Good friend and bond expert, Chuck Butler recently mentioned:

Good friend and bond expert, Chuck Butler recently mentioned:

“And someone somewhere, somehow is buying the 10-year Treasury, and the yield on the bond is slipping again, with it trading with 3.73% yield this morning.”

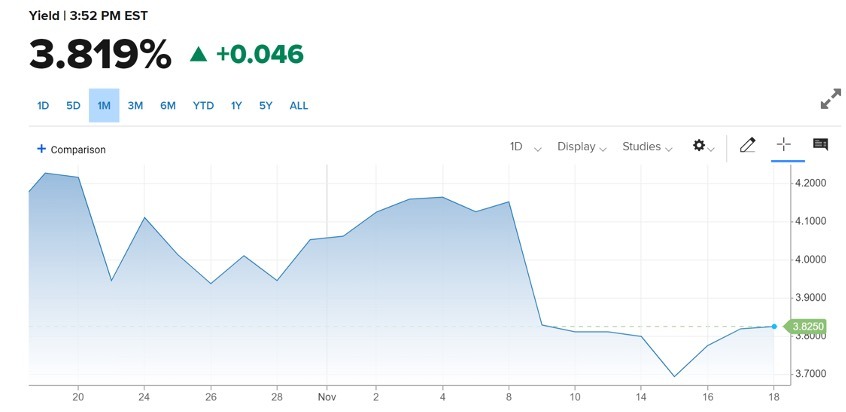

MSNBC provides a graph of yields leading up to Thanksgiving week:

Yields were at a high of around 4.2% and closed out the week at 3.82%. Why are yields slipping? The Fed raised rates and signaled they will continue.

Yields were at a high of around 4.2% and closed out the week at 3.82%. Why are yields slipping? The Fed raised rates and signaled they will continue.

A month ago we cautioned readers to stay short term with bonds and CDs. Now rates are dropping on 10-year bonds. What gives?

Time for a reality check once again…

DENNIS: Chuck, unless I missed something, why would “someone, somewhere, somehow” be buying long-term treasuries? Your closing remarks:

“…. ‘Investors don’t follow the Fed Heads’ speeches’, so that’s where you and I come in; we do follow the Fed Heads’ speeches, and will be ready, willing and able to get the word out we’re giving the wink and nod to investors to buy bonds and/or longer-term CDs again…”

Why would anyone be interested in 10-year treasuries?

CHUCK: That’s a good question, Dennis… Like I explained in our recent Bond interview, there are some entities, like pension funds, state Gov’t., insurance companies that must buy Treasuries as a part of their investment policy. But this buying has been stronger than just that kind of buying, so there’s something more here. And I’m afraid that it is individual buyers looking to “lock in” a rate…

Locking in a rate is a tricky game to play, folks… Like I said a couple of weeks ago, you’ll want to wait to “lock in a rate” until the Fed Heads begin to waver in their talks around the country about rate hike… From the sound of the recent Fed Head talk, there’s not been any wavering at all!

I’ve tried hard to get the message across that this is still not the time to be buying 10-year Treasuries… Interest rate hikes are not about to end any time soon.

St. Louis Fed President, James Bullard recently said that, “I see interest rates between 5-7%. The Fed Fund rate is now at 4%, so we’ve still got some way to go, eh?

The Fed could be buying bonds through the back door and keeping them off their books – for now that is – so the markets don’t get wind of them buying again. There’s that to think about too…

DENNIS: That’s a scary thought….

I see several risks: inflation, timing, and illusion. Let’s deal with them independently.

A lot of baby boomers would love to move some of their risk capital back into safe, reliable fixed income that stays ahead of inflation.

When interest rates were 6%, and inflation around 2%, investors made money and slept well at night. The 2008 bank bailouts took that away from us, affecting retirement planning everywhere. Today’s high-risk bonds don’t come close to beating inflation.

Until interest rates are consistently above inflation, wouldn’t buying long-term CDs and bonds be “locking in” losing your accumulated wealth?

CHUCK: Well, yes, it would be…. In today’s market, you would be locking in a negative yield when inflation is factored in.

The U.S. never did go the route of negative yields, like Switzerland, Japan, European Union, did. With super low interest rates, when inflation took off, the real yields then became negative. They’ve stayed that way for over a decade now.

DENNIS: I cautioned readers to stay short because the future is certainly not clear enough for me to put my money down…

Have you seen any evidence that the Fed is signaling a pivot?

CHUCK: NO. Like I mentioned above, the St. Louis Fed Reserve President, James Bullard, recently said that he would like to see interest rates between 5 and 7%. So, that means there’s some work to be done with regards to rate hikes.

The last FOMC Meeting, where the Fed hiked rates 75 Basis Points, was very telling. Chairman Jerome Powell was very adamant about making sure the markets heard him when he said that this was not the time to pivot.

DENNIS: The “locking in” illusion needs to be addressed.

In 2008, I was 68 years old and had the bulk of our life savings in long-term, safe, fixed-income investments. I knew how much interest I could count on and thought we were set for life. The Troubled Asset Relief Program (TARP) bill was passed and overnight all my debt was called in.

Sure, I had cash, but it produced around 1/3 the income it had in the past. “Locked in” and “set for life” left the building.

Much like homeowners refinancing a mortgage when interest rates drop, banks and bond issuers did the same. They simply called in their debt and refinanced at a lower rate – much to the chagrin of retirees.

Can you explain how that happened?

CHUCK: Prior to the bailout, banks and government had to depend on the market, and compete for capital. Interest rates were regularly above inflation. Investors felt safe tying up their money for longer terms, knowing it would earn real interest above inflation.

When the Fed flooded the system with money, they no longer needed our money, they could get trillions in funny money from the government.

Dennis, you may recall interest rates hit 5,000-year lows and, in some cases, were negative. Banks and governments loved it, “you pay us to hold your money.”

Dennis, you may recall interest rates hit 5,000-year lows and, in some cases, were negative. Banks and governments loved it, “you pay us to hold your money.”

The government stopped borrowing from real people; the Fed just created the money out of thin air (The Magic Money Tree!) to the tune of trillions of dollars. Eventually, the scheme caught up with them and we are faced with double-digit inflation.

Now the Fed is having to reverse course before the dollar and economy totally collapses.

DENNIS: I want to go one step further on “locking in”. I wrote about how “Failing To Check A Simple Box Can Destroy Your Retirement Dreams“.

When a borrower offers a Bond or Certificate of Deposit (CD) to the public, they outline the terms and conditions.

- Non-callable means they cannot be “called in” (paid off) early by the borrower for any reason. They must continue to pay agreed-upon interest until maturity.

- Conditionally callable limits the situations where they can call in their bonds and pay them off early.

- Callable gives the borrower the option to pay off the debt early without penalty – like paying off a mortgage or car loan early.

You told our readers the difference between callable and non-callable is control. If it is callable, the borrower has control and can pay it off at their discretion. If it’s a non-callable CD or bond, you have control. You can choose to hold it until maturity or sell it in the aftermarket.

Chuck, a couple of brokers told me once we reached our “magic number” for retirement savings, buying fixed income would give us the income we needed for the duration.

Unless investors have “non-callable” isn’t “locked in” still an illusion?

CHUCK: Yes… the good thing is that with Treasuries, there’s no such thing as callable bonds… But with CDs and Corporate bonds, where the yields are normally higher than Treasuries, the bonds are known to have callable features, and that would prevent a holder of the bonds from enjoying their “locked in rate” until maturity.

Investors must read the full description of the bond, to know what the features are… Let that be a lesson to learn for all of us.

DENNIS: One final question.

I bought up the fixed-income offerings offered by my broker:

While these rates change by the minute, even the longer-term offerings still fall short of inflation.

While these rates change by the minute, even the longer-term offerings still fall short of inflation.

I researched 10-year AAA, non-callable bonds. There was one AAA bond available at $105.149, yielding 4.333% until maturity in May of 2033.

I searched 10-year non-callable CDs and this message appeared:

“There are no CDs which meet your search criteria ….”

Chuck, this scares me. I fear many brokers will reassure clients they are safe and need not worry, when borrowers can pull out the rug from them like they did in 2008. Looks like the “callable features” you mentioned are not being offered today.

Until borrowers are truly forced to compete for capital, will we ever see new issues that are non-callable? No more “lock in” yields for the long term??

CHUCK: Dennis, once again, thanks for the opportunity to address your readers.

I hope I shed some light on things that are very important, particularly to retired folks, like me! There will be some real changes for corporations going forward, as their funding requirements are all changing. These corporations were able to issue debt very cheaply for so long, that none of them really know what’s going to happen when they have to reissue debt at today’s higher yields…

Competition will play a big part in how they structure their bond issues, that’s for sure. “Non-callable” bonds have more appeal, and the borrower may save a small amount in interest. It will be interesting to see how they run through the gauntlet of higher interest rates…. In the meantime, if you are going to try to “lock in” rates, be sure to check the fine print!

Dennis here. “Locking in” safe, inflation-beating returns is difficult. Don’t get fooled like a lot of people did in 2008! Until “non-callable” comes back into play, when you buy debt instruments the buyer has control and that must be factored into the risk/reward equation.

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

6 month T-Bills are paying 4.7% interest with almost zero risk. It’s a great place to hang out while waiting for things to happen, like S&P to drop below 3500.

https://www.marketwatch.com/investing/bond/tmubmusd06m

“almost”?

care to elaborate?

What do you think the odds of federal failure or default are in 6 months?

50/50.

I concur.

I’m no financial OR political wizard, but it seems to me that investing your hard earned money in Government at this stage can only be seen in one light…fucking retarded.

Starve the beast.

I took ALL of my government bond paper back to the bank when AU was still under $1k/oz.

Paper for metal trade. Why fund the lunacy?

Try to call what you don’t own and you might get some lead as a return, instead.

Too many monkeys throwin’ their peanuts at the elephant. Our efforts are for naught. At least we can die telling ourselves WE did the right thing.

My tomatoes and cucumbers had a great return last year. Long on tomatoes again for the foreseeable future.

Kale, peas and eggplant – not so much.

Do you can or freeze your tomatoes? Last time I gardened, I put up 75 quarts. Lasted 3 years.