Guest Post by

Years after the fact, the mainstream media is discovering that Gen Z is doomed. As CNN puts it, Gen Z is “earning less, has more debt, and higher delinquency rates than Millennials did at their age.”

In short, the pandemic did a number on Gen Z, followed by a wallop from Bidenflation, lagging wages, and now a looming recession.

How are they surviving? Debt.

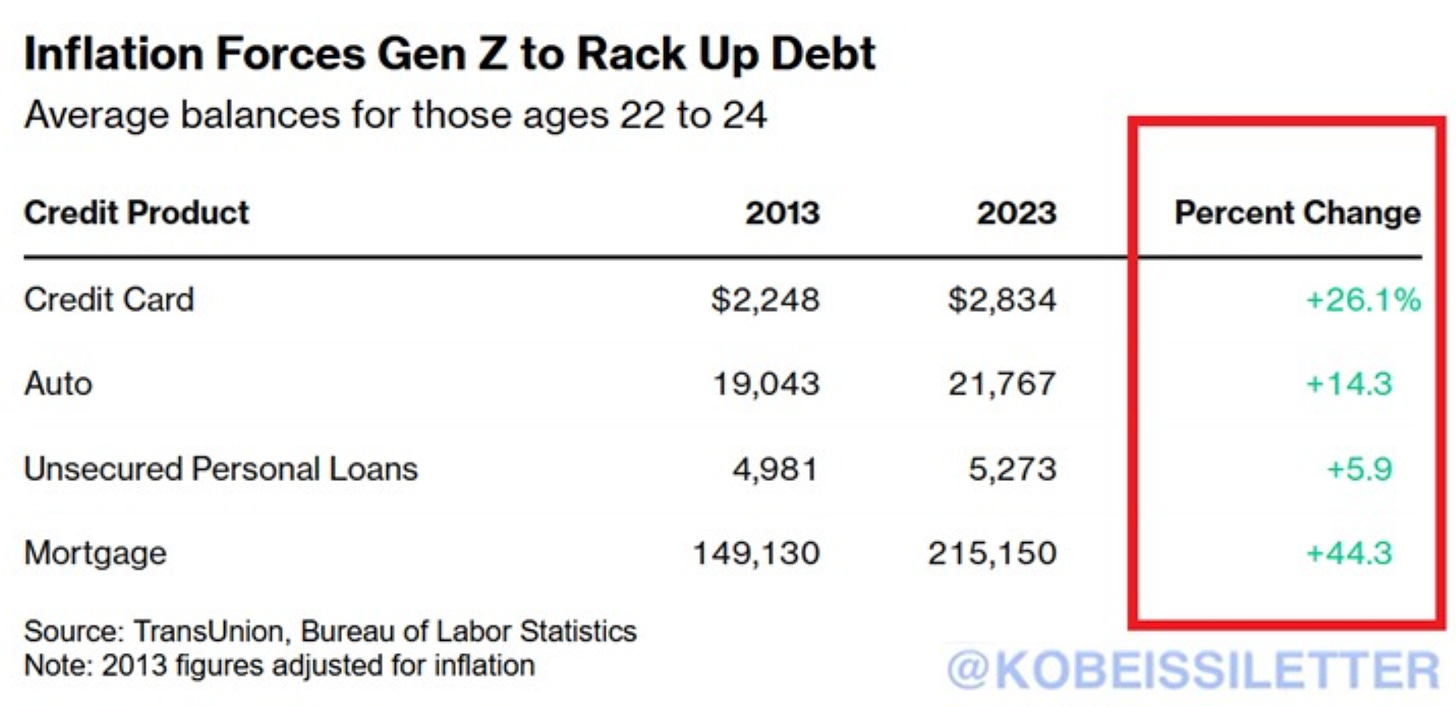

A new study from Transunion finds that, since 2013, average debt balances for those aged 22 to 24 has risen by 40%, including a 14% rise in auto loans and a 26% rise in credit card debt.

For those with a mortgage — which is a vanishingly low percent of Gen Z — the average mortgage debt is up by nearly half to $215,000 — quite a bit of debt at 24.

That, of course, is thanks to the Fed’s money printing that drives house prices to an arm plus a leg.

Gen Z Tapped Out

This debt has mirrored the savings rate, which plunged during Covid from an already abysmal 6% pre-pandemic to just 3.2%. So Americans are saving 3.2 cents on the dollar earned. For perspective, in the early 90’s it was three times that.

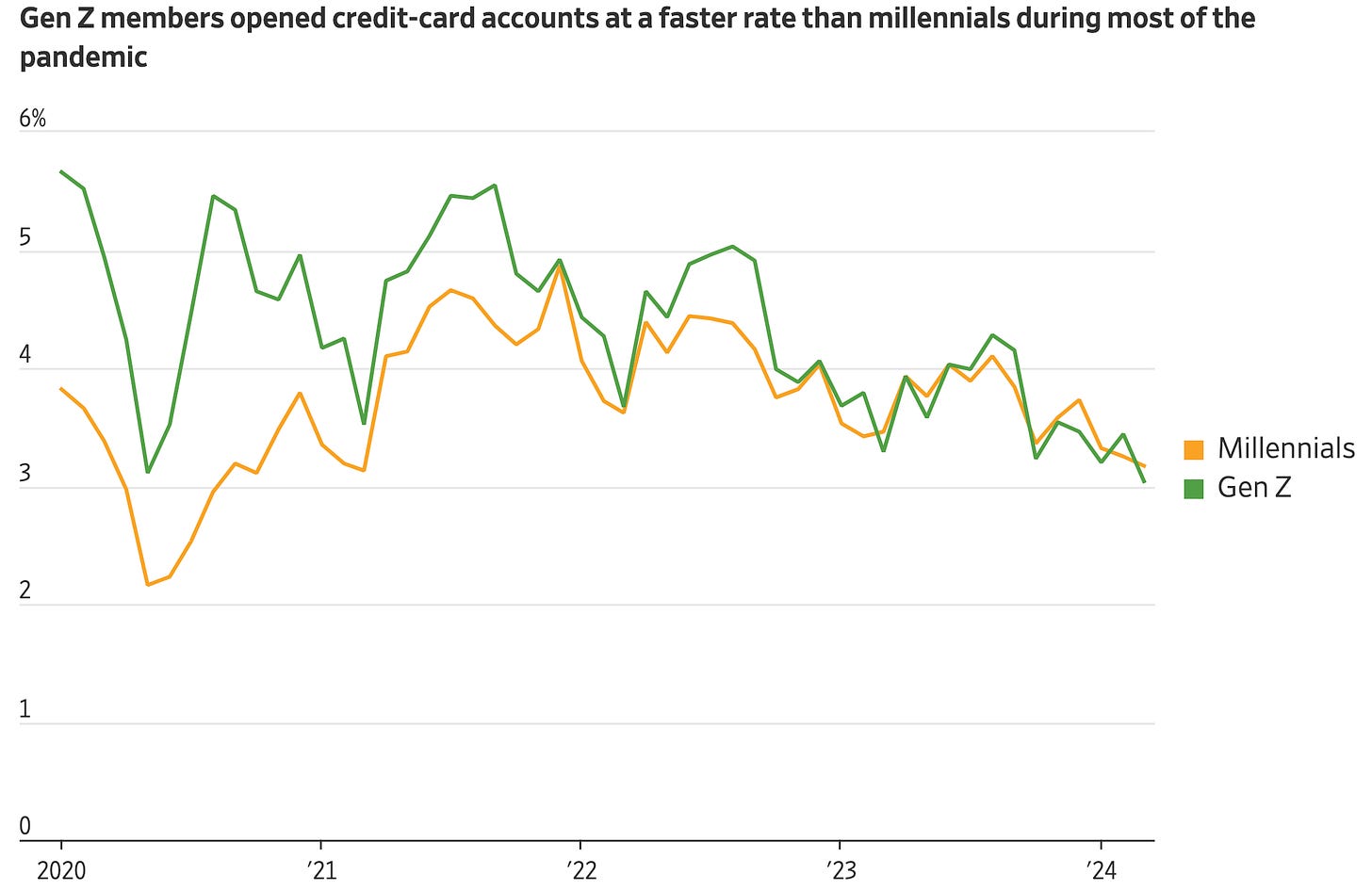

The pandemic apparently accelerated debt, and most dramatically among the young; Gen Z opened new credit cards at a faster rate than even Millennials during the pandemic — during 2020, there were multiple months when almost 6% of Gen Z’ers had opened at least one new credit card in the previous month.

Note Gen Z has the lowest income — therefore the lowest debt capacity — of any generation. Yet here they are sporting multiple cards and giving them a good workout.

All this debt, of course, is now driving delinquincy rates, with auto loan delinquencies rising by half, and credit card delinquencies doubling since 2022 to over 6% of credit cards in delinquency — not just carrying balances, but in actual delinquency.

“Shadow Debt”

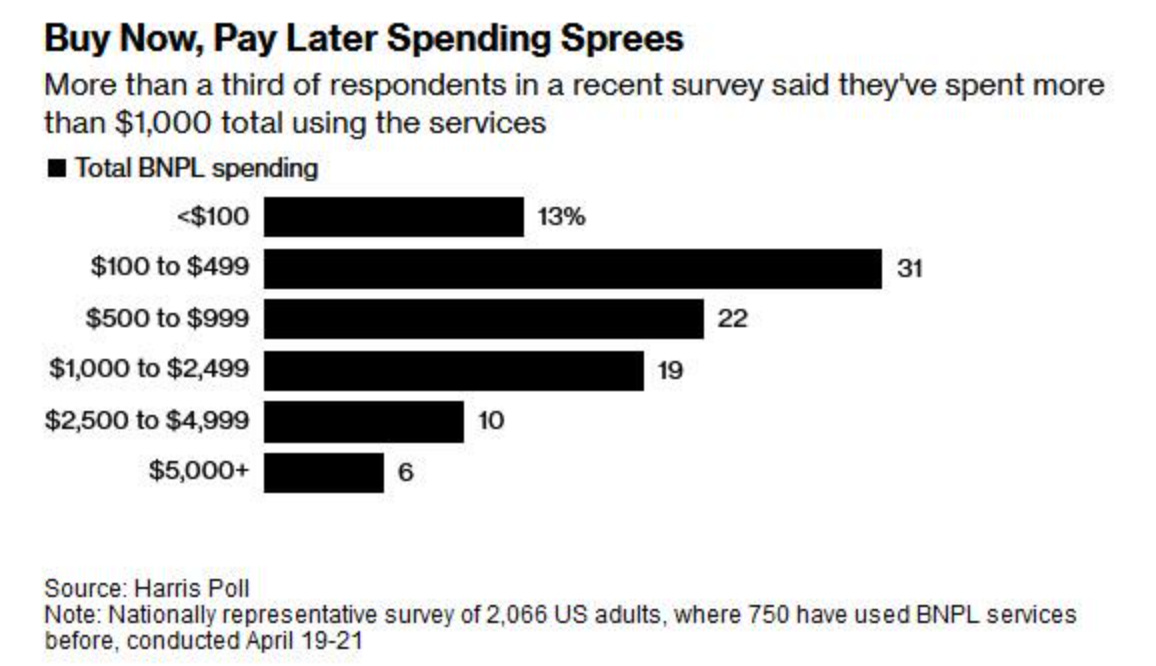

Keep in mind that this is all just the debt we can see — buy-now-pay-later has edged out avocado toast for Gen Z’s favorite daytime activity, totaling an estimated $700 billion in shadow debt.

In a recent Harris Poll, one out of three respondents said they’ve spent more than $1,000 on buy-now-pay-later, and 54% of users admitted spending more than they can afford.

One in four reported that buy-now-pay-later is making them fall behind on other lines of credit — note a credit card charges 24% interest per year, which is slightly lower than the mafia.

What’s Next

In a recent video, I mentioned the real-world fallout from all this debt, with declining sales for low-end staples from McDonald’s to Coke to Kraft Mac-n-Cheese — a Gen Z standby. Now Walmart is rolling out a private label brand of items under $5 to clothe our next generation in all the finery their debt will allow.

Gen Z is a financial train wreck — keep in mind this is the next generation of Americans.

They’re facing soaring prices and plunging wages, even as their formative experience of stimulus checks and student loan bailouts has taught them that maybe if they crash hard enough, Mom and Dad — er, the federal government — will bail them out.

We’re raising a generation of wards of the state, sustained not by productive work but by debt and handouts.

Given that government spending is unsustainable at 7% of GDP, they’ll eventually hit reality.

And they’ll be completely unprepared for it.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Just call them slackers and tell them to pull themselves up by their bootstraps.

That always seems to absolve the elders who let the shitshow get this bad.

I am end-of-boomer age, and I approve this message. Fuck every architect of the mess we’re in , especially the compliant, insouciant masses, who make it all happen.

And fuck everyone else.

Rebel, youngsters. Learn what you’ve missed out on, such as solid families/marriages and communities . . . and try to regain it. Good luck.

“We’re all going to go down in a soup made of ourselves, and we’ll all have our own spoon.” ~ Lemmy:

Don’t blame the elders either..we need to cast blame where it belongs. Banksters, the government who can’t budget, the mic and their forever wars, the Fed, usury theft including de-valuing the currency… can’t blame elders for working hard and living within their means.

You only assist the culprits with the generational blame game that they propagate.

The few who rule humanity only have the power ceded to them by the compliant masses; ergo, the masses are to blame for their own enslavement (and responsible for their own emancipation).

Yes and no. Your neighbors paying too much for a house raises the price of every other house around. Ergo, it isn’t the fault of the ones who didn’t pay that much. That’s just 1 example.

Buyers don’t set prices on anything, they pay them. If too high, they go somewhere else. The ability to pay is an entirely different discussion.

It’s fiat. End the Fed. End collusion and most regulations.

Okay, how?

Buyers do set prices, noting is worth more than someone is willing to pay. The real estate company can put a million dollars on a home, but if the highest offer is $100,000 the house is worth $100,000.

When did this foolish trend of offering thousands more than the asking price get started? Entitlement and greed caused it, I have to have it, at any cost.

Proves true one ex: over 80 percent of dummkopfs took experimental Covid injections, some four or 5 more even. Trump, Biden and others pushed it on orders of the elite controlling the politicians. I have nothing to do with anyone who fell for this B.S. anymore. They are willing slaves and will be a threat to patriot’s safety when the crack down takes place when another fear mongering scam is announced..

No, we need to cast it where it belongs, on everyone’s shoulders. There is a lack of understanding of the rule of law, and the willingness to enforce as the Founders bequeath. We follow like sheep unconstitutional acts, and we deny Constitutional powers that were specifically recognized to be solely in the hands of the people.

The Constitution prohibits the creation of law enforcement agencies such as the FBI, ATF, IRS, and so on, as it clearly states one Institution controlled by “We the People”. Yet, we refuse to adhere to, and even deny and disparage its lawful powers, form and function.

The Grand Jury was not a state agency until the 1960’s, when the courts, like they have been doing, took it from us. It was autonomous and controlled by the people as an investigative, and judicial body that We controlled, not some state prosecutor.

We are much more content being completely ignorant of our unique form of government, to the point of our destruction.

Yes, the implied hyperindividualism implied by such a negative remark (applicable to the context), equates to telling someone who has no bargaining, political, or social power to just work harder, or get another job. It’s typically meant and received as very disrespectful, often coming from those with a rogue capitalist bias, and many of these individuals fancy themselves as some sort of self-appointed aristocracy. As though the person is not already feeling unwell and sick from working fifty-sixty hours or more per week, for instance. Indeed the older generation and those in positions of influence to change the economic balance of power but won’t and the voting class are responsible. They let this become exponential with their vote. Cheap votes for a largely non-starter body politic.

Yeah..cause voting changes everything.. the stupid, it burns.

What retards would downvote the above post? Gen Z is soft and they’re parents did a shitty job!

The shit show started with the survivors of the Greatest Generation, continued with the Silent Generation (some who are still in charge) and continues still with the Boomer generation. What will X, Millennials and Z do? X already has some people in important leadership positions (like AOC) so the shit show is sure to continue.

fuckin lazy generation. Let da cunts eat ze bugz and go into klimate gulags silly fuckwits

Wow, you totally missed the point. Didn’t read, didja? Know-it-alls always don’t know shit.

How to get rid of a basement dweller.

Start charging rent.

First month is free.

Next month it’s $50. Keep raising rent by 50 bucks every month.

Put that money away for basement dweller.

When the basement dweller moves out give it the money.

You may have to repeat this process several times before it sticks.

I sometimes go to a “meeting of the minds” with a bunch of local old timers. The guy who hosts us in his barn has a grandson who graduated high school in 2006. The grandson lives with his grandparents and every few years his mother buys him a newer beater vehicle (With her well off husbands money).

The grandson hasn’t done much of anything in the last 18 years, except smoke and get drunk. Once in a while he has had a job for a few weeks, but it never seems to work out. He is never the problem.

To bad our whole money system is based on debt, wonder where that will lead….

two

Tou

Thiệu

Alright you sloth filled slackers………listen up…………time for a teaching moment !

NO ONE OWES YOU A LIVING !

You are going to have to do it on your own.

That is all………..return to sucking niggercock and taking faggotcock up your butthole now.

Idjit.

You can’t help those who won’t help themselves. Maybe the Z’s can get the niggers,queers and global warmers to help them.

I have a deal with food.

I eat it.

And then I convert it into plant food.

An outfit with a human shit sludge fertilizer actually makes it available commercially

Phi Zappa Krappa.

I have a theory, it’s called the “bald tire” theory.

When I’m in parking lots I look at the tires of vehicles that are about 4 years old or less.

I often wonder how people can afford the vehicles they are driving and by looking at the tires of a lot of these vehicles, they are almost bald and some with chord showing. People can’t afford the cars they are driving so the maintenance goes to shit. Giant 4×4’s with lift kits seem to be the worst. When I see some of the “youngish” characters that get out of their $45,000 to $85,000 vehicles all I see is debt and repos down the road.

I drive a 21 year old Camry that I bought new and probably will until I die.

Oh, and by the way we are all doomed, nobody gets out of here alive.

Cheer up!

At least we have 9gag for memes!

30

You got me beat my minivan is only 18 years old

Got Y’all beat. My car is 19 years old, and my bikes which do most of the heavy lifting for transport are now 31, 37, and 42 years old.

Orang

are you Mr. Money mustaches father

Of course. Best example of this pehnomonon is Atlanta GA. Virtually every AA leases or buys a laate model German luxury car that cannot possibly afford. A Black Water buffalo female was backing her new MB SUV into parking space and I told her that hrt backup lights were not working. Without skipping a beat, she said “do you know how expensive it is to fix that”?

I’m in the lead with a 22 year old jap toyota.

27 year old Plymouth daily driver for me. Bought new. Gettin’ a little tired but still going.

My car is 24 years old. Suspension jobs twice and regular maintenance. Still runs like a champ and costs me on average $1000 or so a year. Owned 1 new car my entire life (65 now).

Something the article fails to take into account is that interest rates for mortgages, credit cards and auto loans has also skyrocketed the past 4 years. Throw in the increase in CC interest rates for every late payment and pretty soon, these kids are looking at interest rates of 30%, or more.

My first mortgage was 12%.

Mine was 13%, but the house cost $72,000.

It’s all relative.

I’m waiting for our “leaders” to do something about banks charging 20% on credit cards for people with GOOD credit and rewarding savers with 0.015% interest. I remember when you could get 7%, but I’m old.

I don’t here Biden or Trump or RFK Jr. or Rand Paul or any of these assholes talk about that. Nope, just finger fucking each other, preaching to their choirs and stating the blatantly obvious or in your face lies.

You did nothing but cry; Maybe now do something??? Knucklehead….

Why are credit card rates so high? Because something like 10% of the balances are defaulted on. Add in they cover the scams etc. But morons scream that the rates on cards are so high! When in fact the rates reflect the default rate, the cost of covering scams, the admin, etc.m as well as the profit.

Here is an idea – pay them off every month and interest rates are zero.

First of all, I never run a balance on a card, so blow me on that.

Second of all, do you have something to back up your claims or are you just pulling shit out of your ass?

What is the default rate on card holders with GOOD credit? What is the default rate on saving accounts with less than zero% interest?

So banks and bankers exist to HELP people and making a profit is secondary? Do you know what fractional reserve banking is? I don’t think so.

Poor bankers, they are just doing the best they can, they have our best interest in the their hearts.

Last I looked the big three banks are fucking killing it right now.

Do your own fucking research, you ignoramus. This shit is easily found, but fucktards like you prefer a narrative.

People with good credit shouldn’t be carrying credit card debt, as there are cheaper ways of borrowing money, but a dumbfuck like you wouldn’t know that. Those that pay the debt off each month don’t give a flying fuck what the interest rates are. And again, if people aren’t getting a positive interest rate, then why aren’t they changing? That is on them. You are dumber than a bag of hammers.

Also, why are people carrying credit card debt? No one forces that shit on them, now do they? The interest rates are clearly visible. They voluntarily agree to the terms. Don’t want to pay the rate – then fucking don’t.

I don’t care if the rate is 100%. It isn’t the bank’s fucking responsibility. It is a damn contract – offered and accepted. Buyer beware. Same goes for any damn thing you buy, or any contract you enter into. No one is forced. The seller is entitle to ask for any damn thing, but the buyer can say go fuck themselves. Credit is a damn right, now is it? I don’t buy into the shit at people need to be protected from their own stupidity. Stupid actions have consequences.

Where did I say banks exist to help people? What a dumbfuck you are. Like every business they exist to make a profit. And they are entitled to try to make as much as they fucking can, And the consumer is entitled to try to get the goods and services for as little as possible,

I love it when ignorant asswipes try to hide their socialism behind populist narratives. Sell your socialist bullshit somewhere else. I ain’t buying.

And re the big three killing it – that is generally a very good thing indeed. When a country’s banks are fucked, shit is going south in a hurry. A country wants its banks solvent and strong, don’t you know.

It’s duhjoos.

What was it George Carlin said? I thought he was “joking” when he said it since he was a comedian. Nope.

9% FIXED

8.125% on a $150K house in 2000.

I had one at 11%

Yep – one of my cards (Discover, I think) recently updated their terms of service, and the APR is going up to 33%

Poor babies. 1) interest rates for mortgages are not high. Maybe still too low. 2) pay off the CC amount monthly and interest is zero, 3) don’t pay the nut late and penalties are zero, ) don’t take out auto loans, especially ones you can’t afford or are for 8 years.

Yes, the economy is in really bad shape. Gen Z is dealing with a bad situation. However, they need to look in the mirror to identify the person who is making bad financial decisions in their lives. Life is hard (always has been) and it’s harder if you are stupid.

Over – don’t muddy the waters by talking about the need to be personally responsible for your decisions. The irresponsible will come out in droves to downvote you for that.

There does not appear to be personal responsibility anymore, Cliff. It is always the fault to someone else. That is what happens to kids who grow up getting participation trophies.

In a few years were all gonna be worse off than them

Months! FIFY

You will be faced with a choice: lose almost everything or go completely digital/biometric/social credit.

Not me. Sorry for your lack of planning.

HOW do you get DEBT @22?? HOW? I was an a/v geek, a year out still from my career job @GE. Loans, debt, CC’s, hell even I LAUGHED at THAT THOUGHT @22!!

What I DID DO is this: I bought a 50th anniversary edition Chevy Impala coupe, painted in Granada gold, like the GTS Cadillac prototype racers today, (1963) for $1000 that I saved up and combined with a tax refund. Today, “Bunny” is worth just north of $50k-NOT for sale! Though, MANY, try.(coupe body, 283/powerglide combo, and vacuum operated locks)

And that IS WITH GHWScherff, er, Bush in charge at CIA for my entire childhood and early adulthood.

NOW, we see the results of THAT, and his obama “project”….(1977)

Side note: I’m just working at my FOH sound station in 1982, dreaming of an IBM 5150 PC in my room, when NONE OTHER than DON RUMSFELD walks up to the podium, and announces his “sale” of aspartame TO Coca-Cola and the FDA “assessments” on future tri-iodine supplementations of US produced salts and flours.(IT WAS REMOVED via the FDA per Rumsfeld’s request-LOOK IT UP) Those cassette recorded minutes are safely stored today in a metal safe that will only be dislodged/damaged via a NUCLEAR detonation….I’m just a dumb 70’s kid, BTW….

It’s not possible without their parent’s help. They don’t have a work history to speak of so it’s all about Daddy’s co-sign. No bank throws money at 22 yo’s…or anyone else for that matter…without collateral.

You don’t know high quality young people, now do you.

You don’t live in America, do YOU?

My family does. And the young ones don’t need such help. Nor their friends. Get a clue.

Debt is a four-letter word. Avoid all debt as best you can. I have Gen Zers for chillins, and they have zero credit card debt. I guess they listened to their Gen X parents who have made mistakes with credit cards in the past? Unfortunately, our “culture” has pushed the need for more stuff, consume more crap that you don’t need. Marketing is a powerful tool for you to buy crap. Breaking out of that cycle is hard for many. I know, been there and do not want to go back. Less is more is one of my mantras, which works for me.

Debt is slavery!

Old economy Steven memes

Old man agrees. Stop the self-righteous, strutting know-nothingism. It IS different today. My folks bought their very plain house in 1967 in rich, safe, west suburban Boston for $26,500. They dumped it in 1991 for $270K after a bit of updating and maintenance. In 2021, with, granted, quite a bit of updating, it went for $1.36 million. Zillow’s algo says it’d go for $1.6M+ today.

So, it doubled in price every ten years. Or approx. 7% a year increase. About the same as putting money in the stock market.

What is your point? Median family income in 1967 was $7000, and is around $101,000. Do the fucking math on that.

The average house size in the US was around 1400 sq feet in 1967. Today it approaches 2500 square feet. Maybe it is more expensive to build a house twice the size? Do the fucking math on that. Also, guess what – the average family size has dropped almost twenty percent. So houses are almost twice the size, while the number of people using the house has dropped twenty per cent.

The young want far more than their parents had at similar ages. They want a house twice the size as their parents, expect historically low interest rates to continue perpetually, want all the tech gizmos, want new cars, want the freedom to take high-dollar university courses with no economic value, and they want it in their twenties, instead of waiting until they can actually afford things, like their parents and grandparents did.

Cry me a fucking river. But yes, I do agree that older gen’s are to blame. They are to blame for raising such an entitle bunch of lazy ass nitwits.

“So, it doubled in price every ten years. Or approx. 7% a year increase. About the same as putting money in the stock market.

What is your point? Median family income in 1967 was $7000, and is around $101,000. Do the fucking math on that.”

That $101.000 income ain’t buying that $1,600,000 house though, is it?

Did you miss the part about how homes have doubled in size? I do not know how big that particular home is, but if all homes averaged half the size, to say 1400 sq feet, you think maybe they would be cheaper? But yes, you won’t buy a $1.6 million home on $100k. But here is the deal – wherever that home was in 1967, it was around the average price for that year. Today, the average price is around $500k. So would that $101k buy the average home today? Why yes, yes it would, so long as you have the down payment. And get this – that home would be twice the size!

So these ridiculous examples are just that. The bullshit of cherry picking one house and extrapolating it across the entire system is absurd. Average household income will buy the average house today, and that house will be twice the size it was in 1967.

Taking a house that was average in 1967 which then exploded in cost to three times average then expecting average wages to pay for it today is absurd.

ONLY TEN BUCKS TO SPEND THIS WEEKEND

.

FULL TANK OF GAS AND CASE OF BEER

$5 cases.

Funny but I don’t feel bad at all…

OK , Boomer

Bring on a hard core recession, even depression. That’s the best thing that can happen, especially for the young.

Gonna suck to be a geezer on the public teat under those circumstances. But the writing has been on the wall for decades now.

The elders are gonna be forced into taking one for the team, and making worthwhile sacrifices to right the many wrongs on behalf of succeeding generations. That’s as it should be, given where we are now.

See top YouTube comment.

What the fuck? From the article: “Given that government spending is unsustainable at 7% of GDP, they’ll eventually hit reality.” Try 37% of gdp is govt spending. Was that a typo or just ignorance?

Yeah, I knew 7% was total BS.

“We’re raising a generation of wards of the state, sustained not by productive work but by debt and handouts.”

By design.

They are also the generation that will be paying your benefits of the ponzi scam called Social Security. I.E. don’t expect much!

I surmised years ago that this was partly the reason for the illegals invasion.

Yes, I’m a 71 yr old boomer. Middle class but inherited $50K in today’s $$$. 1st thing to do? Bought a ’71 Porsche 914 for $2,100. Let’s have fun… and attract chicks.

!974 Tuition: Bama MBA – $350/ semester.

1977 House (married w/ pregnant wife): $1,300 sq ft, 2BR, 1.5 BA in Lenoir, NC: $24,700

So, I feel for Zees. But, as Sly said, “You can make it if you try.”