Authored by Michael Snyder via The Economic Collapse blog,

Economic conditions are much worse than you are being told. Throughout the past year, prices have been rising much faster than most of our incomes have. As a result, our standard of living has been rapidly declining. It has become increasingly difficult for U.S. households to make it from month to month, and as you will see below, more than a third of all U.S. adults are actually relying on their parents to pay at least some of their bills at this point.

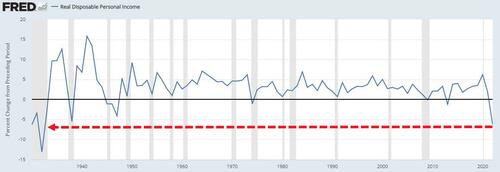

But even more alarming is what has been happening to real disposable income. According to Fox Business, the most recent GDP report revealed that the decline in real disposable income that we witnessed in 2022 was the largest that has been measured since 1932…

The most troubling information in the GDP report is the precipitous drop in real disposable income, which fell over $1 trillion in 2022.

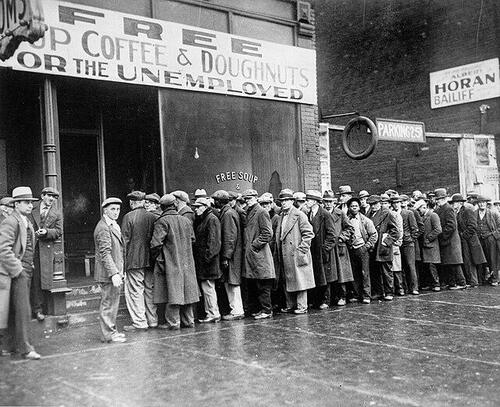

For context, this is the second-largest percentage drop in real disposable income ever, behind only 1932, the worst year of the Great Depression.

Just think about that for a moment.

The last time real disposable income declined this quickly was literally during the peak of the Great Depression.

And as our incomes get squeezed tighter and tighter, more Americans are starting to fall behind on their bills.

For example, the proportion of subprime auto borrowers that are at least 60 days behind on their payments has just surged to the highest level that we have seen since 2008…

In December, the percentage of subprime auto borrowers who were at least 60 days late on their bills climbed to 5.67% — a major increase from a seven-year low of 2.58% in April 2021, according to Fitch Ratings. It marks the steepest rate of Americans struggling to make their car payments since the 2008 financial crisis.

We are already beginning to witness the largest tsunami of repossessions that we have seen since the “Great Recession”, and it is only going to get worse in the months ahead.

One woman in San Antonio that knows that her vehicle could be repossessed at any time has decided that hiding it is the best strategy for now…

For some, however, the only lesson is to try and outsmart the repo man: hardly the best long-term strategy. Take San Antonio native Zhea Zarecor who is currently trying to negotiate with her lender so her 2013 Honda Fit won’t get repossessed. In the meantime, she’s hiding it.

The 53-year-old, who is currently in school for her bachelor’s in information technology (and raking up massive student loans for an education she should have had some 35 years ago) splits the monthly bill for the car — about $178 — with her roommate. But then the roommate lost his job, and with prices for groceries and everyday items increasing, there just wasn’t enough for the car payments.

Zarecor is trying to make extra money with odd jobs like contract secretarial work and participation in medical studies, but it often feels hopeless, she said. “Our money doesn’t go as far as it used to,” she said. “I don’t see prices going down, so the only relief I see is when I get my degree.”

Sadly, most of the country is just barely scraping by at this juncture.

As I discussed in a previous article, one recent survey discovered that 57 percent of Americans cannot even afford to pay a $1,000 emergency expense right now.

And a different survey has found that a whopping 35 percent of all U.S. adults are still relying on Mom and Dad to pay at least some of the bills…

More than one third of adults (35%) admit they still have at least one bill on their parents’ tab. According to a new poll of 2,000 Americans, the top three expenses their parents still pay for are rent (19%), groceries (19%), and utilities (16%). In fact, almost one-quarter (24%) of millennials say their parents cover their rent.

Are things really this bad?

Unfortunately, economic conditions are only going to get even worse in the months ahead as countless more Americans lose their jobs.

On Monday, I was quite saddened to learn that electronics giant Philips will be giving the axe to another 6,000 workers…

Philips announced Monday that it’s cutting another 6,000 jobs worldwide as it works to boost profitability.

The workforce reduction will occur over the next two years with the first 3,000 cuts taking place this year, the Dutch consumer electronics and medical equipment maker said on Monday. In its earnings report, the company revealed it suffered a net loss of 1.6 billion euros in 2022, which is down from a net profit of 3.3 billion euros last year.

And it is also being reported that one of my favorite toymakers has decided to eliminate approximately “15% of its global full-time workforce”.

I could go on and on if you would like.

In fact, every day I could fill up my articles with nothing but job loss announcements.

We have entered a very painful economic downturn, and one prominent Wall Street economist is warning that the full impact of this crisis will not be felt until the second half of 2023…

According to one Wall Street economist, a looming recession this year will feel more like the 1970s than a 2008-07 slump.

“People are too focused on ‘08 and 2020. This is more like 1973, 74 and 2021,” Piper Sandler chief global economist Nancy Lazar said on “Mornings with Maria” Monday.

Lazar predicted feeling the full impact of a recession in the second half of 2023 as lag effects from the Federal Reserve’s rate hikes take hold.

Actually, it would be quite wonderful if her seemingly gloomy forecast is accurate.

Because I don’t believe that we are heading into a slowdown like we experienced during the early 1970s.

Rather, I see all sorts of evidence that indicates that we are in the very early stages of the economic equivalent of “the Big One”.

I believe that things will be very rough this year, and I believe that the long-term outlook is even worse.

Our leaders assured us that everything would be okay even as they were flooding the system with money and engaging in the greatest debt binge in all of human history.

Now a day of reckoning has arrived, and we will get to suffer the consequences of their very foolish decisions.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

She’s trying to get a bachelors in IT thinking that will solve her problems.

I had no background in IT, HTML, or anything digital in the early 00’s but at age 55 I faked it till I made it, building a business in digital marketing where, even though I don’t purport to be an IT guy many clients see me as such.

Fools think the way out of a hole is to keep on digging.

Well, she’s making ends meet by “participating in medical studies,” so she can’t be the sharpest tool in the shed.

If she wants to to IT, she needs to get some basic certifications in actual programming, database, networking, or sys admin. The college degrees don’t mean much, and are only good for moving up to management.

What is this “disposable income” you speak of??

TIA

It’s the money earned by taxpayers, plus Fed-induced inflation, which politicians dispose of in Ukraine, by detonation.

LMAO !! Good One !!

you forgot the 25% that the politicians either pick up in cash personally on visits there, or have crypto deposited to them….like the TURDle did.

10% for The Big Guy!

So we’re all supposed to wear fedoras now? Fuck that.

Instead of a roof.

We used to wear”clothes”

The PC term now is “Micro-Dwellings”.

Rejected terms:

Close Contact Domicile,

Biome Bedding,

“I cant believe I’m home”(failed pitch)

Residential Rayon,

Cotton Commune

Insta-bed.

You Are Your Home

Have you guys see the FED’s new $1 bill yet?

Right On !!

Bix Weir has a great vid on it. Especially the writing.

Survey: Nearly two-thirds of Americans are living paycheck to paycheck

A new survey found that Americans living paycheck to paycheck increased over the last year, with nearly two-thirds of Americans reporting that they do so.

About 64 percent of consumers said they were living paycheck to paycheck at the end of 2022, according to a report from Pymnts and LendingClub. The report found that the number is about 9.3 million more than the previous year and includes about 8 million people making more than $100,000 per year.

They also found 80% of those surveyed were delusional….

The research also found that 4 out of 5 consumers expect their personal finances to improve over the next year, which is up 7 percentage points from July 2022.

I suppose that beats dying in between checks…

“More than one third of adults (35%) admit they still have at least one bill on their parents’ tab.”

Needless to say, this is paying for today with tomorrow. I have two fully grown manchildren under my roof. Every dollar they suck out of my pocket is a dollar that I won’t have in retirement… Thanks again, Traitor Joe…

Maybe they could apprentice in the trades?

” Thanks again, Traitor Joe”

Who raised those boys? Joe or you, fool?

Did you trust school to teach them fiscal responsibility? Or responsibility at all?

Not personally banging on you, Tom. I don’t know you. But this is how we got in this predicament.

Straighten their asses out or shut up.

Massive deflation is coming. It’s unavoidable because we’re about to go through the beginning of the Baby Boomer die off. You can already see this when celebrities like Kirstie Alley (71), Cindy Williams (75), Jeff Beck (78), Tom Verlaine (73) passing away recently. It’s being estimated 5,000 boomers are dying off everyday leaving 4 million houses on the market every year. Additionally, government spending is about to be reigned in because population demographics can’t replace the boomer driven spending of the past 40 years.

https://www.cutimes.com/2022/07/05/baby-boomers-will-leave-housing-glut-after-their-final-move/

30 years ago, we were seeing 5,000 of the “greatest” generation dying every day, but they were leaving a legacy to their children/grandchildren and a windfall to the government through inheritance taxes.

Blackrock to the rescue?

Like being saved from drowning by sharks.

All of the dirt people pouring over the border will need a place to live.

All of the dirt people pouring over the border will need a place to live.

Or as dot gov refers to them:

“The next round of test subjects”

You know, because tptb are just about done with the current group.

I’m 69. And my $$$ from 34 yrs. in biz get split between my 2 daughters. As for our house, 99% of the US would KILL for it. Above tax valuation. Sunrise & sunet marsh view. Private road, we all grow food & chikins. One bridge into our island.

And we have PEACOCKS. OUR EARLY WARNING SYSTEM.

The Shadow Knows!

You can make re-entry heat shielding out of peacock shit.

They should use it to shield the passenger compartment of Teslas.

“Now with protective bird shit!”

‘Tax Revenue’? Laundered and divided. In Cash.

Funny Money since foreva for EVERYTHING else.

Oh my and all this time I thought it was the vacccine that did them in,

If their kids are living in the house won’t it just be inherited by the current occupants resulting in far less than four million empty houses more or less? Articles like this are dangerous as the low information low IQ Demunist fools will say “Let’s give these houses to the poor deserving illegal alien fuques, I mean “migrants” so they won’t sit empty and unused.”

How many people have died because they took the bioweapon clot shot? How many cannot work due to the sever bioweapon clot shot side effects? Who is $ John Galt?

Hmmm…anyone know what is going on with the Debt Clock?

Why is oil, gold and silver to dollar ratio blank???

https://www.usdebtclock.org/

The Fed is between a rock and a hard place. Catch 22.

Can’t help but think this is all by design.

Inflate the supply; lose purchasing power. Easy money; massive debt.

Rothschild banks crater economies with stealth inflation, the elites

scoop up assets for pennies on the dollar, and when it all blows up,

usher in the CBDC’s, by banning cash transactions, as a fix for the problem they created.

Wiemar, here we come. Zimbabwe. Venezuela. Argentina.

One possible safety valve: junk silver. or if affordable, gold in small denom’s.

Otherwise, spend cash on durable items of value w/ no shelf life, barter material.

If you got ’em, smoke ’em.

Sound advice, Anon. I concur.

Now why didn’t I concur?

Outstanding paragraph big picture No Name!

Now we just need someone to punch them in the mouth…

Ag

I wish Snyder would run for office here again so he would slow down on the far porn/book selling. Also he would really irritate the shit out of the politicians in office with his BS. I voted for him last time just for that reason.

When I retire I’m just going to win the lottery. problem solved