Overview

“[B]anks have been managing their paper gold books with one assumption, which is that [Nation] states would ensure gold wouldn’t come back as a settlement medium.” -Zoltan Pozsar

Before we go any further, we read ZeroHedge’s report on this letter Dec 7th entitled: Zoltan Pozsar: Gold To Soar…When Putin Unveils Petrogold (ZH Prem) and have been thinking on it since. Here is one of those thoughts pertaining to the Gold market’s evolving market structure

The statement at top is arguably the most important sentence in Zoltan’s recent post entitled: Oil, Gold ,and LCL(SP)R. It is how he closes that note.

If you have read his letter (excerpt below) you may prefer quotes pertaining to Gold’s price jump from $1800 to $3600 or Pozsar’s follow up statement to the price of Gold potentially doubling where he wrote: Crazy? Yes. Improbable? No.

Those statements certainly are nice to read for real-money advocates; especially coming from one of the most respected economists on the street these days. We cannot lie it makes us smile as well.

However, for anyone with precious metals exposure, like a bank or presumably you reading this piece (thank you for that), the quote at top should rule them all. Here’s why…

Why Banks Short Gold

Zoltan, possibly inadvertently, gives readers the rationale by which banks have been profitably shorting Gold since the 1990s. Here is our translation of that same sentence at top.

Translated from the original Zoltanese:

Banks have been using rehypothecation for decades fearlessly with approval of global governments who promised them Gold would never be used as a settlement medium—i.e. have a practical use — again.

Here’s how a Global head of Gold and Bond trading once explained it to us: Gold? We can short it until the cows come home. Why? Because not only is it unconsumed/indestructible, it isn’t used for anything anymore. Its price is how much more USD money we have to pay you to delay delivery. It’s a collectible, a pet rock, and nothing else. Short it. Government1 can’t let it back in as an MOE. If they did it would destroy them. If we go under, they go under. 2. But I still love Gold. I get to screw the other banks when they get too short every so often.

By inference Zoltan is telling us indirectly what Banks and Nations fear about this Gold-as-settlement-medium concept.

Its return as settlement medium would coincide with the reduction of Bank rehypothecation carry trades as both a cause and effect of Nations needing to actually use Gold in deals again.

Ultimately the root of banking’s short Gold bias is the fact that no-one needed Gold in hand for anything that cannot be delayed3 until later.

This was memorialized in the global market structure by the combination of several things. Chief among them was permitting unlimited rehypothecation (invented by Gold longs, not shorts BTW), changing tax and collateral status (it’s not money, its an asset, Tier 3!), and replacing it (Bretton Woods and its 1971 demise) as the preferred MOE. Once these were done its remaining value as an SOV was an abstraction they could handle. They probably thought: Let it remain an SOV, like art and ceramic figurines. We don’t care. And that is how it has been for decades; until now.

Therefore as Gold owners, traders, and students of economics, we want to know what would entail Gold actually becoming a settlement medium again.

The first question for us in pursuing that goal: What is a settlement medium?

What’s a Settlement Medium?

Here is “settlement medium” in Zoltan’s context again:

[B]anks have been managing their paper gold books with one assumption, which is that [Nation] states would ensure gold wouldn’t come back as a settlement medium. -Zoltan Pozsar

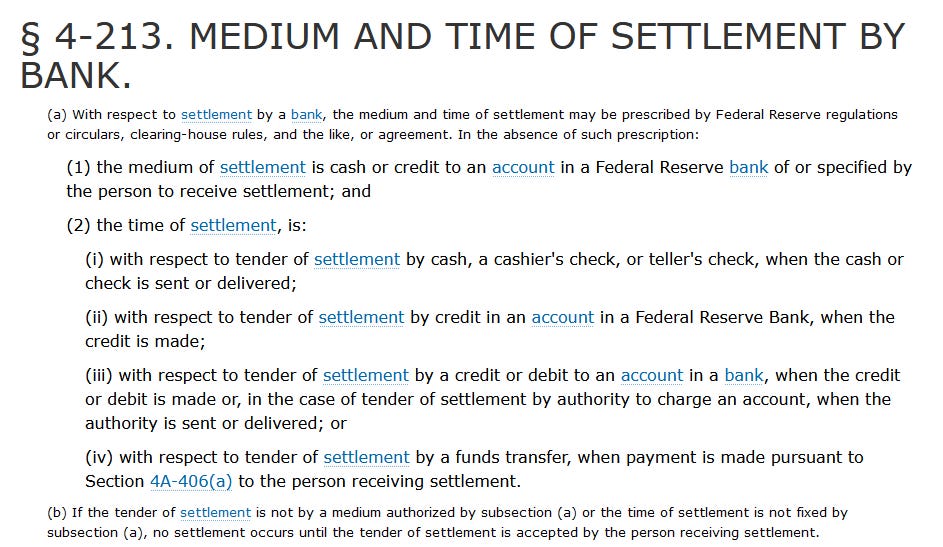

Turns out “settlement medium” is Federal reserve jargon from the UCC: “Medium of settlement is cash or credit to an account in a Federal Reserve bank of or specified by the person to receive settlement.“ –§ 4-213.

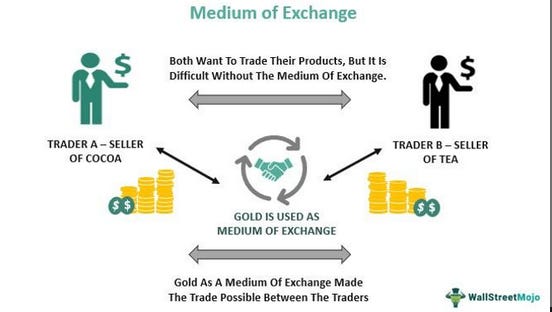

In other words, settlement medium means: Medium of Exchange (MOE).4 Gold, Pozsar is telling us, is in danger of once again competing with the USD as an MOE. Pet rocks aren’t supposed to have use-cases. But Gold is perfect for this use case.

Gold, Zoltan implies, is reemerging as an MOE competitor to dollars for deals. Why does that matter? Using Gold directly means using less dollars. It’s one thing to use gold5 as a store of value (SOV) as it continues to be held by central banks worldwide for “tradition” sake.

Classic pic.twitter.com/T30vDBTI2j

— VBL’s Ghost (@Sorenthek) December 17, 2022

It’s quite another to need it on hand for actual transactions as a settlement medium. Thus, as many of us sense, substituting Gold for dollars as a settlement medium means the price of Gold is way too cheap in dollar terms.6 Gold used as MOE is the nuclear monetary option for nations who feel their currency is unfairly priced against the USD.

Pozsar’s Statement

Before we get to the rest of the sentence, we have to do justice to Pozsar’s Armageddon scenario mentioned prior and what the whole Gold/Fiat world are atwitter over. This is what he said:

War is not about gentlemanly conduct…

The cap of $60 per barrel for Russian oil equals the price of a gram of gold (at current market prices). Let’s imagine this set up as a peg. The G7, led by the U.S., effectively pegs the U.S. dollar to Urals at $60 per barrel. In turn, Russia pegs Urals to gold at the same price (a gram of gold for a barrel of Urals).

The U.S. dollar effectively gets “revalued” versus Russian oil: “a barrel for less”. The Western side is looking for a bargain, effectively forcing a price on the “+” in OPEC+. But if the West is looking for a bargain, Russia can give one the West can’t refuse: “a gram for more”. If Russia countered the price peg of $60 with offering two barrels of oil at the peg for a gram of gold, gold prices double.

Russia won’t produce more oil, but would ensure that there is enough demand that production doesn’t get shut. And it would also ensure that more oil goes to Europe than to the U.S. through India. And most important, gold going from $1,800 to close to $3,600 would increase the value of Russia’s gold reserves and its gold output at home and in a range of countries in Africa. Crazy? Yes. Improbable? No. This was a year of unthinkable macro scenarios and the return of statecraft as the dominant force driving monetary and fiscal decisions.

Let’s game this Gold-mageddon scenario out briefly and describe what would happen if such an event occurred…

End Part 1

Follow VBL’s Ghost on twitter

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Gold from 1971 to 1979 (after the Dick that Tricked caved into the salivating FED Banksters (who he unleashed) went from $35 an ounce to $900 an ounce.

I was 21 to 29 during that amazing run watching it with growing interest…it caught more than just my attention.

But as I had dove head first into my first *DEATH PLEDGE (at 27 every single penny went into the starter home).

We even had a white picket fence, the drop dead gorgeous baby, and debt up to just slightly above our eyebrows.

(Financially I was mooing like cow with a tag in his ear).

After I figured out where the interest was and were the principle was…I had the DEATH PLEDGE epiphany!

After the Hunt brothers challenged the Banksters by trying to corner the Silver Market in the early 80’s…and the Banksters turned the two bold and fearless Texas Billionaires into overnight Millionaires…I watched and learned that buying on MARGIN CALLS is jumping up and down on thin ice…while the Bankster sun is shining.

I had a big Hmmm…moment.

This is all INTEREST UP FRONT!!!

I took my first serious stacking physical – in my hand – position in Silver after the Hunt Brothers were destroyed…and Silver went from $5 to $50…and back down to under $5…I bought in at that bottom under $5…with an eye on the fact I was young.

Read every book I could get my hands on about Gold and Silver. In the mid 90’s discovered the true history of the ‘Creature from Jekyll Island’.

In 1999 I did this.

Gold from 2000 to 2010 was the trade of the decade…anyone who rode that that horse went for a serious $$$$$ ride. I’m living in a house that ride helped build.

Here is my point…

I just watched the first PM Bull run from 71 to 79.

I rode the second PM Bull Run hard and put her up wet.

The third PM Bull run of PMs is just on the launch pad…kept company with all the other commodities and hard assets.

Gold is for Wealth.

Silver is for real money.

PREP IS FOR SURVIVAL!

Do the best you can with what you got…time is short.

*MORTGAGE = DEATH PLEDGE: Latin words Mort-Gage Literally Translated Mort Means (Death) Gage Means (Pledge) “Debt Slavery=Human Mortgages=Debt Till Death.

Thank you

You bet Joe…stay away from those Government I Bonds…their time long passed…and are just a trap now.

Just about the same way I see it. Gold is the safest thing to hold, period. If you don’t belive me just ask the BIS. They say it is literally the only financial asset with zero counterparty risk.

With that said, there are times– as you nicely laid out– that it is not only the safest asset, but one with an explosive financial upside.

I too, think that this is such a time. If I’m wrong, either that time will come in a few years (with my folks unchanged) or things will get so bad that food, water, lead and brass will be the most valuable things.

I am hedged against both of those scenarios as well.

Joe, DRUD,

GOLD PRICES – 100 Year Historical Chart

Interactive chart of historical data for real (inflation-adjusted) gold prices per ounce back to 1915. The series is deflated using the headline Consumer Price Index (CPI) with the most recent month as the base. The current month is updated on an hourly basis with today’s latest value. The current price of gold as of December 28, 2022 is $1,810.41 per ounce.

https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

SILVER PRICES – 100 Year Historical Chart

Interactive chart of historical data for real (inflation-adjusted) silver prices per ounce back to 1915. The series is deflated using the headline Consumer Price Index (CPI) with the most recent month as the base. The current month is updated on an hourly basis with today’s latest value. The current price of silver as of December 28, 2022 is $23.97 per ounce.

https://www.macrotrends.net/1470/historical-silver-prices-100-year-chart

I suspect this is where we are going in 2023 as far as DEFAULTING…and two Hard Assets that will be left STANDING.

Just like they always have the last 5,000 years.

PMs are going up again one way or the other (probably due to BRICS et all destroying the ZOG Economy & dollar and/or the Banksters implementing their Diabolical CBDC), be damned the crooked Banksters shorting PMs, and physical being pegged PMs to paper ETFs; that Bankster conspiracy is like holding a beachball under water. When PMs shoot up again, I expect to see lots of Banksters falling (?) from skyscrapers, or mysteriously suddenly dying.

How many here can afford gold in any quantity that the government can take from you anytime the wish? We seem to like fantasies.

I have been posting this for years on the Burning Platform:

1. Water

2. Food/Food Production

3. Shelter

4. Essentials

5. Guns/Ammo – Training – Defense/Offense Capabilities

6. Medical

7. Cash (Fiat Dollars) in your hands not a Bank (enough for as long as you can build up a surplus for.)

8. Barter

9. Community/Tribe

10. Communication

11. Plan B & C

12. Silver (pre 64 junk dimes, quarters, & 1 oz. American Eagles…this is what most can afford and should buy as far as PM’s.)

13. Gold (only if you have WEALTH, buy it in all values from 1/10 of an ounce to 1 oz.)

Both 12 & 13 must be in your hands.

Yea, 12 and 13 may not be needed at first, but nothing lasts forever, including every single crash in history (but this is an intentional controlled demolition not a crash…so there is that) if you don’t have real wealth, and have not completed 1 through 11 in depth…you do not need to spend what you don’t have (wealth) on gold, but that is another thread.

At this point in time there is more upside to Silver than Gold.

Precious metals are not either or they are part of complete Prep…until/after the top 11 are secured…no matter who you are.

If you do not have any spare fiat…soon to be worthless…focus on 1 through 11…Uncommon Common Sense.

ROOSEVELT’S GOLD? (Written in 2007)

“Well, suppose they confiscate my gold just like Roosevelt did 89 years ago?” If I have heard that once, I must have heard it a hundred times. Did Roosevelt confiscate everyone’s gold back in 1933? If he did, how come there’s still a lot of it for sale in a thousand coin shops and numismatic dealers?

Let’s start at the beginning and see what really did happen. The first thing we must remember, is that America was in the midst of a severe depression, caused by lose money issued by the Federal Reserve, which they still are doing. There was an enormous amount of “liquidity” floating around, as today, and everyone was buying stocks on margin of over 90%, at times, which is not happening today. The stock market was on everyone’s lips and minds. Bootblacks and janitors were buying stocks. Stocks would supposedly go up forever, and there was no risk. Ha Ha. The market crumbled and crashed, leaving everyone out on the well-known limb, owing for stocks which often times weren’t worth much more than the paper on which they were printed. The result was that in fairly quick order, over 25% of the American work force was on the street, selling apples, on the dole, or in bad shape in one way or another. Times were tough, to make it sound kind!

Roosevelt wanted to pull America out of the depression. He thought up all sorts of make-work schemes, and anything to put people to work. But he didn’t have any money. Remember, unlike now, the dollar was BACKED BY GOLD. Therefore, he needed all the gold he could get, so he could print more dollars to spend, to placing more people in those make-work jobs. Everyone knew that gold and dollars were synonymous. Americans were carrying gold coins in their pockets just like they were money, which they were. Small, dime size gold coins were a dollar, and there were $5, $10 (Eagles) and $20 (double Eagles) coins in general circulation everywhere. Gold was money, dollars were money, and the two were the same. How could FDR get gold, so he could print more dollars to spend, to get us out of the depression?

He also had the farmers on his neck. They wanted higher prices for their crops, and there wasn’t any money around to give to them. On March 9th, 1933, FDR declared a “Bank Holiday,” with all the banks closed. Bank “runs” had posed another problem for the “New Deal,” as Roosevelt called his massive move towards semi-socialism. People were closing their savings accounts and bouncing checks by the millions, just to survive in some cases. Today, we have millions of credit cards maxed out for the same reason. There was no FDIC then, so no savings account was insured. (Today, the FDIC has less than a nickel in its accounts for every $100 worth of insurance). Banks had made huge margin loans on now worthless stocks, and they had no money to pay for savings account closures. FDR allowed they could close for a ‘holiday,” so they could get their troops in order. Many didn’t, and never re-opened again. My Parents lost money in a bank which never re-opened.

Banks were in deep trouble. People were demanding their money, and the banks didn’t have any. There was no FDIC, and dollars were backed by gold. The treasury had to have gold to print more dollars to make everyone happy, banks whole, and to fund make-work projects. What to do? Get some gold!

How? The mines were producing all they could, but more was needed. More dollars were needed for stuff that didn’t help get us out of the depression at all. Nothing Roosevelt did got us out of the depression, or even help a bit. As a final effort, he outraged the Japanese enough that they bombed Pearl Harbor, and we were at war. The depression was over.

Roosevelt had the brilliant idea. He would order everyone to turn in their gold, in exchange for paper dollars, which were backed by gold. On April 5, 1933, Roosevelt issued Executive Order # 6012, which ordered Americans to surrender their gold to the government by May 1st, 1933. Violations were to be subjected to a $1,000 fine and as much as ten years in prison. First of all, an Executive Order is not in the Constitution, and an Executive Order could never levy a $1,000 fine or ten years in the slammer! But Americans were broke, miserable, and that $20 gold piece they had squirreled away would buy a lot of food, with bread at less than a dime a loaf. Those who couldn’t afford to hold their gold, turned theirs in and received brand new paper dollars for their gold.

The gold allowed more dollars to be printed, which were foolishly used for nutty things, and none were of help in fighting the depression. A couple of days later, on May 7th, FDR had one of his “Fireside Chats” over radio, to soothe the American outrage. He said that if Americans continued to ‘hoard’ gold, there wouldn’t be any left, and therefore in the interest of fairness, government should own all of it, and use it wisely. Ever hear of such claptrap? Gold markets have existed for thousands of years, and gold has endlessly changed hands around the world! Smugglers and black markets in gold have flourished in times of war, peace, or dictatorships. FDR also persuaded Congress to wipe out the gold clause in existing contracts, which specified payments to be made in gold. In a Joint Resolution of June 5, 1933, all gold payments in existing contracts were made null and void. Even Congress, stupidly went along.

On January 31, 1934, Roosevelt signed into law the “Gold Reserve Act,” which set the gold price at $35 per ounce, as opposed to the former $20.67, which it had been for a hundred years. In other words, he had stolen hundreds of millions of dollars from Americans by raising the price of gold by about 70%, after that were supposed to have turned theirs in.

What in reality he had done, was to lower the value of the dollar by 70%, in relation to gold.

It is estimated that Roosevelt hauled in $7 billion worth of gold from submissive Americans, and still the depression kept right on going. My Dad was a corner druggist in Washington D.C. for 36 years, and I grew up in that drug store. I’ll always remember those days as being educational, and lots of fun. I can still hear my Dad calling Eleanor Roosevelt “Old Horseface,” and bellowing about Roosevelt, calling him every name in the book. He hated the Roosevelts, as did all businessmen, and anyone with a farthing of sense.

Did Roosevelt’s Executive Order # 6012 “seize” everyone’s gold? No! How could government know who had it? Gold coins have no serial numbers, and practically everyone had them. Could government seize socket wrench sets if it passed a law saying that everyone had to turn theirs in? Could government ever know how many people had bought socket wrenches from hardware stores, auto supply stores, Sears Roebuck, Montgomery Ward, etc.? Socket wrenches have no serial numbers, and they certainly don’t have to be ‘registered’ when you buy a set. Both have uses, and both may be about the same size I suppose. Those who didn’t need the dollars, undoubtedly said to themselves, “Me? Give you my gold? “Hell no!” Those who were living at the edge of starvation, having lost their jobs, having lost their savings in closed banks, and seen their stocks go to virtual zero, naturally gave their gold to the government in exchange for bread money. No one was ever fined, and no one ever went to jail for an Executive Order, which could never have been enforced.

There are actual laws against prostitution and drugs, but they flourish on a daily basis. Hookers and drugs have no serial numbers either, and aren’t registered like car titles, real estate deeds or stocks.

How could government “seize” your gold, when no one knows you have it? Registered guns have possibilities for seizure, because of their registration, but when they come to get yours, as I am certain they will, you “had it stolen,” “sold it at a yard sale,” or “gave it away,” hopefully. No gold coin is “registered,” and no gold coin has serial numbers other than the Credit Suisse 1 oz gold bars. A decade ago, in Silverton, Colorado, a miner was accused of stealing gold from a mine, lots of gold sponge was found under his bed. It went to court, and Henry Kolego’s lawyer asked the prosecution if the supposed stolen gold looked different if it came from one mine or another? “No.” Does the supposedly stolen gold have serial numbers for identification? “NO.” Henry went free. Did he steal it? Probably, but it was totally un-provable.

Can anyone from the government, seize your gold like Roosevelt attempted? How could they? Gold is not radio-active, so a Geiger Counter wouldn’t work. “Well, they’ll check your supplier or seize your records.” If you had gold at one time, how could anyone prove you still had it if you had given it away, sold it, or had it stolen? Like registered guns, if you please. The thought of government going through a million court cases, violating the Fourth Amendment, trying to “seize” your hoard of Krugerrands, borders on the insane and, at least is laughable.

As a refresher, the Fourth Amendment says in part, “The right of the people to be secure in their persons, houses, papers and effects, against unreasonable searches and seizures shall not be violated.” Is it illegal for you to purchase gold or silver? No. Is it illegal for you to own them? No. Ever hear of the legal term “ex post facto law?” Just forget the “seizure” nonsense, and protect yourself.

Don Stott

[email protected]

The reason Roosevelt confiscated gold was they planned to revalue gold, and they didnt want the population to sell in to the market after all the people suddenly found that there gold was worth 40% more, and by threatening to conficating gold (thats if the people did hand it in ) they stopped inflation when gold was revalued,

It is estimated :

“The reduction in gold in circulation AFTER the announcement of the Gold Act in April would be about 3.9 million ounces, or roughly 22% of the gold remaining in circulation in March 1933”.

FDR choked about 22% of the gold…out of all the puppies.

https://jessescrossroadscafe.blogspot.com/2009/01/last-time-fed-devalued-dollar-to-save.html

What you don’t own can never be seized.

US Gold coins could presumably be restricted as legal tender, given the fact they are officially stamped with a dollar denomination. This is Roosevelt’s legal justification for government demands for private property. Everyone knows physical ownership is 9/10’s of the law, so when a corrupt government demands compliance, things can mysteriously go missing – for years.

When governments ban, the black markets expand

If you keep your debt to equity always on the positive equity side you will be OK. Cash flow that always exceeds your needs is also a good thing.