Suppose someone wished to sell his house, way back in the 1890’s when gold was used as money, and somebody came to that person and said, “I’ll give you “x” ounces of gold for your house”, and suppose the offer was accepted. This was a commercial operation, where goods traded hands – the owner of a house sold a house, and received gold; the other party delivered some gold and purchased a house.

When, in bygone days, a house was sold for gold coins, all that the seller had to regard was the quantity of gold in the coins offered and whether that quantity was satisfactory or not. Gold was recognized as money!

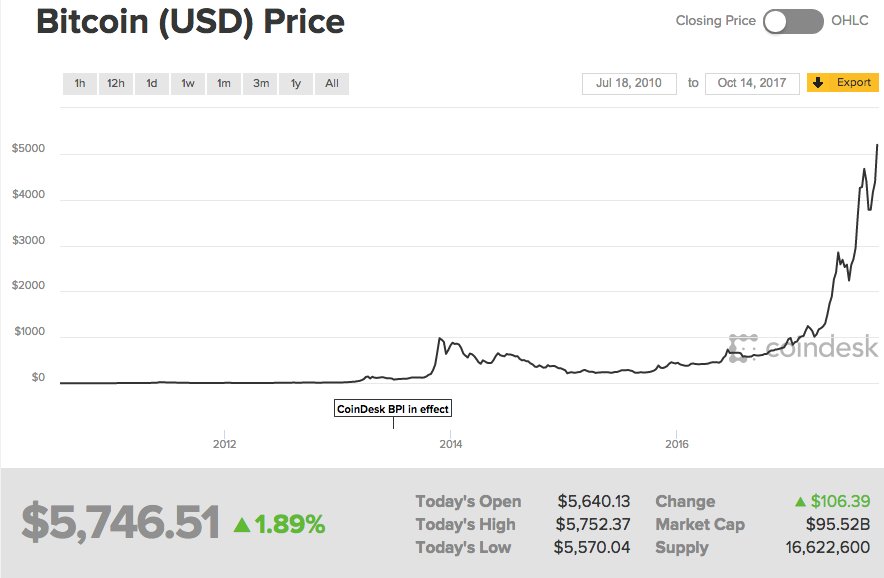

Now suppose you wish to sell your house today, and someone offers to pay for it in “x” number of Bitcoins. The quantity of Bitcoins – unlike a quantity of gold in yesteryear – would mean absolutely nothing to you. You would have to relate the Bitcoins to something else, namely the dollar. You would want to know for how many dollars you could exchange your Bitcoins. The answer would determine whether or not you sold your house.

It is quite clear that the Bitcoin can only aspire to be a derivative of the dollar. It cannot aspire to anything greater: to have an independent, sovereign value, since, unlike gold, it is not something – something that has a physical existence.

The dollar is presently rising in its exchange value against all other currencies. But no one can deny that the dollar is itself a fiat currency, and that in all history, absolutely all fiat currencies have ended in the total collapse of their value in exchange.

Continue reading “More Dirt on the Bitcoin”