Guest Post by Marin Katusa via International Man

Many believe July 2020 was one for the gold history books, but it wasn’t even a top 10 move in gains for gold historically.

Gold’s big move to an all-time U.S. dollar high last month was the 23rd-best spot monthly return.

Let that sink in.

A new all-time high was hit, and yet the “big” monthly move that’s drawn a generation of new investors and captured the imagination of a whole new set of investors … isn’t even a top 20 monthly gain percentage-wise for gold historically.

In short, we are far from the top in gold.

It’s true that gold and silver stocks have responded, catching a tailwind not seen in a decade.

But institutional money hasn’t even entered the sector in a big way.

In my premium research, we published a detailed analysis of the flow of funds from institutions and shared our unique conclusions based on the proprietary data.

A Path to Profit – The Fed Can’t Print Gold

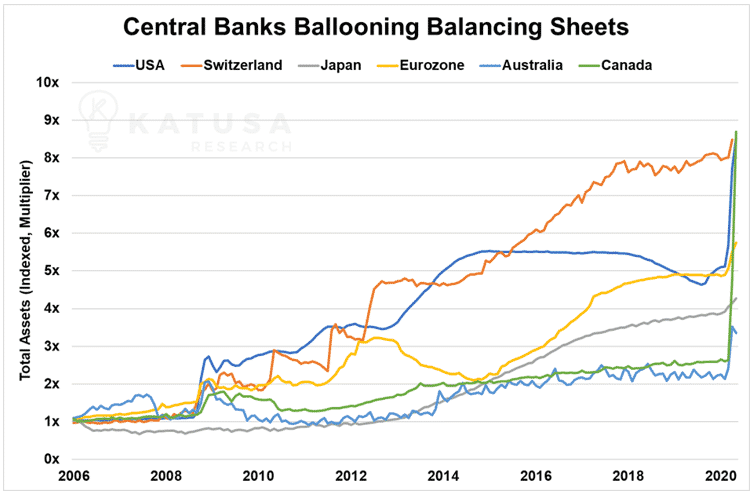

In the 12 years since the Great Financial Crisis (GFC), the U.S. Fed, European Central Bank, Bank of England and Bank of Japan have invented new ways of printing money and keeping the financial markets afloat.

Below is a chart showing how much the total assets (balance sheets) of central banks have ballooned during the crisis.

Expansionary monetary policy is beneficial for gold.

Now, there are two primary schools of thought on this:

- Inflationary

- Deflationary

Regardless of which scenario plays out, gold will benefit because that is its primary draw as an investment—a hedge against fluctuations in the real value of money.

The pandemic and lockdown produced record inflows into:

- Safe-haven investments like AAA-rated government bonds (often with negative real and nominal yields),

- Large Tech stocks with solid balance sheets (think of paying for financial safety in the FANG stocks),

- Currencies like the USD and JPY, and

- Gold and silver.

Gold Goes Mainstream

The so-called “pet rock” and “barbarous relic” is now on the lips of every talking head.

Flip on the financial news today, and every trader and portfolio manager seems to be extolling the virtues of gold and silver.

You will hear guys like Jim Cramer talk about how gold miners like Barrick, Newmont, and Agnico Eagle are better buys right now.

Looking at the YTD returns below. It’s hard to argue that gold and silver aren’t the clear winners in this bull market rally.

Economists like Nouriel Roubini and Mohamed El-Arian are talking more about gold and the benefits of the safe-haven metal in these uncertain times.

Even Goldman Sachs is changing their tune. They once mocked gold as an investment that’s nearly always beaten by the market.

They’ve since joined the chorus of major financial institutions like Bank of America and Citigroup ringing the alarm on currency debasement.

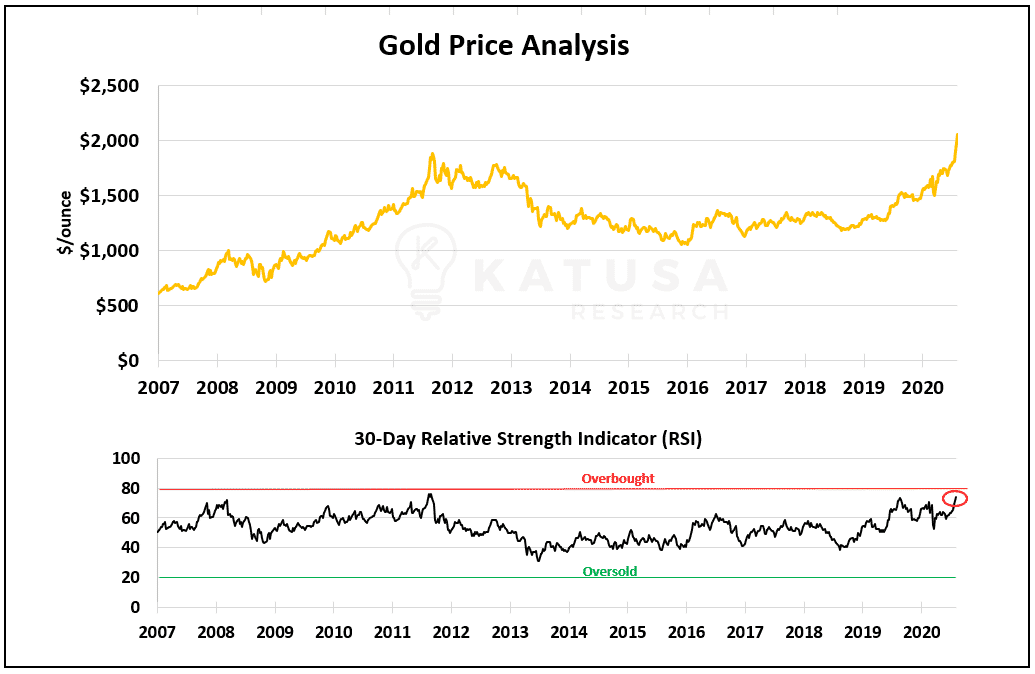

In the next chart, you can look at how gold prices have surged, with a Relative Strength Index (RSI) showing how prices are reaching an overbought level not seen since mid-2011.

But that is one indicator.

Things have changed so much over the last decade, and we are just starting to see the impacts of Modern Monetary Theory (MMT) on the price of gold.

Is There Enough Gold to Meet Demand?

This year, as many as 119 gold-producing mines in 18 different countries have been offline at some point or operating at reduced capacity due to COVID-19.

Estimates vary as to how much 2020 production was lost as a result of the pandemic. The last COVID-19 impact report published by S&P Global Intelligence estimated a 10% decline in their forecasted gold output for 2020 (approximately 11 million ounces).

The 10% estimate was also affirmed by the World Gold Council, despite sourcing their data elsewhere.

So, let’s go with the 10% figure. I have respect for both outfits that have come to the same conclusion.

Previously, 2020 gold mining output was projected to increase by 3.7% YoY. Instead, it’s fallen by at least 6.7%, barring any unforeseen shutdowns.

The most important statistic from the data was an estimated loss of US $2.5 billion in revenue from forecasted gold production. For lost silver production, this amount was US $502 million.

Gold Investor Beware

Gold projects that weren’t economical at $1,750 per ounce, suddenly look like no-brainer investments.

Land packages that were once barren moose pasture are now labeled as “greenfield” mining projects.

For new investors and speculators in the gold space, don’t forget “buyer beware.”

Not all gold projects are equal.

There have always been three types of management teams in the precious metals sector: the innovators, imitators and hot dog vendors.

The latter two aren’t around during a bear market but pop up during a bull market like a plague.

Make sure you know which management team you are backing. Everything starts with great people.

Flavor-of-the-day companies will chase any bull market.

In the late 1990s, there were thousands of dot-com companies. In 2007, there were literally over 500 uranium companies on the stock exchange—15 years prior, there were only 15.

In 2017, the cryptocurrency market exploded, with over 850 coins and new celebrity initial coin offerings announced daily.

There will be an explosion of new precious metals companies and financings looking for your money.

Or worse, looking to leave you with nothing better than an old hot dog.

Is It Too Late to Invest in Gold Stocks?

As gold pushes higher, the economics of many projects will change.

And there are many factors to consider when reevaluating a company. That includes all-in mining costs, exploration costs, administrative costs, royalties, taxes, currencies and more.

Do you know which companies in your portfolio operate in safe jurisdictions and away from nationalization and confiscation risks?

You should.

Is your valuation properly discounted for these potential cost inflations and government risks?

As much as you fawn over a climbing gold price, don’t think that foreign governments aren’t doing the same. They have services and stimulus to pay for those votes and to keep the masses happy. We are in the “Era of Woke,” where feelings matter more than reality and logic.

Supercharged Returns

You don’t have to spend over $500k a year on data feeds and analysts to figure out which gold companies to invest in.

Consider becoming a subscriber to Katusa’s Resource Opportunities and let us do the hard work for you.

So how has Katusa Research done?

Not only have we beaten every index and sector, but our portfolio also consisted of liquid companies (not microcaps) that were considerably lower-risk than the indexes that we all beat.

Be wary of what you are buying and, specifically, your allocation to the different companies.

You do not need to increase your risk exposure to increase your returns; my portfolio has proven that.

You can follow along to see exactly what I’m doing with my own portfolio. In fact, I’ve just released the details on my next major gold investment.

It’s a brand-new company, with a major upside. Even better, it’ll be open to all investors, not just the rich ones. This is going to be a very fun ride.

Editor’s Note: A small amount of money put into mining stocks right now could give you life-changing rewards.

For a limited time, Marin is revealing how you can get positioned alongside him as the bull market kicks off in earnest. Click here to get the details now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

“You will hear guys like Jim Cramer talk about how gold miners like Barrick, Newmont, and Agnico Eagle are better buys right now”.

Right or wrong, I wouldn’t piss on Jim Cramer if he was on fire and I just drank a six pack.

Cramer’s one of those CNBC “rock star” insiders as dirty as the day is long.

Even after the good short-term beating everyone took in PM prices this past week it’s still a good idea to hold onto mining shares. 3Q earnings comes out for Hecla Mining on November 5, right around Election Night.

Boy, that will be an exciting day …. I’m looking forward to it. If it’s a profit day I’ll splurge and buy some German Pilsner at Aldi’s. Can’t beat the price, either. Just over $6 plus tax for a sixpack whereas it’s almost $12 for any sixer of imported crap in NJ. Robbers …. like Cramer.

ed,

I’m not against mining shares if you know what you are doing, just media whores like Cramer. (Nothing against whores, like most men I use to be one).

Gold is good!

I am all for buying more PMs but the central thesis here is flawed. Just because institutions haven’t been buying it, does not mean they will. Instutions are going to continue to rely on maintaining the established order and gold is a hedge against that. I do not see how their self-interest supports them buying significant volume of PMs.

Also, more mining equals more supply, which means lower prices. How much higher does the spot need to be to justify the long term investment for miners?

Anyone know what gold will look like when big bro money lords change from physical to digital currency? Big bro $$Lords like the Bank of England, that just ‘happens’ to own the ‘Federal’ Reserve? And most if not all the central banks on earth.

What good will gold be then? Right now though one can make some $$ via gold. But how long will that last?

Just curious…

SamFox

Sam

There will always be a black market. The NWO doesn’t object to black markets. They object to freelancers who don’t buy a license to run them. Same as drugs.

I do some underground trading myself. But money isn’t digitized yet & I don’t have a smart phone to listen in on me. When $$ is digitized, would you go black market to trade some of your bullets, water, bread, eggs & milk to someone with gold? I wouldn’t.

The NWO does care about every move you make. They just have not quite reached the place they can observe & control every transaction in every country. Have you looked at how the Chinese Communist govt tracks every thing their citizens do? We have to beware of their ‘social credit scoring’. Cameras every where, rewards to snitches, now they’ll be introducing drones. You can be sure that if they don’t already, there will cameras & listening devices like Alexa in every Chinese citizen home. That has already started here with listening devices disguised as vocal information centers.

Perhaps big bro will give digitized currency credits to those who trade in their gold. One never knows.

SamFox

The Chinese still have black markets. Of course it’s risky but with whats coming up living will be risky. These guys work for Satan and Satan likes crime and black markets.

Heres one to consider.

A guy scoffed last week when I said based on 1913 money, silver should be in the $550.00 oz. range. Somebody in the business agrees.

https://www.youtube.com/watch?v=5aU3OVrRRQU

Donkey…pay attention Flea is right…HOLD buddy!

Flea,

I’m not going start taking Silver profit (into other hard assets) until the Gold/Silver ratio is under 50 to 1, and of course other factors.

But, that seems like a wise move/point to start to lock in some serious profit.

mark,

on the fiat money thread where you talked about your friends who you were helping,who are those good dealers you use?

Tampa,

Colorado Gold, http://www.coloradogold.com I use David.

SD Bullion http://www.sdbullion.com.

Long history with Colorado, 12 years, 7 purchases with SD.

regarding silver,not gold–

i saw a headline but didn’t click that said silver is going to drop quite a bit at the end of this month?

has anyone else heard that?

Red.

I’ve heard or read those headlines but didn’t save the sources. It could happen temporarily but inflation and chaos will drive it back up. I would look for the banks to drive it down with uncovered shorts in order to accumulate at the bottom and also discourage us from stacking. Still, any price in the near future under 35 is still cheap for converting fiat. We are at -99cents so at some point when it crosses -1.00 they will change the currency and exchange the new fake stuff at a ridiculous premium. Anything in paper like pensions will be trashed.

Faith is better than pm’s but someone with no faith might stay alive with PM’s till they get Religion when TSHTF.