Guest Post by Simon Black

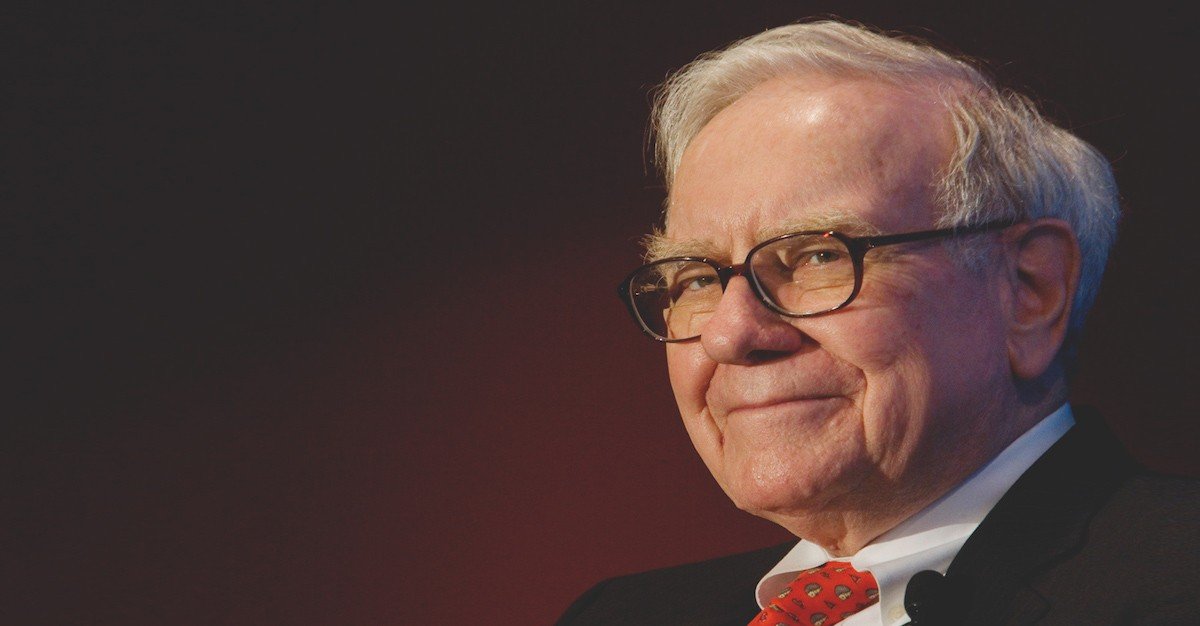

Warren Buffett’s holding company, Berkshire Hathaway, didn’t outperform the S&P 500 last year.

Berkshire Hathaway grew slightly in 2019, but its performance lagged far behind the S&P 500 stock market index.

That’s an anomaly for Buffett. He’s handily outperformed the S&P 500 for decades, endearing himself to millions of investors along the way.

It’s interesting that Berkshire Hathaway typically has its worst years just before stocks crash.

In 1999, just prior to the Dot-Com Bust of 2000, the company’s book value (Buffett’s preferred measure of performance) grew just 0.5%, while the S&P grew 21%. The stock market peaked just a few months later.

Of course, the fact that Buffett’s company underperformed the market so much is not a 100% guarantee that the stock market has reached its peak.

But Buffett himself has been vocal that there are very few good deals out there.

Berkshire Hathaway has amassed a record $125 billion pile of cash based on its most recent financial statements from September– which is an obvious sign that Buffett doesn’t see much worth buying.

Of course, just because the market is already very expensive doesn’t mean it can’t keep going higher in the short term.

But there’s at least one thing you can do to reduce your risk… a way to generate virtually risk-free returns on your existing investments: smart tax planning.

Think about it like this– if you can legally slash your capital gains tax from 20% down to 0%, that would be the same as if you had earned an extra 25% investment return in the market… but without taking any additional risk.

This is a huge anomaly. EVERY investment carries risk… whether you’re stuffing cash under your mattress, buying shares of Apple, or acquiring an apartment building. There are always things that could go wrong. So smart investors weigh the potential risks against the prospective rewards.

Good tax planning is one of the ONLY ways to generate a RISK FREE return. You’re smart, you follow the law, and poof, you end up with more money in your pocket.

As I’ve written many times before– this is why I live in Puerto Rico now. The island is home to not just fantastic weather and great lifestyle, but some of the most extraordinary tax incentives in the world.

Investors who live in Puerto Rico, are approved under the incentives program, and comply with all the rules, pay literally -zero- capital gains tax on their investments. Again, it’s as if you were making an extra 25% without taking any risk.

Another extremely compelling tax strategy to consider is Opportunity Zones.

If you sell your stocks now, Uncle Sam is going to take his cut– as much as 20% capital gains tax, plus the 3.8% Obamacare surtax, plus possibly state and local tax as well.

But if you roll your capital gains into a special fund that invests in Opportunity Zones, you can defer the tax on those gains until the end of 2026.

But the biggest benefit is that any additional gains you make from your Opportunity Zone investments will be tax-free forever, as long as you hold the investment for at least 10 years.

So let’s say you invested $100,000 in Apple several years ago, and you sell it today for $300,000. You’ll have capital gains of $200,000.

If you invest that $200,000 in an Opportunity Zone fund, you won’t have to pay capital gains tax for the next several years… and anything extra you earn on that $200,000 will be tax free forever.

Your fund could invest in the next great startup that turns your $200,000 into $20 million. And you won’t pay a penny on that $20 million.

Aside from Puerto Rico’s tax incentives, I think Opportunity Zones are one of the best tax incentives in the world.

If you want to learn more about Opportunity Zones we just published a free ultimate guide to Opportunity Zones where I share my personal experience with the program.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Berkshire needs to unload at a slow pace cause of the high volume of shares it has of an individual stock. Otherwise he drives down the price hes selling into. Thus it takes a frekin year to take profits. Thats my theory.

He usually does it over a quarter because once it gets out that he is selling, it causes others to sell.

Ain’t shedding any tears for Warren.

He’ll still be getting plenty of action

from the Fed at the old folks home…

What’s worse? Buffet’s face or Bernie Sanders voice.

Sanders voice.

He was able to unload $800 million dollars of Apple stock last quarter, weird I know.

https://www.zerohedge.com/markets/what-hedge-funds-bought-and-sold-q4-complete-13f-summary

Charlie Munger spins about gold, CNBC 2012. It’s on YouTube.

” I think gold is a nice thing to throw in your garments if you’re a Jewish family in Vienna in 1939, but civilized people don’t buy gold, they invest in productive businesses.”

According to kitco.com gold is UP 23.45% for the year as of February 21, 2020.

Gold spot this day 2012 was $1737.

As far as I know, Munger isn’t a fan of gold and BRK hasn’t seen a share split in years. Now if I was the gambling sort, I’d get my head outta my ass about hedging those expensive shares with gold and wonder WTF was I thinking all those years … oh yeah, that’s right.

Gold is dead when you’ve got specially purchased, rock bottom warrants on banks with insider tips.

Just sayin’ …..

This sounds great – you can count your profits while you crash into an earthquake or tsunami, not to mention a hurricane now that global warming is heating up the ocean. Think I’ll stay in UK and drown!

What, you don’t agree with Doug Casey?

You could bug out to Papua and live on coconuts and bananas … that sounds cool until you get anally sodomized and eaten by local cannibals.

Come to think of it the same could happen to you riding the tube near Paddington Station after dark. Don’t bother running, you can’t hide.

Fortunately I don’t live anywhere near that hellhole metropolis but there doesn’t seem to be the ideal bugout anymore – rural Somerset seems as good as anything now I’m over the hill 🙂