman

One of the attempted barbs tossed my way at various points in the past 20 years is “Cassandra.” Though I was often known as a leveraged “raging bull” before the late-1990’s bubble, and have regularly shifted to a constructive outlook after every bear market decline in more than 30 years as a professional investor, Cassandra’s name was called out at me approaching the bubble peaks of 2000, 2007, and again at the recent market highs. Frankly, I kind of like it.

See, in Greek mythology, Cassandra’s curse was not that her prophesies were incorrect. She understood her responsibility to defend others by sharing the future that she saw clearly. The curse was that nobody believed her until it was too late. When she warned that there were soldiers in the Trojan horse, the only person who believed her was silenced. As Robert E. Bell wrote, “her tragedy was knowing the unhappy truth and revealing it, something highly unwelcome then as now.”

Across three decades as a professional investor, we’ve always come out admirably over complete market cycles (with the clear exception of the speculative half-cycle since 2009). Even with recent challenges, we’ve never taken deeper loss during a complete market cycle than the S&P 500 has experienced. Still, the problem with recognizing the future is that one often seems wholly out-of-touch with the present. That was Cassandra’s problem too.

In March 2000, I wrote “The inconvenient fact is that valuation ultimately matters. That has led to the rather peculiar risk projections that have appeared in this letter in recent months. Trend uniformity helps to postpone that reality, but in the end, there it is… Over time, price/revenue ratios come back into line. Currently, that would require an 83% plunge in tech stocks (recall the 1969-70 tech massacre). The plunge may be muted to about 65% given several years of revenue growth. If you understand values and market history, you know we’re not joking.” The S&P 500 followed by losing half of its value by October 2002, while the tech-heavy Nasdaq 100 lost, well, 83%.

As the next bubble was getting its legs thanks to Fed-induced yield-seeking speculation, I wrote, “why is anybody willing to hold this low interest rate paper if the borrowers issuing it are so vulnerable to default risk? That’s the secret. The borrowers don’t actually issue it directly. Instead, much of the worst credit risk in the U.S. financial system is actually swapped into instruments that end up being partially backed by the U.S. government. These are held by investors precisely because they piggyback on the good faith and credit of Uncle Sam.” By April 2007 another bubble was fully formed, and I estimated that the market would have to lose 40% of its value simply to reach historical valuation norms. Following that 40% loss, I observed in my late-October 2008 comment that stocks had become undervalued. Neither view was popular at the time.

Despite anticipating the financial crisis, the accompanying economic consequences were “out of sample” from the standpoint of the post-war data that our market return/risk classifications relied upon, and I very admittedly stumbled as a result of my insistence on stress-testing our methods against Depression-era data (see the “Box” in The Next Big Short for the full narrative). Even so, our valuation methods were no part of that difficulty. They correctly identified stocks as undervalued in 2009 (though in the Depression, the same level of valuation was followed by stocks losing another two-thirds of their capitalization), and they’ve been just as tightly correlated with actual subsequent market returns in recent complete cycles as they have been across history.

While valuations are extremely informative about full-cycle returns and potential risks, returns over shorter segments of the market cycle are primarily driven by the inclination of investors toward risk-seeking or risk-aversion, which is best inferred from market action. The challenge in the recent half-cycle had to do with Fed-induced yield-seeking, which disrupted the historical tendency for deteriorating internals to accompany or quickly follow extreme “overvalued, overbought, overbullish” syndromes as they had in other cycles across history. In the face of zero interest rates, one had to wait for market internals to deteriorate explicitly before taking a hard-negative outlook.

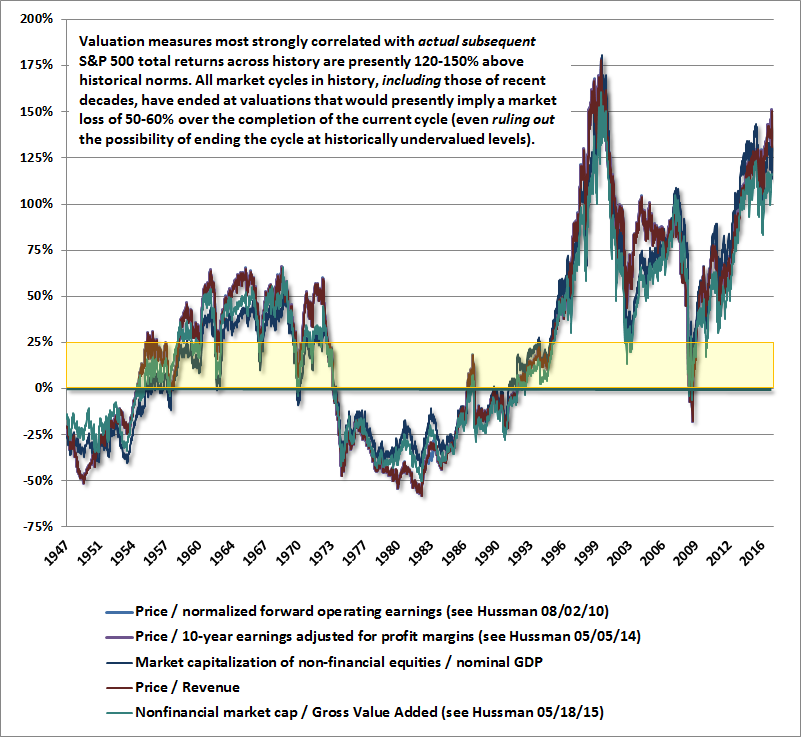

Yet the fact that our valuation approach wasn’t the problem in the recent half-cycle is actually a horrible problem for investors here. See, regardless of market internals or even economic outcomes over a shorter horizon, the speculative extremes of recent years imply profound market losses in the coming years. I see these losses as both predictable and inevitable. On the most reliable measures across history, the S&P 500 presently stands between 120% and 150% above historical valuation norms (depending on which measure one chooses), and the correlation between those measures and actual subsequent market returns hasn’t deteriorated a bit in recent market cycles. Moreover, we’ve never observed a market cycle across history, even at the relatively kind 2002 lows, when these measures did not get within 25% of those norms (usually the completion of a market cycle takes valuations moderately to well-below those norms).

Below, I’ve reprinted a chart I presented last week, which features some of the most reliable valuation measures we follow, showing percentage deviations from their pre-bubble norms. S&P 500 forward earnings and revenues are imputed prior to 1980 based on their relationships with available data having a longer history. The measures below have correlations as high as 94% with actual subsequent S&P 500 total returns, particularly on a 10-12 year horizon.

The resulting arithmetic is fairly straightforward. Moving from 120% overvalued to 20% overvalued involves a loss of about (1.25/2.2-1=) -43%, while moving from 150% overvalued to fair value involves a loss of (1.0/2.5-1=) -60%. Feel free to narrow those projected losses by roughly 4% annually (representing nominal growth in GDP, revenues or corporate gross value-added) for every year between now and the completion of the current cycle, and you’ve got a fairly good estimate of where we expect stocks to end up – at best – by the low of this market cycle.

Causes and Conditions

If one understands

the law of cause and condition

one can find spring

in the midst of autumn frost and winter snow

– Buddhist Proverb

While human beings tend to be very eager to extrapolate existing conditions, and even enlarge them in their imagination, they are less apt to envision what isn’t already happening. The problem with the future, quite simply, is that it hasn’t happened yet. To see the future, one has to look deeply at the seeds that are already there in the present, but simply haven’t come to the surface. One has to recognize the interconnectedness of things – the fact that nothing has a separate self, but is instead the manifestation of a whole set of causes and conditions. A “cause” is a seed. A “condition” is a circumstance that allows the seed to grow.

For example, overvaluation can be thought of as the cause of market collapses, but the aversion of investors toward risk is a condition that allows the cause to manifest. Steep market losses are inherent in extreme overvaluation, but historically, a risk-seeking attitude among investors (demonstrated by a combination of uniformly favorable market internals and the absence of overbought market action and overbullish sentiment) has enabled continued speculation.

As I’ve regularly noted, in the face of the Federal Reserve’s zero-interest rate policies, speculation continued even after “overvalued, overbought, overbullish” extremes were reached, something we hadn’t seen in prior market cycles. One had to wait for dispersion across market internals for the market to become vulnerable to losses. Part of the reason we cannot rule out a market collapse here is that both the causes and conditions that have historically enabled market collapses are now present. The conditions may change in a way that defers a collapse for a while, and we’ll monitor market action to gauge that possibility. But given the valuation extremes that are already established, the cause will not go away.

I view steep financial market losses to be inevitable over the completion of this cycle. Still, we know how to deal with that risk. My concerns have frankly become much broader in recent weeks, particularly in the direction our nation is taking. It strikes me that because the U.S. is a relatively young nation, we are less inclined to recognize seeds that can grow into abuse of power, because the worst examples we recall across history have been in other nations. The progression thus far rhymes more than I’d like. I think it would be wrong to abandon vigilance and scrutiny, particularly where various proposals could have the effect of weakening the separation of powers between the legislative, executive, and judicial branches. Already, the inclinations to waive Congressional rules, to deride and offer selective access to the press, and to weaken ethics oversight are of concern. Recalling Thomas Jefferson, “The only security of all is in a free press. The force of public opinion cannot be resisted, when permitted freely to be expressed. The agitation it produces must be submitted to.” Another concern is the embellished focus on external threats. As James Madison wrote, “If tyranny and oppression come to this land, it will be under the guise of fighting a foreign enemy. The means of defense against a foreign danger historically have become the instruments of tyranny at home.”

I woke the other night thinking about the coming years; in the markets, in our country, and in our world. I reached over in the dark to the stack of 3 x 5 cards on the table next to me, composed these words, and went back to sleep:

To recognize the future in the seeds of the present

is to cry before sorrow falls, and to laugh before joy arrives

Your point?

I agree…what is he getting at here? A Mussolini Trump or a Great Depression v2.1 as a result of that? Please explain?

Hussman has been talking the over-valuation angle for quite some time (correctly). In this written issue, he seems to have taken the liberty to take a stab at Trump.

Just because one may be very proficient in the financial arena, or just like movie stars, there is no magical correlation to proficiency understanding politics, governments, geopolitical issues, etc.

We happen to live in a Fascist state where Mega-Corporations and Government work together to aid each other. Since the Mega-Corp’s own the MSM, Hussman cannot see the existing MSM as nothing but shills (Fake News or Propaganda arms) for the gov’t.

Yes, he is a bit deluded there. The free press should and can be a bastion of freedom, however when nearly all of the press is in the tank for a party that wants big, preferably one world, government, and is willing to ignore ethics to support them, attacking that press and the rise of alternatives is vital. Other than that I am a fan of his work on valuations.

Its more worthwhile to think about what may be undervalued. Just say everything in the USA stock market is over-priced, and most real estate in suburban areas is too high of a multiple of declining incomes.

Whats left ? Not retail shops, not housing, not stocks or bonds. What would you have wanted to own in 1938, right before the ww2 industrial boom ? Thats what it’ll feel like is the USA stops buying so much from China.

Factories that make nails, tires, glass, paint, pots & pans, lumber, robots, t-shirts, gaskets, wire, you name it ought to do very well. I see a Low tech boom looming.

What factories?

To condense this article to a few key ideas:

1. the market works in cycles, what goes up must come down, and this cycle is still in it’s first 1/2 upward cycle, and Hussman “sees” that we are due for a correction.

2. We have elected a business man, who seems well versed in handling bankruptcy, and this is probably why TPTB have foisted him onto the stage, to serve as the fall guy, when the rug gets pulled out from the markets, and everyone runs for the exit.

3. As someone who has benefited from globalism, and central bank policies, Hussman fears and end to the gravy train and is ready to blame the new puppet for all the worlds problems, and believes he can accurately predict the doom and gloom, and is ready to short the market and profit from the correction (this is his “spring” in winter)

I didn’t know that 100,000 voters in PA, MI and WI were “the powers that be”.

Pete has a very good point. Investing today should consist of exactly that. Look for good dividend paying stocks that are not too expensive (primarily because EVERYONE has been so obsessed with tech for 10 + years) and buy them slowly. Now, the important part is to HEDGE your bets. Because if everything falls apart in the market, which is inevitable, your portfolio can go down fast. Hedging is the ONLY way to do any “investing” in these markets. This way you can still participate in the values and opportunities that still exist (albeit small), and be able to sleep at night. If you are properly hedged, then you can at least continue to collect the dividend, and possibly buy more when it gets cheaper, and not be crushed. Just make sure WHAT is paying you that dividend will still be around if everything goes down. Remember, free cash flow is a lot more important than “future growth potential”. US Real Estate supposedly had “good future growth potential” and ended up a heaping pile of crap in 2009. However, if you owned the RE free and clear, then rented it for cash flow, you still collected that cash flow even though the asset itself was lower in price. You even enjoyed contractors that were desperate for work, so you could make improvements with that cash flow at pennies on the dollar.

Predicting the future is impossible, however preparing for the future that is obvious is doable, and figuring out how to possibly make the best out of the lemons is even better.

Hurry up and collapse already.

The “Market” has been manipulated by a consortium of government, Plunge Protection Team and Counter-Risk Policy Management Group, since, at least the first attack on the Trade Towers, under Clinton.

The volatility index is a flat line and interest rates have been on life support, since forever, while gold has been artificially suppressed, on purpose, in order to thwart anyone playing beyond the boundaries of a fixed game.

Read, Dr. Ellen Brown’s, http://www.webofdebt.com.

The answer is to weaponize the phony 1200 trillion in banker debt, by “monetizing” the 1200 trillion in banker debt… investigations, prosecutions, asset seizures and bank nationalizations to follow.

Imagine the efficacy of the parasitic cleanse and ensuing capitalization, when a proper US Mob (from NJ?) couples with VP Putin, while operating in cooperation and the confidence of the American People.

~Michael Keane 1/16/17

“Donny’s Song”

People smile and tell me I’m the chosen one

But we’ve only just begun

Think I’m gonna be the president

It will be Mike Pence and me, as free as a dove

No one else above

Sun is gonna shine on Trump

And even though we ain’t got exports

I’ve lots of ways to make money

And everything will be a part of Trump

And in the morning, when I rise

I’ll bring a tweet of joy to your eyes

And tell folks everything is gonna be alright

Seems as though, a month ago, I was president-elect

Barely getting by

Oh, I was a sorry guy

And now, I smile and face the world that screams my name

Now I’m in charge of the game

This country will never be the same

And even though we ain’t got health care

I’ve lots of ways to make money

And everything will be a part of Trump

And in the morning, when I rise

I’ll bring a tweet of joy to your eyes

And tell folks everything is gonna be alright

Putin’s Russia rising is a very good sign

Strong yet kind

And little Iraq is mine

Now I see a way where there once was none

Now we’ve just begun

Yeah, we’re gonna run the world

And even though we ain’t got jobs

I’ve lots of ways to make money

And everything will be a part of Trump

And in the morning, when I rise

I’ll bring a tweet of joy to your eyes

And tell folks everything is gonna be alright

Love the guy who holds the world in a paper cup

Drinks it up

Friend him and he’ll bring you bucks

And if you find he helps your bottom line, better bring him home

Don’t you tweet alone

Try to grab what other tyrants have

And even though we ain’t got a mandate

I’ve lots of ways to make money

And everything will be a part of Trump

And in the morning, when I rise

I’ll bring a tweet of joy to your eyes

And tell folks everything is gonna be alright

Coyote,I don’t know whether I should forward this to all my friends or curse you for butchering a great song so I think I’ll do both.

Very funny.

I’ve wrecked several songs as TBP exclusives, if it reminds you of them, happy to oblige. The first one I did, there was a guy here who wanted to be a songwriter.

That is a wonderful aspiration, we have too much rap crap.

No, El Coyote, you have NOT wrecked several songs!

You are quite creative in these endeavors. Your latest creation above is exceptionally well done. I love reading them …. something I don’t tell you often enough. Keep up the excellent and creative work, amigo!