“Facts are threatening to those invested in fraud.” ― DaShanne Stokes

Insiders at US companies unloaded $5.7 billion of their company stock this month, the highest in any September over the past decade, according to TrimTabs Investment Research. Insiders, which include corporate officers and directors, sold over $10 billion of their company stock in August, also at the fastest pace in 10 years. With the stock market at all time highs and valuations, based on all historically accurate measures, off the charts, it makes sense for knowledgeable insiders to sell high. Of course, if they were expecting the profits of their companies to soar because Trump says we have the best economy in history, why would they be selling?

When these Ivy League educated superstar CEOs go on CNBC, Bloomberg, and Fox to tout their companies and field softball questions from bimbos and boobs disguised as journalists, they proclaim a glorious future and declare their stocks to be undervalued and a screaming bargain. Buy, buy, buy. They talk the talk, but don’t walk the walk. They personally do the opposite with their own funds versus what they do with shareholder funds. Ethics among corporate executives has never been one of the required traits. Lying with a straight face is the key to being a successful CEO in today’s warped amoral world.

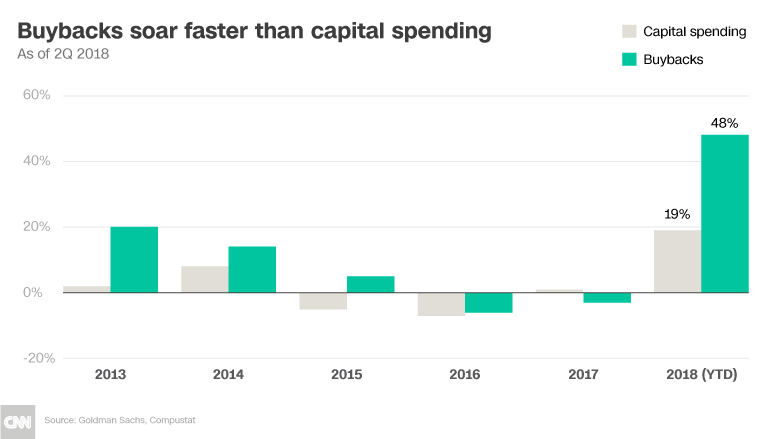

While dumping stock like there’s no tomorrow these very same CEOs of the largest US public companies have authorized a breathtaking $827.4 billion of stock buybacks in 2018 — already a record for any year, according to TrimTabs. Annualized, these CEOs will will buyback in excess of $1.2 TRILLION when stocks are at all-time highs. In contrast, in 2009 when they could have bought their stocks at 10 year lows, they bought back less than $100 billion. Buy high and sell low. How can they go wrong?

These feckless financiers know exactly what they are doing. Corporate executive compensation is mostly stock based, so they have tremendous incentive to boost Earnings Per Share by reducing the number of shares. That is so much easier than investing corporate cash in workers and new facilities to increase profits over the long-term. All that matters to these greedy scumbags is beating next quarter’s earning estimate to boost the stock price and enrich themselves. The stock price is all that matters.

When you hear corporate balance sheets have the most cash ever, take it with a grain of salt. Corporate balance sheets have the most debt ever. The Fed’s nine years of 0% interest rates lured these greedy bastard CEOs into loading up with debt to buy back their shares. And with Trump cutting corporate tax rates from 35% to 21%, the excess profits which were supposedly going to result in massive hiring and massive new capital investment, have mostly been utilized to buy back stock, which adds no value to the nation or the economy. Of course, it probably benefits the most expensive restaurants in NYC and real estate agents in the Hamptons, but doesn’t do much for the deplorables in flyover country.

The fact is these corporate executives know it’s late in the game and they are personally cashing out their chips, while gambling with shareholder chips, because there is no personal downside for these slimy bastards. When the crash “suddenly” occurs they’ll plead ignorance. How could they have known? They’ll be lying through their teeth as they beg for another taxpayer handout and massive helpings of Fed liquidity. The song remains the same. And the music is still playing. You can do as they say, or do as they do. Your choice.

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.” – Chuck Prince – Citicorp CEO – 2007

Greedy scumbag creeps. Who would have that high of a opinion of those dirtbags?

Cannot say it often enough. Do your own DD. Don’t listen to the booh bears any more than you listen to the “everything’s coming up roses” guys. They are both full of shit. Stuff goes up and stuff goes down. Time in the market is the answer.

If you do not know how a bond is valued and do not know what PE (price to earnings) means you are screaming “come fark me in the behind!”

Some CEOs are crooks and their buybacks are not in the interest of the shareholder. Warren Buffet is buying back shares of Berkshire Hathaway. It is selling at a bargain price of 11 times earnings, or a PE ratio of 11. BRK does not buy back its shares unless the book value of the stock is 20% or more higher than the stock price. Right now the book is 40%+ higher than the stock is trading.

If a guy spends a little time and reads a few books and keeps a tab on stocks he has or is interested in he will do well. If you are like the majority clamoring to get “farked in the behind” and have no time to waste on managing and growing assets for the future, you will lose.

Times are changing and so are the people. Remember House Joint Resolution 192 of June 5, 1933 when the government declared payment in gold to no longer be legal and federal reserve notes were to be the form of payment of debts? And people were required to turn in their gold coins to the government. The Federal government had gone bankrupt and needed the gold. Federal reserve notes are debt money.

So all these Billionaires and CEO’s are holding debt money. So what do you think is going to happen when the Federal Government goes bankrupt again? All these federal reserve notes or digital currency will be worthless. Why? Because it is only script backed by nothing. Why do you think the big banks can use so much of it for loans when the big banks don’t have the assets to back their loans?

It is a zero sum game.

The federal debt is a sham. We are on the verge of a great zeroing out of the debt across the board because the dollar is a fiction created by the federal reserve and passed on to the public as real money. It did it’s job to pull us out of a depression. And it worked so well the government kept using it. But now the accounting is catching up with the sham so it has to go.

The game is now coming to an end.

I don’t think the federal government ever came out of bankruptcy. It shamed the people into turning in their gold and has been using this script called FRNs ever since.

I agree with you,

We are in final stages of the bankruptcy of 1933, the FDIC is what spawned from the conservatorships established with executive order under FDR…

Our labor has been taxed as collateral towards the unplayable debt….

A massive liquidation is planned….This will not end well…