Authored by Chris Martenson via Peak Prosperity,

Faster consumption + no strategy = diminished prospects

Here in the opening month of 2019, as the US consumes itself with hot debate over a border wall, far more important topics are being ignored completely.

Take US energy policy. In the US press and political circles, there’s nothing but crickets sounding when it comes to serious analysis or any sort of sustainable long-term plan.

Once you understand the role of energy in everything, you can begin to appreciate why there’s simply nothing more important to get right.

Energy is at the root of everything. If you have sufficient energy, anything is possible. But without it, everything grinds to a halt.

For several decades now the US has been getting its energy policy very badly wrong. It’s so short-sighted, and rely so heavily on techno-optimism, that it barely deserves to be called a ‘policy’ at all.

Which is why we predict that in the not-too-distant future, this failure to plan will attack like a hungry wolfpack to bite down hard on the US economy’s hamstrings and drag it to the ground.

Shale Oil Snafu

America’s energy policy blunders are nowhere more obvious than in the shale oil space, where it’s finally dawning on folks that these wells are going to produce a lot less than advertised.

Vindicating our own reports — which drew from the excellent work of Art Berman, David Hughes and Enno Peters’ excellent website — the WSJ finally ran the numbers and discovered that shale wells are not producing nearly as much oil as the operators had claimed they were going to produce:

Fracking’s Secret Problem—Oil Wells Aren’t Producing as Much as Forecast

Jan 2, 2019

Thousands of shale wells drilled in the last five years are pumping less oil and gas than their owners forecast to investors, raising questions about the strength and profitability of the fracking boom that turned the U.S. into an oil superpower.

(Source)

The main conclusion of this analysis is that US shale producers have overstated their well output by 10% collectively. And as much as 50% for certain individual companies.

These numbers are easy to collect and analyze. While it’s a great thing to finally have the WSJ show up here, many years later than the independent analysts cited above, they still didn’t get close to the actual truth.

In actuality, the shale plays are going to produce roughly half of what is currently claimed by shale operators. Instead of a -10% collective hit to production, we should be ready for something closer to -50%.

Not only does that “raise questions” about the role of the U.S. as an oil superpower, it ought to raise alarm bells about its entire energy strategy.

A Quick Lesson On Strategy

To take a minor detour, I spent several years of my life as a corporate strategy consultant. These efforts involve teams of people, complex processes, and loads of work. But if you strip away all of the complex nonsense, a strategy is quite simple.

A strategy is nothing more than thoroughly addressing both parts of this question: Where are you going, and how are you going to get there?

Or put another way: What’s your vision and what are your resources?

This is true whether you’re a major international corporation, a nation, or an individual. If you know where you’re going and how you’ll get there – congratulations! – you have a strategy.

Because it’s easy to dream up more “vision”, the vital part of having a strategy is being sure that your vision is both grand but achievable given your resources.

The US has been blessed with abundant oil and natural gas resources. What it lacks is any sort of a vision about where we’d like to be when those wind down and eventually run out.

Will the US resemble a 3,000 mile wide version of Detroit, full of decay and misery? Or can it engineer an intelligently-planned and executed transition to a complex network of clean and sustainable energy sources, full of hope?

It’s really not an overstatement to say that the US is currently operating without an energy strategy. The vision, such as it is, seems to rest on the idea that sufficient oil will always be found and produced to meet its needs. End of story.

No, It Won’t

While I have a lot of admiration for the technology, the expertise and the diligence of the people working in the oil sector, I have even more respect for geology.

The US began its love affair with oil by going after the conventional reservoirs that sat atop ancient marine shale basins where 400 million years’ worth of ancient sunlight was stored in the form of deposited plankton and algae.

Those conventional reservoirs eventually were all found and tapped. Everyone in the oil space agrees that the biggest of them have all been discovered and there are very few conventional finds left.

What the shale “revolution” (or “retirement party” as Art Berman more accurately calls it), did was to drill straight into the source rocks themselves. Which require much more energy and cost to coax oil from.

What’s left after the source rocks? Nothing, that’s what. There are no “pre-source” rocks to drill into next.

We’re scraping away at the literal bottom of the geologic barrel, pretending as if that were all perfectly normal and sustainable. It’s neither.

Yes, the shale oil and natural gas extracted by fracking is going to be used. That much is a given. But on what? To continue to allow SUVs and light trucks to continue to be the most popular vehicles sold to US consumers?

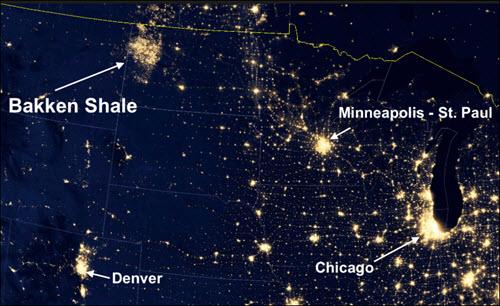

Or to continue to flare off (i.e. burn) excess natural gas from these wells that you can clearly see the wastage from space?

Additionally, fracking has led to shortages of fresh water and sand, as well as pipeline bottlenecks. All of which speak to the blind haste and urgency of the shale business.

As poor as the economics are for the shale drillers, which have collectively spent some $260 billion more than they have taken in from their operations, things are even worse than commonly understood. As the public is on the hook for billions of dollars worth of road and bridge damage caused by fracking trucks.

In Texas, the road damage might be as much as twice the amount brought in by taxing the oil operation revenues. So billions of public subsidies go typically uncounted in the overall costs of fracking for shale oil and gas.

In short, shale extraction efforts are being conducted at such a furious pace and with such an absence of strategic planning that even an illegal warehouse rave seems well-organized by comparison:

Meanwhile the US press continues to cheerlead the efforts to rip the oil and gas out of the ground as fast as possible. As if there were some national emergency where there just isn’t time to do things right.

What’s the emergency, we wonder? What’s so urgently important that we feel the need to cut corners and simply burn our natural gas, a non-reneweable fossil resource, as a waste product into the night sky?

The emergency, we suspect, is that those involved in financing the shale companies don’t want people pausing long enough to ask the right questions, which the WSJ finally did.

Conclusion

Look, I consume oil and gas. I drive a car and I heat my house in the winter. So I’m not even remotely saying that the shale plays should be summarily abandoned.

What I am saying is that we’re blindly proceeding without any sort of national strategy in place, using up extremely valuable and non-renewable energy resources at a blistering pace.

Should our oil be taken out of the ground so quickly that exporting it to other nations is the only opportunity to ‘get rid of it?’

Maybe. Or maybe not.

First we’d have to know how much there is (i.e., the resources) and where we hope to be when it runs out (the vision). If there’s enough to fund both our future visions and export some, too, then OK, go ahead and export it.

The problem, as you know, is that the US has no clear vision for where it would like to be in 20 or 30 years.

If the future is going to be mostly electrified, then there are huge energy expenditures to be made in alternative electricity production and storage, build-out of electric vehicles and mass transit systems, and a complete overhaul of the agricultural system.

I would propose that the energy cost (not the dollar cost) of all that activity is largely unknown. Which means that the US is running the risk of wasting this last bonanza from the shale revolution on frivolous pursuits.

If the WSJ analysis is right (and they did not consult with any of the experts I trust on the matter) then there’s around 10% less oil in the shale plays than we thought. Not great, but survivable.

If the analyses I trust are more accurate, then there’s closer to only 50% of what we thought was there. This is a big problem for a nation without any sort of a plan, especially one that has used the shale output to convince itself that oil abundance is always going to be a part of the landscape.

Beyond the significance of not having an energy strategy, there’s the more immediate predicament of how a nation up to its armpits in debt, and sinking rapidly, is going to fare when the great output boom stops and then heads into reverse.

High levels of debt and rising energy costs are a terrible combination.

We’re placing that collision within the next three years. Are you prepared for that?

As things stand, the US will blunder into that new era completely unprepared, as one might expect for a nation in decline.

In Part 2: A Bust For The Ages, we dive much further into the path and scope of the coming shale yield shortfall, and detail just how devastating it will be for both government, industry and individuals alike given the massive dependency on current assumptions.

If future output disappoints even by a little, the cascade of ripple effects across the economy as that becomes understood will be extremely painful. But the math clearly shows volumes will disappoint by a lot — so get ready for a bust for the ages.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access).

About 10 years ago I read this buffoon writing about how the world could not do without coal. It made sense but I didn’t take the cult of global warming seriously and thought Obama could not be serious when he said he would destroy America’s coal mining and power generation. So, I acted on Martenson’s ‘advice’ and bought $15,000 worth of Arch Coal due to its large reserves in Wyoming’s Powder River, its fat dividend and low share price ( the Dow was then coming off its GFC low.

Needless to say it wasn’t a good investment and neither is anything this POS Chris Martenson writes. If he knew anything he would not be reduced to charging people $300/year to read his articles but would make his money by taking his own advice. He may have and lost whatever money he had and thus, has been reduced to helping other people lose their own money!

I agree with Unit472, Martenson is a hack, trying to sell his book.

this author is talking about “gusher” wells that were the beginning of the oil industry, where the natural gas pockets actually pushed to oil to the surface when tapped, and comparing this to fracking. there is no comparison.

Gusher wells are no longer found in the continental US, so what are we supposed to do? The author makes no forecasts or suggestions, just points out the obvious pattern of current frack yields and diminishing returns. Aka, doom porn.

There is no mention of the incredible technological advances in horizontal drilling that can now be used to minimize drill operations, increasing the yield of offshore finds from single platforms. (off shore is where all the remaining big finds are)

How are we supposed to innovate? and this fracking is a US innovation.

If we left it to this author, we would be dependent on imports,

making us more like Europe and Japan.

No thanks.

Been underweight energy for 7 years now……and counting

Oils is not running out. Plenty of good debate about the best way to use it, but no worry about ever running out.

Much more important for any of the elected officials or civil service “leadership” that call Baghdad-On-The-Potomac home, than having a coherent strategic energy policy, or any strategic policy for that matter: military, diplomatic, manufacturing, trade, budgetary… vision for the United States, is the pressing need to have Confederate statues torn down and sufficient toilet accommodations for LBGTQIPIBN populations.

Now shut up and enjoy the NFL playoffs.

I’m sure much of what he writes here is right, but there’s a distinct possibility (if not certainty) that a national strategy on energy production and usage would be worse than having no strategy. That’s because a national strategy would probably revolve around electric cars, wind power, ride-sharing and driverless cars – the main, not-well-hidden point of which is to eliminate autonomy. When it comes to heating and cooling, the national strategy would entail – surprise – greater housing density, forcibly integrating differing racial and socioeconomic groups and – again – jettisoning autonomy in favor of forced mass transit.

There’s a lot to be said for the proposition that we should let things just run their course, current illogical energy production efforts notwithstanding. If, as he posits, we eventually run out of oil – as seems likely to me – it will happen not all-at-once but slowly. As shortages happen, prices will rise. Rising prices will incent conservation and incent the development of other energy sources. Thorium reactors could make electricity relatively cheap enough where electric cars make more sense than they do now. We’ll work it out – unless we’d fucked it all up with some top-down “national strategy”.

Well said, free markets actually tend to work.

National strategies seem to have a way of destroying nations!

And enriching well-connected crony-capitalists who secure critical positions in these strategies.

You need to get up to speed and read some Gail Tverberg on how energy really works. Its not a linear supply/demand relationship. Go to Our Finite World and read a few of her blog entries. Its fascinating stuff as the price of energy is based more on ‘affordability’ for the average wage earner and not the cost of production. For example, it doesn’t really matter what the price of oil is if the average worker cannot afford to buy the car he would put gasoline in.

Thanks Tverberg’s writings on a casual glance look very interesting.

The author of this article is dead wrong. Far from being “fossil fuel”, hydrocarbons are not only plentiful but are being renewed by yet-unknown processes deep within the earth.

The term “fossil fuel” was coined in the 1950s when little was known about the processes by which oil is produced. Oil is “abiotic” in nature, as even depleted oil wells are “filling back up” from deep below the earth’s surface.

Oil interests are drilling wells, 5,00o feet, 10,000 feet, and 10,000 feet and coming up with oil deposits way below the layers where “fossils” were known to exist.

“Peak oil” is a discredited concept that environmentalists and others are latching on to, in order to display their hatred of oil being a renewable resource as well as to push prices up.

Follow the money.

Quite right, anarchyst.

Methane (the primary energy in natural gas) is attributed

to being produced by ‘biological processes’.

But there are literal seas of methane on Saturn’s

moon Titan, which I seriously doubt were produced that way.

And BP is also following the money right into

finding a billion barrels of oil in their

Thunder Horse location, as well as two new fields:

https://www.cnbc.com/2019/01/08/bp-just-discovered-a-billion-barrels-of-oil-in-gulf-of-mexico.html

All this methane which can become CNG and cleanly burned and way cheaper than the electrics- never going to happen since DC seems to be full of a different sort of methane.

I heard recently a certain democratic socialist say that we cannot take much more oil out of the earth because the engine in the core that makes the world turn needs it. And without it it may make the world stop and that may make us float off into space or on the sunny side of earth get sunbaked to death. She was serious. These people are insane and in power. What does that say about the voters. Welp, we are truly just fucked aren’t we.

Harumphh! We have an energy strategy free here in Germany; Please take our renewable energy monstress (a cutie named Angela) so that affordable energy prices come in sight for us…

Your idiot female in charge is important ing coal because the made it illegal in her country. They now pollute the world to ship coal into Germany because ahe closed all coal industry and then pollute again when they use the coal. Thats why there has never been a female president….just sayin.

I agree totally. Do you take her, plz? Oh wait, you are getting Michelle or Octavia next term, you are screwed already …

On November 28 the US Department of the Interior announced a dramatic new confirmation of huge oil and gas in the region of West Texas into Arizona. The U.S. Department of the Interior via its US Geological Survey announced the Wolfcamp Shale and overlying Bone Spring Formation in the Delaware Basin portion of Texas and New Mexico’s Permian Basin province contain “an estimated mean of 46.3 billion barrels of oil, 281 trillion cubic feet of natural gas, and 20 billion barrels of natural gas liquids,” according to an assessment by the U.S. Geological Survey (USGS). This estimate is for continuous unconventional oil, and consists of undiscovered, technically recoverable resources. Dr. Jim Reilly, USGS Director called the region, “our largest continuous oil and gas assessments ever released.” In brief it is major news for American energy supply.

The report went on to state that oil and gas companies are currently producing oil here using both traditional vertical well technology and horizontal drilling and hydraulic fracturing to extract the shale oil and gas. The USGS added that the Delaware Basin assessment of the Wolfcamp Shale and Bone Spring Formation is more than two times larger than that of the Midland Basin.

Even before this major new discovery of shale oil and gas in the Texas-Arizona region around the Permian Basin, the US, including estimated shale oil, was estimated the world’s largest oil reserve. According to a July 2018 study by Rystad Energy, a Norwegian consultancy, the U.S. holds 264 billion barrels of oil, more than half of which is located in shale. That total exceeds the 256 billion barrels found in Russia, and the 212 billion barrels located in Saudi Arabia.

If the new USGS estimates are included, the US total oil reserves would be well over 310 billion barrels.

https://www.usgs.gov/news/usgs-announces-largest-continuous-oil-assessment-texas-and-new-mexico

Please show me where, in the history of mankind, did government central planning or government management ever succeed in the long run. The problem is NOT the LACK of a national energy policy, but the presence of one that, since the first gusher in Texas, has been 100% oil-centric, with no allowances whatsoever, for the presence of any innovation or real competition. Energy is power, and so long as government controls energy, those above government will do everything to control that power.

Electricity distribution is centrally-managed, centrally-controlled, and small, local distribution of power is nearly unheard of. Automobiles are regulated to the last nut and bolt. What they run on is not only heavily regulated, but “new” technologies are being forced down our throats all to favor another power player in the energy-control market.

What might a free market in energy look like? What innovations might have come in any or ALL of the current alternative energy markets if the government had not been in control of much of the research funding through colleges and universities around the nation? How petro-centric would this country still be if the oil companies had to employ their OWN armies of men to fight and die for their oil wells in the middle east? How much safer might nuclear energy be today if nuclear power companies had to take FULL responsibility for their accidents and PROPER and SAFE disposal of all of their nuclear waste? What kind of alternatives might we be able to choose from if men like Tesla were not shut down by the likes of J.P.Morgan and then murdered by the FBI (one theory) – and who knows what has become of all the other innovators whose inventions NEVER made it to market because of government power plays? Who knows what vehicles might be able to operate on today were not lobbyists stepping in and having FTC regulators shut down innovative car designs before they could ever come to market?

Sadly, too many look to a singular, magical, one-size-fits-all solution to our problems. But the very government that so many turn to, IS the one-size-doesn’t-fit-all “solution” that has generally caused all of our problems by stifling innovation or outright destroying competition on behalf of their “friends.” The beauty of the free market is that enables choice. It doesn’t demand that batteries be relied upon in frigid cold and brutally-hot climates. It does not demand that wind power be required in areas of near-calm. It provides a myriad of ever-changing and improving choices that BEST suit the needs of the consumers it serves.

A FREE MARKET in energy is the ONLY National Energy Policy that this country should EVER have to have.

What I hear people tell me weekly……..

But hey I found out my broker makes 7-10% commission on a minimum of $100,000 investment to sell me oil and gas partnerships or (reits) real estate investment trusts. He promised me energy consumption would never go down in the USA and I would get dividends of 12% for 10 years and then get double back from my deposit. So instead of the prudent 5% investment I put 30% of my life savings into these because he made / convinced me. They have alreasy reduced their dividends to 5% and are now using new investors money to pay us initial investors our dividends and using the newest customers own money to pay them their dividends. Inbelieve thats what is exactly called a ponzi scheme. But when I inquired at the SEC they informed me as long as it was disclosed they were using new money to pay dividends its was legal. I responded by saying using premiums is not a dividend therefore that constitutes fraud. They hung up on me.

They are all in on it. Make us all broke, vote in socialism because we are all broke and they turn that into dictatorship. This boat is sunk people. This turning is a burning…….

Same old crap from this guy. The largest reserves in the world(?) were just discovered on the TX/NM border. Just down the road from the Permian Basin, now the 3rd largest oil producing region in the world..

Every night on my drive to Big Spring, the sky is lit up from flare offs. What should we do? I prefer $1.75 gas to $4. I prefer paying 1/3 the electricity cost here in TX vs what I paid to run my studio in CO.

What I don’t care for are the acres of solar farms here in Lamesa or the miles and miles of wind turbines, all subsidized. Are the roads around here being ruined by the increased traffic? Doesn’t look that way to me, in fact, of all of the places I’ve ever lived, I have to say that Texas has some of the best infrastructure and maintenance I seen.

https://newspunch.com/glass-sphere-may-revolutionize-way-we-power-earth/