Guest Post by Eric Peters

Raising the gas tax – overtly – is politcal TNT.

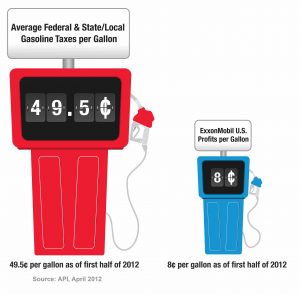

Chiefly because it’s a tax everyone feels, every day – and it’s an extremely disproportionate tax already. About 50 cents per gallon – which amounts to a roughly 20 percent tax added to the cost of every gallon of fuel. The government makes (takes) more money off each gallon than the Evil Oil Companies earn from the sale of each gallon. Yes, really.

The gas tax is also extremely regressive, in the language of the politically correct. It hits those least able to afford the cost the hardest.

So how to raise it covertly?

By raising the mandatory minimum octane rating.

This is being urged by the car companies, who would like to be able to design all their engines to be high-compression engines, which are more fuel-efficient engines – but require high-octane fuel to achieve the efficiency gains.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

And because it’s a cheaper way for them to achieve compliance with Uncle’s fuel efficiency fatwas. A roughly 3-4 percent uptick in MPGs can be obtained via high-compression (and turbo-supercharging) engines without resorting to more expensive engineering extremes, such as transmissions with 10 speeds, three of them overdrive. Or direct injection, with a port fuel injection system in addition and added solely to deal with the carbon fouling problems caused by the direct injection. Or light weight but easily damaged, more expensive and harder to repair alloy bodies. Etc.

The ethanol lobby wants it, too – because it’s a clever way to obfuscate the currently-too-obvious crony capitalist corn con, which operates under the auspices of the Renewable Fuel Standard. The RFS is a federal mandate that the nation’s fuel supply be adulterated with “renewable” fuels, in the name of conservation. In fact, it is a government mandate to feed our cars ethanol, which is made from corn. Which costs more to turn into alcohol than oil into gas – and won’t take your car as far on a gallon, either.

It’s a billion dollar business, if you can use that word without feeling the bile rise in your throat.

Well, in addition to being “renewable,” ethanol is also – wait for it! – an octane enhancer. Instead of force-feeding it to us in the name of conservation or renewable-ness, it can be funneled down our throats in the name of raising octane – emptying our pockets in the process.

Twice.

Well, times two – or even three.

Gasoline is already ethanol-adulterated (10 percent of most of it is ethanol, hence “E10,” the formal name for the stuff). And that adulteration costs us in the form of reduced mileage – if your car doesn’t have a high-compression engine. Which is probably the case, unless it’s a very new car or an older high-performance car.

Until about five years ago, most cars had engines designed to burn regular, 87 octane gas. The reason being the understandable desire of the average person to not have to pay 30-50 cents more per gallon (the cost difference, regular vs. premium) to fuel their car.

These cars will be on the road for quite some time to come. But if the machinations to make premium fuel mandatory are successful, the owners of those cars will be paying 30-50 cents more per gallon for fuel their cars do not need.

In effect, it will amount to a doubling of the current motor fuels tax – and it will be viciously regressive, since the majority of people affected are people who own ordinary economy and family cars, minivans and so on that were designed to happily burn regular gas, not expensive premium gas.

Unfortunately, the forces arrayed in support of premium uber alles (and for alles) are powerful and stopping this ball, already rolling, is not going to be easy. It will be very interesting to see whether so-called “progressives” erupt in outrage over this act of extreme regressiveness.

Both at the pump as well as down the road. Keep in mind that not only does premium fuel cost substantially more to buy than regular, if the car it’s put into hasn’t got an engine designed to burn premium, your mileage will go down. You will pay more to not go as far.

Lovely, isn’t it?

“Progressives” should be outraged, assuming you take their “progressivism” at face value; that it really is all about tempering the hard effects of The System upon the less-well-heeled.

It isn’t, of course.

There is a conflicting interest – the “progressive” antipathy toward cars and driving. By making it more expensive to drive, the hope of the “progressives” is that fewer people will drive.

“Conservatives,” meanwhile, tend to defend the ethanol sop – because of the political power of the corn states and a ludicrous veneration of family farms, which are in fact enormous agri-business cartels.

The car industry is just being practical. Trying to find some way to make Uncle happy, or at least get Uncle off their backs.

The motoring public is to be squeezed for their mutual benefit.

The car companies are only looking to meet the average fuel economy of NEW cars.

The fact that making a car designed to run on regular gas run on premium will make those older cars LESS fuel efficient is overlooked.

Ethanol also reduces the overall efficiency by 3%-5% too.

Drop the ethanol requirement and they automatically get a boost in performance and efficiency, but the car manufacturers know that they can’t beat the corn lobby so they want to screw owners of existing cars to make the MPG numbers on new ones.

Your government at work.

Bravo Steve C!

A decrease in fuel efficiency means an increase in fuel consumption.. which is an increase in the amount of tax ((THEY)) collect from fuel sales.

((GOVERNMENT)) can BOOST its tax revenues by implementing this ((CHANGE))!!

We will have to PAY PAY AND PAY some more for LESS LESS AND LESS!

Keep preaching the ((TRUTH))!

My last car costed the same exact amount regardless of the fuel I put in it. If I paid 15% more for premium, I actually got very close to 15% more mpg. Not sure if my current truck works the same way but the mpg is so poor that it probably doesnt matter.

Great. Gas with alcohol in it goes bad so fast. If you take a 250 gallon delivery you need it to last without the added expense of shit tons of sta-bil.

All this bullshit makes me want to burn a bunch of tires. Trade you some real pollution for your fake co2 pollution.

Emigrate While You Still Can!

Where are you gonna emigrate to that has cheaper gas than the states??

Venezuela??

UAE – EMIGRATE TO THE EMIRATES

Thanks to the drop in oil prices the fuel here is no longer subsidized and now cost the same or more than in the USA.

All things considered my low-compression ’76 Oldsmobile 350 with Quadrajet runs pretty good on today’s 87-octane corn alcohol shit gas.

Anyone who was into cars in the days of leaded gas or even pre-enthanol gasoline in the 70’s and 80s can tell you it had more power and a better smell about it.

If you can increase compression to about 16:1 the ethanol will yield gasoline like mileage but I am not aware of any gas engines working at that pressure.

Methanol is a much better automotive fuel than ethanol and costs way under a Dollar a gallon without subsidies. You just can’t make it from corn, which is of course probably the single worst crop from which you can make ethanol. Six times as much ethanol per acre with beets and ten times as much per acre with sugar cane. Your government at work.

If people would just lighten up about an increase in the gas tax, the government wouldn’t resort to bullshit schemes like CAFE standards, and a requirement for higher octane fuel. Instead of simply paying a little more in gas tax, we push car prices through the roof with extreme efficiency mandates and push the cost of gas higher through octane mandates. In contrast, just raising the gas tax has the benefit of simplicity and revenue to the government that could reduce the deficit. Also, the “regressive” nature is a good thing, since a higher gas tax is paid by illegal aliens and other tax scofflaws.

Iska, do you really think that any tax would go toward reducing the deficit? Really? EVERY. SINGLE. TAX. EVER. that I have seen in my life has been spent, and then some, on bullshit “new programs”. Never once……once have I ever seen a situation where the tax actually paid down, or off a public debt. This is true at the local, state and federal level.

They view us as tax donkey’s, and a never ending Well in which to enrich themselves and their donors. Any and all taxes nowadays are to be voted against. Not because taxes are necessarily bad for the public good…..in theory, but because of the current “system”, there is no hope whatsoever of any tax actually being used to benefit those which it is intended.