Best of Dennis…

Dennis is tending to his health again and hopes to be back writing very soon. Here’s an article that is a very interesting look back at the 2017 market and is worthy of a re-read in these times. This article was originally posted on December 7, 2017.

When Advice Conflicts, Who Should You Listen To?

We moved to Texas in the early days of the dot-com boom. I reconnected with a boyhood friend Tom. He has an economics degree from an Ivy League school, became a successful stockbroker and economics consultant.

We moved to Texas in the early days of the dot-com boom. I reconnected with a boyhood friend Tom. He has an economics degree from an Ivy League school, became a successful stockbroker and economics consultant.

My broker would “suggest” I consider some of the hotshot dot-com stocks. Tom provided a good offset, suggesting caution.

Many of these companies were not making money. Those showing profits had extreme price/earnings ratios; their stock prices were outrageously high. Tom warned that “eventually” the tech market would suffer a horrible crash.

Who should I believe, my life-long friend, a recognized expert, or my stockbroker? I cautiously limited my exposure to the tech sector and invested in other areas. While they did not provide astronomical gains like some tech stocks did, we did well.

Tom’s prediction “eventually “came true.

Wikipedia supplies the details:

“The value of the NASDAQ…. rose from 1,000 in 1995 to 5,000 in the year 2000. By the end of the 1990s, the NASDAQ Composite reached a price-earnings ratio of 200….

…. On March 10, 2000, the NASDAQ Composite peaked at 5,132.52, but fell 78% in the following 30 months.”

I second-guessed myself constantly, wishing I had invested more. I’d calculate fantasy profits I would have made if I had enjoyed the frenzy; buying and selling at exactly the right moment.

Should I have paid more attention to my broker than Tom? He was “eventually” right, but a lot of people made billions while I sat on the sidelines waiting for the inevitable crash!

The Beat Goes On

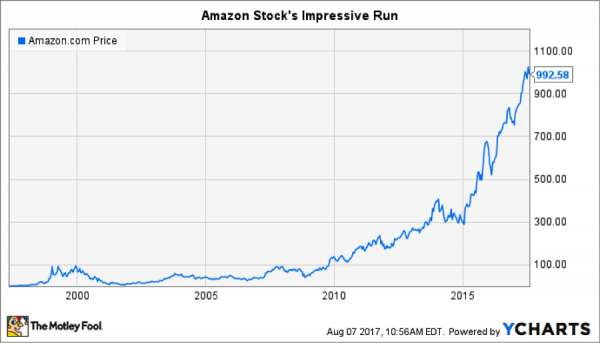

How many of us wish we had bought Amazon a decade ago and held on? In August 2017 Yahoo Finance’s article, “Amazon Stock’s History: The Importance of Patience” tells us:

“Amazon.com has an impressive stock price history – perhaps one of the greatest over the past two decades. After accounting for three stock splits, Amazon’s shares have advanced from $1.50 in May 1997 to near $1,000 today – a 66,600% return!”

The price has risen another 10% and now sits above $1,100/share. Investor’s patience has been rewarded handsomely over the last decade.

A different perspective

Recognized expert, Bill Bonner, has a different perspective. His recent article, “The World’s Favorite Stock Is Doomed” describes the dilemma:

“Nearly 20 years ago, we described Amazon as the ‘River of No Returns.’

Since then, the stock has made investors rich, and we looked like a fool for two decades.

…. Amazon is now one of the most richly valued stocks in the whole world….

…. Two friends and colleagues (both former Wall Street insiders), Rob Marstrand and David Stockman, examined Amazon carefully and independently. They came to the same conclusion: The company loses money in its core retail business.

…. In other words, the business model is a failure.

…. It’s still the ‘River of No Returns.'”

The greater challenge

The concern is more than Amazon; it’s the entire market. Some experts feel it is overvalued and is due for a major crash. Others feel there is still plenty of money to be made before a correction.

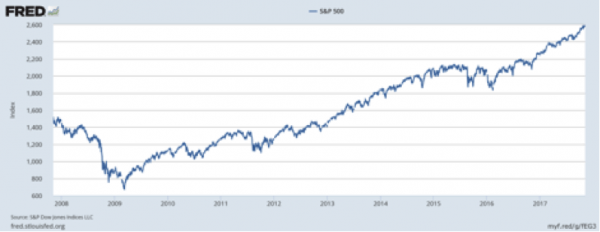

When stocks tanked in 2008, interest rates hit historic lows as the government created trillions of dollars out of thin air to bail out the banks. Historically, massive scale money printing leads to high inflation, which causes stocks to fall.

Many predicted another, inevitable crash. Some investors sat on the sideline, while others, desperate for yield, poured money into the stock market driving it to all-time highs.

A recent “Federal Reserve press release” paints a positive picture for what lies ahead:

“Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate… Household spending has been expanding at a moderate rate, and growth in business fixed investment has picked up in recent quarters.

…. Consequently, the Committee continues to expect that, …economic activity will expand at a moderate pace, and labor market conditions will strengthen somewhat further.”

I recently interviewed Matt Kerkhoff. Matt studied under renowned expert, Richard Russell and I value his opinion.

We discussed TINA (There Is No Alternative) – the idea that the market is currently high because investors, desperately seeking returns, are left with few alternatives. Matt is not alone when he tells us:

“Right now, we’re in the midst of a strong primary bull market. Economies around the world, including our own, are showing slow but sustainable growth, and this provides a great backdrop for stocks.

…. But that will change. Ultimately, our current situation will come to an end, and we’ll see the stock market top out on a longer-term basis.

…. For now, enjoy the bull market!”

Matt echoed his comments in a recent article for Dow Theory Letters paid subscribers, “Three Concerns Plaguing Investors”:

“While there are always a host of concerns for bulls to worry about, right now the primary areas of weakness do not appear to be harbingers of an impending change in the primary trend. We’ll continue to monitor as conditions evolve, but right now investors should stay the course until further developments arise.”

Is the bubble about to burst?

A recent CNBC article, reports, “Since the prior bear market ended in March 2009, this advance in equities is now the second-oldest on record without at least a 20 percent drop in the S&P 500.”

A recent CNBC article, reports, “Since the prior bear market ended in March 2009, this advance in equities is now the second-oldest on record without at least a 20 percent drop in the S&P 500.”

They offer a variety of opinions, but none predicting any imminent danger.

James Rickards, another well-respected voice writes, “The Hidden Danger The Bulls Are Missing”:

“Bull markets in stocks seem unstoppable right up until the moment they stop. Then comes a rapid crash-and-burn phase. (Emphasis mine)

Is there ever any warning that a collapse is about to happen?

Of course there is. …. The problem is that everyone ignores them!

…. This may be your last clear chance to lighten up on listed equity exposure before the bubble bursts.”

John Hussman’s Market comment, “This Time Is Different, But Not How Investors Imagine It Is Different”, tells us we are on thin ice but OK for now:

“…. The U.S. equity market is now at the most offensive level of overvaluation in history, exceeding even the levels observed in 1929 and 2000. …. Our very near-term outlook is rather neutral, allowing for both further speculation and abrupt market losses.

The most historically reliable valuation measures are obscene here. We expect the market to lose nearly two-thirds of its value by the completion of this cycle…. In my view, Wall Street is completely out of its gourd.” (All emphasis mine)

Other pundits are sounding more imminent danger:

- Rising Debt Spells ‘Warning!” for This Bull Market.

- A historic market crash is imminent and the tidal wave of volatility that follows should crush every investor.

- An 80%-plus crash in the US stock market could begin in a matter of MONTHS … if not WEEKS!

While a market crash is inevitable, is it imminent? I’m sure many investors who followed Mr. Bonner’s advice wish they had bought some Amazon along the way.

Like it or not, retirees, desperately seeking return must put money at risk to survive. What should they be doing?

Understand your personal situation. There is no “orderly market” when the inevitable “Crash and Burn” correction finally arrives. Monitor your investments and take profits where appropriate. Preservation of capital is high priority with retirement funds.

How do you know when it’s the real thing? Former Fed chairman Ben Bernanke spooked the market when he uttered the word “taper” and stocks tumbled. It took the Fed a month to calm the market.

What may appear to be a flash crash could turn into a major correction. You never know when an up/downtrend is over until later.

Don’t try to time the market? It’s foolhardy and expensive for individual investors to think they can beat the programmed traders. There are times it’s better to sell a year early than a day too late!

Patience is a good thing. Don’t allow the fear of losing out cause you to make a costly mistake. Many investors jumped in near the end of the dot-com boom and lost money. The market will “eventually” correct and good buying opportunities will come along.

Do what you think is right. When the plane hit the first tower on 9/11, people who thought and acted independently got the heck out of the other tower. They didn’t wait or need to be told what to do. Don’t expect any guidance from your brokerage firm; they will be too busy protecting their own holdings.

Don’t beat yourself up! Looking back, my frustration about not investing more during the dot-com boom was wasted energy. I was being cautious, lamenting fantasy profits, assuming I knew what to buy and timed the market perfectly. Don’t let those frustrations affect your judgment today.

In October, Business Insider reported:

“…. The S&P 500 has closed at record highs 66 times this year, the most since the mid 1990s.

…. And on Monday, the S&P 500 completed its longest streak ever without a 3% intraday drawdown.”

With all the conflicting opinions from market experts, the safest assumption is the market is on thin ice. The warning signs say, “Proceed with caution!” Don’t ignore them.

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

The Truth About How Governments Will Use Inflation To Redistribute Wealth

“As bad as the situation with inflation is right now, it’s nothing compared to what is ahead of us.

The coming money printing could be unlike anything we’ve ever seen before.”

Another article on the same subject.

The “Global Warming” MYTH was a scam created and still pushed by Al Gore to raise taxes, so naturally it was grabbed for that purpose by NGO’s and governments. Gore just got some media exposure and likely some speaking fees from some of the HOAX peddlers.

The big proponent has always been the U.N., and their sponsoring of Sweet Greta baby, to give them more money to change the weather is laughable.

“What he means is that the US may once again be on the path to becoming self-sufficient in energy, and not peddling money to corrupt “green” lobbies and interests.”

https://www.zerohedge.com/markets/landmark-ruling-supreme-court-deals-massive-blow-bidens-climate-change-agests.nda

We are all going to lose, lose a lot due to inflation. It is now unchecked and the Feds paltry 1.5% with at least 9 % actual inflation eating everything will be the laughing stock of the future beer halls.

I don’t think many understand what inflation does…. once It comes out of a well sealed bottle, it goes about and eats everything, EVERYTHING !

Savings, business, labor, carefully made plans, retirements, food, essential energy, transport, net profits. Homeowner costs, repairs and yes even the share market.

It rewards few and until it is checked, life becomes “those who loses the least wins” because everyone will lose.

It in the end exhaust all hope and causes, in the end, deflation. That destroys the overriding ..FV= PV+ I……. and all bankers know future value must be maintained or faith in its growth magic “increase” collapses in a Heap.

Tonight will be a stick save of the vanities on the Markets.

Do not be fooled.