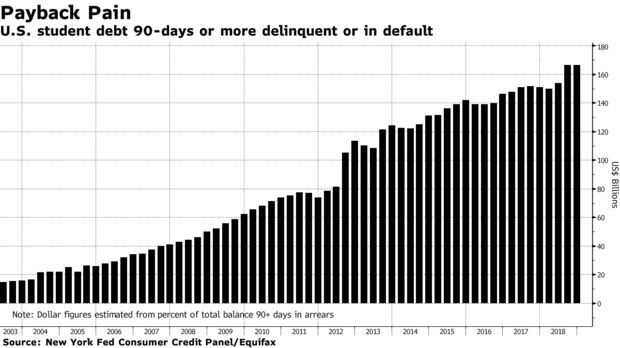

Student-loan delinquencies surged last year, hitting consecutive records of $166.3 billion in the third quarter and $166.4 billion in the fourth.

Bloomberg calculated the dollar amounts from the Federal Reserve Bank of New York’s quarterly household-debt report, which includes only the total owed and the percentage delinquent at least 90 days or in default.

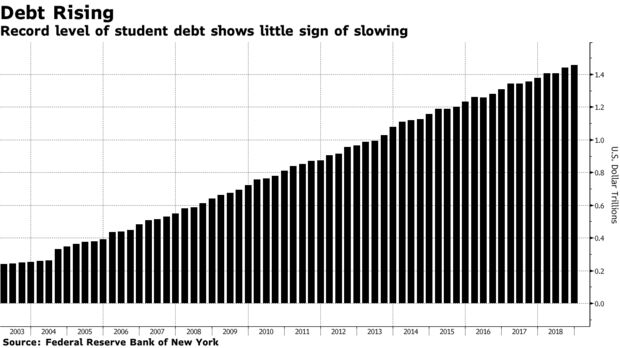

That percentage has remained around 11 percent since mid-2012, but the total increased to a record $1.46 trillion by December 2018, and unpaid student debt also rose to the highest ever.

Delinquencies continued to climb even as the unemployment rate fell below 4 percent, suggesting the strong U.S. job market hasn’t generated enough wage growth to help some people manage their outstanding obligations.

Income levels for graduates “are not necessarily high enough for debt payments overall,” said Ira Jersey, Bloomberg Intelligence interest-rate strategist. “If you have a choice to pay your student loan or for food or housing, which do you choose?”

The delinquencies also have broader implications. Because most of the loans are government-sponsored, they probably won’t hurt the economy the way mortgage debt did in 2007, Jersey said. “But incrementally, it does mean higher federal deficits if the loans are not repaid.”

The total in arrears is about twice the amount the U.S. Treasury provided to bail out the auto industry during the last recession.

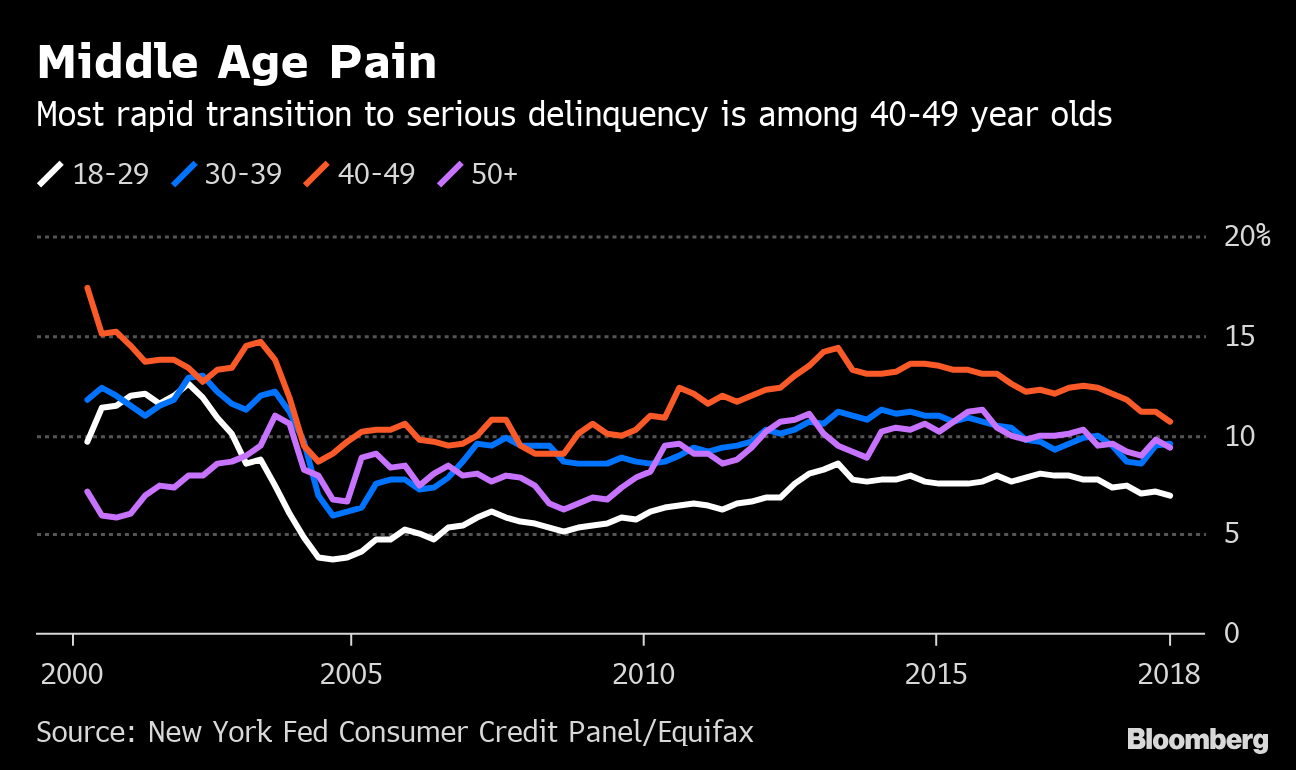

Loans at least 90 days past due are considered to be in “serious delinquency.’’ The age group transitioning into this category at the fastest pace is 40-to-49 year olds; that’s partly because of parents borrowing to pay their children’s expenses.

Middle Age Pain

Most rapid transition to serious delinquency is among 40-49 year olds

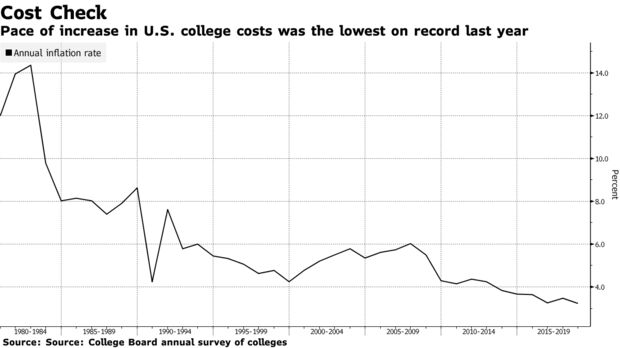

The cost of higher education has roughly doubled in the past 20 years, and the Federal Reserve Bank of St. Louis recently posted a blog entry asking “Is College Still Worth It?’’ The answer was not a definitive yes. One of the conclusions: “In terms of wealth accumulation, college is not paying off for recent college graduates on average — at least, not yet.’’

Some schools have taken note, providing more support. The percentage increase in tuition at Cornell for the 2019-2020 academic year “is the lowest it has been in decades, and we are budgeting for a significant increase in financial aid,’’ the university said on Feb. 11. And 2019-2020 will be the seventh consecutive year Purdue University hasn’t boosted room and board rates.

Still, in-state tuition and fees at public four-year institutions rose at an average rate of 3.1 percent a year beyond inflation in the past decade, according to the College Board.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Wow who saw this coming millions of college grads with degrees in lesbian Afrocentric underwater basket weaving in debt with no job prospects to service that debt . Over 100 MILLON Americans unemployed or grossly underemployed a labor market flooded with illegals driving average wages down and once thriving industrial areas looking like bombed out war zones along with cities with miles of boarded up and collapsing houses . Meanwhile some wonk college administrator convincing this gullible skull of mush to indenture themselves to fund the college employees lifestyle by destroying their future . Meanwhile the taxpayer pays the banks the banks pay the college and the graduate has an IRS bulls eye on their ass for life . Wow what a deal !

I know Obama and his ilk did it to , I mean for the children !

At least basket-weaving courses once taught you something worthwhile and hands-on.

I saw the student loans-> then and work for 30 years in a corporate cubicle scam in it’s infancy back in 1989 and I wanted no part of it.

Insanity reigns.

Recently read story of how the over 60 cohort is now defaulting on their own loans-not to be confused with loans they cosigned. Old codgers borrowing to get smarter??? WTF?

A month ago there was a similar story about upward trend in defaults in reverse mortgages. Hells bells, I didn’t even know it was possible to default on a reverse, but there is: if the lender does not escrow your T and I and you then fail to pay you go to shit city pretty quickly.

A couple years ago there was a graph that said it all: it showed the upward trend in availability of education loan money (due to frequent lifting of that spending cap) with the upward trend of the rising cost of tuition overlaid-even an idiot could see the correlation coefficient was damn near 1 dot oh.

I now understand why Mrs. B. Sanders sometimes smiles (and I doubt she’s waiting for old Bernie to come home to soothe her).

There is no upper age limit on stupidity.

The “go back to school” (in your 50s or 60s) thing is just plain sad.

Really? I was 43 when I went back for my Master’s, and earned it; 47 when I stayed on for my Ph.D., earned at 54. When are you too old to learn, again? and how do you know?

If I hadn’t stayed on for my Ph.D. I doubt I would be employed now – but as a consultant, that Ph.D. is keeping me employed when some 62 million of my fellow Americans are not. What is that worth to you, one less unemployed and welfare-supported near-senior? I know what it’s worth to me.

We need to end student loans. Period. Full stop.

https://www.cnbc.com/2019/02/13/a-gop-proposal-would-snatch-your-student-loan-payment-right-from-your-paycheck.html

Agreed.

Low quality crap posing as higher education and the finance machine that fuels it must be called out and ridiculed.

Just like low quality crap writing must be called out and ridiculed- not given a participation trophy.

Bullshit. That is just more big brother bullshit. Because people are too stupid to not do X, Y, or Z, we gotta ban it for heir own good? That is liberalthink at its finest.

Get the fucking, god damn government out of it, period.

Let the free market decide; even banksters will not play if they have no government backstop. It will self regulate and few lenders will step up, but tuff shit, snowflake-get a couple jobs and study hard, learn to drink cheap coffee to stay awake when you pull the all-nighters during finals week.

To ban or not to ban will no longer need to be discussed.

Now excuse me while I go take a piss.

Llpoh true personal responsibility must take hold though we must take into consideration the brainwashing in public schools that lead these youthful lemmings racing to sign on that dotted line with a cheer leading section of school administrators and student advisory staff who for all facts and purposes make the film flam man look like a saint !

What needs to end is the exclusion of student loan debt from bankruptcy relief.

That would curtail most of the student-loan stupidity we see going on at the moment.

Indeed it would. No one in the private sector would make any students loans.

Student loans were dischargeable in bankruptcy prior to 1976.

Apparently, Harvard had a student loan program in 1840. So . . . .

There ya go, AC. I stand corrected.

Twice. 🙂

Yet this $166B debt is still rated A/A+ investment grade paper by the ratings agencies and willfully marketed and sold to public and private sector retirement funds.

Fuck you ratings agencies! Fuck you SEC!

Actually, fuck you too public sector pension funds!

Amen to fuck public sector pensions now nationwide $7 trillon in the hole . Don’t look at boatguy his old steelworker pension took a dirt nap in 1984 and I did what it took to play catch up so no I have nothing left for others what I invested and managed is for me and mine . Want to retire at 50 get busy with your own wealth and abilities and leave me and mine alone !

Steelworker? You slung auto parts at GM before getting fucked over?

Kidding!

Lucky you weren’t an airline pilot.

No Shit I know a few pilots

Boat – nice comment. The entire idea of leaving your future in the hands of benevolent govt, unions, businesses is ridiculous. Gotta take care of your own self.

Quietly gamed employer’s 401K rules before any of the asshol*s really understood the lax Ts and Cs of what they had foisted on us worker bees starting in ’82. Nothing done was not legal (double negatives: the favorite persuasion tool of the political class). Paid off quite nicely. The rules were changed after the big bust in ’08, but the gulag had an escapee by that time.

BG, did you ever read “American Steel” by Richard Preston? Good read that takes one’s mind off the outrage slung by morons in D.C., snowflakes on campus, and black queers in Rahm’s village. The story tells of how one company risked everything to develop New Steel as a way to survive what was happening to Old Steel. Fun fact: the ancestor of the company manufactured and sold the REO Speed Wagon. Every so often HQ in Charlotte gets a call from South America asking if they still have parts for the Wagon.

Geez, I think of all the good platform parents trying to enable their kids with a good start toward sustainable life in the working world.

Here’s to yours and their success, in emerging with a worthwhile education & a degree in a field with strong prospects.

And, God willing, a manageable means to afford the costs, without becoming long term debt slaves.

Many people are going to burn, when that student loan debt gets defaulted on.

May the most pain be inflicted on the gov., banks, & institutions who enabled the slavery, with false promises of the benefits.

So, too, a portion of pain to the debtors abusing or abandoning the debt obligations, ignoring fiduciary responsibility.

Tax payers should not be on the hook.

Not going to end well.

There is a lot of low hanging fruit out there; Bernie, call your office.

I haven’t yet seen any discussion of the “student loan crisis” take this beyond the surface layer. What does this situation mean? It means that without extreme, artificial, and dysfunctional debt/subsidy most people can’t actually afford college.

In the last couple of decades the average income of the parents of college students has risen significantly. Gucci bags and designer labels are the norm now at state colleges – places that used to be the more “modest” educational choices for newly middle class families hoping to solidify their place in the American Dreamscape or first generation kids of working class families going for upward mobility. Now it’s morphed to a warehouse and/or finishing school, teaching the etiquette and social signalling of the elites to their youth. (STEM etc excluded) Today’s student stock comes from significantly higher income homes AND STILL people can’t afford this on their own, without loans…which they can’t pay back. If the loan crisis proves anything it’s that the product itself is largely worthless, and the market for it still exists largely due to subsidy and habit.

This can’t go on forever so some propose the panic-driven solution of Free College for all, which of course would not be free but paid for by all of us. Some of the people proposing that solution are unicorn-dream socialists, but I feel really certain that behind that row of pawns is a group of serious big picture people who are scared shitless about what happens when the jig is finally up.

If you don’t live in a college town, work at a college, or know someone who does, you will have no way to understand the level to which these fucked up Institutions of Higher Bullshit prop up the wider communities they are in. Yes, it’s a Ponzi-type way to circulate money through a society, but it’s deeply entrenched.

When (not if) the university systems finally start collapsing in earnest (and not just crumbling at the edges as they are now) entire communities are toast. You may hate the university system (and those who reallly hate it work there, you have no idea) but these campus closings will be as bad as major plant shutdowns, and maybe even worse because we have so little holding us together anymore. Yes, it’s absolutely a shit system, keeping kids busy with classes and ideas that do not translate to jobs, but whatever right? because there won’t BE jobs. Busy-work, keeping the outrage going, giving the policial classes stuff to haggle over, keeping the merry-go-round spinning, extending the inevitable awareness of how fucked we really are.

All of us will be fucked when the U-systems go full Detroit, even the annoying assholes we think we hate. The blue-haired gender-fluid wimmin’s studies majors are being played just the same as the rest of us. Yeah they’re blue-haired bullying assholes, but it would be good to give some serious thought to what is going to happen when the circus finally pulls down its tents and leaves town for good. University systems are the major employer in a whole lotta states.

Well put.

Borrow, pay higher tuition, borrow even more next semester, keep repeating. The professors love you.

Some community colleges are gaining ground on the bigs.

The real pisser was when I heard about borrowing enough extra to pay for the South Padre Island trip in March. These are the same ones who will buy their $5 latte on the one card that has yet to max out. GPA? What’s that?

An old but true story: Kenny was a “tenured” student at State U. in the years before the Vietnam draft. One spring the department head called him in and gave him a list of the various degrees he was already entitled to receive-3 or 4 them-and told him to select one and get the hell out of there forever. He took his sheepskin that May, screwed off for 6 months, then took a job with the Social Security Administration. Interestingly, that was in the day before student loans were invented and the cost of state colleges was reasonably attainable for many students.

“Some schools have taken note, providing more support”.

That one reminds me of the fable of bil clinton’s “Spiritual Advisory Team”.

Oh Lord, I remember that.

What a riot!

Included the good Reverend Sharpton-perhaps as tax advisor to Bil ‘n Hil Crime Syndicate?

Let us pray.

My eldest is graduating this spring from Liberty University. We told him we were done with any more financial support. He called a few nights ago saying he was accepted into a masters/jd four year program. 36K. 35k scholarship. Room and board paid for by teaching undergrad classes plus a stipend. So glad for him because after 4 years we were done. Working at the Heritage Foundation this summer. I’ve never met a more well read millenial in my life. I believe he will be one of the ones to bring us back after the 4th turning has its way with us.

If I may be so bold – law schools are notorious for laying traps re scholarships. Many, in the fine print, require the scholarship recipient that the must maintain say a B+ average, or they lose the scholarship. They set the average so high that it is virtually unachievable – most do not make it. Miss it by a poompteenth, ad the scholarship disappears, and then they are willing to give the student loan, as they then have them hooked.

If he has not done so already, my advice would be to read the fine print. It is pretty rare these scholarships do not contain that clause. Here are some articles on this issue:

https://lawpreview.barbri.com/1l-grades-impact-law-school-cost/

From the NYTimes:

” [S]ome schools lure top students with offers of merit scholarships that pay thousands of dollars annually. The schools bolster their U.S. News rankings by attracting academic overachievers, but there’s a catch: the students must maintain high GPAs to retain their scholarships, which students often are unable to do partly because schools grade on a curve, thus ensuring that only a small percentage of students will earn the sort of grades needed to retain their scholarship money, according to the Times.

Students accuse some schools of a bait and switch by offering high-paying scholarships without fully informing prospects of the likelihood that they will be able to do well enough to keep the scholarships.”

https://blog.powerscore.com/lsat/no-such-thing-as-a-free-lunch-the-fine-print-on-full-scholarship-offers

A lot depends on which school. Good luck to him.

Thanks so much for the info llpoh, I will look into it. Hopefully since it is truly a Christian school they don’t pull any of that crap (Regent). But who knows. Anyway, he doesn’t want to practice as a lawyer, so there’s that.

And the answer is…

FREE COLLEGE

Mwah hahahahahaha

You want to suck my what ? Fuck you!

all for it but the pro-fessors would take a salary hit…and that they CANNOT do, as good socialists??

more blacks…they don’t pay back loans…

barry sotero put out the word he wanted to go to big name grad school; connections found an Arab sugar daddy to pay all his expenses. No need for a scholarship, nor for a repayment schedule.

That was for the guy who became editor of the Harvard Law Review but never had anything accepted for publication. Come to think of it, he never accomplished anything of value in his next big gig either.