Guest Post by Martin Armstrong

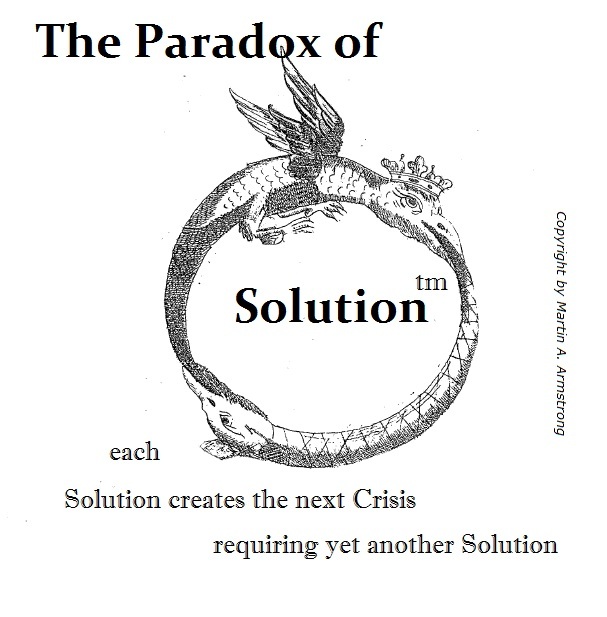

I have warned that whenever a government creates a solution to any crisis, that solution becomes the next crisis. This is what I have called the Paradox of Solution.The unfolding of the exit of the central banks from the Quantitative Easing monetary policy will become a much more serious threat to the financial markets than anyone suspects. The Federal Reserve has already exited and begun to raise rates while also announcing it will NOT be reinvesting the money when the government debt they bought expires. The Federal Reserve is already shortening their balance sheet. Bills of $426 billion will be due at the Fed in 2018, and again about $357 billion a year later. So the Fed will not repurchase that debt. The US economy is absorbing this because US dollars are effectively the only real reserve currency in the world right now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

The real problem lies with the European Central Bank (ECB) and the Japanese central bank and when they exit their Quantitative Easing programs, their economies are not the reserve currency and lack a solid bid from international capital. The end of QE will lead to a sharp increase in yields on the bond markets, and thus the financing costs for the states will explode far more rapidly today than at any time in past history. It is also possible that other sectors of the financial system, such as the stock markets and the foreign exchange markets in peripheral economies to the USA, will be cast into turmoil experiencing great difficulties without the financial support of the central banks.

Since 2008, the Bank of Japan recorded an increase of 107 trillion yen. The ECB has more than doubled its balance sheet from EUR 2 trillion to EUR 4.1 trillion and holds 40% of member state debt while tensions rise against the EU. The crisis emerges when governments, who are the ones who have been subsidized since 2008, find no bid for their paper. This will really send rates upward at a rapid pace.

As central banks appeared as omnipotent purchasers of government bonds to the un-savvy trader, the yields of the debt by no means reflect the risk of a default in the country’s payments. The decline in yields masked the rising risks from fiscal mismanagement that has been widespread.

While the Federal Reserve had recently announced that it would no longer reinvest its gains on government bonds that had matured into new US securities, the US bond market will need to find new buyers to absorb the additional supply. That may not be a problem right now, but as other government debt moves into crisis, we will see the capital flight from bonds to equities unfold.

The balance sheets of both the Japanese central bank and the ECB are unlikely to follow the Fed just yet. A withdrawal of the ECB’s purchases of securities could produced the most widespread damage in Europe since the Dark Ages.

If the fed won’t reinvest and need to find buyers but can’t, supply increases while demand stays constant should that not halt rates at least temporarily. After all, supply and demand is the primary foundation. Just in time for the ’18 elections so snowflakes can blame someone. I agree each solution becomes the foundation of the next crisis……been there seen that many times….

Bones-

“If the fed won’t reinvest and need to find buyers but can’t, supply increases while demand stays constant should that not halt rates at least temporarily. After all, supply and demand is the primary foundation.”

Set me straight-if they need to find buyers but can’t at current % rates,won’t they have to raise rates?

A bit off topic but financially related.

Last week somebody asked about bitcoin.Here’s an article about crypto currencies and the huge bubble that’s developing there.

Aha….the perfect self-eating watermelon!

For centuries: silver coins, gold coins, lead ‘not coins’, and a good stock of food, seeds, and water purification tablets.

These are all good investments when the people running the show are a bunch of F ups.

Face it everything is going to shit but the head rats will be making off with the cheese : war or depression probably both is the solution . We will convince another generation to wave a flag tie a yellow ribbon and tag them all heros as they embark on another fools errand .

Been there done that all I got was a tee shirt and cheap nikes made in some Asian swamp we bombed the piss out of for the “MILITARY INDUSTRIAL COMPLEX”

Wash Rinse Repeat !

Don’t believe what CB’s say. Government Debt has gone past the rational free-market supply/demand theory.

The CB’s will probably buy ALL the worthless debt in the future. This will precipitate a change to the monetary system.

For many, these changes will be no fun at all.

Let it all fall down. That is the ONLY solution at this point. Every day the ‘status quo’ is maintained, is a day closer to a catastrophic ending which multiplies in severity with every minute of growth.

So,

nobody wants to buy Central Bankers bonds, boo hoo.

these entities are responsible for ALL of the financial bubbles, and the popping of said bubbles.

Now the CBs are just plowing all that printed money into the US markets.

The effect is to raise the price of stocks (again), and create the mirage of global growth.

this charade will end, and yet another generation will be robbed of the their savings,

so that the cycle can be repeated.

in 2000, they stole from the first 1/2 of baby boomers, and the last 1/2 of the “greatest generation” (1st turning, and 2nd turning)

in 2008 the stole from the last 1/2 of baby boomers and the first 1/2 of genX (2nd and 3rd turning)

in 201x they will steal from all 4 generations,

from what is left from the 1st (baby boomers parents, folks in their mid 80’s)

from the baby boomers (from 50 years to 70s)

from the GenXers (30 to 50)

from millenials (20’s to 40)

There will be a lot of angry people when this next stock market bubble crashes.

and yet, these cycles will continue, for greed and lust are very powerful human emotions,

and logic and reason will take a back seat during times of crisis.

Enjoy the music,

but make sure you have a chair, before it stops.

Mario Draghi’s term at the ECB ends in October, 2019. It is Germany’s turn to appoint the next director. The Euro may not survive long after that. If my thinking is right the dollar will soar as Europeans do what they can to get out of their dying currency and seek a safe haven. This will allow the Fed to unwind its balance sheet. Japan, being a single nation, can probably manage any upheaval from the BoJ ending and reversing QE. If it got through the 3/11 earthquake, Fukushima and the shut down of its entire nuclear fleet they probably can survive Central Banking too.

Think of all the latent bad Karma stored up in all these Fiat currencies and all the derivatives

and unfunded liabilities floating around out there. At some point that Karma has to be paid.

The Piper always gets his money. Just because he didn’t collect yet doesn’t mean he won’t.