The massive leveraging of US nonfinancial businesses over the last several decades is utterly incompatible with the stock market cap rising from 62% to 204% of GDP.

The US business economy is now carrying 13X more leverage than it did 50 years ago.

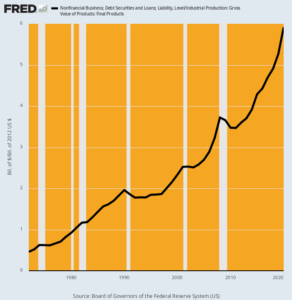

Nonfinancial Business Debt as % of Gross Production, 1972–2020

Here is what has actually happened to business balance sheets:

- Back in 1972, total business debt outstanding of $634 billion amounted to just 46% of the gross value of US industrial production, which was $1.38 trillion.

- By 2007, business debt had soared to $10.1 trillion and stood at 321% of the gross industrial production of $3.15 trillion.

- By 2020 the debt figure had risen to $17.7 trillion even as the value of industrial production had remained pinned to the flat line. That is to say, at the end of last year’s Fed-fueled borrowing spree in the US business economy, the leverage ratio clocked in at an off-the-charts 592%.

With this high leverage, growth and profits-generation will become steadily weaker over time. This means that the stock market capitalization rate of the national income should be falling, not heading skyward as described above.

Indeed, since March 2009 equity investors have come to realize that any correction would lead to a bounce and a new upward run. At the beginning it took a long time before positive trading emotions and Pavlovian rewards emerged, but as the bull run accelerated, the rewards came faster and faster.

Until very recently.

Previously, all the dips — even micro-dips — were almost instantaneously bought by the herd of traders and homegamers driven by Pavlovian reflexes, thereby reinforcing the power of positive feedback loops. But as Zero Hedge observed, this loop may finally be reaching its sell-by date:

Something’s different this time.

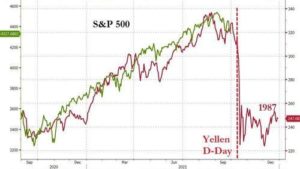

For the first time since the collapse in March 2020, the S&P 500 has failed to rebound back to new highs after testing its key uptrend technical levels.

Source: Bloomberg

The larger problem is the risk that an external shock — a black swan — will break the entire chain of dip-buying and options-based speculation and eventually trigger a put-buying stampede, especially among the homegamers who have never experienced a down market.

Their Reddit gurus will tell them they can ride out the storm and safely hang on to their FANGMAN, Teslas, and meme stocks by buying “protection” via puts on their portfolios. That, of course, will trigger more delta hedging among options dealers, more ETF liquidations, and more temptations for the fast money to engage in open shorting of a market suspended on a sky-hook.

As one analyst pointed out, the 1987 crash is a good illustration of the risks associated with out-of-control positive feedback. In the chart below, he laid the recent S&P 500 run against the final 12-months preceding the 30% stock market meltdown in October 1987.

We have no idea whether the high has yet been reached or what “shock” might cause the present coiled spring to lunge into reverse. But with each passing episode of sharp selloffs and only partial BTFD (buy the freaking dip) rebounds, the odds of a meltdown reversal continue to rise.

Editor’s Note: Washington DC politicians and central planners have unleashed the most destructive monetary policies in the country’s history. It’s a foolish financial gamble that will ensure the destruction of the economy, people’s livelihoods, and ultimately the US dollar.

The truth is, the biggest threat to your financial future is even BIGGER than the trillions of dollars in stimulus.

There are still steps you can take to ensure you survive the coming turmoil with your money intact.

That’s why bestselling author Doug Casey and his team just released an urgent new PDF report that explains how you to survive and thrive in the months ahead. Click here to download it now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Might want to stock up on guns,gold,grub——and GOD.

Proverbs 21:31 The horse is prepared against the day of battle, but safety is of the Lord.

Stock up on necessities but remember the Lord is more important.

Now if only He would show up when we really need Him.

Respectfully disagree. God gave us the both the ability and the obligation to provide for our own safety. However, we continually refuse to do so in the name of ‘civility.’

The USSR survived for seven decades with less resources at its disposal. Who knows how long their levitations will survive, absent a epiphany from the masses…or even a smattering of the masses.

The Soviets had London and New York bankers, as well as captive populations to loot and consume. Look at the natural resource base of the CCCP: stunningly huge. Of course, they wasted most and misallocated the rest…

Fair enough, but the USSA’s corporate partners and denizens can carry the load for sometime.

What they are doing is inflating the currency, taking away our buying power and using it to buy real assets, it’s a giant Ponzi scheme, they’re playing musical chairs and if we don’t do anything they are going to be the only ones allowed a seat when it all ends.

They are trying to set up a neo feudal system, that’s what the great reset is, that’s what the social credit ESG banking system is set up for. That’s why they will collapse the system, to do a tear down to Build Back Better, better for them not us. That’s why they are buying up all the single family housing, because home ownership is a way t that the middle class uses housing costs to build wealth.

They are trying to thread the needle between a reset that they control and a total economic collapse that is reminiscent of the end of Rome.

I don’t trust that the bankers and self entitled self defined elites can pull it off because the world’s economy is too complex to break up and have the soft landing needed for a reset.

Factor in that the death injections are going to throw a big spanner in the works, and soon. It appears that the Great Reset Davos WEF crowd have been played by the lucerfierian death cultists. Because they can’t have both things a great reset and a world wide Jonestown

(((Stockman))) has predicted 37 of the last 0 market crashes. He should go back to writing gun-grabbing articles for his Jew friends. We all know the economy is rigged.

Ken31, I agree, I listened to him in mid 2015, he was screaming get out of the stock market. I don’t disagree with his analyses and concerns including this one. Stockman’s predictions relative to timing is 0 for 37