After repeated laments by the likes of Bill Ackman, who most recently said that “I continue to believe that the best course of action is a temporary @FDICgov deposit guarantee until an updated insurance regime is introduced” (and who just flip-flopped on his “Fed must hike with shock and awe“ call from 2022 and is now urging for a Fed hiking pause), and following a Bloomberg weekend report that US mid-sized banks demanded a two-year total deposit insurance scheme from the FDIC, and warned if it doesn’t arrive, there may lots more shotgun weddings (or shotguns), moments ago Bloomberg reported that “US officials are studying ways they might temporarily expand Federal Deposit Insurance Corp. coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis.” Guess our March 12 tweet was ahead of its time yet again.

FDIC unveils new sign pic.twitter.com/PbYESPaji5

— zerohedge (@zerohedge) March 12, 2023

The BBG report explains that “Treasury Department staff are reviewing whether federal regulators have enough emergency authority to temporarily insure deposits greater than the current $250,000 cap on most accounts” without formal consent from a deeply divided Congress, and goes on to note that “authorities don’t yet view such a move as necessary, especially after regulators took steps this month to help banks keep up with any demands for withdrawals” which is an important caveat, and is the same one that hawks are using to justify why a Fed pause would be self-defeating (“why is the Fed blowing up their last bit of inflation-fighting credibility; what do they know that we don’t): the same question can be applied to the Treasury: “what does the Treasury know that we don’t.”

Most likely nothing – after all bank crises are non-linear, but as Bloomberg notes, “still, they are developing a strategy out of due diligence in case the situation worsens.”

“We will use the tools we have to support community banks,” White House spokesman Michael Kikukawa said, without directly addressing whether the measure is being studied. “Since our administration and the regulators took decisive action last weekend, we have seen deposits stabilize at regional banks throughout the country and, in some cases, outflows have modestly reversed.”

Still, the report notes, the behind-the-scenes deliberations show there are concerns in Washington’s corridors of power as midsize banks call for broader government intervention after three lenders collapsed this month when uninsured depositors pulled their money, and as a fourth firm strives to avoid a similar fate. Shares of that one, First Republic Bank, tumbled an additional 47% on Monday as industry leaders tried to find a way to bolster the company’s finances.

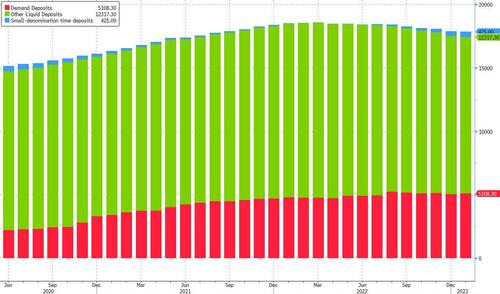

Ok, that’s the theory. What about the practice? After all, as regular readers know there are $18 trillion in total deposits, all of which will have to be insured…

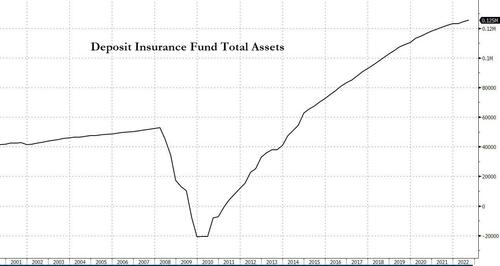

… and just $125 billion in the FDIC’s Deposit Insurance Fund, which makes an outright guarantee of all deposits just a small mathematical impossibility.

Well, there’s always printing. According to Bloomberg, one legal framework under discussion for expanding FDIC insurance would use the Treasury Department’s authority to take emergency action and lean on the Exchange Stabilization Fund. The same magical Exchange Stabilization Fund which the Treasury is already using to backstop its latest bank bailout facility, the Bank Term Funding Program, or BTFP.

Here too there is a small problem: that ESF pot of money is used to buy or sell currencies and to provide financing to foreign governments. A bigger problem: the ESF only has $25 billion currently in it as parts of its BTFP backstop…. but it has to do, as it is the only pot of money under the full authority of Janet Yellen, with other spending and financing under the jurisdiction of Congress.

Any mechanism using the ESF as a bailout mechanism uses the cash from the fund as a first-loss equity tranche to which the Fed then applies leverage. LOTS of leverage, because if authorities plan on backstopping the $18 trillion in total US deposits, the Fed will need to cover the difference… of some $17.975 trillion (unless Congress reaches a bipartisan deal to infuse more capital in the ESF, the same way the ESF was expanded to $500BN during the covid crisis

Meanwhile, in keeping with the tradition of saying the polar opposite of what it is doing, a Treasury spokeswoman said in a statement that “due to decisive recent actions, the situation has stabilized, deposit flows are improving and Americans can have confidence in the safety of their deposits”

Which of course explains why First Republic is about to join the collapse contagion and why Treasury is planning a full deposit backstop.

Finally, such a program will likely have to also be the result of an executive order since it has little hope of passing in Congress where members of both the left and right will be vehemently against it.

“Any universal guarantee on all bank deposits, whether implicit or explicit, enshrines a dangerous precedent that simply encourages future irresponsible behavior to be paid for by those not involved who followed the rules,” the House Freedom Caucus said in a statement, and we are confident most of the progressive wing will not be too excited about bailing out billionaires and corporations with orders of magnitude more in the bank than the FDIC limit.

As The Chicago Fed wrote in a paper in 1986 – after the deposit runs at Penn Square National Bank and Continental Illinois Bank – uninsured deposits are a source of market discipline for banks. Herbert Baer and Elijah Brewer go further, warning that doing away with insured deposits (i.e. by insuring every deposit as is being considered currently) would actually increase risk in the banking system.

“While such proposals might reduce the likelihood of bank runs, they would at the same time reduce banks’ incentives to control risk.”

Will US bank regulators learn from the mistakes of the past?

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

STUDY FINDS: Results never good when GOV tells public what it is studying. The intelligent public recognizes this as the admission of failure that it represents.

People look to you assholes for answers and solutions, and all you’ve got are studies, excuses and circle jerks.

You AIN’T leading.

I ain’t following…

because you assholes can’t get out of your own way!

How to guarantee $18 trillion? First of all don’t even try because it’s impossible and would only impoverish us more, but, since that won’t stop them, I suggest taking back all the trillions the oligarchs pilfered during the faux pandemic, the GFC, and all the other swindles they’ve gotten away with, which would be multiples of $18 trillion. Then, for good measure, arrest the banksters and their political puppets who got us into this mess and chop government by 90%. About as likely to happen as the Cowboys’ cheerleaders gang banging me, I know, but as fun to fantasize about, too.

I have it in my will that when I die, the undertaker is directed to pull all my gold fillings and crowns from my mouth and give them to my heirs.

Biden will tax that gift.

Wasn’t it the Cowboys cheerleaders that recently hired a trannie?

Brokeback mountain cheerleaders? (No, I never saw the movie, only heard about it.)

Ah, Biden will just print $18 trillion. What could go wrong?

He thinks big government spending is the cure for all evils and has said so many times! I am sure if things do go around China will give Joe and his family asylum!

For a minute I thought that was a babylon bee headline

Like I said, the banks are fine, All deposits will be guaranteed. The fact that it might only be able to buy 2 McDoubles is the problem.

What a joke the government has become. This is funny to the point of frightening. The arrogance of those In control, thinking you can back up trillions upon trillions of dollars.

Just change the name of every bank to MORAL HAZARD and be done with it.

“Just make a twenty trillion dollar coin, use what you need, and keep the rest for walking around money.”

Nobel prizewinner paul krugman to joe biden

All $US Dollars come into being as a “credit” to the banks, remember that the value of 1 divided by 0 is infinity.

Easy. Just impose CBDCs and steal it all one night. Oops…did I give away their plans???

No fair … you read ahead in their playbook …

Grocer bringing wagon full of money to pay his employees (Weimar Germany 1920s, US 2024).

This is what that foul “villain” Hitler saved Germany from. They hate him because he took control of Germany’s money supply away from the Jew bankers, and in doing so lifted Germany out of the global great depression created by said bankers.

More evil than good is not to be celebrated.

Um, if you think Hitler was “more evil” then all you know about Hitler came from Jewish schoolbooks.

Among other things Hitler did, as soon as he took power?

Banned homosexuality and pornography. You know the LGBTQ Jewgenda we live with now? Hitler put a stop to it. Something that, were he one of our active “politicians” today, you would cheer his name in the streets for doing.

Oh, he also passed what amount to the first animal cruelty laws in the world. You like puppies and kittens? Fuzzy bunny rabbits? HITLER liked puppies and kittens and cute bunny rabbits, too. Do you know what “Kosher” even means on a food label? It means that the animal in question was killed CRUELLY, in a Rabbi-approved fashion with Rabbi-approved tools.

The good Hitler did was enormous. Legendary, even.

He did nothing “evil”, and any notion that you have in your wee little head that he did didn’t come from your own research from non-biased sources. It came from JEWS, who have done nothing but lie to you for your entire life.

Unless you’re a Jew yourself, in which case you know all ABOUT the Kol Nidre. Don’t you? We goyim aren’t supposed to know that you are avowed liars, are we? That you PRAY on it!!! And if you happen to NOT be a Jew, I suggest you look this up.

And before you stand up and go “But oh the 6 million that we were all programmed with! THE 6 MILLION!!! MY PROGRAMMING CAN’T BE WRONG!!!”, I would point to the FACT that I have the official Red Cross document (last revised in 1983) that shows the OFFICIAL DEATH COUNT of all of the camps COMBINED was a grand total of some 282,000.

Do you know the difference between 282,000 and 6,000,000? A Jew hopes not. Because the Jew wants you to think he is your FRIEND.

HE AIN’T.

You have to do away with FRACTIONAL RESERVE LENDING.

You have to eliminate the foreign-owned Rothschild Ashkenazi Jew-owned central banks.

You have to go back to sound money backed by COMMODITY rather than FIAT currency.

These things aren’t hard to figure out.

Forget banking, what time do they cuff the orange dude ,I’m getting tired of waiting…..it’s past my naptime?

Just mint 18 coins that say $1 Trillion dollars on each one. Problem solved.

Oh, no Stucky, you moran! That won’t work because it’s FAKE money!

Me. Hmmmm …. and that $20 dollar bill in your wallet isn’t?? Bwahahaha!

Hi, I’d like a pack of gum and change from my trillion dollar coin.

Sorry sir, we don’t have that kind of change, but if you give us another twenty dollars we can give you a coke to and it call it even.

Joe Biden’s economy.

Stucky- I’m sure you hooted with pleasure when Kansas beat UK. I’m still sticking with Gonzaga.

Ok, here is their plan, in detail:

Remember – USD $17.66 were printed up during REPO from Sep 2019 to Jun 2020. US Federal debt was over USD $16 trillion. Was entire Federal debt wiped out by issuing US Treasury dollars with REPO?

Now they want to throw USD $18 trillion out there to cover the money that goes poof.

These numbers are all too close to be a coincidence. Is this about replacing the $17.66 trillion US Treasury dollars issued under REPO with $18 trillion issued by the FED? With Treasury holding entirety of USA Federal debt was USA debt free in July 2020 and didn’t know it? Is that why they are wasting record amounts of money in DC – to re-enslave us to the FED?

Nationalizing the banks this overtly is quite uncomfortable and unfortunate. We’ll just have to watch it unfold. We’ve proven willing to tolerate even this kind of repression in the recent past. More to come.

When you fail the bank takes your house and your car.

When the bank fails the government takes your tax money and saves the bank.

This is because capitalism is so great in America.

Just print another 18 trillion. Inflation, aw who cares?

There is no such thing as “inflation”. This is a Jew-approved manipulation of language term.

For reference, see “The Protocols of the Learned Elders of Zion”. Suggest Yandex for a search engine for this.

There is only DEVALUATION OF THE MONEY SUPPLY. There IS NO INFLATION. It doesn’t get more expensive to produce things. It gets cheaper. Your money is worth LESS because it is based on DEBT rather than COMMODITY and thus there is an INCENTIVE ON THE LENDER to DECREASE ITS VALUE BECAUSE THAT FORCES YOU TO BORROW MORE MONEY ON WHICH THEY CHARGE MORE INTEREST.

This is why debt-based NOTES can ONLY devalue and why metal (commodity) backed CERTIFICATE MONEY can only HOLD VALUE. One is incentivized to devalue and one is incentivized to maintain value.

I suggest reading “Modern Money Mechanics”.