Authored by Mike Shedlock via MishTalk,

The Fed released its “Z1” report yesterday on Household Net Worth and Domestic Nonfinancial Debt. Let’s dive in on wealth.

Please consider the Fed’s Z1 report on Recent Developments in Household Net Worth and Domestic Nonfinancial Debt.

Hooray for Bubbles!

“The net worth of households and nonprofits rose to $113.8 trillion during the third quarter of 2019. The value of directly and indirectly held corporate equities decreased $0.3 trillion and the value of real estate increased $0.2 trillion.”

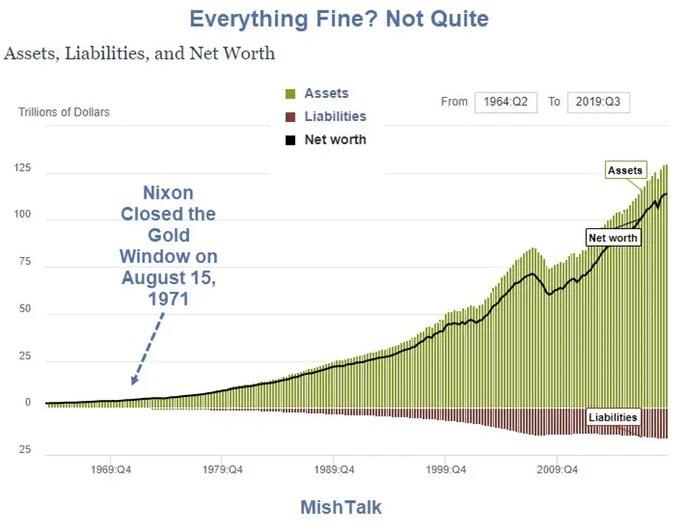

The Fed offers an Interactive Chart on Wealth.

Assets vs Liabilities

- Assets: $130 Trillion

- Liabilities: 16.4 Trillion

- Net Worth $113.8 Trillion

Aggregates Mislead

Median Net Worth

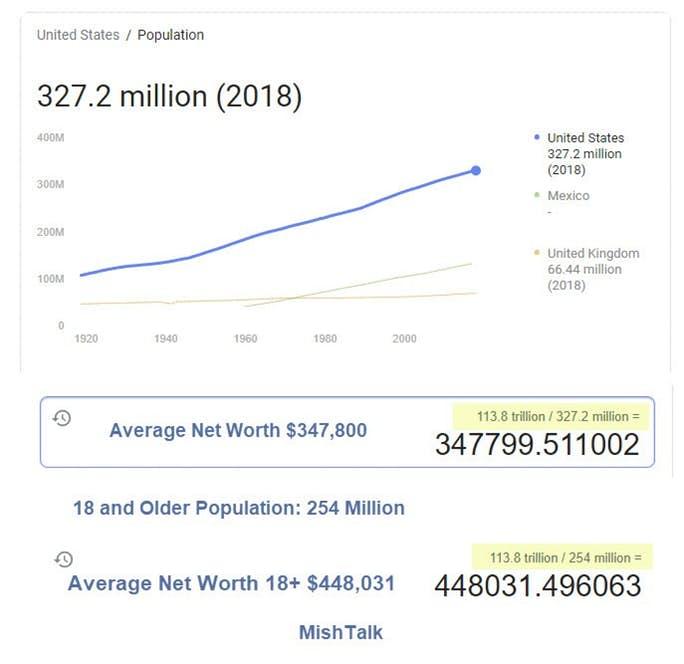

The average net worth is $347,800. The average net worth of those 18 and older is $448,031.

The median net worth of those 18 and older is about $100,000.

The median net worth is skewed by the biggest stock market bubble in history. It’s also skewed by a housing bubble.

Unlike Elizabeth Warren, I am not proposing wealth redistribution schemes.

Rather I am pointing out problems with the rosy-looking picture.

What the Chart Does Not Say

The chart paints a rosy picture. Liabilities are low. Hooray.

But what the chart does not say is where the wealth is and where the liabilities are.

The assets are concentrated in the hands of the top 10%. The liabilities are concentrated in the bottom 90%.

Bubble Blowing Tactics

Most of the country isn’t prepared for retirement. And many who think they are prepared do so only because of inflated asset prices, unlikely to last.

This is a result of bubble-blowing tactics ongoing for decades. Escalation took off when Nixon closed the Gold Window in 1971.

For discussion, please see Nixon Shock, the Reserve Currency Curse, and a Pending Currency Crisis.

Nixon Shock coupled with irresponsible Fed policies are to blame for widely reported “wealth gaps”.

Meanwhile, if you do not feel wealthy, then most likely it’s because you aren’t.

Addendum

ZeroHedge just provided this pertinent picture.

US household balance sheet. As a reminder 70% of net worth is held by just 10% of the population pic.twitter.com/WWMZXR4AAm

— zerohedge (@zerohedge) December 12, 2019

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Another set of statistics to show us what we already know. Our government is owned by the wealthy who skew everything in their own favor. This trend will contiue until the open bribery of elected officials is outlawed. Of course this will not happen until the average American pulls their head out of their anal orifice and gets a clue what the hell is going on.

Andrew Sullivan on Twitter: “Simple lesson: there is a big majority in US and U.K. for anti-pc nationalism wedded to leftist economics. The first Democrat to get there wins.” / Twitter

https://mobile.twitter.com/sullydish/status/1205361116861390854

The concept of “wealth” here (as most places) is flawed. What is perceived as “wealth” is largely a bunch of abstract digits which could disappear at any time.

Other “assets” held by the wealthy may well be stranded ones, with negative or soon-to-be-negative returns (shopping malls? fracking wells? Tesla production lines?).

For homework:

Read —if you can find a pdf copy somewhere, since the printed version is $80+ (I bought it in 2010 for $12.. could have been a good investment!) Frederick Soddy’s “Wealth, Virtual Wealth, and Debt”:

Debt is not wealth, at least from the borrower’s perspective. This is a lesson people, for some strange reason, forget when the guy they voted for is sitting in the white house.