With the headlines blaring, “‘Extraordinary’ – US Consumer Prices Soar At Fastest In Over 40 Years”, citizens struggle to pay their bills and protect their wealth.

With the headlines blaring, “‘Extraordinary’ – US Consumer Prices Soar At Fastest In Over 40 Years”, citizens struggle to pay their bills and protect their wealth.

Chuck Butler regularly asks his Daily Pfennig readers, “Got Gold?”

Why is gold special? As J.P. Morgan said, “Gold is money. Everything else is credit.”

Historically people sought a reliable medium of exchange for goods and services. Seeking Alpha explains “Aristotle’s Money Criteria Support Gold”:

“At the heart of the idea surrounding money, the purpose is to swap universal value back and forth even when both persons don’t match up on their desired goods and services at that point in time. So, Aristotle came up with 4 characteristics of this universal value (what we call money). The four absolutes of money include:

1. Durable– the medium of exchange must not weather, fall apart, or become unusable. It must be able to stand the test of time.

2. Portable– relative to its size, it must be easily moveable and hold a large amount of universal value relative to its size.

3. Divisible– should be relatively easy to separate and put back together without ruining its basic characteristics.

4. Intrinsically Valuable– should be valuable in of itself, and its value should be totally independent of any other object. Essentially, the item must be rare.”

I’d amplify #4; whatever constitutes money has a somewhat finite supply. You can’t weave straw into gold.

Mark Nestmann tells us, “Gold is still the ultimate store of wealth. It’s the world’s only true money. And there isn’t much of it to go around. All of it ever mined would fit into a small building – a 56-foot cube. The annual world production would fit into a 14-foot cube, roughly the size of an ordinary living room. If each Chinese citizen were to buy just one ounce, it would take up the annual supply for the next 200 years.”

Governments create “fiat” currency, basically paper money. Investopedia explains:

“Fiat money is a government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the government that issued it. The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it.

Most modern paper currencies are fiat currencies, including the U.S. dollar, the euro, and other major global currencies.

KEY TAKEAWAYS

- Fiat money is a government-issued currency that is not backed by a commodity such as gold.

- Fiat money gives central banks greater control over the economy because they can control how much money is printed.

- Most modern paper currencies, such as the U.S. dollar, are fiat currencies.

- One danger of fiat money is that governments will print too much of it, resulting in hyperinflation.”

The word “fiat” is translated as “it shall be done.” Fiat currencies only have value because the government says it is so. While fiat currencies may be durable, portable, and divisible, they have no intrinsic value

| “If you don’t trust gold, do you trust the logic of taking a beautiful pine tree, worth about $4,000 – $5,000, cutting it up, turning it into pulp and then paper, putting some ink on it, and then calling it one billion dollars?”

— Kenneth J. Gerbino |

Fiat currency is nothing more than a political promise and is as sound as the government and politicians backing it.

It is used because people comply with the government decree and agree to accept it. They trust that it will be accepted by merchants and other people.

For almost 200 years the US dollar was backed by gold or silver. Today the US dollar is an IOU from the Federal Reserve, not backed by anything. The emperor has no clothes….

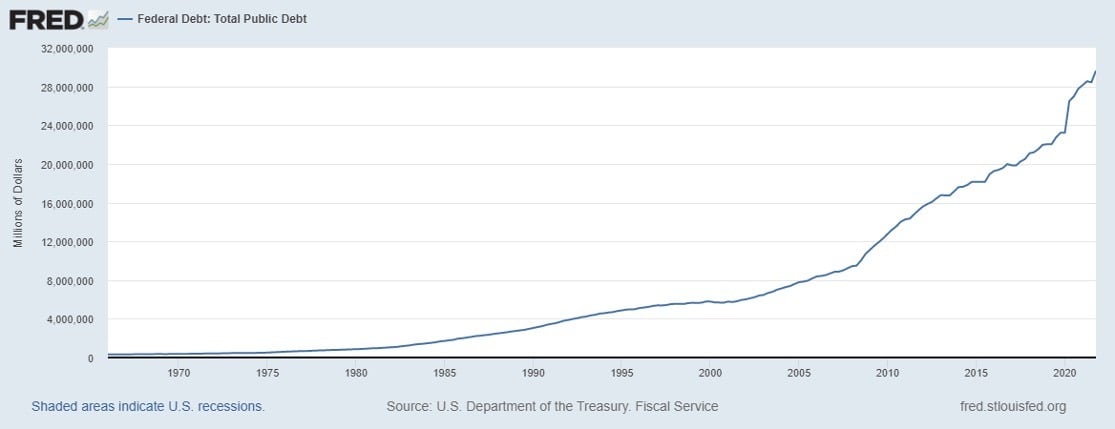

The gold standard limited government spending to the amount of gold/silver they have and what they can borrow in an open market. In 1971, President Nixon took the US dollar off the gold standard and government spending/debt has skyrocketed.

The danger of a fiat currency is inflation, and even hyperinflation. Seeking Alpha continues:

“Fiat paper currencies (digital…included) are convenient for stabilizing economies and redistributing wealth. But fiat currencies miserably fail Aristotle’s fourth and most important principle, the intrinsic value principle. …. History tells us time and time again that these currencies tend to be produced more and more and the supply rarely contracts.

“Fiat paper currencies (digital…included) are convenient for stabilizing economies and redistributing wealth. But fiat currencies miserably fail Aristotle’s fourth and most important principle, the intrinsic value principle. …. History tells us time and time again that these currencies tend to be produced more and more and the supply rarely contracts.

It comes as no surprise that no fiat currency has ever lasted more than a few hundred years at best.

| “All money is a matter of belief.”

— Adam Smith |

The Denarius (Rome’s currency) slowly reduced its coinage from 94% to .05% silver content over a period of about 170 years. By the time the Roman Empire collapsed, no one accepted the Denarius as a medium of exchange.

The French also had several very unsuccessful attempts at fiat currency. John Law first introduced paper money to France called “Livres”. The new paper currency rapidly became oversupplied until, yet again, people demanded coinage instead of paper money.

By the 18th century, the French government, again, tried to give paper money a shot with “assignats”. By 1795, inflation erupted to around 13,000%.

…. What Aristotle described as money several thousand years ago still holds true today. The lesson is simple. Fiat currencies do not work as a long-term store of value, and eventually, all of them collapse. It makes no difference whether the currency is digital or paper. Fiat money has not worked in the past, and our currencies of today are no different.”

Politicians never change

Politicians want power and control over the population for their benefit. They think they are God, controlling and redistributing the wealth of the nation to suit their political purposes. They spend more than they collect in taxes, making promises they cannot, nor do they intend to keep, buying votes. They create more fiat currency to finance the illusion.

The U.S. Debt Clock shows us that US government debt is over $30 trillion, over $91,000 per citizen.

Government “unfunded” political promises dwarf that number – $169 trillion, over $500,000 per citizen.

![]()

Those political promises are impossible to keep. In 2021, “57% of US households paid no Federal Income Tax.” Our country is being flooded with illegal immigrants, adding to our already enormous welfare system.

The Federal Reserve reports 39% of Americans don’t have enough money to cover a $400 emergency. Who’s going to pay for these politicians’ promises? It’s no wonder all fiat currencies eventually collapse.

Blame the political class. They avoid unpopular tax increases; spending trillions more than they collect in revenue. They sell what debt they can at negative interest rates and allow the Federal Reserve to create the shortfall. They behave as though money grows on trees. This created a huge inflation problem which is robbing the wealth of the nation. Rather than address the problem, they resort to deception.

Blame the political class. They avoid unpopular tax increases; spending trillions more than they collect in revenue. They sell what debt they can at negative interest rates and allow the Federal Reserve to create the shortfall. They behave as though money grows on trees. This created a huge inflation problem which is robbing the wealth of the nation. Rather than address the problem, they resort to deception.

Peter Warburton warned:

“What we see at present is a battle between the central banks and the collapse of the financial system…. The central banks preside over the creation of additional liquidity for the financial system to hold back the tide of debt defaults that would otherwise occur.

…. They incite investment banks and other willing parties to bet against a rise in the prices of gold, oil,…commodities or anything else that might be deemed an indicator of inherent value.

Their objective is to deprive the independent observer of any reliable benchmark against which to measure the eroding value, not only of the US dollar, but of all fiat currencies. Equally, they seek to deny the investor the opportunity to hedge against the fragility of the financial system by switching into a freely traded market for non-financial assets.”

Chris Powell explains how banks rig the gold market using derivates and Central Bank leasing:

“…. Gold derivates have created a vast imaginary supply of gold – a supply of paper certificates for gold that does not exist but for which delivery has not been demanded. That’s because most gold investors leave their gold purchases on deposit with the investment banks that sold them only promises of imaginary gold.

…. The world now has a fractional-reserve gold banking system that is leveraged in the extreme.

…. Gold market consultant Jeffrey Christian of CPM Group testified…that the ratio of “paper gold” to real metal in the so-called London physical market may be as high as 100 to 1. That is, there are as many as a hundred claims on every actual ounce of metal traded or vaulted in the London market.”

No fiat currency has lasted more than a few hundred years at best. What happens to those who own gold when the US dollar collapses?

Rick Santelli warns, “If you trade in paper, the notion of many who trade gold…if the financial world comes to an end, they’re going to have the gold. If you’re playing in ETFs, you’re going to have a piece of paper.”

George Bernard Shaw adds, “You have to choose [as a voter] between trusting to the natural stability of gold and the natural stability of the honesty and intelligence of the members of the Government. And, with due respect for these gentlemen, I advise you, as long as the Capitalist system lasts, to vote for gold.”

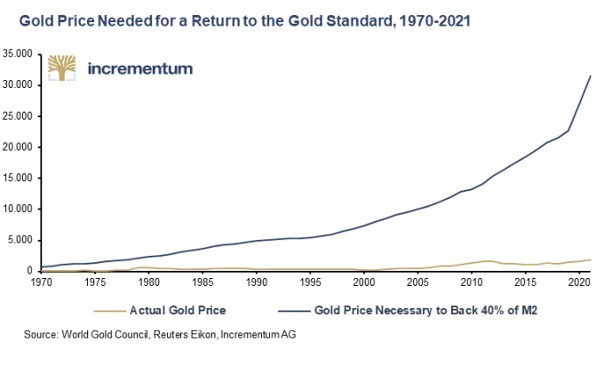

Matterhorn Asset Management provides a graphic for the gold price should it return to the gold standard, 1970-2021.

I hold mining stocks and physical metal, no paper gold. It is not for sale!

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

Gold is not magic, it isn’t going to increase in value like early Microsoft or Amazon stock, BUT it will retain value as the dollar gets destroyed.

At some point in 2011, gold hit a high and has pretty much stayed there. With all of this inflation…I thought gold was supposed to increase in price with high inflation. Isn’t it supposed to be an inflation hedge?

“Because gold is considered a hedge against inflation, many investors decide to buy gold to protect their capital against value erosion, which arises from an increase in general prices. At the time of writing, gold’s rate against the USD is around $1,390 and has been strongly influenced by the Fed’s recent comments regarding potential upcoming interest rates cuts.” Article from inflation.com 2019.

Yesterday:

Glock-Depends if you are talking about a tail hedge from hyper inflation or just increase on value as inflation creeps. Those who purchased gold when it was $250 to $800 per oz have seen a respectable increase in value. Paper contracts and stock hype may look more exciting but those can become completely worthless overnight, where holding physical gold in your hands will never become worthless and will retain your wealth with no third party. As a tail hedge, it will give you the ability to buy your way out of SHTF situations like an insurance. Most likely you will see great gains in gold price during intense hyper which is the “tail” of which I speak.

Gold is a losing to inflation as we speak.

Just wait how Gold will lose to hyperinflation!

It sure is.

That should be (counter-party risk), not third party….proof read Bea.

For some perspective, the USD has lost 22% of its value since 2011. So in dollar terms gold is up 22% even though its price is flat. Get it?

Current Dow down -1063, gold up $9. Techs getting hit while gold yawns.

Russian ruble on fire, gaining strength.

I’m talking about cash.

No because if you convert that gold to cash, your cash has lost 22%. Are the things I need priced differently in cash vs. gold?

Glock- You don’t convert to cash if you are holding /retaining wealth in gold. You ONLY sell gold for fiat if you HAVE to. You will need to move from gold before the USD replacement is implemented. Even then, keep some gold as the CBDC may not work out as planned.

The citizens in India are a good example Glock, they learned the hard lesson of “currency”. They GENERATIONALLY hold their wealth in gold. They ONLY sell if they need currency to meet an obligation. That is how they avoid swings in buying power or the currency becoming worthless..

And 99% of them eat bugs for breakfast. How does gold gain on currency if you buy and sell into that currency? It can’t. If I purchase $100 worth of gold and gold never goes higher but the currency loses 20% purchasing power, than so does the gold I’m holding.

Yes, against other assets that are losing value against gold/dollar, then I win.

Are you purposely being obtuse? If you paid $1900 for an ounce of gold in 2011, you have an ounce of gold in 2022. $1900 is now worth $1500 due to inflation. You can’t buy an ounce of gold today for $1500. The $1900 doesn’t happen in a vacuum. You have to earn the $1900 to buy the gold. Today you have to work many more hours to earn the $1900 than in 2011.

I give up Glock….if I bought gold at $250 oz at a time when it cost $50 for a weeks groceries, that gold is now $1900 but the weeks groceries now cost $400…. how did I not retain my wealth and hedge inflation? The dollar lost huge value while my oz. of gold went up greatly. If I need to sell the gold to cover an emergency, I could but otherwise I sit on it and retain my purchasing power. What if it went to $5000 per oz? Did I do well, did I hedge against inflation? This is not hard.

What if the dollar goes full retard and it costs $100 for a loaf of bread, while gold goes to $15,000 an oz, how many loaves of bread could I buy compared to you holding only USDs, how many loaves are you able to buy?

BL,

You’re talking about ifs. You’re also talking about buying before gold exploded.

I’m saying, if gold doesn’t go higher, and it really hasn’t since, what, 2011, then your gold is losing power the same way as the dollar. Why isn’t gold going up right now? We have, what, highest inflation in 40 years or something? What’s keeping it down? Will whatever is keeping gold down be able to keep it down for longer? How much longer? Is paper gold checkmate?

Wip is right.

Gold was $2500 in 1980. Hope you didn’t buy then. Equivalent to around $9000 current dollars. But it is 1900. Or it has lost 3/4 of its value since then.

Timing is everything.

I can’t tell if you’re kicking my ass or if you don’t know that gold was $850 in 1980.

Gold was 2420 on April 1, 1980, according to my charts.

Gold reached 2500 in Jan 1980.

Sorry – there is a bad chart floating around. $850 is right it seems. Which would be over $3000 in today’s dollars.

But if you sell that $1,900 gold, the $1,900 dollars you get are worth $1,500.

That is entirely true. If instead of gold, someone bought stock etf for 2200, they would now be able to trade that for 2.5 ounces of gold. Thems the facts Jack.

No you don’t. That is ridiculous. You got this entirely backwards. In today’s dollars, an ounce of gold costs 1900 or whatever. 10 years ago it cost 2200. Which in todays dollars is around 2700.

But you can get an ounce of gold for 1900. So it takes literally 2/3 the working hours today to by an ounce than it did 10 years ago. Assuming wages have matched cpi, which they more or less have.

Seriously, Admin – you have this wrong.

Seriously, admin, you are not seeing it. Yes you can buy an ounce of gold for 1500 in 2012 dollars (1900 or whatever current dollars). It cost 2200 in 2012. So it has cratered.

You can buy an ounce of gold for 30% less labor today than in 2012.

Say you used to make 2200 in 2012 and gold cost 2200. You now make 2700 in 2022 dollars – wages have kept up with inflation more or less. Gold costs 1900 in today’s dollars. But you make 2700. So you can buy an ounce of gold with around 2/3 the labor it took 10 years ago.

Gold has done very poorly last 10 years. If you put the price of gold in stocks 10 years ago, and sold today, you would now have 2.5 ounces of gold. If you put the 2200 in the bank at 0% interest in 2012, and bought gold today you would now have 1 1/7 ounce of gold. Even though inflation has been high. Gold has dropped faster than inflation.

Horseshit. Indians have no fucking wealth. The MEDIAN wealth of an Indian adult is $3200. That is the MEDIAN. So the median adult if he converted all they have of everything would have ……. 1.5 ounces of gold. Indians spend every fucking cent they have on a bowl of rice.

“CBDC WILL not work out as planned”

Fify

Svarga- Gold will still be a store of wealth LONG after any scheme fiat like CBDC is just a memory. I don’t think CBDC will be around long either. 🙂

Hi,

In 1999 the average price for gold was $278.86.

Best regards.

Dennis Miller

That’s right Dennis, and lucky are the folks who bought gold and held on to it.

BL,

My first thread with Maggie.

6. We put the remainder (about 50%) into Precious Metals. At the time, 1999, I saw PMs as the greatest potential long term macro move of my life. I was right. I believe there is great potential and safety today in PMs and we are still stacking.

https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

https://www.macrotrends.net/1470/historical-silver-prices-100-year-chart

The third Precious Metals Bull Market of my lifetime (and potentially the greatest) is on the launch pad.

BL,

Yes, of course IF YOU BOUGHT IN 1999.

Why hasn’t gold gone up during the highest inflation in the last 40 years?

Now that the Fed is raising rates, you think gold is going to $5,000/oz?

Au contrare , mon ami. If gold was $2200 in 2012, which it was, and it is now around $1911, which it is, then gold has lost around 30% of its buying power in the last 10 years.

In other words, you can buy an ounce of gold for $1911 at the moment. $1911 is = to say $1500 in 2012 dollars. So you have lost almost $700 an ounce in 2012 currency (2200-1500). Or its relative value to inflation has dropped almost 1/3 in 10 years.

You have it bass akward. Sorry but that is the way it is. For gold to be up 22% it would need to be around the 2800 mark. It has not held its value in the last 10 years. It has cratered.

If you used the 2200 to buy a full breadth of stocks 10 years ago you would now have double that, say 4400, which would buy almost 2.5 ounces of gold. Today. Of course timing is everything.

And 8 people gave you a thumbs up.

Yes. As long as the current system is maintained with the gold price controlled the banks with their imaginary paper gold this will hold true. When (or if) that control is lost, the price of gold will explode relative to the fiat currencies. Therefore, it seems prudent to be diversified and have some of your assets in gold, some in land and some in the BS financial markets (which I have not really done so did not realize a lot of gains since they have kicked the bucket down the road a lot longer than I expected them to be able to).

“With all of this inflation…I thought gold was supposed to increase in price with high inflation”

gold does. GLD – the paper-backed comex “gold” – doesn’t. the comex just prints “gold certificates” in complete disregard of any quantity of actual gold they have on hand, and they reserve the right to settle any account in dollars instead of gold. this means the supply of GLD is subject entirely to their control, just like the dollar, and they pass this off as being the price of gold itself. and this does indeed control the price of gold itself, since most dealers won’t vary much from the GLD price.

rant 7,

You’re agreeing with me or?

more like clarifying. in markets, yes, gold is an inflation hedge. but we no longer have access to markets, rather we have access only to scams and fronts that are use to control the price of (fill in the blank).

Glock, the crash hasn’t even started yet.

We do not have monetary inflation in isolation, we have supply inflation being combated with demand destruction . These are not markets, but cartels.

The fed actually bought some breathing room on inflation by strengthening the dollar with the rate hike. I don’t pretend to know how long that can kicking can last, but I haven’t heard anyone else mention that it effectively exports lots of USD by having the fed fund rate nominally positive.

Ken31

Miller forgot to include the attribute of fungible, to gold.

Gold is a hedge against a fiat monetary system… or it should be… if the Plunge Protection Team and the ability to create/destroy millions of paper gold/silver contracts wasn’t in place. But then, TPTB don’t want market discovery…

So, gold ain’t too good if .gov can control its price then.

Why is gold special?

You can hammer/roll it in to thin sheets of foil…And garnish your cake before you eat it.

Virtually every fleeing anybody is always caught with suitcases/duffel bags of $100 bills. more of them than $1 bills in circulation.

Must be something to it. Worthless? maybe, but even a child perceives ‘value’ in change and cash.

Wouldn’t hurt to get some. Gonna carry around triple-beams and pare off grams of gold and silver?

Until we are trading food for water/other. cash will rule.

Rafi Farber has an interesting take on “fiat” currencies. They are entirely misnamed. The idea that they have value because the government dictates that they do is silly. Why would they ever lose value then? Why did not the government of Weimar simply decree that the Reichmark shall have value?

They could more accurately be called “confidence” currencies. Yes, they are printed at the whim of the government, but they have value as along as the people believe that they do.

“Rafi Farber has an interesting take on “fiat” currencies. They are entirely misnamed.”

indeed. they’re not fiat currencies, they are fiat debt. for every $1 trillion the “federal” “reserve” prints, we owe them $1.1 trillion or so.

by the time gold is money again the entire distribution system will have collapsed and no-one anywhere will be selling what’s left for any amount of gold. silver too.

But they still will be selling for paper Dollars?

I mean what’s the argument.

When the SHTF and the system completely collapses, money, including precious metals, will be useless. Barter for food, ammunition, and other goods will be the rule. Shiny gold coins and bars will be nothing more than pretty paperweights.

“what’s the argument”

that very little selling of any kind will be taking place. goods simply will be scarce and hoarded.

Not even barter?

sure, some, here and there. but barter isn’t all that fungible, especially when there’s few goods or services to obtain at any price. you may be a good repairman and need a new pair of shoes, the guy down the street needs his field plowed and will trade a goat for it, and another guy has a load of potatoes and needs some medicine for an infection – well, that doesn’t barter very well. even now with grid up, people have formed barter clubs where lots of people gather to trade goods and services – but they peter out, ’cause it’s just not fungible. it’ll be worse grid down when there’s little to be had to begin with. gold doesn’t make goods and services appear, it can only work with what exists already, and there won’t be much.

It’s pretty.

Lead.

Invest in lead.

It’s value is Ft/sec, not ounces.

😂 and ft/lbs dissipated

yeah, sure, but others will be “investing” in that too, and chances are high that their “investment” will outshoot yours. and even if it doesn’t, it only takes 1/10 ounce to bankrupt your entire business plan.