As children, our elders programmed us with certain “core” beliefs. As adults, finding contrary evidence to those beliefs creates discomfort called “Cognitive Dissonance.” Psychology Today defines:

As children, our elders programmed us with certain “core” beliefs. As adults, finding contrary evidence to those beliefs creates discomfort called “Cognitive Dissonance.” Psychology Today defines:

“Cognitive dissonance is a term for the state of discomfort felt when two or more modes of thought contradict each other. The clashing cognitions may include ideas, beliefs, or the knowledge that one has behaved in a certain way.”

My mother was a single parent long before it became commonplace. My grandmother was the predominant figure in my childhood development.

She was constantly praising President Roosevelt and Social Security. She explained, the government takes money out of your paycheck and “saves” it for you until you retire.

When I got my first real paycheck, the deduction for social security was more than income tax. I was shocked. She reassured me that I should be happy, the government was saving my money for me.

While she grumbled about taxes, she exempted social security, it was not a tax, it was the government saving YOUR money for YOU.

It took decades for me to realize FDR, like all politicians, lied. “Cognitive dissonance” was real. I was very uncomfortable letting go of a core belief and facing reality. Despite my grandmother’s beliefs, the government was not “saving” my money.

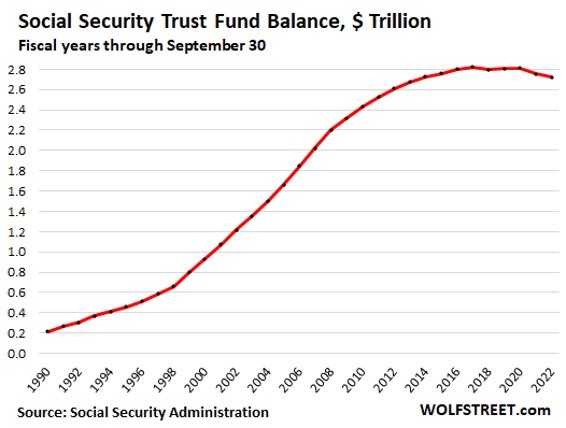

A recent Wolf Street article, “Status of the Social Security Trust Fund, Income and Outgo: Fiscal 2022 tells us:

“The balance in the Social Security Trust Fund – technically known as ‘Old-Age and Survivors Insurance (OASI) Trust Fund’ – declined by 1.2% during the US government fiscal year through September 30, to $2.72 trillion…. In the prior year, the balance had dropped 2.0%; in 2018, the balance had dropped by 0.8%. Those were the only three fiscal-year declines in the fund balance since 1987.

Despite those declines, since 2010, the balance of the fund has risen by 12.1%.”

That paints a rosy picture, but it is an illusion; something all Americans, young and old will have to deal with.

There is much reference to the “Social Security Trust Fund”. This is where my grandmother thought the government “saved MY money” for ME.

John Attarian writes, “The Myth of the Social Security Trust Fund”: (emphasis mine)

“Is it a real trust fund?

A trust fund is money, investments, or other property held in a trust, a trust being ‘A fiduciary relationship with respect to property, subjecting the person by whom the property is held to equitable duties to deal with the property for the benefit of another person….’

All trusts must have a ‘settlor,’ who sets up the trust and puts property into it; a ‘trustee,’ who manages the trust and has legal title to the property in it; a ‘beneficiary,’ who holds equitable title to the property and for whom it is managed; property; and terms of trust stating its purpose and duties, the powers of the trustee(s), and the beneficiary’s rights.”

Mr. Attarian outlines how the Social Security Trust fund compares to the definition, concluding:

“All this confirms the observations by Suffolk University Law School Professor Charles Rounds:

Despite the term ‘trust,’ the Social Security system contains nothing that remotely resembles the common law trust. There is no segregation of assets, no equitable property rights, no private right of enforcement…. It is merely a system of taxation and appropriation sprinkled with trust terms to hide its true nature.

Moreover, Social Security’s Trust Fund does not operate as a trust fund does. Social Security revenues go into the Treasury’s general fund and are automatically credited to the Trust Fund in the form of Treasury bonds. The Treasury pays Social Security benefits and administrative outlays out of general revenue and debits the Trust Fund an equivalent value of bonds.

Any leftover Social Security revenue finances general government operations, with an equivalent value of bonds remaining in the Trust Fund as Social Security’s ‘surplus;’ to cover any revenue shortfalls.

This is how a Treasury account, not a trust fund, works. And calling a Treasury account a ‘trust fund’ to influence public opinion does not make it one.

In all respects, then, Social Security’s Trust Fund is bogus.”

The Treasury Department collects social security from workers and makes an accounting entry to credit the Trust Fund. Wolf Street explains how the money is “invested”:

“The OASI Trust Fund invests in Treasury securities and short-term cash management securities. These securities are not traded in the secondary market….

The fact that securities in the Trust Fund are not subject to the whims of the secondary market is a good thing: The value of these holdings…doesn’t fluctuate from day to day with the whims of the secondary market. Because the Trust Fund holds Treasury securities until they mature (when it gets paid face value), the day-to-day price fluctuations are irrelevant….

…. These securities are not traded in the secondary market, their value equals the face value at all times, which is the amount that the Fund paid for them when it invested in them, and the amount it will be paid at maturity by the US Treasury Department.

The strategy of investing in Treasury securities and holding them until they mature is a low-risk conservative strategy that essentially eliminates credit risk.”

Wolf Street laments current ultra-low interest rates hurt the fund’s income:

“Interest income crushed by Fed’s interest rate repression.

…. In 2010, the Fund earned interest at an average rate of 4.4%. In 2022, it earned interest at an average rate of 2.3%. If in 2022, the Fund still earned interest at an average rate of 4.4%, it would have collected $120 billion in interest, instead of $65 billion, and this additional $55 billion in interest income would have generated a surplus of $23 billion, instead of the $32 billion deficit. Yield investors around the country have gotten crushed even worse. Thank you, Fed!”

John Attarian tells us the farce was exposed, and ignored since social security was established: (emphasis mine)

“…. Criticism arose. Winthrop Aldrich of Chase National Bank argued that the reserve would be fictitious; the government would just be issuing promissory notes to itself. As for interest on the bonds, which would supposedly help pay future benefits, the government would get the interest money from ‘the only source it could obtain it-the general taxpayer. The whole elaborate reserve set-up would not relieve him of any burden whatever.’ Finally, the tax revenue the Treasury got in exchange for the bonds would be a standing temptation to extravagant spending.

…. During the 1936 presidential campaign, Republican candidate Alfred ‘Alf’ Landon said…‘Social Security’s forced savings were “a cruel hoax.’ President Franklin Roosevelt retorted that Social Security tax dollars ‘are held in a government trust fund solely for the social security of the workers.’

…. Critics…pointed out that unlike insurance companies, which invest their premiums to build a reserve to pay on their policies, the government was only issuing claims on itself. Hence the Social Security reserve was merely worthless IOUs. To pay future benefits, Americans would have to be taxed all over again.”

What does this mean?

There is no “trust” in the Social Security Trust Fund. The treasury collects social security money from workers and employers. Benefits are paid. If there is a surplus, the government spends the money and makes an accounting entry, putting additional IOUs in the so-called trust fund. If there is a deficit, they reduce the amount of IOUs in the fund, borrow more money in the market to pay the obligations – on top of record deficit spending.

| “In politics nothing is accidental. If something happens, be assured it was planned this way.”

— Franklin D. Roosevelt |

Current projections are for the fund to run out of money around 2035. The “cruel hoax” is there is no money, just government IOUs – $2.7 trillion dollars’ worth of political promises. Despite Roosevelt’s assurances, politicians did not save our money, they spent it.

If trustees of a company-sponsored pension fund invested all the money in that company’s bonds (IOUs) they would go to jail for breach of a fiduciary relationship.

The US Debt Clock paints a more realistic picture:

Baby Boomers were brainwashed, believing their money was “saved” for their retirement. They expect future generations to make good on these political promises.

Citizens can’t afford the government’s promises, past and present. Projecting interest cost of the national debt, plus government unfunded liabilities, it’s impossible for future generations to pay the debts incurred by their elders.

Expect more inflation, higher taxes and benefit reductions. Politicians will take class warfare to unprecedented levels while trying to keep citizens from storming the palace.

Richard Maybury sums it up well:

“For the economy, and therefore your savings and investments, do not expect any kind of stability for a long, long time. When laws and currencies are not stable, nothing is….”

There is no “security” in Social Security. Collect your benefits as soon as you can; who knows what the future will bring.

Time to face reality, we are on our own…. The political class has ignored the problem for generations and now we are past the point of no return.

We must earn more, spend less, save and invest the difference; live below our means. While it is impossible for governments to do this, citizens must if they hope to retire comfortably. Invest in hard assets like precious metals, solid real estate and keep working as long as possible.

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

You mean there’s no trust fund? !?!?!

Someone musta Madoff with it.

Sincerely,

Kneel Cash-Carry

Governments lie…

About everything!!!

Taxes are theft…

But you can call them FICA, Social Security, whatever makes you, or (((them))) feel more comfortable or less guilty.

It’s in a lock box.

Big Gay Climate Al pinky swears it.

That depends on what the meaning of ‘is’ is…

Where is AlGore’s SSS “Lockbox”???

Gone. He divorced her.

Thank God for ss disability otherwise how else would 500 pound niggers survive.

Ok, I’ll take a shot a fixing Social Security.

No one will earn Social Security benefits without contributing for 25 years. As a normal work span is 45 years the amount awarded will be prorated from 25 years up.

As a further note, Social Security, as a prepaid program has higher priority for funding than other money giveaways such as welfare, food stamps and foreign aid.

If you paid, you deserve it more than those that didn’t!

Falsely-framed argument. Stop stealing money from the productive and subsidizing the unproductive.

The fix is free markets, abolition of .gov and central bank counterfeiting, and allowing people to keep the fruits of their labors.

“Fixing” social security is like fixing a tumor, instead of eradicating it.

They need to lift the cap on SS taxes. Only the first 147K is taxed. That means people who earn Millions/ Billions pay exactly the same dollar amount as the shmuck who has the misfortune to earn 147 on the nose and have every penny taxed. I confess I don’t have the math, but I would bet that if we applied a flat say 5% across all incomes there would be more than enough money and the vast majority of us would actually pay less than we currently do.

While I am not in favor of more taxes, for the vast majority there would not be and I see no reason the wealthy should not pay the exact same percentage of their income as everyone else and it would solve the problem.

It is not the point of no return unless we allow it.

You are correct, but that should also apply to income taxes.

Our system is a progressive system where the better you do for yourself, the more you are taxed. That isn’t right, or fair. Either a flat rate across the board, or no taxes period.

Falsely-framed argument. Taxation is theft. So is fiat currency. Let people keep their money for retirement or whatever.

Abolish the state.

You didn’t read my last sentence.

My father told me 40 years ago that there would be nothing left by the time I retire. Fortunately I’m still getting money. Who knows for how long, though.

Glad your catching onto the scam, Now Do the Federal Reserve.

Somehow they convinced everyone that “social” security was a check from the government and not an actual social network of people around you that care for your well being.

Destroy the extended family, long live the nuke family.

Don’t worry, SS, Medicare/caid will take care of you when you get old.

Just part of a the long slow grind to isolate and destroy us as individuals. Now you see them going after the nuke family. Along with faith these are the things that sustain us.

Alone and broken people will turn to the State for succor and direction when their work on society is complete.

SS is fairly safe right now because if they cut off 20 million vets, the’d have nothing to lose and that makes a person very dangerous. Now the woke generation………..they’re fucked.

In Canada, the Canada Pension Plan has an investment fund that operates like any private investment fund, as does the Quebec Pension Fund (Canadian provinces are allowed, under the constitution, to opt out of the federal pension and employment insurance plans).

But Employment Insurance (used to be called Unemployment Insurance) is just I.O.U.s from government even though it is funded the same way; from payroll taxes, approximately half from employees and half from employers (although from the viewpoint of employers, it’s all paid by them).

However the CPP was too generous with the earliest retirees, who hadn’t contributed very long, after it was initiated; and has thus become less generous with each passing year. I’ve read that recent entrants to the workforce will, after adjusting for inflation, receive less in benefits than they will have paid in contributions (based on predicted average retirement age and age at death).