Authored by Jeffrey Tucker via The Epoch Times,

Such strange times.

We are living through the most destructive bout of inflation in 45 years, one that threatens to become worse and perhaps just as ruinous in the long run as the last one.

And yet daily and for years, we’ve been told it’s not so bad and that it’s nearly over anyway.

How can we reconcile these two realities? They cannot both be true.

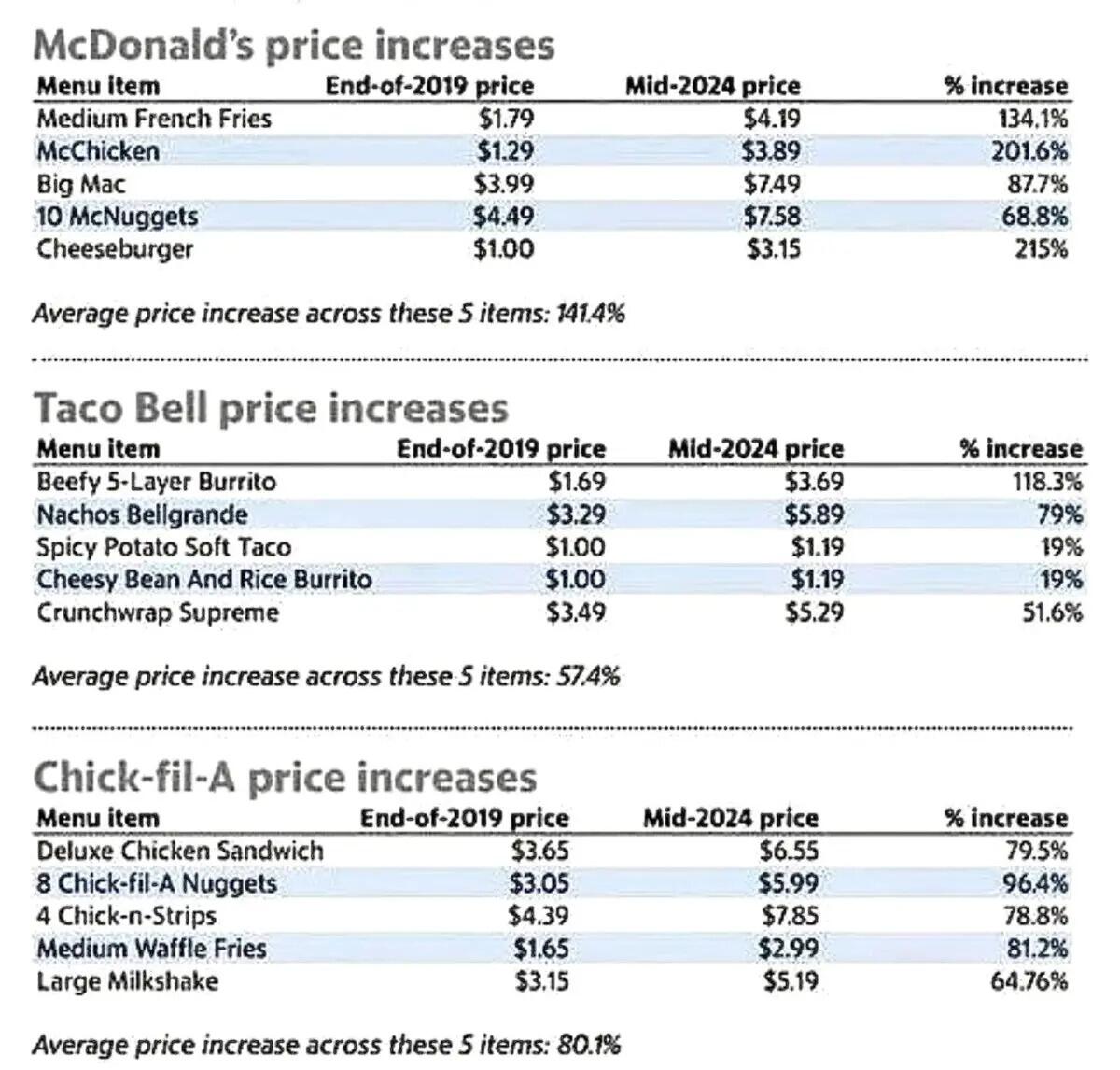

An image of verified accuracy has been circulating all over social media lately: A list showing the price increases from the end of 2019 to now at major fast-food outlets. It fits with your own experience. It indicates that in four years, your fast-food prices have doubled, so that your dollar is now worth 50 cents or even 25 cents. That’s an astounding level of inflation by any standard.

The validity of this is easily verified, and it certainly fits with our experience. And not only with fast food. It’s true of all food out—and food at home, too. In my own estimation, trying my best to recall prices from late 2019, I, too, have a sense of inflation of 50 percent to 100 percent or more.

But there is a major problem.

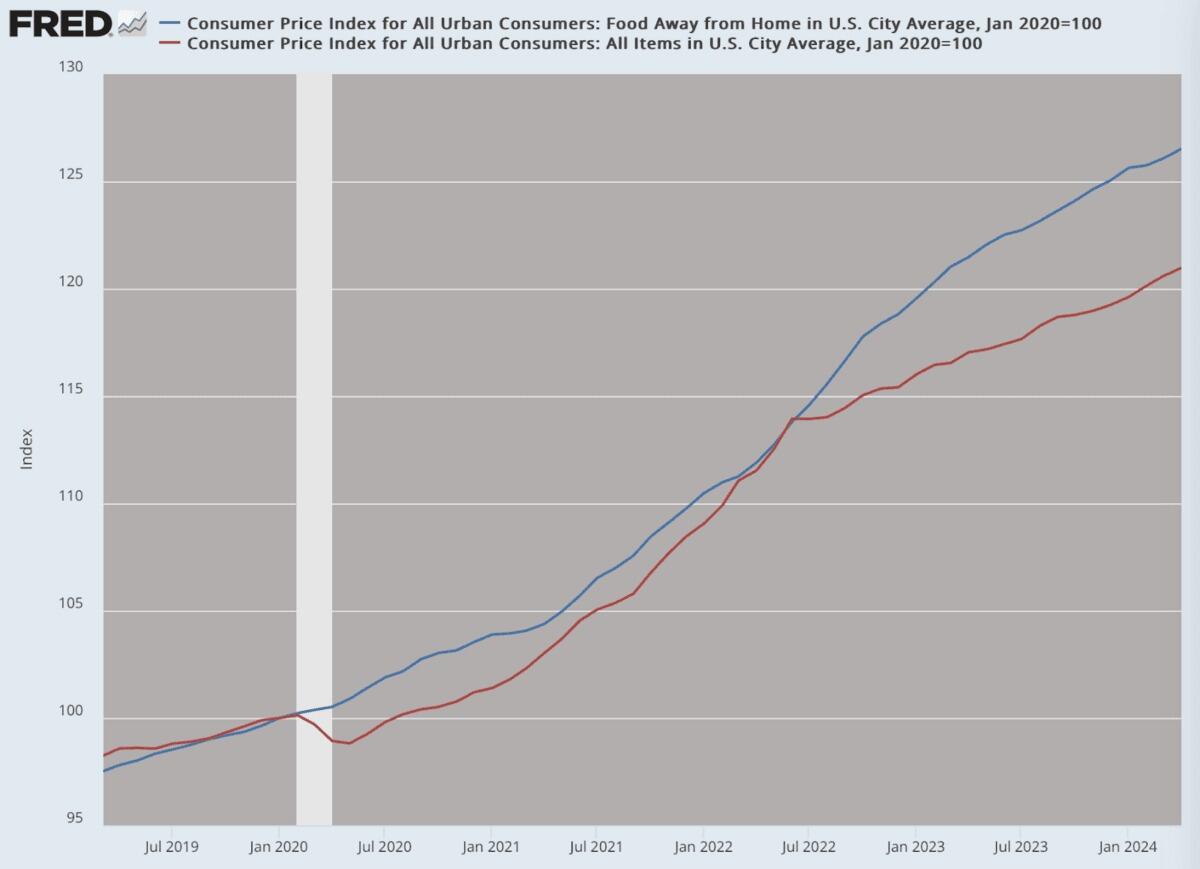

The government says otherwise. Looking at official inflation data, what we see is something very different. It shows food-away-from-home prices going up by about 26 percent and prices in general up by 21 percent. Setting the index at 100 for January 2020, we end up with indexes of 126 and 121, respectively, today.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

What does one do when official data depart so dramatically from lived experience? As Chico Marx said, who are you going to believe, me or your own eyes? It seems to me that your own eyes are a better guide.

So what in the world is wrong with government statistics on inflation? It’s a huge combination of factors. In the most rudimentary form, the inflation calculation used by the government no longer consists of a basket of goods and services carried over from one period to the next. Starting in 1996 and following, economists started pushing “hedonic” adjustments to the index. What does this word mean? It is from the Greeks meaning pleasure.

The idea is that consumers are getting more pleasure from purchases, so the price needs adjustment based on that. In the most obvious case, your television today is vastly more functional than it was 30 years ago, so it makes no sense to only compare the prices between them. The new prices need to be weighted and adjusted for such quality changes.

In the end, however, this concession unleashed the statisticians to manipulate figures in ways that are beyond all plausibility. The term hedonic ended up meaning that inflation data should be adjusted at the pleasure of government statisticians. As a result, hardly anyone can keep up with all the razzmatazz that the Bureau of Labor Statistics pumps out. All we can really know is that it is all a big fakeroo.

But it really does matter for a range of issues. For example, economists like to look at real versus nominal statistics because real numbers make little sense in inflationary times. For example, if you are looking at retail sales, you need to know the inflation number. One hundred dollars spent on hamburgers four years ago means $200 today, but you cannot then say the retail sales numbers have doubled. In fact, the dollar is merely worth half, so retail sales are flat.

An accurate number is also important for adjusting tax tables and cost-of-living adjustments. Failing to capture inflation accurately amounts to a modernized version of coin clipping that benefits the government at the expense of the people.

The website ShadowStats.com offers alternatives. It calculates inflation in the way it was done in the 1980s. It comes up with astounding results that produce inflation numbers that are generally twice the official data. This strikes me as far more accurate. You can see an explanation of this on its website.

And yet even that doesn’t exhaust all the problems.

The consumer price index (CPI) does not include interest rate costs, thus excluding all servicing of debt, including mortgages and credit cards.

The CPI does not accurately render housing or rent thanks to a crazy complicated formula called owners’ equivalent rent. It is utterly bonkers on issues of health insurance premiums. It uses the trick of adjusting downward all that you spend based on how much you consume, which means that the CPI will register a deflation even if, with your own eyes, you can see your premiums rising and rising.

The CPI also cannot accurately track shrinkflation. The bureaucrats might pretend to do so, but there is no evidence that they do so or even have the capability of doing so on every product even if they wanted to. It also does not track the millions of hidden fees that people pay today on nearly every service or product you can imagine. It’s not possible to buy tickets anymore without paying some delivery or service fee. And airlines have become infamous for crazy charges imposed at the last instant before you are ready to go through security, and the prices seem arbitrary. Suddenly you are paying $75 merely for having a small overhead bag.

This is just the beginning of the problems with official inflation data. This is also why it is a far more reliable method just to look at the same product today and five years ago and compare. And yet not even that fully works either. The hamburgers at your favorite fast-food place are actually smaller and with less meat. You have surely noticed that your restaurant is short-changing you on the pricier ingredients and piling up on the cheaper stuff.

The result of all this creates an internal sense of bitterness. Here we are living through a disastrous period in which the American standard of living is plummeting dramatically. Everyone senses it. And yet at this exact time, we are surrounded by experts who confidently assure us that all is well and that the worst is over. They have been saying this for four years.

And Wall Street is nothing if not overjoyed by this. My goodness, traders are even expecting the Federal Reserve to cut rates in the coming months and are buying more stocks at high prices in anticipation. This is addictive behavior, bumping from one fix of easy money to another. If this happens, it risks kicking off another big wave of inflation in the coming few years.

It’s one thing to observe that the experts are lying. We know that. What is frustrating is knowing that and yet being denied the truth at the same time.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

A war footing economy and ” emergency measures ” ticks off a lot of boxes.

Seize the means of production is the commie motto.

I’m more concerned with all the non native born and their offspring. How long are they supposed to live here? When they reach old age who is supposed to support them? Do the countries they left even want them back in that they are old? This is all stupidity on steroids.

They won’t get old , they’re cannon fodder

It’s all seems pretty simple to me. It’s all fancy words for……The powers that be are stealing from the people, robbing us blind and then making excuses/explanations/lies on why it’s happening. What amazes me is that most people can’t see through their lies

Not to sound like John Edwards (remember that blow-dried chameleon?) but there are two americas. NPR continually runs stories explaining about how the economy is better than it feels. It’s like people who claim to like scones (“they’re better than they taste!”). Some wealthy retired white woman not far from me actually started a NextDoor thread a couple months ago wondering why Biden isn’t getting the credit he deserves for the fantabulous economy. The rich people agreed and the poorer people rightly took her to task. Paul Krugman writes columns explaining how great things are.

I think the number of people who can’t afford McDonald’s anymore exceeds the number of NPR listeners.

It’s like people who claim to like scones (“they’re better than they taste!”).

Best comment of the day, Iska

How about we rage against the inflation (creators)!

skewed

GAAP vs. Non-GAAP: What’s the Difference? – Investopedia

Even worse than the high cost is the collection of riffraff behind the counter.

Tatted up misfit apprentice democrats for the most part.

You dont know where these jackoffs hands have been.

Avoid consuming anything handled by a democrat if you want to live.

Great article. Also not factored in to our REAL cost of living are taxes (that’s convenient) and more importantly the quality cost. When you buy a “durable good” that lasts 2 years that replaces something of much better quality that lasts 5 years you have a more than doubling increase even if prices stay the same. So if that item increased 20% over that time, well, do the math. They are FKNG liars on inflation because they have NO CHOICE because Goal 1 is to keep Govt in place – as is – and nothing will destroy Govt faster than rising rates to combat massive inflation.

Don’t forget the opportunity costs. If you have to spend time doing crap on something that shouldn’t need it you loose the opportunity of doing something else productive. We are at the point now where I think it was Von Mises that said “Inflate or Die.”

The scum that own this country have no interest in bringing down inflation. Kiss the value of your 401k, pensions, etc., goodbye.

Inflation is nothing less than legalized theft.

Another Big Lie Part 2 was really interesting, thanks for posting it. The comment at the end was great.

Have always thought the last four years especially has been a time where God is giving a taste of what is yet to come as revealed in this statement from Second Thessalonians 2:11 from the Amplified Translation of the Bible ‘Because of this God will send upon them a misleading influence, [an activity of error and deception] so they will believe the lie,…’.

A person can see it all around them on a daily occurrence.