The financial concept of wealth is broad, and it can take many forms.

While your wealth is most likely driven by the dollars in your bank account and the value of your stock portfolio and house, Visual Capitalist’s Jeff Desjardins notes that wealth also includes a number of smaller things as well, such as the old furniture in your garage or a painting on the wall.

From the macro perspective of a country, wealth is even more all-encompassing — it’s not just about the assets held by private households or businesses, but also those owned by the public. What is the value of a new toll bridge, or an aging nuclear power plant?

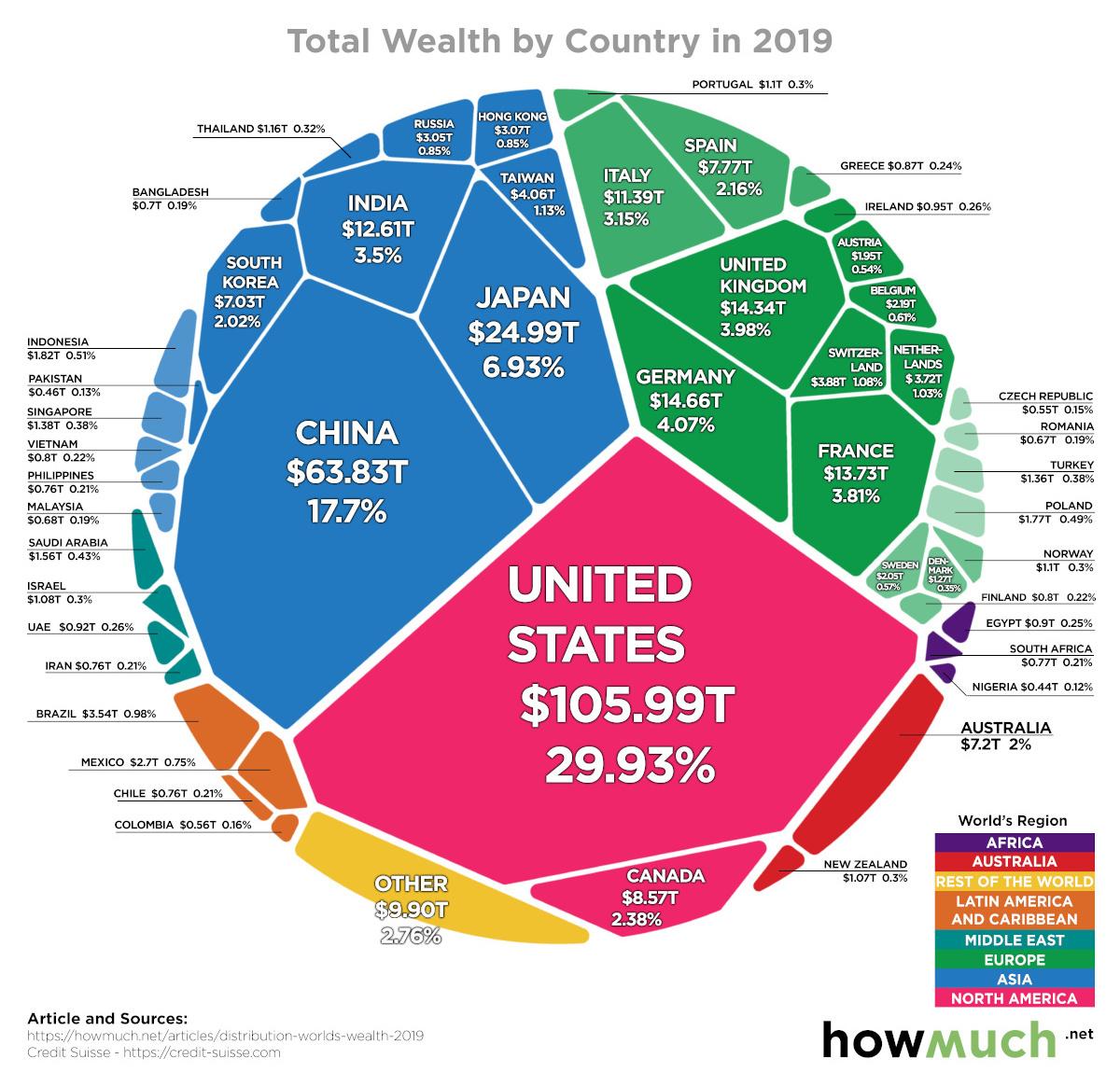

Today’s visualization comes to us from HowMuch.net, and it shows all of the world’s wealth in one place, sorted by country.

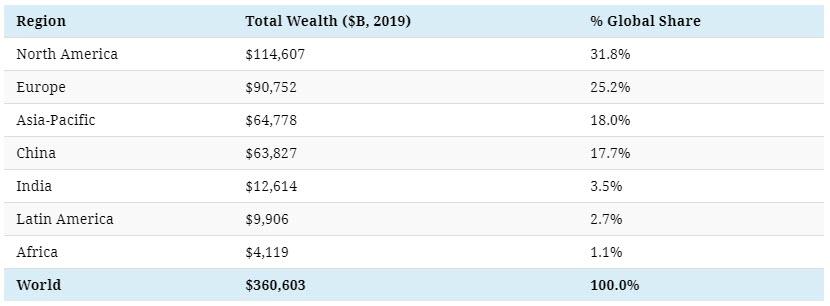

Total Wealth by Region

In 2019, total world wealth grew by $9.1 trillion to $360.6 trillion, which amounts to a 2.6% increase over the previous year.

Here’s how that divvies up between major global regions:

Last year, growth in global wealth exceeded that of the population, incrementally increasing wealth per adult to $70,850, a 1.2% bump and an all-time high.

That said, it’s worth mentioning that Credit Suisse, the authors of the Global Wealth Report 2019 and the source of all this data, notes that the 1.2% increase has not been adjusted for inflation.

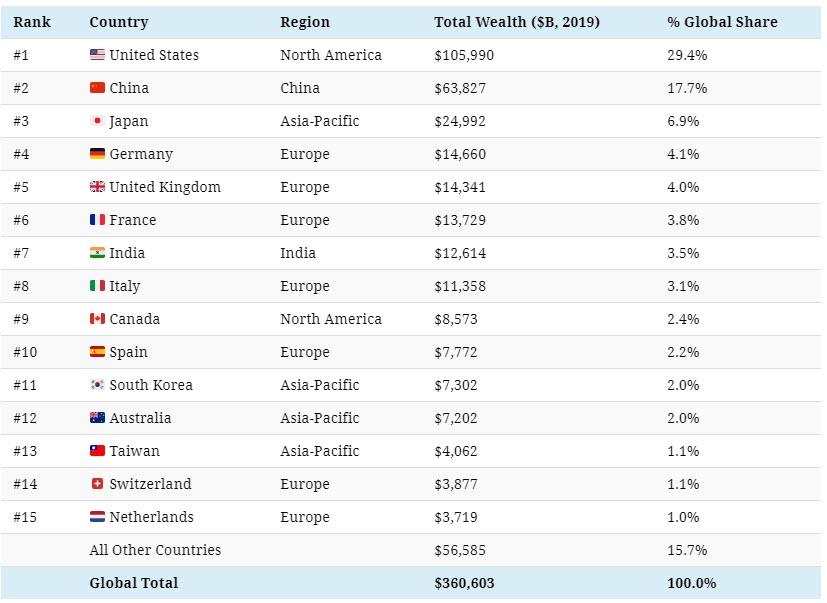

Ranking Countries by Total Wealth

Which countries are the richest?

Let’s take a look at the 15 countries that hold the most wealth, according to Credit Suisse:

The 15 wealthiest nations combine for 84.3% of global wealth.

Leading the pack is the United States, which holds $106.0 trillion of the world’s wealth — equal to a 29.4% share of the global total. Interestingly, the United States economy makes up 23.9% of the size of the world economy in comparison.

Behind the U.S. is China, the only other country with a double-digit share of global wealth, equal to 17.7% of wealth or $63.8 trillion. As the country continues to build out its middle class, one estimate sees Chinese private wealth increasing by 119.5% over the next decade.

Impressively, the combined wealth of the U.S. and China is more than the next 13 countries in aggregate — and almost equal to half of the global wealth total.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

It would be interesting to see those figures broken down as a percentage based on population.

https://thefederalist.com/2017/09/01/southern-poverty-law-center-got-busted-sending-millions-offshore-accounts/

Does the wealth figure include all debts, including debt obligations? Because usdebtclock.org and others put the total of unfunded liabilities for just the US at around $250Trillion. So whatever the so-called wealth might be, it is heavily mitigated by owing debt on all or even more than all of it. This shit isn’t going to end well. Meanwhile, all the presidential candidates keep pointing to the “wealth” number and claiming we can spend even more (both worthless major parties included).

Looks flat Earthyish, don’t you think?

IMO, one of the most under-appreciated concepts is “malinvestment” as defined by the Austrians. The idea is that not everything produced is worth producing.

A truly functioning market allocates scarce resources fairly efficiently. The stuff that people really need and want gets produced (because it’s profitable). Other investments that don’t provide more value than what they cost, fail. This frees up resources to reinvest in worthwhile projects.

In our financialized economy, Fed money-printing, gifted to their Wall Street buddies, makes it impossible to distinguish good (profitable) investments from bad. Huge malinvestments don’t get purged and in fact are often rewarded more by stock speculators.

Measurements of GDP do not distinguish between Apple and WeWork. Even government spending is counted as a plus to the economy. All just a long way of saying that we don’t know if this chart represents any kind of reality or not. With our fiat-money way of valuing things, the stock markets can “lose” trillions of dollars in a recession. Think about that a minute – can real wealth just disappear?