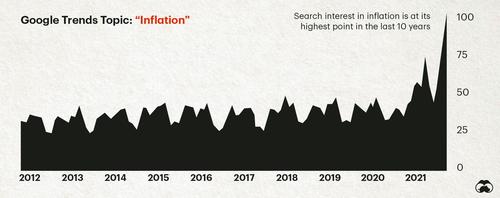

Prices have been going up in a number of segments of the economy in recent months, and, as Visual Capitalist’s Nick Routley exposes below, the public is taking notice. One indicator of this is that search interest for the term “inflation” is higher than at any point in the past decade.

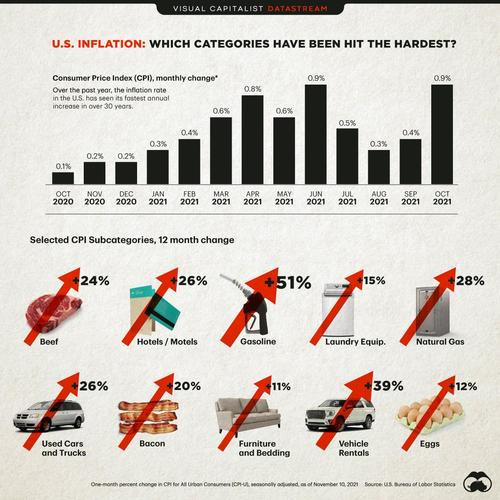

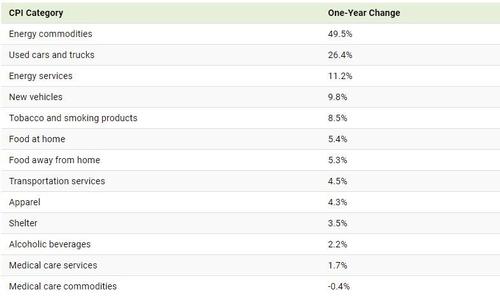

Recent data from the Bureau of Labor Statistics highlights rising costs across the board, and shows that specific sectors are experiencing rapid price increases this year.

Where is Inflation Hitting the Hardest?

Since 1996, the Federal Reserve has oriented its monetary policy around maintaining 2% inflation annually. For the most part, U.S. inflation over the past couple of decades has typically hovered within a percentage point or two of that target.

Right now, most price categories are exceeding that, some quite dramatically. Here’s how various categories of consumer spending have fared over the past 12 months:

Of these top-level categories, fuel and transportation have clearly been the hardest hit.

Drilling further into the data reveals more nuanced stories as well. Below, we zoom in on five areas of consumer spending that are particularly hard-hit, how much prices have increased over the past year, and why prices are rising so fast:

1. Gasoline (+50%)

Consumers are reeling as prices at the gas pump are up more than a dollar per gallon over the previous year.

Simply put, rising demand and constrained global supply are resulting in higher prices. Even as prices have risen, U.S. oil production has seen a slow rebound from the pandemic, as American oil companies are wary of oversupplying the market.

Meanwhile, President Biden has identified inflation as a “top priority”, but there are limited tools at the government’s disposal to curb rising prices. For now, Biden has urged the Federal Trade Commission to examine what role energy companies are playing in rising gas prices.

2. Natural Gas (+28%)

Natural gas prices have risen for similar reasons as gasoline. Supply is slow to come back online, and oil and natural gas production in the Gulf of Mexico was adversely affected by Hurricane Ida in September.

Compared to the previous winter, households could see their heating bills jump as much as 54%. An estimated 60% of U.S. households heat their homes with fossil fuels, so rising prices will almost certainly have an effect on consumer spending during the holiday season.

3. Used Vehicles (+26%)

The global semiconductor crunch is causing chaos in a number of industries, but the automotive industry is uniquely impacted. Modern vehicles can contain well over a thousand chips, so constrained supply has hobbled production of nearly a million vehicles in the U.S. alone. This chip shortage is having a knock-on effect on the used vehicle market, which jumped by 26% in a single year. The rental car sector is also up by nearly 40% over the same period.

4. Meats (+15%)

Meat producers are facing a few headwinds, and the result is higher prices at the cash register for consumers. Transportation and fuel costs are factoring into rising prices. Constrained labor availability is also an issue for the industry, which was exacerbated by COVID-19 measures. As a top-level category, inflation is high, but in specific animal product categories, such as uncooked beef and bacon, inflation rates have reached double digits over the past 12 months.

5. Furniture and Bedding (+12%)

This category is being influenced by a few factors. The spike in lumber prices along with other raw materials earlier in the year has had obvious impacts. Materials aside, actually shipping these cumbersome goods has been a challenge due to global supply chain issues such a port back-ups.

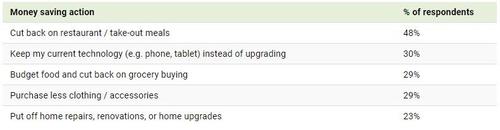

How Inflation Could Influence Consumer Spending

Rising prices inevitably impact the economy as consumers adjust their buying habits.

According to a recent survey, 88% of Americans say they are concerned about U.S. inflation. Here are the top five areas where consumers plan to cut back on their spending:

Will Inflation Continue to Rise in 2022?

Many experts believe that U.S. inflation will decelerate going into 2022, though there’s no consensus on the matter.

Improved semiconductor supply and an easing of port congestion around the world could help slow inflation down if nothing goes seriously wrong. That said, if the last few years are any indication, unexpected events could shift the situation at any time.

For the near term, consumers will need to adjust to the sticker shock.

* * *

Where does this data come from?

Source: U.S. Bureau of Labor Statistics – Consumer Price Index (November 10, 2021)

Data Note: The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and

urban wage earners and clerical workers, which represent about 93% of the total U.S. population. CPIs are based on prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy for day-to-day living.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Natural gas 28% That’s a good one!

Sept. .24@therm

Oct. .35@therm

Nov. .40@therm

For the math challenged, that is 60% and heating season just started. I will bet on 140 to 150% by February.

Slo Joe is on our side. NOT

Balb- I would say that if your January/February heating bill is usually $350 to prepare for $750 . If we start having the kind of winter China and Russia are having, it could be much worse. Edmonton in Canuckistan has had some horrid weather and we are a month away from winter.

On my last bill, my NG was exactly the same price as last October’s bill $0.995 per MCF

The main reason fuel prices are up is Joe Biden. He took actions his first day in office to restrict the supply and shut down production. And ZH blames… the pandemic.

Give me a break.

This is true. The main reason is not the restricted supply itself; it’s that it removed the incentive for other oil producing nations to keep their production up. They had been maintaining high levels of production in order to make American production in places like (but not exclusive to) the Bakken formation economically unviable. Biden shutting the Keystone pipeline and other pipelines and taking federal lands out of production signaled other oil-producing nations to go ahead and restrict production and force prices higher.

Does anyone know where the flush handle to the DC Metro area is?

No, but I’ll personally start a go fund me page for anyone who can find said handle. It would be the greatest fundraiser of all time. 🙂

Rising oil prices is a bonanza to Putin and the Ruskies. Trump was hurting them in the pocketbook and the first thing the creepy, old, senile pedophile did was to bottle up our natural resources, letting the Ruskies and Saud’s restrict production and push prices up. I’m sure Hunter’s old Ukrainian company is doing quite well, so buying the Biden influence was a good investment.

Let us not forget the appointed secretary of energy is jennifer granholm from the communist state of michigan. Yes, I am from the communist state of michigan where lie, cheat and steal has become the new political norm.

Real inflation over the past several decades has in fact averaged about 10%.

That number is derived using the method for calculating inflation used by the U.S. government up until 1980, when they starting re-defining inflation to make it appear lower than it actually was/has been/is.

I didn’t look at the source, but I doubt the new car increase accounted for this….

When trucks are advertised at $10,000 over MSRP, what does MSRP even mean?

I recently saw a loaded F-150 @ $15K over list.

Let it rot on the lot.

At least we didn’t need to buy furniture and bedding this year. Just everything else that had high inflation.