Via Investment Research Dynamics

Several “black swans” are looming which could inflict a financial nuclear accident on the U.S. markets and financial system. I say “black swans” in quotes because a limited audience is aware of these issues – potentially catastrophic problems that are curiously ignored by the mainstream financial media and financial markets.

The most immediate problem is the Treasury debt ceiling. The Treasury is now projected to run out of cash by mid-summer. Of course, in the spurious manner in which the markets evaluate the next trade, July may as well be a decade away. My best guess is that the “market” assumes that, after drawn out staging of DC’s version of Kabuki Theatre, Congress will raise the debt ceiling, probably up to $22 trillion. Then the Fed will extend its highly secretive “swap” operations to foreign “ally” Central Banks (hint: Belgium and Switzerland) in order to fund the onslaught of Treasury issuance that will ensue. Problem solved…or is it?

(Note: Plan B would be another one of Trump’s bewildering Executive Orders removing the debt ceiling. Plan B is another form of “fiat” currency issuance)

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

The second “black swan” seen by some but invisible to most is the ongoing collapse the shopping mall business model, erroneously blamed on the combative growth of online retailing. But when I look at the actual numbers, that argument smells foul.

Is Online Retailing Actually The Cause Of Brick/Mortar Retail Apocalypse?

More than 3,500 stores are scheduled to be shuttered in the next few months. JC Penny,

Macy’s, Sears, Kmart, Crocs, BCBC, Bebe, Abercrombie & Fitch and Guess are some of the

marquee retailing names that will be closing down mall and strip mall stores. The Limited is going out of business and closing down all 250 of its stores.

The demise of the mall “brick and mortar” retail store is popularly attributed to the growth in online retail sales. Too be sure, online retailing is eating into the traditional retail sales

distribution mechanism – but not as much as the spin-meisters would have have you believe. At the beginning of 2015, e-commerice sales were about 7% of total retail sales. By the end of 2016, that metric rose to 8.3%. However, looking at the overall numbers reveals that nominal retail sales have increased for both brick/mortar stores and online. In Q4 2015, total nominal retail sales were $1.186 trillion. Brick/mortar was $1.096 trillion and online was 89.7 billion, which was 7.6% of total retail sales. In Q4 2016, total sales were $1.235 trillion with brick/mortar $1.133 trillion and online $102.6 billion, which was 8.3% of total retail sales.

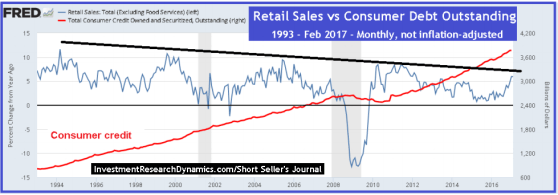

As you can see, there was nominal growth for both brick/mortar and online retailers. My point here is that the spin-meisters present the narrative that online retailers are eating alive the brick/mortar retailers. That’s simply not true. Part of the problem that the total retail sales “pie” is shrinking, especially when analyzing the inflation-adjusted numbers. I created a graph on from the St. Louis Fed’s “FRED” database that surprised even me (click to enlarge):

The graph above shows the year over year percentage change in nominal (not inflation-adjusted) retail sales on a monthly basis from 1993 (as far back as the retail sales data goes) thru February 2017, ex-restaurant sales, vs. outstanding consumer credit. As you can see, since 1994 the growth in nominal retail sales on a year over year basis has been in a downtrend, while the level of consumer credit outstanding as been in a steady uptrend. Since 2014, the rate of growth in debt has exceeded the rate of growth in retail sales. If we were to adjust the retail sales using just the Government-reported CPI measure of “inflation” retail sales would be outright declining.

The problem with the mall business model is debt. The mall-anchor retailers who are vacating mall space like cockroaches vacate a kitchen when the light is flipped on have been leveraged to the hilt by the financial engineers who control them who in turn have been enabled by the most permissive Federal Reserve in U.S. history. Too be sure, online retailing is cutting into the margins of Macy’s, JC Pennies, Sears, Dillards, etc. But these companies would have no problem “fighting back” if they were not over-leveraged to the eyeballs.

Layer on top of that the leverage employed by the mall REITs and the recipe for a financial crisis larger than the 2008 “big short” mortgage/housing crisis has been created. To compound this problem, mall owners are now starting to mail in the keys to financially troubled malls: More mall landlords are choosing to walk away from struggling properties, leaving creditors in the lurch and posing a threat to the values of nearby real estate…[as] some of the largest U.S. landlords are calculating it is more advantageous to hand over ownership to lenders than to attempt to restructure debts on properties with darkening outlooks (LINK).

But it gets worse. I referenced the consumer’s ability to borrow in order to spend money. Economic activity in the United States has relied heavily on an increasing amount of debt issuance for several decades. At some point consumer borrowers reach a point at which they can no longer support taking on more debt, whether in the form of mortgages, auto loans/leases or credit cards. The problem for the U.S. financial system is that there will be widespread defaults on the consumer debt that’s already been issued. The average U.S. household has “hit a wall” on the amount of debt it can absorb. This is why restaurant and retail sales are dropping and why auto sales have rolled over. All three will get worse this year.

This Will Crush The Pensions

Finally, the third “invisible” black swam is the looming pension crisis. A colleague of mine who works at a pension fund did a study last year in which he concluded that, because of the extreme degree of public pension underfunding, a 10% decline in the stock market for a sustained period – i.e. more than 3 or 4 months – would cause every single public pension fund to blow up. As he has access to better data than most, he also surmised that the degree of underfunding is 2-3x greater than is publicly acknowledged by the mainstream media (see this article for instance: Bloomberg claims $1.9 trillion underfunding).

Circling back to the mall/REIT ticking time-bomb, while the Fed can keep the stock market propped up as means of preventing an immediate nuclear melt-down in U.S. pensions (all of which are substantially “maxed-out” in their mandated equities allocation), the collapse of commercial mortgage-back securities (CMBS) will have the affect of launching a nuclear sub-missile directly into the side of the U.S. financial system.

The commercial mortgage market is about $3 trillion, of which about $1 trillion has been packaged into asset-backed securities and stuffed into yield-starved pension funds. Without a doubt, the same degree of fraud of has been used to concoct the various tranches in these CMBS trusts that was employed during the mid-2000’s mortgage/housing bubble, with full cooperation of the ratings agencies then and now. Just like in 2008, with the derivatives that have been layered into the mix, the embedded leverage in the commercial mortgage/CMBS/REIT model is the financial equivalent of the Fukushima nuclear power plant collapse.

It’s a matter of time before a lit match hits one of the three lethal powder-kegs described above. This is why the bank stocks were hit particularly hard last week when the Dow was in the middle of its 8-day losing streak. Of course, all it took to spike the Dow/SPX higher was a couple of immaterial “consumer confidence” reports in order to reflate the stock market with some “hope.” Don’t forget, the last time consumer confidence high-ticked was in 1999, right before the tech bubble imploded.

Unfortunately, the next financial catastrophe that is going hit the system, and for which the Fed is helpless to prevent, will make everyone yearn for just the tech bubble or “big short” bubble collapses. Meanwhile, the stock market and its collective universe of “investors” will continue sticking its head deeper into the sand, oblivious to the sling blade that is swings closer to its neck.

Portions of the above analysis were excerpted from the current Short Seller’s Journal. That issue contained more in-depth data and two short ideas, a mall REIT and retailer that has bubbled up beyond comprehension. You can learn more about the Short Seller Journal here: SSJ Weekly Subscription.

Facts of financial life. You can ignore reality but you cannot ignore the consequences of doing so. SHTF Day approaches.

For all you naysayers out there, this is how it will play out….

You will hear that there is some sort of problem in the banking system in the background out of all the TV noise. Not noticing or caring, you decide you need to go to the supermarket and get some grub. At the checkout, you notice that there is a problem with your plastic card. The checkout gal exclaims that she has had trouble with “Insert Your Financial Institution Name Here” all day! You attempt another card, and it too, – declines the sale. “Must be our computer system is not working properly” she exclaims. In frustration you hand over some cash.

When you get home you call your financial institution to find out what’s wrong with your card, but all you get is a recording saying that all customer service agents are currently busy. “Please try again later”

Yup! – this is what happens when the banks turn on one another…. credit freezes up, because banks don’t trust other banks! Their reserves for the day have been blown, and they can’t get anymore credit. Result??.. your card stops working across the banking system.

Of course Donny will step in and “guarantee” the TBTF banks…. but that will be weeks into the shit show, and SNAP card freaks will already be in the streets breaking shop windows and lighting the city up……..

This “consumer” is well able to borrow more on his current cards. One is now paid off and kept paid off, in that anything (usually subscriptions) new that shows up is paid off that month. We are gradually paying down the other one, and the $10k limit we were bumping up against now has a balance below $7k.

The bank raised the credit limit on the paid-off one from ~$5k to ~$7.5k as a “reward” for being so credit-worthy. We are ignoring that entirely.

Consulting has been good for the last six months or so, and we now have ~$3.4k in cash on hand, ~$5.5k set aside for taxes, and around $8k set aside for a car down payment – on a 2013 used vehicle from the in-laws (they have retired, and don’t need this meticulously-maintained large van we are paying online blue-book value for without any loan from any bank, just my good word to pay that much in checks small enough not to draw FATCA attention over time).

I have come to understand that all banks are there to screw their customers, and I hope to avoid any more loans until I pass away. If you don’t play by their rules, their fees can’t cheat you out of every nickel you have.

The market does have its head buried, however I wouldn’t necessarily say it was deep in the sand!

The problem I have with these articles is that I’ve been reading them for more than a decade now and somehow the PTB always manage to kick the can further. I made an overhaul on my investments in 2005 and while I did ok on the PM investments made in the 1st 3 years, I have SIGNIFICANTLY underperformed the overall market since then. I’m getting sick of investing based on fundamentals, only to have those fundamentals have ZERO impact on the markets.

As they say, “Markets can remain irrational longer than you can remain solvent.”

Nothing to do about it but take comfort in the fact that I have less worry about my limited retirement next egg than the ignorant masses should.