With The White House having desperately tried to front-run this morning’s inflation print, analysts were expecting a jump higher led by food and energy costs. They were right in direction but it was way worse as the headline CPI soared 9.1% YoY (vs 8.8% exp and 8.6% prior)…

Source: Bloomberg

The 1.3% MoM rise is the hottest since 2005 and the 9.1% YoY is the hottest since 1981.

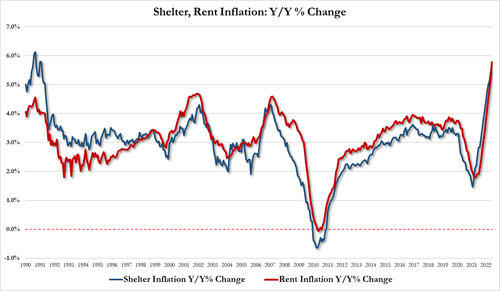

Under the hood, energy costs dominated the rise, but the rent index rose 0.8 percent over the month, the largest monthly increase since April 1986.

The motor vehicle maintenance and repair index increased 2.0 percent in June, its largest increase since September 1974.

The index for dental services increased 1.9 percent in June, the largest monthly change ever recorded for that series, which dates to 1995.

Focusing on the roof over your head factor, shelter inflation +5.61%, up from 5.61%, highest since 1992, and rent inflation +5.78%, up from 5.22%, highest since 1986

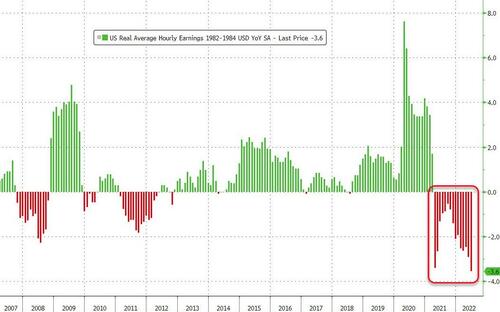

Real wages fell for the 15th month in a row… (Americans’ purchasing power domestically fell by a record 3.6% YoY in June)

Developing…

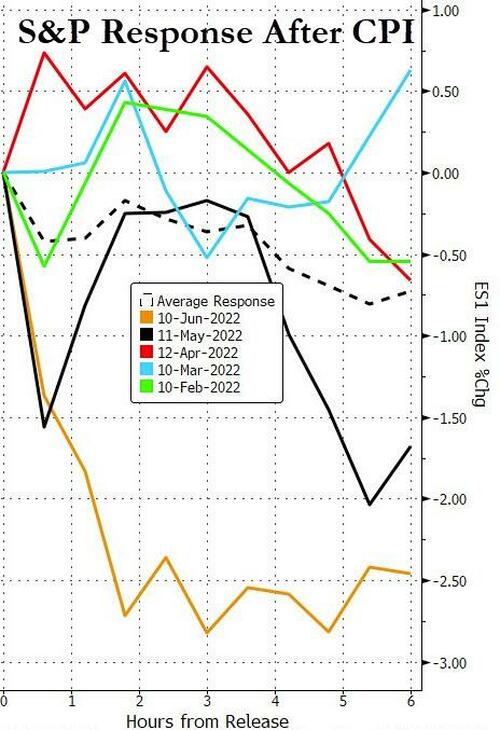

Finally, the S&P has ended the day lower on 5 of the last 6 CPI days…

Trade accordingly.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

You just know they were ordered to shave a full point off, because that is way more believable than the “forged” leak report story.

Real wages will continue to drop. In a global market, the current US wage for unskilled or modestly skilled labor is too high. By somewhere around 30% if my last calls on the back of an envelope are anywhere in the ballpark. The US standard of living has been propped up by mountains of debt, and historically low interest rates, for a long time. It is drawing to a close. What it is is what it will be. What cannot be continued will not be continued. The decline may be a lot faster than I guessed, and the mark may well be overshot.

It is not looking like it will be a nice, soft gradual landing.

Edit: just looked at the productivity numbers for the first quarter. Down over 7%. Uh-oh. Every hr worked is producing 7% less than the previous year, if that holds. Bad news.

It depends on who is “producing” what. Malinvestment is a huge, huge problem. I don’t know what the actual numbers would be, but there are a whole lot of companies that shouldn’t exist and a whole lot of people doing things that wouldn’t pay in an honest economy.

[edit] One of the great things about capitalism is “creative destruction”, the process where unprofitable ventures just fail, freeing up resources and people to go on to productive pursuits. A hallmark of “managed” economies, whether the US administrative state or the Chinese Communist party, is the inclination to “save” worthless ventures with subsidies, bailouts, and the biggest crime of all, easy money created out of thin air.

I have heard them called zombie companies – still walking, but actually dead. They are actually dying in large numbers in Australia . The covid stupidity killed them, but it took a long time for them to fall over. Nice comment.

Would a Tangible Book Value

-12,648,000 that’s billions be a Zombie company, asking for a friend.

Look at all the billion$ misdirected to the ‘green new deal’-type of enterprises — as well as to ESG and other such nonsense …

All of that, and more, is geared toward destroying our economy — and our (slightly) Sovereign Nation …

Counts as GDP though. Even if it’s digging a hole and filling it back in.

Are incomes keeping pace?

NO

Real wages fell for the 15th month in a row… (Americans’ purchasing power domestically fell by a record 3.6% YoY in June)

Admin,

Does that 3.6% number make sense to you? I’m guessing it doesn’t. Everything is up over 3.6%, no?

Not to worry Glock SS is going to give the geezers a 10% raise in their check come January. We’ll be in high cotton then, except bread will be $10 a loaf. 🙂

I have always said that the checks will never stop coming (as that would generate such outrage it couldn’t be contained), but so long as they do, most won’t really complain even when bread is $100 a loaf.

Liberty- When you need $300 to buy a loaf of bread, a dozen eggs, and a pound of bacon, I think everyone will grumble . I agree the checks will remain until 2025-26 when they plan a 25% haircut on SS but we will just go back to pre -2022 benefit levels so no biggie if the currency reset has taken place. A rose (dollah) by any other name will smell as sweet. 🙂

Sometimes I dream of the 7 billion deaths Reverse Engineer often mentioned.

Look around Glock, your wish is their command. You do realize your leaving along with the rest of us….right?

I’m one of the 7 billion that is going to be deaded? Nah, I’m going to make it down to the 500,000,000 cut.

Nobody here gets out alive. _________ SSS

That’s how you know it’s working.

CPI is over 18% as measured in 1980 when Volcker raised the Fed Funds Rate to 20%. Powell is still below 2%.

They included food, gas , rents and utility/energy cost in the CPI back in 1980. You take the proles biggest expenses out and it looks rosey.

Average 30y mortgage rate, per internet, is around 5%. So someone can borrow for a real interest rate of about -15%. Nobody at the maff-challenged Fed or White House sees a problem with that, apparently.

Don’t make me take you outback of the wood house like I did m. Run the compounding numbers on those shadow stats against a basket of goods. Hell, start with 1992, compound the cpi for $1 and see what you get as a multiplier. I will help you. The average looks to be around say 8%. 8% compounded over 30 years is 10.06. So, what what was a basket of goods back in 1992? Here is a sample I found:

– Fresh eggs (1 dozen): $0.86 Anyone paying 8.60 a dozen today? Actually under $3.

– White bread (1 pound): $0.75 anyone paying $7.50? Actually $1.60

– Sliced bacon (1 pound): $1.92 anyone paying 19.20. Actually 7.40.

– Round steak (1 pound): $3.38 Anyone paying 33.80? Actual price around $10

– Potatoes (1 pound): $0.30 Anyone paying 3.00. Actual is around $2.

– Fresh grocery milk (1/2 gallon): $1.39 Anyone paying 13.90? Actually 4.15.

Gas was around $1.10. Anyone paying $11, yet? Not hardly.

So please, those shadow stats are full of shit. You know how to compound. You can check my figures. But those shadow stats are absolutely full of shit, which can be easily verified via compounding what they are saying are the actual rates. And don’t get me started on insurance. Insurance is not a product, but is a mass covering of the consumption of the insured products, where the total expenditure on the good insured is divided by the number of people being covered, plus admin. It reflects how much is used, as well as how much the underlying goods have inflated. In other words, if you were eating one banana a day, and now eat two, you cannot say that the product went up 100% in price.

Basically since Old Joe was placed in office our money has lost about 25% of its value