Guest Post by Eric Peters

Every kid knows what happens when you try pumping up a leaking tire. As soon as you stop pumping air into it, the tire begins to go flat.

New car sales have been working that way for the past couple of years – with effectively free (zero or little to no interest) loans extended over the horizon – and leases counted as sales – serving as the “air” in the tire.

We’ve been told that business is great.

In fact, it’s as rickety as a Jenga tower.

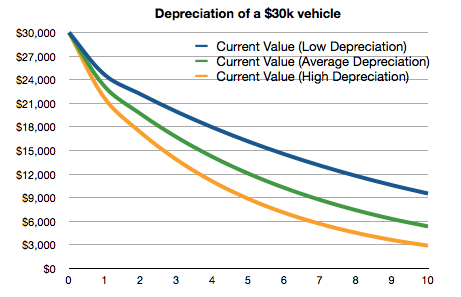

What’s happening in the used car market is a portent. Prices are collapsing – chiefly because of historically unprecedented depreciation. During the past twelve months, the average used car lost 17 percent of its value. This is almost twice the annual average depreciation rate just three years ago. It smacks of the post-2005 collapse of housing prices.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

There are several reasons for what’s happening, all related and feeding off one another like chum-crazed barracudas.

The first is the inflated prices – as distinct from value – of new cars.

Things that have value – intrinsic worth – tend to retain it. Things that merely cost a lot – when they are new – but whose value is essentially a function of their newness and not intrinsic worth – hemorrhage value the moment after they are no longer new.

This used to be almost uniquely true of high-status cars, which people bought largely on the basis of their being the Latest Thing. A year – six months – later, of course, they no longer are. This is why a high-end car that sold for $80k three years ago is worth maybe $50k today.

And will be worth next to nothing – relative to its purchase price – five years from now.

But this canker now afflicts cars generally.

Part of the problem is that all cars are now priced – and sold – to a great extent on their being the Latest Thing. Not on the merits of the parts of the car that serve to make it go, which get you from A to B. The internal combustion engine is a near-perfected technology. Has been, for at least 20 years. There are few new Big Strides to be made.

Instead, little steps at big expense.

But there is not much value in this.

How does the buyer benefit from – as an example – the changeover from a six-speed transmission to one with nine or tend speeds? The car now gets 2 MPG better mileage – on the EPA’s test loop – but it costs $600 more than it did last year. And it will cost much more to repair when the more complicated components fail.

The price goes up – but the benefit doesn’t track with it.

Gadgets – electronic things – have an extremely short shelf-life. From the resolution of the touchscreen to the speed of the processor that runs it. And modern cars have become more gadgets than cars. Cell phones that roll. But very, very expensive cell phones. The average cost is now well over $30,000.

So people rent rather than buy. That is to say, they lease.

Leasing is a short-term (2-3 year) commitment; it is a revolving-door way to perpetually drive something new. And a way to avoid being stuck with something old.

It is also a way to hide the inflated value of new.

The monthly rental payment is much less than it would be if the car were purchased (i.e., financed). Leasing also helps the car industry hide the growing problem of people not being able to afford new. A 2-3 year lease (and revolving debt) rather than trying to spread payments over seven or eight years, in order to make them manageable. But then arises the almost-inevitable problem of the buyer owing more on the car than it’s still worth after making five or six years of payments on a seven or eight-year loan – which is becoming a general problem.

KAR Auction Services – a major industry player – expects vehicles repossessions to more than double this year, in the vicinity of 2 million or more than twice the number of defaults at the bottom of the post-housing collapse recession/depression (which we’ve never really recovered from, Happy Talk and Wall Street notwithstanding).

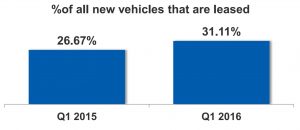

Leasing used to be a small slice of the new car business; something realtors and a few other professional people did in order to take advantage of tax deductions for their business-related car expenses.

Less than 10 percent as recently as the late 1970s.

Today, leases account for a third of all new car transactions (see here). This fact – which ought to send a cold chill down the spine of anyone with a stake in the health of the car industry – tells us a lot about the fundamental unsoundness of the new car business. When roughly triple the number of people who used to buy now rent, you have a problem, Houston.

You also have blowback.

The main factor driving today’s alarming depreciation rates is the glut of used cars on the market. And a very large number of these cars are ex-lease cars. The presence of vast fleets of 2-3 year-old cars on the so-called secondary market depresses the primary market. Why buy a new car for $35,000 when you could buy the same car – more or less – with 30,000 or so miles on it (hardly broken in, for a late-model car) for $20,000?

Conversely, it’s hard for the new car salesman/dealer to make a decent profit on a new car given the downward pricing pressure created by all those barely-used/ex-lease cars sitting on the lot.

Either way, margins are slimmer than a Dachau inmates thighs at this point. And that is unprecedented. Usually, new car sales are strong – and profits good. Or used cars are selling at a healthy profit. Today, there is the scent of desperation in the air.

The earnings being reported are Enron-esque. A spreadsheet Potempkin village. There is a reason why the entire car industry is frantically investing in ride-sharing and “transportation as a service,” the latter amounting to leasing by the hour and day.

It is like a starving man scraping the bottom of the barrel, hoping to find some leavings.

“Why buy a new car for $35,000 when you could buy the same car – more or less – with 30,000 or so miles on it (hardly broken in, for a late-model car) for $20,000?”

One big problem in the NE is the crap the states use to melt ice/snow – it eats metal. I would have preferred to buy a used vehicle, but I would have had to travel to a Southern State and Car-Faxed every potential vehicle to ensure it wasn’t moved from North to South.

Note: Two years ago, I had to junk a 11 year old SUV due to frame eaten away and it only had 53,000 miles. It was a good vehicle that I hoped would last another 11 years.

Note: State of CT has a big problem with their highway trucks being dissolved by the same crap.

I haven’t seen a collapse in used car prices so far, where are they collapsing?

Drove the kid down to Williamsburg Virginia for freshman year at the College of William and Mary. Didn’t see any Teslas after the Delaware bridge, didn’t see any eurotrash after Baltimore. Never been to Virginia b4. Such nice people, then the dream became a nightmare again after the Delaware bridge, and into the people’s republic of New Jersey.

Why do people pay $600 more for an extra 2mpg? It would take 10 years of driving 12K miles a year to make up for that cost. 5 years if gas goes to $5 a gallon. Not worth! And where does it end? How much of the price of a new $25000 car is composed solely of fuel saving measures? $2000? More?

they pay it because the automakers pretty much have to do it that way–

Because the fascists in Government and the idiot libtards keep forcing more and more “efficiency” through the CAFE standards. Engineers are forced to make their designs ever more complicated (and expensive) in order to appease these government “betters” and climate change nut jobs.

I wonder if Peters catches any crap for the Dachau inmate leg comment?

Or perhaps he wants the attention?