By Larry McDonald, author of the Bear Traps Report

We are living in a period of mass “Jonestown” economic delusion. Just twenty months ago – central bankers were offering to buy nearly every junk bond known to mankind, dramatically distorting the “true cost of capital.” All the way from crypto to emerging markets – it was a moral hazard overdose. Everyone on earth was borrowing money at fantasy-land bond yields.

Now, the Fed is promising endless rate hikes and $1T of balance sheet reduction onto a planet with emerging market and Euro-zone credit markets in flames.

Listen, all I have is an economics degree from the University of Massachusetts, but after having spent the last 20 years trading bonds professionally and embarking on a 20k feet deep autopsy on the largest bank failure of all time – from my seat the current Fed agenda is sheer madness and will be outed very soon.

The true cost of capital was distorted for so long, we now have hundreds of academics– clueless to the underlying serpent inside global markets. When the 6 foot seven, Paul Volcker walked the halls of the Marriner S. Eccles Building of the Federal Reserve Board in Washington, our planet embraced about $200T LESS debt than we are staring down the barrel at today. Please call out the risk management imbeciles that make any reference of “Powell to Volcker.”

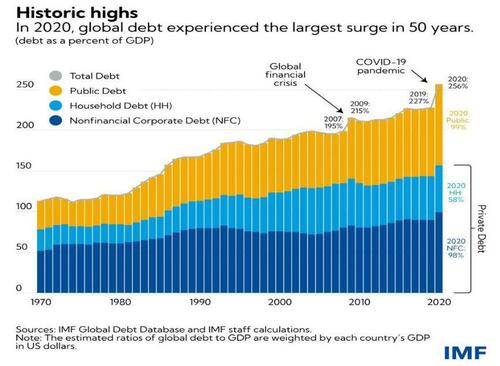

In 2021, global debt reached a record $303T, according to the Institute of International Finance, a global financial industry association. This is a FURTHER jump from record global debt in 2019 of $226T, as reported by the IMF in its Global Debt Database. Volcker was jacking rates into a planet with about $200T LESS debt. Please call out the risk management imbeciles that make any reference of Powell to Volcker.

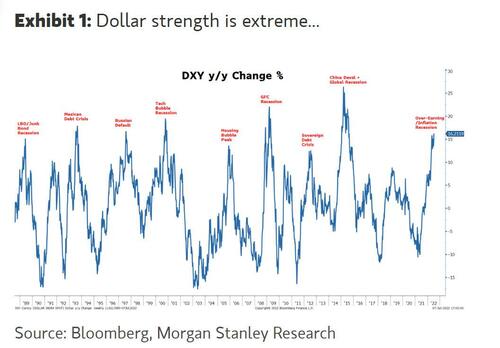

Many economists in 2022 are highly delusional – a very dangerous group indeed. When you hike rates aggressively with a strong dollar you multiply interest rate risk, which was already off the charts coming from such a low 2020 base in terms of yield – it’s a convexity nightmare. Interest rate hikes today – hand in hand with a strong U.S. Dollar – carry 100x the destructive power than the Carter – Reagan era.

At the same time, you add lighter fluid on to the credit risk fire in emerging markets with a raging greenback. Global banks have to mark to market most of these assets. If global rates reset higher and stay at elevated levels, the sovereign debt pile is in gave danger. The response to Lehman and Covid crisis squared (see above) has left a mathematically unsustainable bill for follow on generations. The Fed CANNOT hike rates aggressively into this mess without blowing up the global economy. We are talking about mass – Jonestown delusion on roids.

Then Covid-19 placed a colossal leverage cocktail on top. Emerging and frontier market countries currently owe the IMF over $100B. U.S. central banking policy + a strong USD is vaporizing this capital as we speak.

A dollar screaming higher with agricultural commodities – priced globally in dollars – is a colossal tax on emerging market countries – clueless academics at the Fed are exporting inflation into countries that can least afford it. Emerging – and

frontier market countries owe the IMF over $100B – U.S. central banking policy – strong USD, is vaporizing this capital.

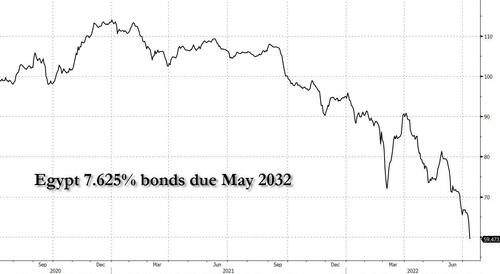

A quarter-trillion dollars of distressed debt is threatening to drag the developing world into a historic cascade of defaults. The number of developing nations trading distressed has doubled, with El Salvador, Ghana, Egypt, Tunisia and Pakistan appearing particularly vulnerable. With the low-income countries, debt risks and debt crises are not hypothetical – try buying oil in USD in an EM currency. A fifth — or about 17% — of the $1.4 trillion emerging-market sovereigns have outstanding in external debt denominated in dollars, euros or yen, according to data compiled by Bloomberg.

Academics at the Fed are exporting inflation into countries that can least afford it – decimating communities all over the planet. The tragedies are piling up. While given cover from their well-placed collection of pawns, tough guy Powell is playing his Volcker act – right out of a scene in a poor man’s poker game. In terms of who ́s actually running the show – emerging market bonds are plunging 10 points a week and Powell wants you to think he’s got pocket Kings.

Truth is, the global credit risk dynamic has the Aces, and the Fed is looking down at pocket 2s, if that. The IMF has total lending capacity near $1T, Powell is currently wiping out 10% of that. Ultimately, this lost tribe will be coming back, “hat in hand” – yet again to the U.S. taxpayer.

So now we have global bank balance sheets, stressed by $20T to $30T in mark to market losses from Equities, Treasuries, European government bonds, Crypto, Private equity and Venture capital – in the middle of the worst emerging market credit crisis in decades. All after just 150bps of rate hikes from the Fed? Hello?? Anyone home? There are A LOT of bonds that look like this! Oh – by the way – Egypt owes the IMF $13B, the Fed just lit these liabilities on fire.

If the Fed keeps its policy path promises, take the tragedy in Sri Lanka and multiply it by ten across the globe over the next six months. Check-mate FOMC.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Everything’s going to be fine , bruh. Just axe any Bolshevik.

That shouldn’t be too hard, since they all grew up and moved to Amerika. Although today we call them “liberals”, “progressives”, “woke Karens” or “Democrats”. Sometimes “reptilians”.

Question is, “why would you ask a Satan worshiper anything?”. All they know how to do is lie, cheat, steal and murder. The Truth is not in them. Never was.

Republican Bolsheviks are different. bruh . They speak the gospel,

Straightforward from here:

1. Biden announces not running again.

2. 2022 focus turns to R extremism, Ds do well in Nov.

3. Inflation subsides, Ukraine defeats Russia, Biden is successful 1-term president.

4. Younger moderate D defeats Trump or Trumpist in ’24.

Pourquoi pas?

— Bill Kristol (@BillKristol) July 13, 2022

Red diaper baby Bill (((Kristol)))

Gavin Newsom, Governor of CA, was at meetings at the White House yesterday 7/13/22. I get a cold feeling down my spine that they’re going to try and put him in as President.

Kamalato’s VP for a week or two and she has a vaccine injury death and ………….

He’s got the presidential hair, bruh. He’ll be a shoo-in

Exactly, flash… presidential timber fer sure. With a top-notch hairstylist, the sky’s the limit as to how far a guy can go.

That’s why Raymond Burr left his entire fortune to his live-in hairstylist. Well, that’s what I heard.

They lit the debt bomb to get Cloward-Piven.

Cloward-Piven?

Yet another seemingly mandated variant. Early Town Crier.

The Fed can’t grow food or extract and refine oil or build houses or transport goods or manufacture anything.

That is why the Fed is always reactive and behind the curve and can’t (or won’t) accurately predict economic trends or recessions. This country was doing fine without it and has been going down the shitter since it’s inception.

Useless.

The economy needs to reset. What does this guy suggest? I didn’t see anything of substance. It – the world – cannot continue as it is. Why has so much been loaned? Why have interest rates been allowed to drop to zero, negative even? Why have unfunded liabilities been allowed to skyrocket? Why is the US fed debt $30 trillion plus? Why are nations loaning billions upon hundreds of billions to nations who have zero prospects of repaying it?

This shit has to stop. This author just seems to want to stay the course. Bullshit. Let the water find its own level.

Good observations. This guy is a bond fund manager. He doesn’t want his gravy train ride to come to an end.

Wow.

Does anyone ever write anything anymore whereby they don’t promote views benefiting their own self interests??

Nope.

#EmpireOfLies

Jubilee is the magic word.

there will never be a jubilee

Sure there will, bubba.

“If something cannot go on forever, it will stop.”

― Herbert Stein, What I Think: Essays on Economics, Politics, & Life

End the FED. Reinstate Currency Act of 1792.

Flash- There are strings on the jubilee this time, I’ve seen the plan. In order to have all your debt excused, you have to move to assigned small quarters and sign that you understand and agree that you will never own anything but personal property such as clothes ,furnishings etc.

Hope they have plenty of soma. Soma is what sheep crave.

The SOMA will be required, a dopey sheep is a controllable sheep. You will lose your stipend each month if you don’t take your daily doses.

The answer to most of your questions is politicians and government, the creators of most of our problems.

Do give credit, WHERE credit is ‘due’.

1 & 1/3.

There’s no perfect analogy, but one of the best I’ve read compares the damage caused by inflating currencies to the consequences of not properly managing forests.

In the case of forests, by putting out each and every fire that springs up, undergrowth and deadwood accumulates, rot and insect infestations spread, and the problem only gets worse over time. Eventually, a fire will start and it will be so big and fierce, there will be no possibility of controlling it. Everything burns. This is where the economy is now with the Fed and government not allowing the cleansing to take place. Every time it looks like the elites’ portfolios are going to drop, crank up “QE” (monetary inflation) and lower interest rates (monetary inflation).

Arguably, the best strategy is to just let nature taking its course (free market) but maybe protect particularly vulnerable people and property (but not the stupid ones). But somehow we insist on letting the “experts” handle things. And that actually can work fairly well. In the case of forests, logging and slash-removal pretty much kept things under control. Also, consider the southeastern forests owned and managed by for-profit paper and timber companies – no problems there.

But now, inevitably with politicians, our government experts “managing” public forests here in the west are now eco-sensitive in much the same way that our politicians and the Fed are sensitive to the needs of the elite. The result is nonstop out-of-control wildfires every year.

The point is, it’s going to burn. Letting the problems continue may make the inevitable happen a little later, but it will be much worse. So yeah, what’s this guy’s plan? What the Fed is doing is far too little far too late, but it’s something.

Excellent analogy, had they done this in 2008 I think life would be much different today. Many views that I read advocating this tactic (Ron Paul included) were ridiculed. The elites needed to get their money back one way or the other, all ways coming through our wallets. And we get to pay again, thank you dir may I have another.

Why has so much been loaned?

Simply because the fiat ponzi scheme requires ever more bux in the system to kick the can down the road a bit further

“Why has so much been loaned? ”

ALL the emperors need to be attired in the same, latest, fashion trend?

Well, Larry,

“ Listen, all I have is an economics degree from the University of Massachusetts, but after having spent the last 20 years trading bonds professionally – from my seat…”

Maybe U should hire J. Kim as a consultant. If Ya REALLY think the Plotted Course is gonna change? (Hint: It’s NOT)…

You could at least formally introduce Us to Your family?

Klassik.

In other words, all is on track for the next great wealth transfer to the banksters.

This is the final scam to divy up what crumbs are left on the plate, A CYA move for the banksters before the Great Reset is kicked into full play. Then the financial overlords introduce you to the “new game”.

Excellent analysis Beartrapsman – all in line with my predictions last month and my book ten years ago.

https://austrianpeter.substack.com/p/a-perfect-storm-the-money-crisis?s=w

They are saving the dollar and going for deflation. All the bubbles will pop. Bad as that is, it’s far better than hyperinflation. Bankers prefer inflation and hate deflation. The Biden Show will get the blame. At some point I think the Federal Government will default on the debt. No other way, as can never be paid and is a permanent yoke around any economic recovery. Then possibly back the dollar with gold or other real things. If you have the cash things will get a lot cheaper. Also, the USA has far more gold than the experts believe. Any other route is a path to a Dark Age.

Let’s just say for the sake of argument….

THEY WANTED THIS THE ENTIRE TIME.

Why?

GLOBAL POPULATION REDUCTION

Where?

PREFERABLY EVERYWHERE, BUT FOR RIGHT NOW THE LOW HANGING FRUIT.

Countries that have always teetered on the edge of poverty are the same ones that are still teetering on the edge of poverty.

Egypt

Tunisia

Sri Lanka

Most of Africa

Bangladesh

A lot of India

There are more of course.

So all you need to do is make them dependent on easy money for a long time, corrupt their leaders, and voila! Pull the rug out and millions die from hunger, disease, and lack of health care.

Who suffered the most from the Covid-1984 lockdowns? Well, rural India peoples had a really really bad time of it. You are talking about rural peasant people that work each day to eat and have zero savings. When you “lock them down” meaning preventing them from going to work every day to fucking EAT, they starve. I can guarantee you not one of them gave a rat’s ass about Covid. You know what’s way more important that some damn flu? Not eating for days.

The cry babies in affluent countries were bitching about masks and not being able to go to Outback Steakhouse for some meat while people in India were locked into their hovels and unable to go work for a day’s gruel.

And if you wear a body down with starvation then sure as shit that same body will now be MORE susceptible to all kinds of raggedy shit coming down the pike.

There was an article about TB, malaria, and some other egregious poor-country shit that has erupted over the past few years:

https://www.who.int/news/item/14-10-2021-tuberculosis-deaths-rise-for-the-first-time-in-more-than-a-decade-due-to-the-covid-19-pandemic

Of course these morons say “due to covid -19 pandemic” which is disingenuous in my opinion.

See, TB is actually deadly across the board as opposed to Covid-1984. And if you delay treatment you will end up with some pretty damaged lungs and spread it far and wide.

We need to stop being distracted by all this bullshittery and see it for what it is.

Even in this country the failed policies and ‘treatments’ for Covid-1984 were far worse than the actual goddamn virus.

Anyone can see it. We have all screamed and railed at the seemingly ‘inept’ politicians who put this crap in place. Why, WHY could they not see the evidence before them and stop?

Simple.

It was done on purpose.

Once you see that, and accept it, then the rest makes total sense and you can stop being distracted by all the background noise of George Floyd, BLM, Antifa, Jan 6, blah, blah, blah… and prepare.

Better to be three years early than one day too late.

They are trying to kill us. End Quote. Repeat the line.

Great post Pup — love the rant…

At work, I try to correct people when they say something or other was “impacted by covid”. I say no, it’s “impacted by government response to covid”. The libtard lemmings don’t like that jab of truth.

The other day this woman reports to us that a project manager at another organization we are affiliated with is now permanently debilitated and cannot work anymore because he had a “super, super rare” reaction to being “vaccinated”. I bit my tongue because likely all (except myself, of course) on the call were vaxtards, and I know whatever I might say would make no difference — and may even get me harassed by HR or worse.

There are none so blind as those who will not (can not / refuse to / afraid to) see…

I don’t have an Economics degree (although my son does) nor have I worked with bonds for 20 years, but I at last understand arithmetic.

If I create $100 dollars as a loan and then say you must pay back $110 in a years time, somehow at the end of the year there must be $110. Where can the borrower get an extra $10? Only if I create another $10 dollars.

So with $300T in debt, we have to create another $3T each and every year, just to pay interest on the debt at 1%.

The whole shit-show is nonsense.

Money should, in an ideal world, expand not more than necessary to allow for liquidity in place of direct barter (and only where direct barter is not possible)

All other money is inflationary.

What the Fed is doing is exactly what happened in 1929 (except that 1929 was a few cents compared to today’s volumes) and will have the same effect (except that being a billion times bigger in volume will create a billion times more damage.)

Fortunately I am so old that I don’t give a damn, but if the youngsters of today were smart enough to see what is happening they would commit suicide en masse (after killing all people over 30).

There is no way to allow for the system to continue and no way to replace the system, except for total world-wide and absolute Debt Repudiation. Which is morally reprehensible and politically impossible.

Josiah Stamp, former Director of the Bank of England said:

“Banking was conceived in iniquity and was born in sin. The bankers own the earth. Take it away from them, but leave them the power to create money, and with the flick of the pen they will create enough deposits to buy it back again.”

“However, take it away from them, and all the great fortunes like mine will disappear and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of bankers and pay the cost of your own slavery, let them continue to create money.”

Josiah Stamp

we have to create another $3T each and every year, just to pay interest on the debt at 1%

Yes, as I said in response to LLPOH’s question above: the fiat ponzi scheme requires ever more bux in the system just to keep it afloat

Money should, in an ideal world, expand not more than necessary to allow for liquidity in place of direct barter (and only where direct barter is not possible)

Milton Friedman understood that the money supply needs to expand at a rate equal to the growth in population (IIRC). Although if he ever discussed sovereign/debt-free money as the proper standard for GOVT-issued — as opposed to (((private bankster)))-issued — currency, I am not aware of that. But either way, he studied the Feral Reserve and its role in the 1929 crash and subsequent depression, so he knew the score and the players involved…

Your comment, in total, is at odds.

“…no way to replace the system, except for total world-wide and absolute Debt Repudiation. Which is morally reprehensible and politically impossible.”

But then you quote Josiah Stamp

The dollar and the system are failing. Overload a failing system to destroy it. (rules for radicals stuff) Offer the reset as an alternative.

It will get really bad so people will almost beg for change.

Hey Jackass, keeping rates as low and long as they did was even more stupid. And, quite frankly, criminal.

I disagree. Not sure what you are talking about but I think differently. Annoying isn’t it?

It is obvious you have an econ degree – so do I (Masters deg) but you have totally bought into the fantasy (A.K.A. – time value of money) – I have not so was able to retire at 50 to a country estate in a very exclusion area.