For almost a year now, we have been dutifully tracking several key datasets within the auto sector to find the critical inflection point in this perhaps most leading of economic indicators which will presage not only a crushing auto loan crisis, but also signal the arrival of a full-blown recession, one which even the NBER won’t be able to ignore, as the US consumers are once again tapped out. We believe that moment has now arrived.

But first, for those readers who are unfamiliar with the space, we urge you to read some of our recent articles on the topic of car prices – which alongside housing, has been the biggest driver of inflation in the past 18 months – and more specifically how these are funded my the US middle class, i.e., car loans, and last but not least, the interest rate paid for said loans. Here are a few places to start:

- Are We Headed For An “Auto Loan Crisis” As Delinquencies Begin To Rise? – July 7

- A Flood Of Repossessed Vehicles Poised To Hit The Used-Car Market – July 25

- American Drivers Go Deeper Into Debt As Inflation Pushes Car Loans To Record Highs – Aug 29

- Credit Card Rates Just Hit A Record As The Average Car Loan Rises To Fresh All Time High – Oct 9

- New-Car Loan-Rates Set To Hit 14-Year High As Affordability Crisis Worsens – Nov 3

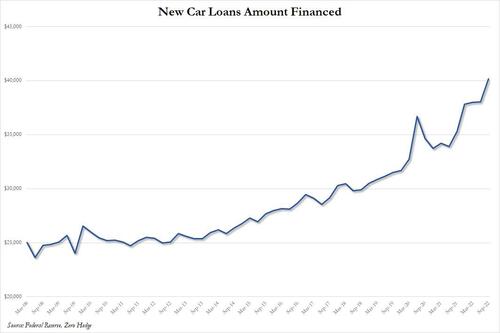

So while the big picture is clear – Americans are using ever more debt to fund record new car prices – fast-forwarding to today, we have observed two ominous new developments: the latest consumer credit report from the Fed revealed a dramatic spike in the amount of new car loans, which increased by more than $2,000 in one quarter, from just over $38,000 (a record), to $40,155 (a new record).

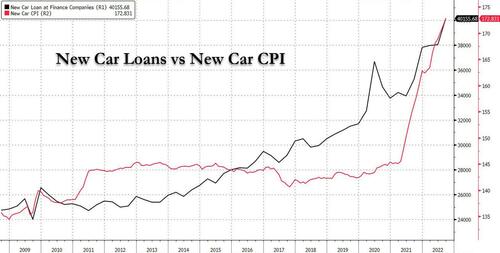

Now this shouldn’t come as a shock: a simple reason why new car loans have hit record highs is simply because new car prices have also soared to all time highs, as the next chart shows.

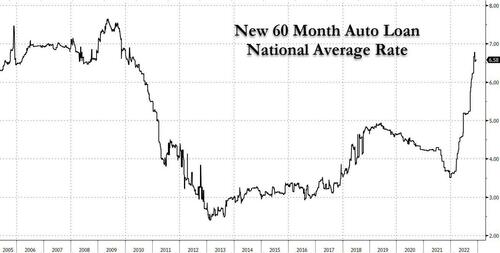

Here we will ignore for the time being cause and effect, or “chicken or egg” questions – i.e., whether record new car prices are the result of easy record credit, or whether record new car loans are simply tracking the explosive surge in car prices, and instead focus on something even more ominous: the explosion in the average interest rate on a new 60 month auto loans: according to Bankrate, as of Dec 16, the number is just over 6.50%, almost doubling since the start of the year, and the highest in 12 years.

It is this surge in nominal auto debt as well as the unprecedented spike in new auto loan rates, that we believe has finally pushed the US car sector to the infamous Wile Coyote point of no return.

Consider the following: according to various recent financial analysts, a growing number of consumers are falling behind on their car payments – a trend which will only accelerate – in a sign of the strain soaring car prices and prolonged inflation are having on household budgets.

As NBC reports, whereas repossessions tumbled at the start of the pandemic when Americans got a boost from stimulus checks and lenders were more willing to accommodate those behind on their payments, in recent months, the number of people behind on their car payments has been approaching prepandemic levels, and for the lowest-income consumers, the rate of loan defaults is now exceeding where it was in 2019, according to a recent report from Fitch.

Naturally, with the economy set to slump into a Fed-induced recession, the trend will only get much worse into 2023 with economists expecting unemployment to rise, inflation to remain relatively high (at least until the economy crashes) and household savings – already at record lows – set to dwindle. At the same time, a growing number of consumers are having to stretch their budgets to afford a vehicle; the average monthly payment for a new car is up 26% since 2019 to $718 a month, and nearly one in six new car buyers is spending more than $1,000 a month on vehicles. Other costs associated with owning a car have also shot up, including insurance, gas and repairs.

“These repossessions are occurring on people who could afford that $500 or $600 a month payment two years ago, but now everything else in their life is more expensive,” said Ivan Drury, director of insights at car buying website Edmunds. “That’s where we’re starting to see the repossessions happen because it’s just everything else starting to pin you down.”

The silver lining is that while the US auto sector faces unmitigated disaster in 2023, for those in the repossession business, it’s been difficult to keep up. Jeremy Cross, the president of International Recovery Systems in Pennsylvania, said he can’t find enough repo men to meet the demand or space to hold all the cars his company has been tasked with repossessing. With the holidays approaching, he’s been particularly busy as people prioritize spending elsewhere, and he’s expecting business to keep up throughout next year and 2024.

“Right now, it’s really the perfect storm,” said Cross. “Over the last two years, vehicle prices were inflated because there was no new car supply, people were still buying like crazy because they had a lot of stay-at-home cash, they had inflated credit scores, so it was like a recipe for disaster.”

Ironically, at the same time, the number of repossession companies has shrunk by 30% as many firms closed up shop and the workers found jobs in other industries when repossessions tumbled during 2020, Cross said. Now, he told NBC, lenders are paying him premiums to repossess their cars first in anticipation of a continued increase in loan defaults (read: plunging prices).

“The volume is picking up, and the remaining companies that are still performing repossessions are very busy,” Cross said. “The overall numbers are still not prepandemic numbers, but we will see a big change coming in ‘23 and ‘24 that I think the lenders are starting to recognize because they are offering financial incentives that they never had to do in the past. They’re jockeying for position knowing that there’s only a certain amount of bandwidth available.”

Predictably, the coming auto crisis is an issue that’s raised concern among officials at the Consumer Financial Protection Bureau, who say they are seeing troubling signs in the auto market, particularly among so-called subprime borrowers, who have below-average credit scores, and those with loans taken out in 2021 and 2022 when auto prices were particularly high.

Yes: that 2008 deja vu feeling is back front and center….and so are the defaults.

“Loans taken out in those years are performing worse than prior years just because those consumers had to finance cars once the supply chains were jammed and the prices started to go up,” said Ryan Kelly, acting auto finance program manager for the CFPB. “Those consumers got hit with inflation twice. First, when they had to finance a car after the prices went up, and then when they had to put gas in the car after the Russia-Ukraine conflict started. So there’s just a lot of consumer stress.”

What happens next?

Well, as the economy continues to deteriorate in 2023, the number of those falling behind on their car payments will continue to rise, even as consumers tend to give priority to their car payment ahead of most bills because of the importance a car plays in getting to work or potentially providing shelter, industry analysts said.

For now, the rate of defaults and repossessions isn’t expected to reach 2008 and 2009 levels, when there was a spike caused by the financial crisis. The percentage of auto loans that were 30 days delinquent was at 2.2% in the third quarter compared with 2.35% delinquent over the same period in 2019, according to data from Experian. By contrast, just over 4% of auto loans went into default in 2009. However, that could quickly change once the 2023 economy unleashes the final whammy of mass layoffs (which have already slammed the tech sector).

“We’re expecting it to continue to increase and maybe even breach prepandemic levels because of the macroeconomic headwinds of higher interest rates, higher cost of borrowing and expectations for unemployment to continue to increase,” said Margaret Rowe, the lead auto analyst at Fitch. “I think our expectation is that we’re going to continue to see it go up, but it’s just been so low that even going up isn’t like what we saw in the Great Financial Crisis.”

Some, like Cox Automotive, remain optimistic: their analysts (who just may be a little conflicted) forecast that while loan defaults and repossessions will increase from their pandemic lows, long-term through 2025 they predict overall defaults and repossessions will remain at or below historic norms.

Still, the financial squeeze has been particularly difficult for lower-income consumers looking for budget vehicles, which have been particularly hard to find. While in the past, those car buyers would have purchased a used car for $7,000 to $15,000 they are now having to spend $20,000 to $25,000 for the same type of vehicle. Among dealers that cater to subprime and deep subprime consumers, the average listing price on their cars has almost doubled since the beginning of the pandemic, according to the CFPB.

“That near prime and subprime group of consumers, they’re getting hit very, very hard by inflation. That group of people did not have much disposable income. They had to finance a more expensive car and then they got hit with prices going up overall. There’s just a lot of stress,” said Kelly.

Ally Financial, which has a significant share of loans to subprime borrowers, said in its October earnings report that it expects delinquencies to increase to as much as 3.8% compared with 3.1% in 2019. That estimate will prove to be overly optimistic.

Another risk to car buyers’ finances is the growing length of auto loans, many of which now exceed seven years. While those longer term loans can lower the monthly payments amid higher prices, consumers risk paying off the loan much more slowly than the car is depreciating, leaving them underwater if they need to sell the vehicle. It can also mean higher interest costs over the life of the loan on top of already inflated vehicle prices.

And speaking of interest rates, they have not been this high since 2009 and will stay at their current levels until the Fed finally pivots. As NBC notes, “for consumers, there is unlikely to be any relief over the next year. Interest rates are expected to remain high for those needing to borrow to buy a vehicle, and Covid-related plant closures and material shortages are continuing to ripple through the car manufacturing supply chain, limiting the number of new vehicles.”

“I dare think what happens to people who are signing up for new loans today,” said Drury. “It’s not going to be better when we see these payments so high.”

But wait, there’s more.

As twitter’s CarDealershipGuy – who claims to be an anonymous auto-industry CEO and whose analysis has been featured in places like the NY Post and who frequently Tweets about the state of the auto market – laid out a long thread on Thursday, all of the above may end up being an overly optimistic assessment of the perfect storm that’s about to hit the auto sector:

“This morning I discovered something *extremely* alarming happening in the car market, specifically in auto lending. I’m now convinced that there is a massive wave of car repossessions coming in 2023,” he wrote.

Recapping much of what we said above, he noted that over the past 2 years, many people took out exorbitant loans on cars and while car values were inflated (and still are) but many people simply had no choice and bought an overpriced a car. Then, echoing the Fitch assessment, he notes how those buyers are underwater: “Car valuations are now plummeting. Some cars have declined in value as much as 30% y/y. And these same people that took out these big loans are now ‘underwater’. Basically, they owe banks more on these cars than they are worth. And the banks are well-aware of this.”

The punchline is his personal experience from late last week. “This morning, one of our General Managers opened up DealerTrack — a portal that dealers use to communicate with auto lenders — and highlighted something very concerning. 9 of our lending partners have started WAIVING ‘open auto stipulations’ for consumers.”

What this means, he explained, is that once consumers are stuck with a vehicle they paid too much for, they can’t trade it in without putting some money up front to cover the difference of what is owed on it versus what it is worth. At that point, he notes, “Dealer can’t sell consumer a car, Consumer can’t buy a car, And, you guessed it, lender can’t finance a car!”

The lender then knows that most consumers are stuck and waives the open auto stipulation – meaning they allow the consumer to buy the new car with a second loan knowing they already have a first one. But the lender does it because they know that the buyer will default on the old, other car.

Cue default avalanche: “This is NOT normal. But it’s the only way lenders can finance cars and dealers can put cars on the road. And the implications of this will be tons of repossessions,” the CEO wrote.

He concluded: “I’ve been a doubter, but after what I saw this morning, I’m now FULLY convinced that a wave of car repossessions will hit in early/mid 2023. If lenders are willing to backstab each other in order to put more loans on the road, we’re in trouble.”

Here is a snapshot of his entire thread:

This morning I discovered something *extremely* alarming happening in the car market, specifically in auto lending. I’m now convinced that there is a massive wave of car repossessions coming in 2023.

Here’s what I discovered (and what no one knows):

Background:

Over the past 2 years, many people took out exorbitant loans on cars. Car values were inflated (and frankly, still are to some extent). But many people simply had no choice and bought an overpriced a car.

Well…

Car valuations are now plummeting. Some cars have declined in value as much as 30% y/y. And these same people that took out these big loans are now “underwater”.

Basically, they owe banks more on these cars than they are worth. And the banks are well-aware of this…

But there is no easy solution. You can’t just put the genie back in the bottle. This brings me to what happened this morning:

Every Friday I conduct a team meeting to recap our week.

This morning, one of our General Managers opened up DealerTrack — a portal that dealers use to communicate with auto lenders — and highlighted something very concerning:

9 of our lending partners have started WAIVING “open auto stipulations” for consumers.

Wait, wtf does that even mean?

Let me explain using a simple, hypothetical scenario:

1) Consumer takes out an auto loan in 2020/2021 on an overvalued car

2) 2022 comes around and that overvalued car is now rapidly declining in value

3) With the car declining in value, consumer now owes more on the car than it is worth

4) Consumer no longer wants the car. Maybe they outgrew it. Or maybe it keeps breaking. So consumer wants to trade it in.

5) But dealer can’t trade the car in because the consumer owes WAY too much on it. So dealer asks consumer for lots of money down to cover the difference.

6) But of course, the consumer doesn’t have $1,000s to cover the difference between what they owe on the car and what it’s worth. And here comes the perfect storm…

7) Dealer can’t sell consumer a car, Consumer can’t buy a car, And, you guessed it, lender can’t finance a car! Everybody loses! Oh no. So what happens next?

8) Lender knows that most consumers are stuck in this situation, and does the following:

WAIVES THE OPEN AUTO STIPULATION.

Meaning, the lender lets the consumer buy the car KNOWING that they already have an open auto loan with another bank!

Why the f*ck would they do this?

Surely the lender knows that consumers that take out a 2nd auto loan are MUCH riskier and have a MUCH high risk of default? Right? RIGHT?

Yes, but the lender does it because they know that the consumer will default on the other car !!!!

Dog eat dog style.

Let me be clear: This is NOT normal.

But it’s the only way lenders can finance cars and dealers can put cars on the road.

And the implications of this will be tons of repossessions.

I’ve been a doubter, but after what I saw this morning, I’m now FULLY convinced that a wave of car repossessions will hit in early/mid 2023. If lenders are willing to backstab each other in order to put more loans on the road, we’re in trouble.

This will not end pretty.

What does this mean in simple terms: well, besides the imminent devastation across the auto sector, including a surge in defaults and car repossessions, we are about to witness a historic collapse in car prices. In fact, in a subsequent tweet, the CarDealershipGuy noted the plunge in prices at troubled used-car dealer Carvana which will be the first domino to fall and be forced to liquidate much if not all of its inventory to stay afloat:

Carvana may have just quietly started liquidating:

The company is now advertising its *retail* inventory to *wholesale* dealers.

Look at the $5,000 price difference. Wild times. pic.twitter.com/fp7PXODEhF

— CarDealershipGuy (@GuyDealership) December 17, 2022

Translation: just as soaring car prices were the leading indicator for red-hot, runaway inflation in 2021 and 2022 (followed by housing, food, goods and finally services) so the plunge in car prices – first used, then new – is the canary in the recessionary coal mine of deflation that will send all prices – cars, houses, and everything else – sharply lower in the coming months.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Yes when you give a 50k car to a 20 yo bobongo with 8 years of payments what could go wrong .

Still driving the2004 Suburban. Maintaining your stuff is the gift that

keeps on giving.

I’m betting I get 300k on my Camry before I let it go.

222,000 on our 2007 Elantra. No rust and well maintained.

Ya know if you think a comment needs a down vote you might at least be intelligent enough to explain why other than your level of ignorance.

Both Toyotas here are north of 250.

Toyotas are the closest thing to car immortality ever manufactured.

My 1998 camry turned 250k when I sold it in great running condition for my current 2013 with 150k now.

I turned 60 today and still running like a top.

My folks are both 90.

My ’92 4 door has 98,500 km. Family owned since new. Gave it a new paint job 3 years ago. This year my project for it is new brake lines. Winters kill brake lines up here.

Happy Birthday from another 60 year old

Dad made it to 94. Mom is 98.

Happy birthday!

We had the transmission replaced in the 2009 Tucson and Nick just changed the struts. We’re good for another 130K, I think.

2011 Jeep’s rocking along at 101K.

On the other hand, the 2016 F150 is a pain in the ass.

My old ’30 Ford is still carrying on. I have no idea of the mileage. I’m not worried to take a 10hr. trip, it’s just a little slow, so back roads are for me. I can remake every part on it, except for the block and crank and heads, but I have extras for those. I used to drive it to HS, but bought a ’76 Toy for longer drives to college. No computer. I can start it w/o a battery. If you leave your butt on the seat when starting, you’ll feel like you are sitting on “Old Sparky” (the electric chair, I sit up a bit when I hit the starter on the floor, I love to watch a friend when I hand him the key,lol). Cruise at 45mph all day, after setting spark and cruise control ‘ears’ . Hard steering and double clutch, but I never even think about that stuff.

Good grocery fetcher, they fits right nice in the rumble.

I’ve just about retired my 2002 silverado to boat ramp duty. Nearly 300,00 miles it earned it.

AC still works like new.

Suburban near that……everything still works.

I remain a Chevy man.

Titan has over 250K, runs like new. Venza has 170K and also runs like new.

My 2002 2500HD just went over 370,000 miles and going strong.

My ’93 Suburban 4×4 is not retired. XLNT inclement weather grocery getter and road warrior, battle wagon. Enough room to carry a sqaud.

Still driving my 2011 4wd Tacoma bought new with a 5 speed antitheft device. Not even 100,000 miles yet. Last vehicle I’ll ever have to buy. Unless one of those dangerous antivaxers crashes into it/s

Me too. Had 310k on mine and the engine developed a lifter tick so I just put in a brand new engine for 5k. Traded a guy a mini-split for some body work this year too so now I’m driving as close to a new vehicle as I’ll ever want to get. Can’t beat a suburban for all around utility and as long as they’re 2005 and older they’re cheap to work on. Bought it from my son-in-law 3 years ago for 3300.00. He sold it because some spic had stolen it and overheated it and that’s probably where the lifter problem came from.

Lifter tick if hydrolic and not solid(then adjust)give a oil change with one can of Seafoam replacing 16 oz.s of oil/drive a 100 miles or so and then listen.

I have made many folks happy with this protocol.

or a quart of transmission fluid…not synthetic. added will free lifters and clean better than the old oil sludge flush treatment.

What happened in 2006? Lower quality across the board from manufacturers? Sudden increase in use of electronics?

The “bottom line”?

It will happen slowly at first, and then all at once-Hemingway

Those with cash will be cherry picking vehicles and sitting pretty. I hope you’re among them.

Real Estate will be the next bubble to break, and when it does, it will make 2008-2011 look like the good old days.

Plan accordingly….

Or you will eat ze bugs, have nothing, and like it!!- Satan Klaus

03 Tahoe here and you’re absolutely right. Had to put a transmission in her back in ’19 but $1800 installed (incl. rear main seal) was far better than payments, higher taxes and insurance.

2010 Ford Explorer going strong. Needed engine replaced at about 100k because of timing belt failure. Ouch. But I like that model year because it’s before the major restyle.

The last time I went into the dealership, one of the first questions out of the salesman’s mouth was “How much do you want to spend a month on your car?” My answer ” As little as possible for as short a time as possible.” That shut down the dumb ass questions for a while. I negotiated the best deal I could and when he pulled out the credit application, I told him I was paying cash.

I was with my father back in ’87 when he bought a brand-new F-150. Taxes and all, it came out to just over $13k.

When dad reached in his pocket and started counting out $100 bills, the look on the salesman’s face was classic: he was counting on all the spiffs he would get if he could get people on payment plans, you could see it light up his greedy little eyes. But that light was gone once he realized it was a straight cash deal.

And that F-150 lasted two engines in it, by the way, before my niece totaled it. Of effin course.

My cousin got asked the same question. He said, “Tell me the price and I will figure out the payment.”

Long story short – spent an afternoon and evening at a keg party with the manager of a car dealership, and all of the salesmen, including one who was his son in 92.

Once they were in their cups one wolf howling story after another of how they skinned, cheated, and over sold naive, inexperienced, and stupid people gleefully poured out.

What a bunch of glib, fast talking, con artist shysters.

My father taught me how to buy a new car…but I drive two 23 year old beaters (Mazda Pick Up – Honda) with a combined mileage of close to 500,000.

My wife drives the newer big SUV (need lots of steel around my treasure). Had fun with the salesman…saved the paying cash punchline until the last split second.

Laughed all the way home crowing to my wife about the look on his face…as I sucher punched him with I was gonna CASH.

https://images.complex.com/complex/images/c_fill,g_center,w_1200/fl_lossy,pg_1,q_auto/hoongqg6exdcjqwzdxfx/punch

I follow car dealership guy and saw his thread. It makes sense. I’m going to wait a bit and buy a repo at a greatly reduced price.

I used to buy new, no more. You drive it off the lot and it depreciates by 20%. Most people need gap insurance these days if they take a loan on a vehicle.

New cars lose approximately 20% of their value in their first year.

The good news is that the rate of depreciation levels out for the next few years meaning your three-year-old car is worth about the same as your one-day-old car.

Now think about you buy that $70,000 dollar tricked out pickup truck. $14 grand gone when it hits the blacktop!

Meanwhile, back at Ford….

Ford Jacks Up Price of F-150 Lightning for 3rd Time since EV Incentives: What You Get for Subsidizing Products Already in Hot Demand & Short Supply

Since the $7,500 EV incentives in the Inflation Reduction Act last August, Ford hiked the Lightning price by $16,000.

I warned about this over a year ago, when the prior version of EV incentives were being pushed in Congress: You do not subsidize a product that is already in red-hot demand with short supply or no supply, with huge waiting lists and long-sold-out production runs. You’re not making this product cheaper for consumers, you’re just making it more expensive because automakers will instantly hike prices to swallow all of those incentives plus some, and that’s exactly what is now happening, and it’s going to stimulate inflationary pressures further and cause more headaches for the Fed and the economy.

I would rather ride a fucking bike than buy one of these POS. Wait until they have to replace the batteries. Also, if you bought a EV in the North and did not understand battery efficiency below 50 degrees, well LMAO

Don’t forget the tremendous amperage draw of an electric heater & defroster

Electric Bike for short trips and a Toyota gas guzzler 4 runner for everything else seems like the best hedge.

Because most presidents are morons. Biden, is a special kind of moron. Not since Woodrow Wilson.

Biden is just a puppet; an amoral puppet, but a puppet just the same.

Here you could (not sure if still happening) sell back your new vehicle even, or for a profit, because the lots were empty. Seems still pretty sparse.

My first and last Ford F150 – 2015 – bought new, looks new, but 165k miles on it. I have been dumping money into the POS 3.5L ecoboost for 2 years now. Last GMC went that far on just 3 or 4 sets of tires, regular serive, and one set of brakes. Just waiting on the market to change and then pick up a nice 3/4T repo.

Let me know when those truck deals become available! I haven’t seen any cracks in the market yet, but I’m looking hard.

I am waiting for this on the housing market(must have minimum 20 acres),it will happen or crash so bad just no longer matters,excuse me while I get a beer and some more popcorn.

It would have already happened, but BlackRock, et. al., stepped in to prop up the market by buying everything.

https://www.foxnews.com/media/blackrock-investment-firms-killing-dream-home-ownership

You vill own nothing.

That other outfit Blackstone that was also doing that appears to be in big financial doo doo. If those assholes all have to delever it will wipe out a lot of faux “equity” people thought they had in their $300 sq. ft. palaces.

Track a realtor in the region you seek. Often they will post upcoming/new listings on their own web page before it hits the MLS. I bought a small ranch surrounded by parkland in the dead of winter from a senior itching to sell. Drove up, inspected, zoning was good, made an offer using the same realtor, and financed it on a line of credit. It’s a gem. Paid off in two years. Now we own a mountain and a secluded valley with good grazing.

I’m doing the same although I have the land. Lumber has dropped $1 a board foot back to “normal” prices of the current 38 cents. Oil is getting closer to normal so all the stuff for plastic and resins might be coming down soon too. Maybe we’ll do a house of the future with it underground and only a tank turret above ground. Eek.

I call bullshit. Crashing? What does that word even mean anymore?

I promise you will know it when you see it. We all will.

i believe that martin armstrong’s computer has been saying 4 a long time that 2023 will be a bad year —

Gotta love that Apple 2

Good. Lets get those cars at auction and on the market. I’ll pay cash since we don’t borrow $. My wife needs a car since my daughter has taken over hers.

… and on that note, my 2010 Hyundai Tucson just turned over 120k. I have full documentation for every bit of maintenance and oil changes ever done to it. This car has far exceeded my expectations for it, and it still purrs like it did 100k ago.

Best of all, I paid it off 5 years ago.

My 2009 Ford Fiesta diesel has just turned 100k – purring like a good’un – 50+mpg – she will do another 10 years with no trouble – I only clock 4k/year anyway and like you CO – I have full docs and annual oil change etc. People are mad to finance a car these days.

The next big thing in the automotive world is buying a “subscription” from the auto maker. For example, for $699.00 per month you can get access to drive a vehicle or switch to other vehicles within the agreement for one to twelve months. Taxes, maintenance and insurance included.It is basically renting a car on a short term with the ability to change to select vehicles at any time.

I think it is more or less just a short term lease that does not stick the consumer with tax, insurance and upkeep.

I wrote this BL at page 181-2 of my book, 8 years ago:

https://www.researchgate.net/publication/358117070_THE_FINANCIAL_JIGSAW_-_PART_1_-_4th_Edition_2020

“However what Tony Seba makes clear in his report is that immense changes

are already in place to adversely affect the smooth operation of our integrated energy

infrastructure. The economics of ‘transport-as-a-service’ (TaaS) offers a much lower

cost transport alternative; about four to ten times cheaper per mile than buying a new

car and two to four times cheaper than operating an existing vehicle in 2021. This

beats even electric vehicles as the main economic driver because this is Uber and any

transportation-on-demand service. If we look at how readily and rapidly internet users

have adapted to using the Microsoft ‘cloud’ then we can see the same process

potentially unfold in personalised transport. We might be seeing the demise of

personalised transport in the New Economy”

https://tonyseba.com/

Looks like you are bang on – again! 🙂

Peter- I have written about measured use and subscription auto plans here numerous times. I am baffled how the “usual suspects” can lock down entire countries for a never ending virus threat and THEN hawk (use it, then park it) daily/hourly rentals where numerous drivers with God knows what kind of illnesses just parked the car before your got in. Russians have been using the drive it/park it rentals in the larger cities for years now.

So far as the subscription auto plans to rent vehicles from the auto manufacturers, it is survival for the auto makers through the worst of the hyper-inflationary cycle to flame out the USD and the only way Joe six pack will be able to afford a new car. Dealerships are dinosaurs and I’m guessing insurance agencys also..

Klaus & Co. know that in their skillfully crafted system their (((club))) will own EVERYTHING the useful idiots will rent and own nothing because (((they))) are the only ones worthy of owning this planet and everything within.

That’s plan BL but I suspect it’s a fantasy that won’t mature. However you are right about auto ownership as I read below and here in UK already 95% of new cars on the road are leased. The buyers look only at the monthly payment – stupid beyond measure.

You vill own nothing.

If you like this idea, the Great Reset is just your cup of tea. Hope you like renting used underwear too.

Probably MORE lies to the low side.

“As twitter’s CarDealershipGuy – who claims to be an anonymous auto-industry CEO and whose analysis has been featured in places like the NY Post and who frequently Tweets about the state of the auto market ”

CarDealershipGuy is anonymous, but has a blue check mark?

How does that work?

$8/month buys the badge.

No car loans at this house and I’m glad. When this comes apart at the seams I won’t feel sorry for many. We will reap what we have sown.

Look on the bright side. There will soon be a lot of irresponsible assholes off our public highways.

And if they turn to crime? Well they’ll be easy enough to catch on foot!

Problem is some will reap what others have sown, and that will work in both directions.

Careful what you wish for.

How is that a fuckin’ problem again?

The poors of course will be affected first and they will be pissed as hell when they realize how fucked they are so expect massive crime. Prepare. Don’t wear anything expensive and stay home after 6pm. Get a dog.

Dog? Get a fucking GUN. Of course, if you have to be told this it’s already too late…for you.

You sir are an ass. Dogs and guns are not mutually exclusive. And if you have a few of the right dogs, dogs that mean business, they are a very effective deterrent of miscreants.

ha ha ha …Hi ya Loop … can you spot the ass that glows?

Do dachshunds qualify as dogs that mean business? Probably not.

I’m way too cheap to spend big money on a car. Haven’t had a car loan in over 25 years. I’ve had good luck buying 7-10 year old sedans. You can get a dependable vehicle for $6-8k on Craigslist. I’m not picky or fancy, though.

Same. I look for older clean vehicles with no damage that don’t run. I ask if I can try starting it. Make a deal. Fire it up with some TLC and limp to my mechanic. I stay with vehicles that I’m familiar with. Lately I’ve been playing with 4.3l V6 4x4s. Rebuild brakes, lines, new pumps, new ignition, wires, new rubber, glass, do some fun mods, paint, lift kit or dub kit. Last one a 91 S-10, throttle body injected. Pretty little beast. I kept that one. Did a low rider for the wife out of a 95. Initial price $700, repairs $3000. She loved it, but i talked her into a mazda2, and sold her cherry ride for $7k. She’s too old to be gawked at. Looking at an abandoned pontiac fire chicken right now. Gutless straight 6, but I might mod it as an EV. Looks do-able. Farm life.

“Ally Financial”

https://projects.propublica.org/bailout/entities/236-gmac-now-ally-financial

https://www.ally.com/about/history/ REALLY funny if ya read it…

correctlyat all.” Ally Financial is a bank holding company organized in Delaware and headquartered in Detroit, Michigan.”

https://en.wikipedia.org/wiki/Ally_Financial

What’s your point? Many (most?) large corporations are incorporated in DE because of their laws.

Built that way, by design. brandon…Sorry! outta paint.

Ally used to be known as GMAC. General Motors Acceptance Corporation which financed cars. Pre GM bankruptcy.

Well, UK seems OK so far – but I guess when it hits here, it’s going to be large and fast, so 2023 could be a sudden shock all round.

https://www.theguardian.com/business/live/2022/dec/05/uk-2023-recession-oil-opec-output-cuts-services-sector-car-sales-business-live

Could be a good time to buy if you can pay cash for nearly new cars.

A warning from the same author….

I do not want new(newer)cars with all the bullshit computers/sensors ect.

Why I am building the 4X4 van from 81 and always buy old cars/ease to work on,nothing in excise taxes(theft),just a win all around.

The 70 thou folks spend on a new truck that looks like every other truck is insane/can build a good/built to the hills 4×4 pickup for 25-30,will pull the frame out of the new trucks in a heartbeat!

I would love to find another diesel Rabbit from the 80’s,45 around town and easy to work on,most are rotted out/wrecked unfortunantly.

I got rid of my F350 for that very reason, frik’n electronics and sensors for everything. Go into the shop for anything and its a $1000 bill, minimum. Everything si designed to get you back into the dealershit. I sold off the junker and bought an older 95 f150. Fuel injected but no other electronics, the windows are powered by armstrong. Won’t nuy anything new again.

Just last year I had an 81 Rabbit diesel in for work, had a very early aftermarket turbo kit! Turbo was still functional, barely, it was hanging on for dear life by 3 exhaust bolts, NO remaining gasket!

Took me back to my early career. So damn easy to work on, though VW is infamous for special tools, I had them all! Even the dial indicator adapter for setting injection stroke!

Hell, I’d even take a gas one, incredibly durable cheap ass vehicle!

🤣 Just another Variant, of..https://gothelittle.blogspot.com/2009/07/clunkers-for-cash-subsidy-for-rich.html

https://www.caranddriver.com/news/a18737347/how-to-destroy-a-clunker-engine/

Apparently, all the ones smuggled out in near pristine condition, and ‘Gifted’ to various ‘Leaders’ throughout the world are wearing out.

Should be a windfall for them.

Guilty as charged, I spend a fair amount of money on vehicles. I get accused of over doing it, Friday alone I spent $1750.00 for a set of ZR rated tires. In 2023 I intend to add the Dark Horse to my stable. Only a motor head can understand that.

Does it at least have a pussy magnet?

By default

That actually in todays day and age seems pretty inexpensive for those tires.

I get a fairly good deal from the dealer. I only go to one mechanic for all my automotive needs. Last year I had him install a whipple supercharger on my 2021 mach1. That set me back 14K. Looks exactly like this

What is the speed limit again?

Boogie,

I like the part where it accepts “Over the air updates.”

If the don’t like you just a little they’ll send “Shut it down and lock the fucker inside.”

If they don’t like you a LOT they’ll send “Floor it, disable brakes and record screams.”

I feel like a piker. My 20 year old van only has 238,000. Admittedly getting a bit rough.

The salami king

HR,get on it,make it a custom,here is inspiration,say hello to Warchild.

When me mum died 2 days after Christmas last year was down and out and major stall on the build,am now hitting with a vengence(have some esoteric parts coming from Cali.) and though cold will keep going till first snow hits,before that,under fancy cover on stands,she WILL be going with a growl in spring,when done,will have about 25 or so but everything rebuilt/new/cozy!

I keep checking, but no discounts on used vehicles showing up yet.

Cars in America are a poor tax. Change my mind.

Take away the cars and whaddaya got?

A car repo just flew over my house!

I gave my grandson my 07 Silverado several months ago. I’m glad I haven’t found a replacement yet. Maybe I’ll wait a few more months…

99 Mercedes e300 turbo diesel, 342,000 miles.

Perhaps now is a good time to start shopping around if interested in buying a used vehicle.

Car dealerships in my area are heavily advertising on the radio right now. A Dodge dealership known for lending to the “credit challenged” is hawking they’ll pay off up to $10K in credit card debt. Next month it’ll be another gimmick in the run up to tax refund season where they’ll battle for those refund checks with pool dealers, kitchen & bath remodelers and the general after Christmas sales in the retail sectors.

Before I retired I worked across the street from a repo company. Business was slow January to March but once April kicked off and all those new car buyers were 90 days late, WHAM! The snatch trucks ran back and forth like ants at a picnic.