Submitted by Jan Nieuwenhuijs, of The Gold Observer,

The gold price is inversely correlated to the “real interest rate,” as derived from the 10-year Treasury Inflation Protected Security (TIPS). The 10-year TIPS is a U.S. government bond that protects the owner from consumer price inflation. If the TIPS interest rate, for example, is 1% and annual inflation 3%, the owner of the bond receives 4% interest (1% + 3%). The owner of the bond is always protected against inflation.

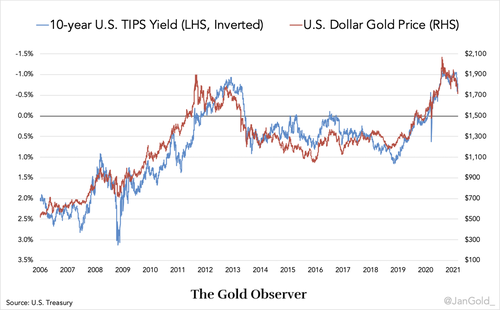

In the chart below you can see the correlation between the gold price and the 10-year TIPS rate. Note, the axis of the 10-year TIPS rate is inverted in the chart, because when the TIPS rate falls, the gold price rises, and vice versa.

According to bond market math the 10-year TIPS rate equals the nominal 10-year Treasury interest rate minus inflation expectations.

TIPS rate = Treasury rate – inflation expectations

Since March 2020, inflation expectations have been rising and so did the price of gold. But, from March until September the nominal 10-year Treasury rate barely moved (around 0.6%), after which it began to rise. Since October 2020 the 10-year Treasury rate is rising in a fashion that makes the TIPS rate go up, and thus gold down. At the time of writing the 10-year Treasury rate is roughly 1.6%.

The above is a very brief update on what is happening in the gold market. Currently, I’m working on a few articles that require a lot of research, but I wanted to give you a heads up on the gold price and its interaction with the bond market. We will discuss the correlation between the gold price and real interest rates in-depth in a forthcoming article.

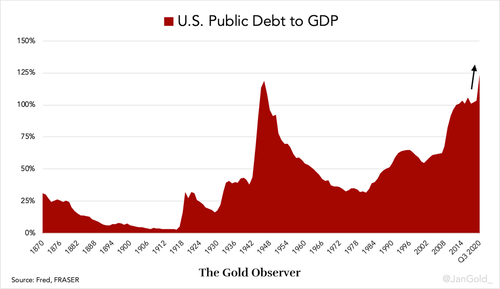

I think the gold price can stay weak for a while, but eventually I’m expecting the Fed to step in and lower long-term Treasury rates. Likely, the Fed will implement yield curve control to manage interest rates across the entire curve. The U.S. government has never been this much in debt and rising rates will push the government into bankruptcy. In addition, rising rates slow the economy (and hurt the stock market), which is not what the Fed wants at this point.

In the current economic environment, the U.S. government doesn’t want to be limited in spending, and so a possible scenario going forward is what happened after the Second World War. In the early 1940s the Fed put a cap on yields of government bonds across the curve; a policy that lasted for two decades. The Fed printed whatever was necessary to fund the government and inflation was allowed to run much higher than interest rates. The result was deeply negative real interest rates, which washed away the debt relative to GDP (see last chart). For more information read my article, “Why Yield Curve Control by the Fed Will Be Bullish for Gold.”

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

is now the time to buy gold/silver ?

Tampa,

There is no one single perfect time to buy PMs…And I have no idea of your personal prep/economic situation.

You’re asking a simple question that requires a complicated answer…but the answer has to be based on information none of us have.

To be honest…and I like you…I would spend the dying dollars I have to Prep with basic life needs first…no matter what my wife says or thinks…now you can do both at the same time…prep and buy PMs…I have. With me both have been processes not events.

Many years ago you asked me a Prepping question and I sent you this:

I don’t think you purchased it…if you did…all your Prepping, and sustaining life questions would have been answered. Better late than never.

It is written by a woman…share it with your wife…the author may win her over. My experience has been woman like this book.

You can’t drink or eat or stay warm or defend yourself with PMs.

Getting the PM buying/selling timing exactly right is a rare…here are two vids I have posted on other threads, by much wiser men than me…I would watch both.

Good luck Tampa!

thanks,i will buy it

I think it quite simple…any and every dollar you would save for the longer term (5+ years) save instead in gold and silver.

Now, investing for the short term in metals more problematic, but still not difficult. I have a very shallow understanding of financial markets or investment strategies, but there are VERY simple rubrics to use. The DOW/Gold ratio is simple one. If it’s over 15 move to gold, if its under 5 move to DOW. Over the past 100 years, you would have made only six transitions and would have made more than either the DOW or Gold.

The other thing that is very simple, is to make asymmetric bets. I think right now, you can make them very easily in the Gold and, particularly, silver miners. Find some very junior minors, companies that are struggling just to stay afloat with current prices, but hopefully with some proven reserves. Bet $100-200 bucks on them. You could lose it all, sure, but if precious metal prices skyrocket, they could go up 100s of percent, because their profits are based on margin. If an ounce of silver, let’s say, costs them $25 to produce…they are making less than a dollar per ounce. If it goes to $35, they are suddenly making $10 and ounce….a 1500% increase in profits on a 40% gain in silver price.

thanks

i think the crazy price of ammo in the states (where at least people can get the stuff without all kinds of insane restrictions) demonstrate that now the more relevant metals are steel, brass, and lead.

gold and silver are money for civilized society. Where things are headed i fear we will have more need of lead than of gold, until the whole modern world has crashed and something like an economy starts coming together again from the bottom up. and even then, its going to be a very touch and go environment probably for the lifetime of most of us reading and writing here, where any commerce that does re-emerge in the post-collapse world will need to rebuild trust and familiarity up from nothing, and rely heavily on security. probably a lot of piracy and other such parasitism will plague attempts at reviving any trade for a long time.

of course this is not easy for us to manage. most of us at least started prepping thinking that we’d move savings into PMs and from there start to get more self reliant , etcetera, but be able to fall back on savings in PMs for hard times. but the hard times coming now are gonna be way worse than previous times.. ask folks who lived through the 40s in europe about some of that. in many places there was at least a season of almost no food availability, people traded gold coins for a single potato or loaf of bread. i suppose the gold still made the difference between eating and starving, but if one were laying up preps right now, it’d make more sense to put away a barrel of wheat, than a gold coin, knowing that if it came down to it, the barrel of wheat would feed you for months and could _possibly_ even net you some gold coins in trade.

again though lead will be the penultimate precious metal, because with that, someone else will relieve you of both your wheat and you gold coins.

shitty times we’re living through and this is just the opening act.

Maybe the precious metals make more sense if you are in a position to be more community-reliant than self-reliant.

Precious metals only make sense after you have secured all the other forms of Prep…

In my mind everything flows downstream from the spiritual headwaters creating the cultural, political, and economic realities…in that flowing order…and PMs are just part of tail end Charlie…the economics.

The historical hedge, and wealth protection of PMs as the corrupt government and Banksters (congress & the Treasury & the FED…etc. etc. etc.) conspire to hyper inflate to keep the greatest debt bubble in the history of the world from imploding (that was one of the major reasons for the Lockdowns) owning PMs (and other hard assets WITH NO COUNTER PARTY RISKS) will make the difference in-between wealth and poverty in the coming inevitable popping of the ‘Everthing Bubble’. (It popped in Sept. 2019 starting in the REPO market).

Having PMs will put you in a much better position…that the vast majority of Americans are clueless about.

Only 12% of Americans own any gold, and 14.7% own any silver. Most of the others (and many holding…depending) will be wiped out in the coming Great Reset, never to recover economically as they are ping pong balls floating on the tide the Banksters control…they are simply clueless in all ways, probably wearing a mask, and eager for the jab among other walking dead Woke nightmares.

The greatest transfer of wealth in the history of the world started in 2008/9 and will be coming to a close in the early 2020’s, before 2024. It is a multi-generational plan by the international Luciferian Banksters.

BUT??? I have a sense the Luciferians have over-reached, and are trying to bum rush the world into the 7 years they are allowed by God…if that is true it is my hope God will teach them a lesson, and we will get more time???

Anyway, here is their playbook/plan from their god:

Assuming from the question the intent to buy gold and silver, they are significantly less expensive than they were in August 2020. Can they go lower? Yes. Will they go lower? Perhaps. You pay your money and you take your chances.

But be aware — you will not be able to buy gold or silver for anything near the paper price. Silver paper price is about $25, but you will have a hard time buying 1 oz silver rounds for less than $30; US silver eagles for less than $33/$34.

anytime is ok

How about the simple fact that the whole market is rigged and precious metals are at the center of the manipulation through fraudulent naked paper shorting on the Comex ?

very true, but their manipulation will continue right up until the moment those markets fly apart into complete irrelevance. so any paper ‘profits’ will in the end, supposing you were there to collect them, would also that moment be nothing but toilet paper (if you at least got it in clean bills it might work out a better deal on TP than paying the cash price of a roll by then! hah!)

still gold , and to some extent silver, are probably going to be for a while just long term wealth to save for a future generation. when there’s no economy, even the best kind of money doesnt buy anything. if these davos monsters manage to accomplish their global prison camp a.k.a. great reset, then that certainly will be a while where there wont be functioning markets where you’d dare let anyone know you have gold. they probably wont manage to complete their plans but theyre going for broke trying now. regardless, we have at least a couple decades of very sketchy conditions ahead and in such times money of any kind doesnt buy much. in the states silver might get back into circulation sooner than elsewhere.

“when there’s no economy, even the best kind of money doesnt buy anything”

(laugh) I’ve been saying that for ten years now, and whenever I do everybody gets mad and runs off on a tangent.

“A couple of decades of very sketchy conditions ahead and in such times money of any kind doesn’t buy much”.

Let me fix this for you:

“A couple of decades of very sketchy conditions ahead and in such times CURRENCY of any kind doesn’t buy much”.

Real ‘money’ will always be real ‘money’…fiat ‘currency’ will always return to its real value…ZERO.

It’s called history.

No Name,

Take those rose colored binoculars you are predicting through and reverse them…you are looking through the wrong end.

Want to laugh and cry with a fictional (but real) American family buddy? Through a ‘can’t stop reading novel’ taking place from 2029 – to 2047…that fits your post like a roll of currency dollars in a toilet paper tube?

With dry wit and psychological acuity, this near-future novel explores the aftershocks of an economically devastating U.S. sovereign debt default on four generations of a once-prosperous American family. Down-to-earth and perfectly realistic in scale, this is not an over-the-top Blade Runner tale. It is not science fiction.

In 2029, the United States is engaged in a bloodless world war that will wipe out the savings of millions of American families. Overnight, on the international currency exchange, the “almighty dollar” plummets in value, to be replaced by a new global currency, the “bancor.” In retaliation, the president declares that America will default on its loans. “Deadbeat Nation” being unable to borrow, the government prints money to cover its bills. What little remains to savers is rapidly eaten away by runaway inflation.

The Mandibles have been counting on a sizable fortune filtering down when their ninety-seven-year-old patriarch dies. Once the inheritance turns to ash, each family member must contend with disappointment, but also—as the U.S. economy spirals into dysfunction—the challenge of sheer survival.

Recently affluent, Avery is petulant that she can’t buy olive oil, while her sister, Florence, absorbs strays into her cramped household. An expat author, their aunt, Nollie, returns from abroad at seventy-three to a country that’s unrecognizable. Her brother, Carter, fumes at caring for their demented stepmother, now that an assisted living facility isn’t affordable. Only Florence’s oddball teenage son, Willing, an economics autodidact, will save this formerly august American family from the streets.

The Mandibles is about money. Thus it is necessarily about bitterness, rivalry, and selfishness—but also about surreal generosity, sacrifice, and transformative adaptation to changing circumstances.

“Real ‘money’ will always be real ‘money’”

(shrug) sure. but without a real economy real money is pointless.

Rut Roo…gman…is that your tell? (Hmmm)…

I bought 90 OZ in 1999 for $290 oz…..just sayin

Why the gold price is dropping is to shore up the illusion that the dollar is gaining value. The market price is suppressed by selling gold contracts at a lower price than current spot, with the knowledge that the gold will never be delivered. The contracts will later be settled with payments in currency.

When this kind of manipulation is happening, the saying ” Those who have gold aren’t selling, and those selling have no gold” applies.