Author’s note: Some of you may remember a booklet called “How You Got Screwed” that Jim shared here about a year and a half ago. After seeing it online, a publisher contacted me and asked if I would flesh it out so they could release it as a full book. It just came out a few days ago (you can find it here), and Jim suggested I share a few chapters through TBP. This is the first of three to be shared; I’ll release the next two over the next few weeks. Thanks to Jim for all his support!

Note also: Footnotes/sources not included here but are in the book itself.

Chapter 4: How you’re getting screwed by…Retirement Promises

The Point: Most people have an expectation that they’ll be taken care of later in life thanks to government programs like Social Security and Medicare, private or public pensions, or through their own efforts to build up their net worth. In reality, it was never possible for governments and corporations to fulfill the promises they made to you, and those assets you saved may not be worth what you think they will be, when it’s time to cash them in.

There is a predictable pattern to life: We start out as dependent children; grow to be independent adults; and, inevitably, become dependent again as we move into old age. We know this is coming; not a single person in history has avoided it. So it’s important for us to plan for that while we’re in our prime.

There is a predictable pattern to life: We start out as dependent children; grow to be independent adults; and, inevitably, become dependent again as we move into old age. We know this is coming; not a single person in history has avoided it. So it’s important for us to plan for that while we’re in our prime.

Unfortunately, the vast majority of Americans are completely unprepared for the 100 percent certainty of old age. There are many reasons for this:

- Because we live in a debt- and credit-driven society, we have come to think only of our immediate needs and wants. There’s no need to save for the things we want to buy: We just borrow the money and promise to pay for it later. This mindset not only means that we’re hard-wired against saving, it also means we’re probably going to grow old with a pile of debt—all those things we said we’d pay back in the future. We have some assets—notably our home equity—but all that debt keeps our net worth low.

- We’re about to deal with a huge demographic bubble—the aging of the huge Baby Boomer population—which will result in a selling frenzy of the assets they accumulated in better times. Asset prices will crash due to little demand and huge supply of those assets.

- The government has promised to take care of us in our old age thanks to programs like Social Security and Medicare, while many big businesses, along with the government, have similarly promised to take care of their employees through pensions. These promises—which are actually false promises, in that they cannot be met—have allowed us to forgo our own efforts to prepare for the future.

In short, even though we know for a fact that we each need to prepare for our old age, we’ve been taught not to worry about it and robbed of the ability to do it. It’s guaranteed that this will not end well for the majority of people in this country.

Are Americans Ready to Retire?

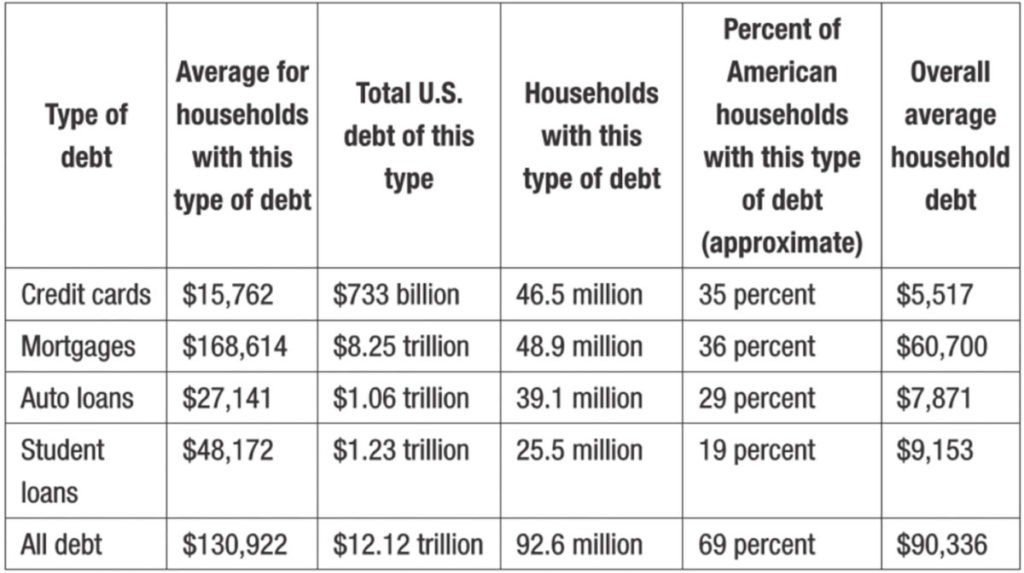

Americans are awash in debt, with credit cards, mortgages, and auto loans among the primary contributors. According to NerdWallet, with additional color added by Fool.com, 69 percent of U.S. households have one or more kinds of debt, and the average level of debt carried in those households was $130,922 at the end of 2015. Levels of household debt in the U.S., along with the numbers and percentages of households that carry that kind of debt, are as follows:

“Surely,” you must think, “those numbers aren’t the same for people across age groups. Young people must take on a lot of debt, while people near retirement have paid theirs off.” While that’s true to an extent, a lot of people enter retirement age with a lot of debt. In fact, according to the U.S. Census, in the year 2011, 60.4 percent of people in the age 65–69 bracket carried debt, and the average amount of that debt was $109,973. And the debt levels of people nearing retirement age have grown over the past several years: According to data from the New York Fed, the average debt levels of people ages 55–64 have grown an average of 66 percent between 2003 and 2015.

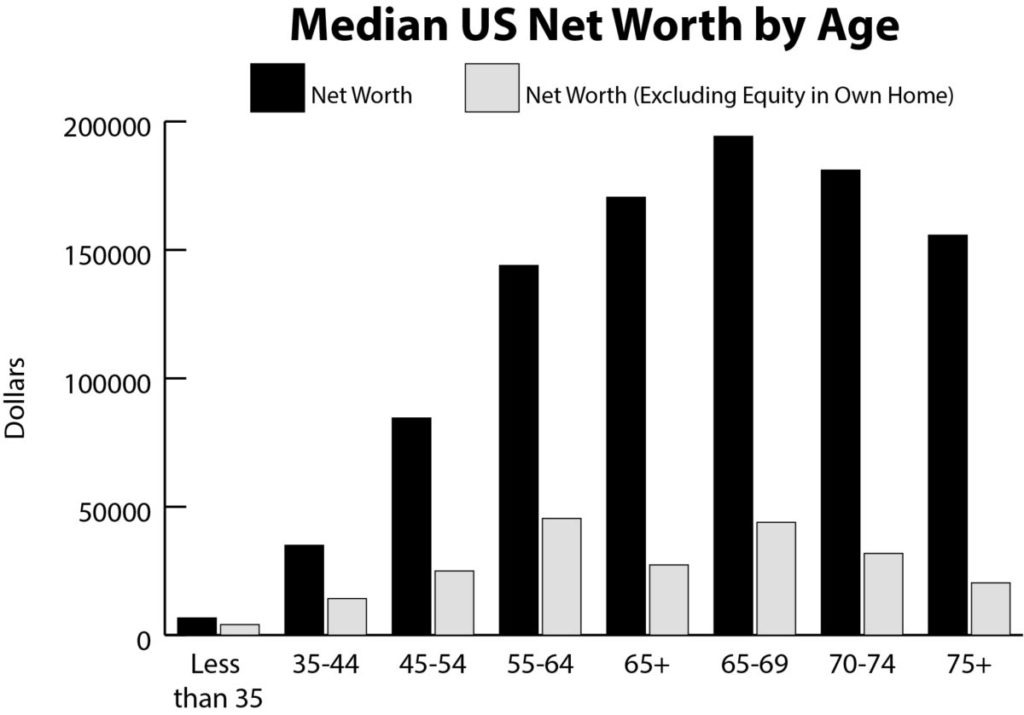

And what about the other side of the coin—savings? Those debt levels wouldn’t be bad if savings were much higher. However, according to the U.S. Census, in 2011 only 21 percent of households entering retirement age (55–64) had a net worth (in other words, after debt is subtracted out) of $500,000 or more, while 43 percent have less than $100,000 in assets. And for most, more than half of their net worth comes from the equity in their homes, meaning they would need to sell their houses in order to live off those funds. In fact, as The Fool website reports, “According to the U.S. Census Bureau’s data, the typical American’s net worth at age 65 is $194,226. However, removing the benefit from home equity results in that figure plummeting to just $43,921.

The Demographic Bubble

From post-war 1946 to 1964, the United States produced an epic wave of children. This generation, known as the Baby Boomers, remains the single largest generational group in the country, and as they moved through their lives from birth to seniorhood, they have had a profound impact on American society.

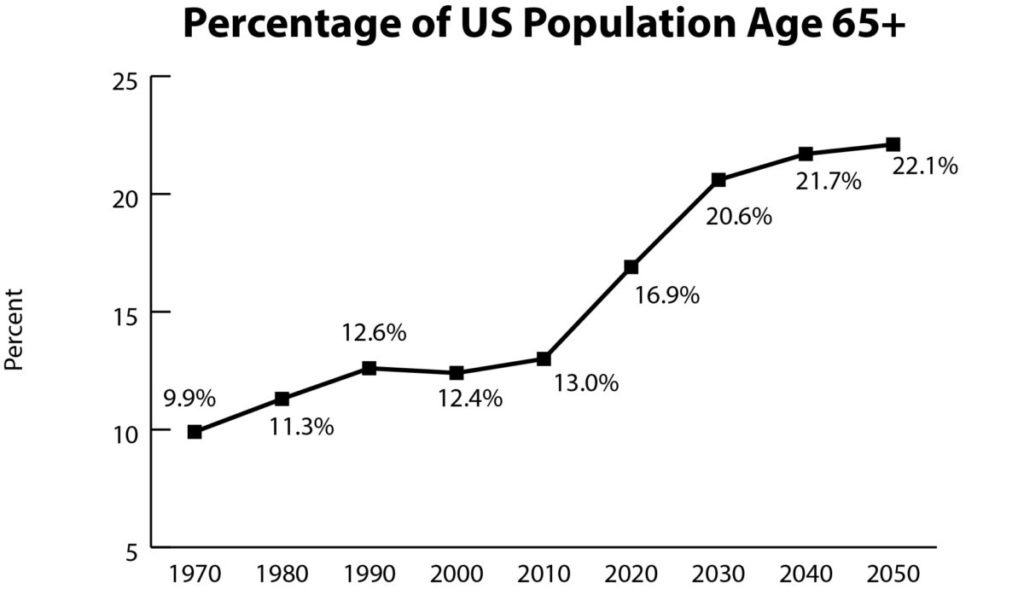

But their greatest impact may still be to come: The first of those Baby Boomers began to hit retirement age in 2011, and as a result the number of retirees in this country is projected to go from 40.3 million in 2010 to 82.3 million in 2040. In terms of percentages, thanks to the Boomers, retirees will go from 13 percent of the population to 21.7 percent during that time.

This is a huge population shift in a very short amount of time, and it’s going to hit our country like an earthquake. That’s 42 million additional people drawing Social Security. Forty-two million receiving Medicare. Forty-two million needing all kinds of specialized products and services, such as elder care facilities and transportation services. And most important, 42 million who are no longer contributing to the tax base, but instead beginning to draw from it. We’ll explore some of the implications in the next few sections.

Personal Assets

Let’s consider the market theory of supply and demand:

- Suppose you go to a farmer’s market and see a handful of vendors selling bananas, and hundreds of people lining up to buy them. What do you think will happen to the price of bananas?

- Suppose you go to a farmer’s market and see hundreds of vendors selling bananas, and only a handful of people interested in buying them. What do you think will happen to the price of bananas?

Now substitute bananas for stocks, bonds, or homes, and think about what happens when the millions of Baby Boomers need to sell their assets into a market of people who are barely making ends meet. What’s going to happen to prices for stocks, bonds, or homes?

In truth, it’s not clear how much of an impact this will have on the stock market: While Boomers own 47 percent of equities, most of those are concentrated in the hands of the wealthiest 10 percent and will not be sold for living expenses. But it will certainly provide a headwind, particularly as Central Banks put so much effort on boosting the prices of assets in order to create a “wealth effect” and assure people that all is well.

The greatest danger lies in the housing market. If Boomers have not saved enough to survive in retirement, and their homes represent 77 percent of their net wealth, simple logic tells us that those homes will have to be sold in order to cover their expenses (at least for a few more years). And the generations coming up behind them, including Generation X and the Millennials, have less wealth, making it that much more difficult to absorb that housing surplus. The future is not bright for those who hope to sell assets at current price levels.

Social Security

Many people look at Social Security as their retirement plan, and as a guaranteed right. The government does not. In the landmark Flemming vs. Nestor case of 1960, the Supreme Court ruled that paying into the system does not mean you have the right to receive benefits. As the Social Security Administration itself admits, “In its ruling, the Court rejected this argument [that people who pay into the system are guaranteed to receive benefits] and established the principle that entitlement to Social Security benefits is not contractual right.”

The Act itself states that Congress has the authority to alter, amend, or repeal any element or rule that they want. They can raise the age for eligibility to eighty, they can limit the program to people living below the poverty line, and they can cut benefits in half if they so choose. As the Cato Institute notes, “Social Security is not an insurance program at all. It is simply a payroll tax on one side and a welfare program on the other. Your Social Security benefits are always subject to the whim of 535 politicians in Washington.”

At its core, Social Security is a Ponzi scheme, designed so that a large group of people would pay into a system that provided benefits for a few. It worked at the time it was designed, but the variables have changed over the years to turn it into a disaster in the making. Dr. Ken Dychtwald provides the following analysis:

The problem is that current government entitlements and pensions were masterfully designed in an era when there were dozens of workers supporting each recipient, people died relatively young, most workers were diligent savers, and the government and employers were widely trusted. We now live in an era, where there are very few workers to support each retiree, most people die very old, savings rates have plummeted, and the government as well as employers’ promises are not generally trusted. The ratio of 40 productive workers to each retiree that existed when Social Security was launched, has steadily shrunk, from 16 to 1 in 1950 to only 3.3 to 1 today. By 2040, it is projected that there will only be 2 workers, and perhaps as few as 1.6, to support each boomer retiree, who could be living as many as 20 to 40 years in retirement. And, between 2010 and 2030, the size of the 65+ population will grow by more than 75 percent, while the population paying payroll taxes will rise less than 5 percent.

Perhaps the most confusing and controversial element of the Social Security story is its “trust fund.” The Social Security Administration will tell you that they have a trust fund of $2.8 trillion, and that those reserves will cover the system through 2034. What they don’t like to tell you is that those reserves aren’t actually sitting around in a bank, in actual cash form: The government spent that money as soon as it came in and left an IOU in its place in the form of “special issue securities.” These securities are special in the sense that they cannot be sold on the open market: They can only be redeemed by the U.S. government, and since we’re already running a large deficit from year to year, they’ll have to raise new money to redeem those bonds, either by further increasing the deficit (i.e., even more Treasury bonds), raising taxes, or reducing spending elsewhere.

If you’re still comforted by the illusion of a $2.8 trillion trust fund, it may be worth considering what happened when the government bumped up against its debt limit in 2011. When asked what would happen to Social Security checks if the government failed to raise the debt limit, President Obama said, “I cannot guarantee that those checks [he included veterans and the disabled, in addition to Social Security] go out on August 3rd if we haven’t resolved this issue. Because there may simply not be the money in the coffers to do it,” a statement later confirmed by Treasury Secretary Tim Geithner. With nearly $3 trillion in reserves, wouldn’t the Social Security Administration just redeem some of those securities to ensure that payments were made? Or does this make it clear that these reserves are a convenient fiction?

Considering that 36 percent of current workers expect Social Security to be a major source of income when they retire—10 percentage points more than a decade ago—it’s critically important that people realize just how unreliable this program may be in the future, and what the implications of that would be both personally and to the country as a whole.

Medicare

Building on the foundation of social welfare established by Social Security in 1935, President Lyndon B. Johnson signed the bill that led to the establishment of Medicare (for those 65 and older, regardless of financial status) and Medicaid (for low-income citizens) in 1965. Now, just over fifty years later, Medicare serves around fifty-five million seniors and people with disabilities, and accounted for 15 percent of federal spending, $632 billion, in 2015. The program is currently funded through general funds (40 percent), payroll taxes (38 percent), and other sources.

Simply put, Medicare is a bomb with a fast-burning fuse. We have a rapidly-growing population of seniors (see the information on demographics above) about to enter a system that has seen regular increases in spending: According to the Kaiser Family Foundation, Medicare spending increased at an annual average rate of 9 percent from 2000 to 2010, and then at 4.4 percent from 2010–2015. Going forward, the Foundation expects average annual growth in total Medicare spending to be 7.1 percent between 2015 and 2025, resulting in a program costing well over $1 trillion per year. Beyond that, as healthcare costs continue to increase and the bulk of the Boomer generation moves into retirement territory, it’s anyone’s guess as to where those numbers could go, or how the program could continue to be fully funded. For an explanation of why prices keep going up, see chapter 12, “The Healthcare System.”

Pensions

For those of you with a pension from your corporate or government employer, there’s bad news: It is extremely unlikely that you’ll see all of the payments and benefits promised to you. In fact, depending on when you retire and the state of your employer, it’s very possible that you won’t see anything at all.

The problem with pensions—especially “defined benefit” pensions, which guarantee a certain payment regardless of the performance of the pension fund’s investments—is that they were popularized at a time when the world was very different. Like Social Security, they were introduced when people didn’t live much past retirement, and they were designed by corporate and government leaders who wanted the immediate benefits without having to stick around to see the end game, so it was easy to make promises that future generations would have to fulfill. As a wave of retirees hit the eligibility mark, and the expected returns on pension funds’ investments fail to materialize, we’re seeing the end game for these retirement promises.

Private Pensions

Private pensions are more than a century old—the first was offered in 1875—and are an artifact from an era when people would hold a job with a single employer for an extended time, often for their entire careers. While they are in decline (only 18 percent of corporate workers have them today, compared with 35 percent in the early 1990s) because of the changing nature of the job market and because employers now have more retirement plan options available to them such as 401k programs, the fact remains that a large number of Americans receive, or expect to receive, support from these defined-benefit programs.

And they have some reason to expect that their pension plans will deliver on their promises: After some pension programs went bust in the 1960s due to a failure of employers to contribute as promised (the most notable case being the Studebaker auto plant), Congress passed a law in 1974 that set rules mandating that employers fund these programs, and established an insurance program through a new Pension Benefit Guaranty Corporation (PBGC) that takes over for failed pension programs.

However, rules or no rules, corporations have had a hard time staying in business with the burden of these plans, and can shed them through bankruptcy or other restructurings. That’s when the PBGC takes over. As of 2014, the organization has taken over 4,640 pensions covering more than 2.2 million retirees, with some of the biggest coming from the airline (Delta, Pan Am, United) and steel (Bethlehem, LTV, National) industries. As a result of its obligations, the PBGC was $61 billion in the red at the end of 2014.

So, while the organization is currently able (despite its running deficit) to make the majority of people whole, or close to it, the future is less certain. Based on reports from private pension funds to the PBGC, they have seen the levels of funding among still-operating pensions drop from 84 percent in 2008 to 75 percent in 2014, putting the PBGC at risk of covering an additional $550 billion in obligations in a worst case scenario. Private pensions are clearly struggling, and the PBGC may soon be making some hard decisions on how to leverage its limited resources.

Government Pensions

Pensions for civil servants became popular at the same time as private pensions, when it was seen as a way to compensate government workers who received average to low pay.

And those pension plans are entering a crisis phase: Depending on who you ask, public pensions are underfunded by as little as $1.5 Trillion (according to the Pew Charitable Trusts) up to more than $5 Trillion (according to a Pension Task Force established by the Actuarial Standards Board). No matter which estimate you accept, the deficit in what pensions have versus what they have to pay out is staggering, and it’s happened for three reasons:

- Outsized promises. Pension details vary widely by state, but as a rule pensions pay out much more than they take in from participants. Some are far more generous than others; California offers retirees a pension at 87 percent of what they were making as employees, with lifetime benefits approaching $1.3 million, while Mississippi offers retirees 54 percent of their former salaries, leading to average lifetime benefits of just $307,000. And this is typically after thirty years of employment, resulting in people retiring in their fifties and living for thirty years or more.

- Underfunded systems. Politicians are typically very good at making promises, but very bad at following through. And as required payments to state pension systems become greater and greater, squeezing out other government priorities, many politicians have opted to delay or skip making those required payments, which will just compound funding problems in the future.

- Unrealistic assumptions. In order to maintain the illusion that they’ll be able to meet future obligations, most pension funds assume that they’ll consistently make a fantastic return on their investments: Of 150 public pension funds surveyed, 97 percent assume that they’ll make annual returns of between 7 and 8 percent. Since low-risk investments don’t provide anything like that (the 10-year Treasury bond is close to 2.5 percent as of this writing), many funds pursue risky investments in order to attempt to clear this bar.

While problems for public pensions were always considered to be in the future, there have been some recent developments indicating that the future is becoming today. Some towns, such as Stockton and San Bernadino in California, have been forced into bankruptcy due to their pension obligations. And some pension funds, such as the Central States Pension Fund and the Dallas Police and Fire Pension System, have either started talking about reducing benefits and halting lump-sum buyouts.

Whether you’re relying on Social Security, pensions, or your own investments, the reality is that the stories you’ve been told about preparing for retirement have been just that: Stories. It’s time to think about other ways to protect yourself in the future.

It’s good to be 77.

Dave…….So not here when the shit hits the fan?

I’ve read the same information umteen ways. There is no solution except the “Great Reset.”

The only solution ( I was lucky enough ) is to be good at an in-demand career, and be smart enough to capitalize on it. I’d say one has to make at least $150k – $175k a year to start saving serious money.

Agreed, if you have kids. But what this excerpt does not discuss, the real elephant in the room, is what your government is likely to do when the masses without savings demand action. Namely, confiscate at least part of your retirement funds, and demonize you and your family for having saved in the first place.

I’ll tell you how bad the gubmint is right now: They tax your Social Security benefits, additionally I live in the Progressive state of Minnesota – Land of 10,000 taxes. Minnesota is one of a handful of states that tax SS benefits. I already paid tax on the FICA contributions, now I have to pay tax on the benefit.

Government everywhere is the biggest criminal on earth.

good article crimson–

pyrrhus,you said they would confiscate part of people’s retirement funds–

during the 2008 campaign,a dem congressman let the cat out of the bag but he was quickly shushed lest he hurt obama’s chances,and i have never seen it brought up again–

they want to take your pension plan $ & roll it into a govt guaranteed pension,much like social security,all to protect you of course–

I have heard that as well; and I would not doubt that this sort of thing is indeed planned for the future.

Boom! Only they won’t demonize you for saving, they’re glad you did because it is there for THEM to spend. They will demonize you for wanting to keep the money you saved so you could have it to use later in life, or give it to your kids, for that matter. They wll say it is your duty as a producer to support others, regardless of why they don’t have money of their own. Many weren’t as disciplined as you. They spent theirs and are now eyeing up yours and believe they have right to it.

Eventually it ends in war and anarchy…..both nearly impossible to plan for. Isolated farm?

Read the booklet and loved the way it presented the material in an easily understandable format, forwarded it along to my two older boys to read. Just bought the book and will do the same, pass it along to my boys to read. They grew up ‘redpilled’ but in going on to ‘higher education’ I’m finding that a refresher redpill is necessary. 🙂

Excellent read…. I suggest reading it twice VERY slowly the second time to let it sink in. This is the reality will will all face in the very near future.

Greetings,

None of this matters. If you built a time machine and took these people into the future and showed them living in an alley and eating Alpo it still wouldn’t help. I had the closest thing I could think of to a Time Machine moment yesterday and it didn’t help me one bit. Please indulge me while I elaborate.

My daughter announced to me that she was gonna go back to school for the 4th time and get herself an Associate Degree in Social Media Marketing. Now, it isn’t like she is telling this to some guy flipping burgers or her grandma but someone that has product sitting in showrooms in 15 different countries and made it all work by using the internet. I spend a lot of time thinking about marketing.

I told her that if she would give me 15 uninterrupted minutes then I’d reward her with Mai Tai’s at the local Tiki bar – game on.

I asked her what she thought a Social Media Marketer should earn and she responded with 80-100K a year. I briefly explained that asking for 80k meant that someone would actually have to shell out about $110k to cover taxes and other expenses. With 110k as our baseline and a quick statement along the lines that someone that gets 110k has to at least provide that much in value to the company, we set off on our journey of discovery.

I showed her a website that I use called Fiver.com I showed her all the business marketing services I could receive from Translation of tech manuals, jingles, motion graphics, marketing research, media promotion – everything you could want and you can get these services for $5.

I showed her that I could get 7 professionally made motion graphic title videos in HD, get it in three day, be allowed 2 revisions and spend a total of $10. I showed her that I could get those Whiteboard videos that are popular on youtube and get a 90 second video for, you guessed it, $5.

The people providing the service are rated and you can see examples of their work. I should also mention that many of these people are outside of the USA. I’ve used services from Fiver such as proofreading Press Releases and Tech Manuals. Getting someone that has more than 1000 happy customers to review my work with fast turn-around and get it for $5 is a no brainer. I’d be an idiot not to do this.

I next asked my daughter to list all the services someone like me might need in the upcoming year which she did as I was still within my 15 minutes. Try as we might, we could not spend more than $250 for all the services she could think of. I then asked her why a businessman like me would spend $110k a year for services that I could get for $250. Why would I choose to do that? Why would anyone?

None of this mattered. Even though I just showed her the future and showed to her that the thing she was about to spend time and money on was worthless, she still didn’t listen and is going ahead and is going to take these classes.

It is no different than the people that believe that Social Security and Medicare are going to take care of them and that their assets will have value when an entire generation is trying to offload their stuff all at once. No amount of evidence can convince someone that will not accept logic and reason and it is most certainly hard to accept logic and reason when your future depends on things being otherwise.

Great educational story of personal experience there, Nickel.

Eye opening to those who can see.

Thx for that.

My sister in her late 50s got a counsing degree as her master’s. It would have been 2/3 less at ASU. But she liked the private university. It took her a year to get accredited after graduating. With ASU it would have been instant. With her debt she’ll work last 75. Her daughter is making her car payment and insurance for her. She should have stayed at her old job to retire earlier. It is mostly an American female problem as they don’t think long term. At least my mom and sisters.

That’s a great story, sorry she wasn’t able to see the value in your lesson, but human beings need to learn some lessons on their own.

Great story. I’m seeing the same denial in members of my extended family (but not in my kids, who are quite red pilled)….no matter how many facts you point out, they insist that the government, or some corporation will take care of them…

[img [/img]

[/img]

Robert (QSLV)

Nickel, are you paying for your daughter’s 4th trip back to school? Subsidizing her lifestyle while she ejumacates?

Nothing like trying to pay rent and buy gas when deciding whether an associates degree in Social Media Marketing taught by people who, if they really knew internet marketing, wouldn’t be teaching it in an associates degree program, they’d be enjoying those Mai Tais full time. You actually could earn a living as a youtuber or instagram model…but you can’t learn it at a community college.

Greetings,

Gosh no. I’m no longer a fan of higher education now that information is more or less free. I went to college because I wanted access to our university library. A research library in the time before the internet was worth its weight in gold. There simply wasn’t much of a way to find anything out outside of a such a place.

That isn’t true today. What knowledge is there such that it can only be housed in a university? 99% of anything anyone might need to know can be found online and for free.

And complete with multiple YouTube tutorials.

Your analysis doesnt mean anything. What is the average user’s content on facebook worth? According to any sort of rational analysis, it would be between $0.01 and $0.05. Yet facebook made $26 off every US user. This quarter alone!! Who in the bloody hell is generating $8 per month of revenue for facebook? Facebook as a company is worth nothing more than the hardware in their server rooms, which means probably less than $500 million. Anyone can set up a social media website. And anyone can transfer all their pages over to it. Yet facebook is somehow worth half a trillion, more than 100 times the value of its assets.

It is these examples of sheer absurdity that drive people into thinking they can have their own piece of the absurdity.

This book points out what most Americans simply refuse to acknowledge, either from ignorance or an unwillingness to become informed, which is that the US government is rapidly approaching a fiscal brick wall. It’s not a question of “if” it’s a question of “when” we’ll reach a national day of fiscal reckoning, one that will have profoundly broad and deep implications for all Americans. If you think your government benefits, your pension plan, even your personal qualified plans (IRAs), are safe, then you’re one of many in for a very rude and stark awakening.

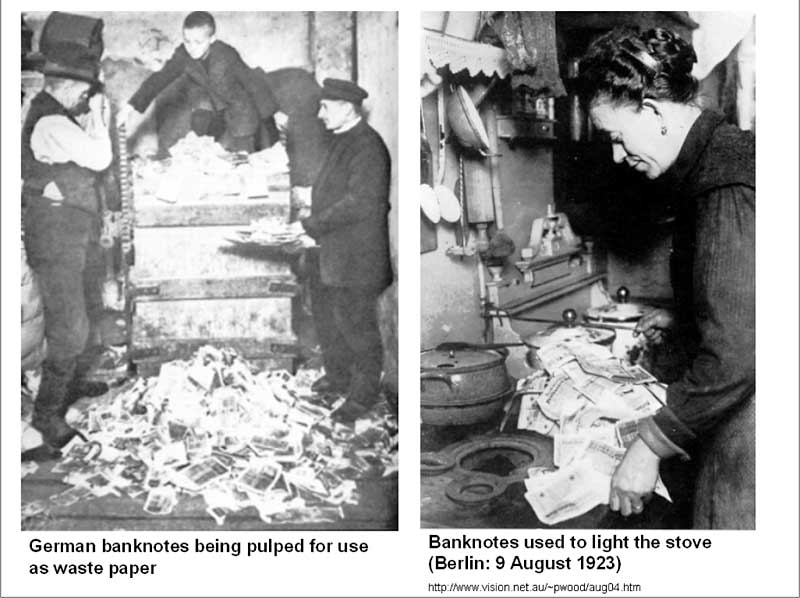

My only question is if the Social Security and Medicare people are screwed and will not see any funds for retirement, then ” How did the government get into trillions of dollars of debt, and the military continue to get massive billions of dollar increases every year?” I would suggest it was by printing money that has no asset to back it . Granted the future dollars may only buy 1/2 of what they could buy today, or less, but dollars will be printed and passed out to every welfare and social service individuals until they are basically worthless. There is no other way out of the box, until you see the South American world chaos and the collapse of society.

[img [/img][img]undefined[/img][img]undefined[/img]

[/img][img]undefined[/img][img]undefined[/img]

Robert (QSLV)

Nickel Thrower ,I liking you more and more day by day .Now fuck off!

The ” money power ” rest on debt. Christians are to avoid debt as a moral principle. Debt rest on covetousness which is a desire to have what our neighbors have.As a result of ENVY / Coveting the slave desires to have a nice car , house , clothes and other ” shit ” which he see others having. The covetous man or nation goes into debt to gain added power and prestige .Debt is a way of life .A sinful covetous way of life and a form of slavery.Only one way to slap the nation back to responsible living and that is to drag down our idols and wound us very badly.

Interesting observation ….you begin your message with “Now F*@k off” and then commence to point out the Christian attributes that condemn envy/coveting.

My compliments to Crimson!

Consider this, the stock market goes 2008, and the banks fail.

I lost 50% of my investment, albeit it was only an 18K gone…18K remained. (small IRA)

We have too many people in line for bananas, as in there will not be enough

bananas to go around. Medicare, SS retirement, Public and Private pensions

are on a pay-as-you-go plan, and there aren’t enough people to pay. I guess

these programs will cease to exist.

Then consider this:

“Russell Napier, writing in ZeroHedge, called it “the day money died.” In any case, it may have been the day deposits died as money. Unlike coins and paper bills, which cannot be written down or given a “haircut,” says Napier, deposits are now “just part of commercial banks’ capital structure.” That means they can be “bailed in” or confiscated to save the megabanks from derivative bets gone wrong.

Rather than reining in the massive and risky derivatives casino, the new rules prioritize the payment of banks’ derivatives obligations to each other, ahead of everyone else. That includes not only depositors, public and private, but the pension funds that are the target market for the latest bail-in play, called “bail-inable” bonds.” (Ellen Brown is a smartie)

https://www.huffingtonpost.com/ellen-brown/new-g20-bailin-rules-now-_b_6244394.html

Okay, people can’t sell their homes, have debts to pay even after retirement, have a fraction

or nothing of a SS benefit, public and private pensions are defunct (or confiscated), and our meager

savings are stolen. What will people do? Shall they build shanty towns, generations live

together, or will they quickly die from starvation and no medical support? Then…Gov.

confiscates the crummy house (or mansion) for back property taxes.

Not good news for the 90%. And what of the people that depend 100% on public charity/welfare?

The MIC pays those who have the power . Social Security folks do not have that kind of money so as to pay the powers that be . John

My comment was that the article was perfect. Now how do we tell 90% of the country this is their future. Nickel did a great job!!!! and he proved that you just can’t convince them!!!! BB be nice.

Remember Nickel it is always easier to shoot the messenger, even if it is your father. I have learned a lot in the last ten years since the crash of ’08. I keep enough cash in the bank to cover the bills and withdraw the rest. I have a reserve but blow the rest. Guns, food, gold, silver to name a few. I still have investments in various vehicles tied to the markets but have written them off along with social security. Yes I leave them in case we are all wrong and a miracle happens. I am 57 years old and have no idea how I am going to finance my old age. That said I honestly do not expect to survive to older age. Take an honest look at the state of this country. The economy WILL collapse. The vast military industrial complex is not going to save any of us it will be busy trying to save itself and will also fail without the support complex of this country behind it. There was a time walking in a foreign country and being American was a good thing, try that now and see how well it goes. We as a country are at best tolerated out of simple fear and I hazard to guess how much outright hated there is, look at all the terrorists trying to kill us is a good clue. WE as a country are heading for a reckoning for the ages and the chance that most of the people reading this, myself included, surviving are slim to none. And still we prepare for a future that most will not see or recognize. So just who is delusional? those that are unaware or those that read this. As for me I freely admit to what all my friends and family already know. I AM JUST PLAIN NUTS and that explains a lot.

Retirement is a myth that was invented a 100 years ago. People worked until they died, or just a year or so before.

Even if you have your home paid off – with our debt driven system expenses / taxes don’t stop just because you’re 65. I say 99% of the people will have to work until they are unable.

Greetings,

As a father I am obligated to state the obvious even if I know that the message will not be well received. For my daughter, her starting point on her search for truth is how she wishes things to be. I have a much different starting point.

My prediction for SS, is that some time in the 2020s it will be indexed to income as the medicare

charges to recipients are now and that the medicare indexed to income charges will escalate every 3 to 5 yrs. Doing that and increasing the income subject to FICA will all be necessary, but probably not sufficient to solve the problem of underfunded demand.

When I say ‘indexed to income’, I mean that the larger your AGI excluding SS, the less SS you will be allowed to collect.

Regardless of how well we as individuals prepare for our future and ultimate health and care expenses till death the economic debacle that is the United States is nothing less than apocalyptic in proportions . Anyone who claims to have a solution that is workable on a national scale is either the second coming of Jesus or unequivocally full of shit ! Nothing will move our government and population do anything to truly accept the consequences that must be incurred except divine intervention coupled with catastrophic failure on all fronts !

Human beings, for the most part, don’t change until the pain of change is perceived to be less than that of remaining in the status quo or put another way, nothing will change until the pain of doing nothing is perceived to be greater than that of taking action. Which is precisely why we’ll see the Powers-that-Be drive the economy into a ditch before anyone will do anything, at which point it will be too late to salvage the country as we once knew it. It probably already is, the only question remaining is how much animosity and fall out there will be between the various groups vying for control of limited financial resources?

I suspect that the screwing has just begun…The author doesn’t mention the 60 million aliens now living in our midst, some of whom will soon be citizens, who will want their retirements despite having done nothing to merit them….

No mention of annuities…?

I took an early buy-out of a private pension at 150% of the lump sum I would have got at age 65, and bought an annuity that matures after 10 years. There are no-fees, guaranteed not to lose equity, and has options for interest accumulation both during the maturation period and after lifetime payments begin. When I die, my wife gets a reduced amount for life, or can draw what is remaining over a 5-year timeframe.

Not when the currency turns to toilet paper and the desperate are feeding upon the haves with ruthless abandoned ! All the annuities and promises assured will not be worth squat . I know we will be armed and blah blah blah ! That may work for awhile . Being over run by determined desperate people where shit gets up close and personal sucks ! You are aware of an extreme likelihood of a total societal breakdown . Look what happens when EBT cards are 72 hours late being funded due to a Monday Holiday / computer misshap !

@Rise Up

Insurance companies that sell annuities can go out of business too. Annuities are not covered by the FDIC. Some states do cover them, which will last until the states can no longer afford to.

If someone has seriously delved into the nature of the annuity being considered, including various scenarios, and decides it is worth taking a chance on it, “you pays your money and you takes your choice.” But don’t imagine annuities are risk-free.

Bushcrafting is going to be the retirement plan for those who survive the coming shitstorm.

My plan is to work myself to death. I think it has all the hallmarks of a successful plan.

I second the motion.

My epitaph: “He died in the harness.”

Robert (QSLV)

My epitaph: “He died with his monitors on.”

Great news about getting published, Crimson. Very cool.

I think that as uncomfortable as the thought is, it is impossible to know what is going to happen in the future. The unaccounted for factor is the capacity of humans to quickly adapt to a changing environment. Humans are in charge of all of the institutions. Humans are on the receiving end of any benefits. Extreme circumstances will provoke extreme adaptation. I don’t think anybody can know what will happen as competing interests are protected. There are just too many variables. My guess is that we will see a lot of instability and consequently a lot of “adaptation”.

Congrats, Crimson.

Thanks to all for the kind words and insightful thoughts. I’m looking forward to Jim’s retirement, when he’ll have time to write a book that will blow away anything I could put together.

Here is a detailed review of the pension business. Read it and weep, or arrange your affairs accordingly.

http://realinvestmentadvice.com/the-pension-crisis-is-worse-than-you-think/

If I were the powers that be I would want to disarm every person out there that would be pissed off after the tsunami of gubmint debt hits the fan and they start looking for someone to snipe . The founders plainly stated that our republic was fit only for a moral and honest people . That ship has long sailed .