Back in April of 2018, when the trade war with China was still in its early stages, we explained that among the five “nuclear” options Beijing has to retaliate against the US, one was the block of rare-earth exports to the US, potentially crippling countless US supply chains that rely on these rare commodities, and forcing painful and costly delays in US production as alternative supply pathways had to be implemented.

As a result, for many months China watchers expected Beijing to respond to Trump’s tariff hikes by blocking the exports of one or more rare-earths, although fast forwarding one year later this still hasn’t happened. But that doesn’t mean it won’t happen, and overnight President Xi Jinping’s visit to a rare earths facility fueled speculation that the strategic materials will soon be weaponized in China’s tit-for-tat war the US.

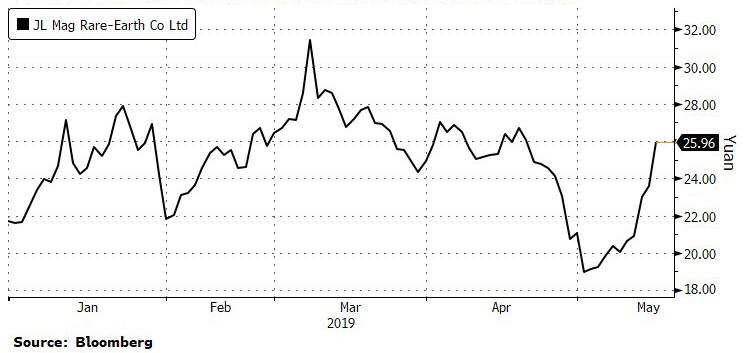

As Bloomberg reported overnight, shares in JL MAG Rare-Earth surged by the daily limit on Monday after Xinhua said the Chinese president had stopped by the company in Jiangxi, a scripted move designed to telegraph what China could do next.

The reason for the dramatic market response is that the presidential visit flags policy priorities, and “rare earths have featured in the escalating trade spat between the U.S. and China.” Specifically, as Bloomberg notes, China raised tariffs to 25% from 10% on American imports, while the U.S. excluded rare earths from its own list of prospective tariffs on roughly $300 billion worth of Chinese goods to be targeted in the next wave of measures. And just in case the White House missed the message, Xi was accompanied on the trip to JL MAG by Liu He, the vice premier who has led the Chinese side in the trade negotiations.

Why does China have a clear advantage in this area? Simple: the U.S. relies on China, the dominant global supplier, for about 80% of its rare earths imports.

The visit “sends a warning signal to the U.S. that China may use rare earths as a retaliation measure as the trade war heats up,” said Pacific Securities analyst Yang Kunhe. That could include curbs on rare earth exports to the U.S., he said.

Xi’s visit came just hours after the Trump administration on Friday blacklisted Huawei and threatened to cut it off from the U.S. software and semiconductors it needs to make its products. A spokesman for China’s foreign ministry told reporters Monday to “please wait and see” how the government and companies respond.

Of course, a Chinese export curb, or ban, would also cripple domestic producers, as domestic rare earth miners would be hurt, and likely need state subsidies, similar to US soybean farmers. But curbs could potentially help companies like JL MAG, which makes magnets containing rare earths that are used in products including electric vehicles and wind turbines.

Finally, to those looking to trade a potential rare-earth export ban, one place would be to go long the REMX rare earth ETF, which after hitting an all time high of $114 in 2011 during the first rare-earth “scare” during the China-Japan trade war, is trading some 90% lower as the market has all but discounted any possibility of a price spike.

Needless to say, should China lock out the US, the price of rare earths could soar orders of magnitude higher.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I think they are telling us to “Get Ready” but if they don’t do it, “I Just Want to Celebrate” …..and President Trump would not have to say “I’m Losing You”

I’m sooooooo excited. The morans are coming! The morans are coming!

Now we get hear from ‘Anonymous’ sources that say we can put China out of the rare earth business by mining them from the ocean!

Do your homework!

Anonymous

“Au contraire….there are lots of sources of rare earth minerals….under the sea, Afghanistan etc….and even right here at home and in Canada. Not to worry our smart bombs will still have the required materials to hit the targets.”

China will use the Rare Earth Element “weapon” but since 2010 when they embargoed Japan over the fate of a fisherman the West has taken this risk into consideration and technologies are being developed with reduced reliance on Rare Earths and alternative sources of supply have been located. China used the lever too early and for little gain as they were blinded by their visceral hatred of Japan. Typical and while there may be short term disruption (2-4 years tops) China has shot themselves by playing the rare earth card.

https://www.wired.co.uk/article/race-for-rare-earth-minerals

Martel said,

I doubt it. Let me pose a question…Who do you think North Korea will ultimately open up it’s country and the trillions pf untapped rare earth minerals waiting to be exploited to, the West and it’s corporations or China and Russia, allies to North Korea and regional partners?

https://qz.com/1004330/north-korea-is-sitting-on-trillions-of-dollars-on-untapped-wealth-and-its-neighbors-want-a-piece-of-it/

Gosh, you won an argument with yourself….you strawman! Is North Korea the only non-Chinese source of REE? Err no….Japan just made a huge find and Afgh has a treasure trove and so do lots of other places. My point had nothing to do with North Korea (but nice try asshat) my point was that leverage point from China is not new and has been evaluated and strategies for mitigation developed over the last decade. China went for the cheap win with Japan and that started the process of seeking alternatives.

You mean we’re in danger of running short of smart phones to spy on us? Woe is us. How am I going to get the latest Snapchat info about Game of Thrones?

Hahaha! Hilarious! Good one!

REMX chart looks pretty bullish, but at 60k average daily volume, market makers and high frequency traders can toss it around like a plastic fuck doll.

Almost ALL the Western REE mining corps have low share prices and very narrow volume – and almost all of them are operating at a loss.. One of the better ones, Lynas, an Aussie company, has a P/E of 24, a PPS of 1.52, and a profit of $.06/share with a low liquidity and trading volume. A big pre-market block buy of even a thousand shares would spin up the fucking HFTs in a heartbeat and net the buyer a heartache on the open – if there was enough float available to get, that is.

Buying physical is possible, but would be stupid as there’s no real exchange with enough liquidity to buy and sell with regularity.

Shortage of Rare Earth elements? Hell no – I bet there are a lot of fish around that Fukushima place, that are loaded with them. Also try Castle Bravo site. Maybe even Chernobyl.

Good, it’s a wake up call for the West. Besides, rare earth’s are not rare….we just have to mine our. Own sources again. So just do it,dig it up and process it. Bring manufacturing jobs back to our shores. Maga bitches

Where did I hear this before? Oh, that is right – I said this card would come up. Told ya so, told ya so, told ya so.

My forecasting record remains perfect. And yet there are still dumbasses that disagree with me when I make my forecasts. Dumbasses.

You got a prediction for the NBA finals?

Yes, I do. What is in it for me? A good bottle of hooch payable in advance seems fair.