“Now remember, when things look bad and it looks like you’re not gonna make it, then you gotta get mean. I mean plumb, mad-dog mean. ‘Cause if you lose your head and you give up then you neither live nor win. That’s just the way it is.” – Josey Wales – Outlaw Josey Wales

To hell with them fellas. Buzzards gotta eat, same as worms. – Josey Wales – Outlaw Josey Wales

There is a war underway in this country. The working middle class that built this country from the ground up are being systematically eliminated by a small cabal of super rich powerful elite. The middle class was much like Josey Wales, a peaceful Missouri farmer just working his land trying to make an honest living. Then a band of lawless thugs come along and kill his wife and son and burn down his farmhouse. A man can only take so much before he gets mean and vengeful. The rich and powerful, the corrupt Wall Street bankers, the banker controlled Federal Reserve and the bought off politicians in Washington D.C. have been pillaging the middle class for decades.

They’ve killed the middle class and in 2008 they essentially burned down the worldwide financial system. Somehow, they convinced the American public the war was over. A small band of super wealthy individuals on the boulevard of greed, Wall Street, and in the putrid swamp of Washington D.C. blackmailed the American middle class taxpayers by threatening to bring down the financial system unless they were handed $700 billion, saved from bankruptcy by the Federal Reserve buying $1.2 trillion of toxic mortgage debt, and provided free money by their sugar daddy at the Federal Reserve. The politicians then absconded with another $800 billion of taxpayer funds and handed it out to their corporate political cronies in the name of shovel ready projects and adding 3 million new jobs.

At the end of the Civil War, the Confederate guerrillas that Josey Wales had joined agree to lay down their arms with a promise of freedom. Instead the Union thugs began to mow them down with a Gatling gun. This is perfect symbolism for what the ruling elite have perpetrated in the last three years. Within months of nearly destroying the worldwide financial system, the Wall Street desperados were paying themselves hundreds of billions in bonuses for a job well done plundering and sacking the American middle class taxpayer. They certainly earned the bonuses, considering they could borrow from the Fed at 0% and earn 2.5% on Treasuries or pile into stocks and commodities, knowing Uncle Ben would guarantee profits with QE2.

Jim Grant, in early 2009, described the excessive response by those in power to a crisis caused by them:

“To try to exorcise the Great Depression, President Herbert Hoover deployed fiscal and monetary stimulus equivalent to 8.3% of gross domestic product. To banish the demons of 2008-9, successive administrations have spent, or encouraged to printed, the equivalent to 28.9% of GDP. A macroeconomist from Mars, judging by these data alone, would never guess how much more severe was that depression than this recession. The decline in real GDP from August 1929 to March 1933 amounted to 27%; that from December 2007 to date, just 1.8%… so for a slump 1/15 as severe as the Depression, our 21st-century economy doctors administered a course of treatment more than three times as costly.”

Ultimately, GDP fell 3.1% between the 3rd quarter of 2008 and the 3rd quarter of 2009. The government response has amounted to throwing $7 trillion ($4.2 trillion increase in national debt, $700 billion of TARP bailouts, $200 billion of losses taken by Fannie Mae & Freddie Mac, $100 billion of losses taken by the FDIC, and the Federal Reserve increasing their balance sheet by $1.8 trillion) of your tax dollars at the problem. As a side benefit, they have thrown senior citizens under the bus by paying them 0% on their savings, not providing a cost of living increase to their social security for two years, and hitting them over the head with 10% levels of inflation on food and energy.

At this point it looks bad for the working middle class and it looks like they aren’t going to make it through the next banker made financial crisis. The middle class just wants the chance for a new beginning. They want jobs. They know the country has been hijacked by the banking corporatocracy, supported by the corrupt political class in D.C. It is time for the middle class to channel their inner Josey Wales and get plumb mad-dog mean. It is not time to lose your head and give up. The middle class are being pursued by Wall Street bounty hunters and government crooks trying to finish them off. It is time to make a stand and fight. It is essential that we know our enemies and how they achieved their power. It all began in 1913 with the creation of the Federal Reserve and the implementation of the personal income tax. I’ve previously detailed how the baby boom generation contributed to our fiscal plight in Part One – For a Few Dollars More, how the actions of the Federal Reserve’s over the last few decades have impoverished the middle class and placed the country at the brink of collapse in Part Two – Fistful of Dollars and addressed the nefarious creation of a central bank in Part Three – The Good, the Bad, and the Ugly.

How to Buy a Tax Break

“There’s another old saying, Senator: Don’t piss down my back and tell me it’s raining.” – Fletcher – Outlaw Josey Wales

When the Federal government spends more each year than it collects in tax revenues, it has three choices: It can raise taxes, print money, or borrow money. While these actions may benefit politicians, all three options are bad for average Americans. – Ron Paul

The Senator pissing down the backs of Americans while telling us it was raining was named Nelson Aldrich, from Rhode Island. He was a Republican lackey of J.P. Morgan who was the driving force behind the creation of the Federal Reserve and the passage of the Sixteenth Amendment, creating the personal income tax. His daughter married John D. Rockefeller, Jr. and his son became the Chairman of Chase National Bank. I wonder how beholden he was to the banker class. A decade before 1913 Aldrich had declared an income tax as communistic. He was right. Karl Marx published his Communist Manifesto in 1848. It included ten planks. Two of the ten planks were as follows:

- A heavy progressive or graduated income tax.

- Centralization of credit in the hands of the State by means of a national bank with State capital and an exclusive monopoly.

The United States had tinkered with an income tax during the Civil War and the 1890’s, but the Supreme Court declared it unconstitutional. Until 1913, the Federal government was restrained from overspending because it was completely reliant on tariffs and duties to generate revenue. Without the ability to print money and tax its citizens, politicians could not roll out new programs and fight foreign wars of choice.The Sixteenth Amendment changed the game forever.

“The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

Politicians pulled the old bait and switch on the American people. The initial tax rates of 1% to 7% were low. That did not last long. By 1918, the top marginal rate was 77%, as Woodrow Wilson needed to fund his war of choice. The top tax rate reached 92% during the Eisenhower Administration and today rates are still 500% to 1,000% higher than they were in 1913. The government is addicted to tax revenue. In 2009, they absconded with $1.2 trillion in taxes from American individuals. Does anyone think the bloated government bureaucracy spends these funds more efficiently or for a more beneficial purpose than its citizens could have? The income tax distorts financial planning and business investment, and it encourages tax avoidance and evasion.

Partial History of

U.S. Federal Income Tax Rates

Since 1913 |

Applicable

Year |

Income

brackets |

First

bracket |

Top

bracket |

Source |

| 1913-1915 |

– |

1% |

7% |

IRS |

| 2003-2009 |

6 brackets |

10% |

35% |

Tax Foundation |

Source: Wikipedia

The average American thinks income taxes are essential because politicians tell them so. The only discussion is about what the rates should be. But, the country grew tremendously between 1789 and 1913 without a personal income tax. Income taxes do not benefit the average American, they drain wealth from the citizens and hand it to politicians who then use them to bribe constituents for votes with handouts and fund foreign wars of choice. The IRS tax code has progressively been utilized by the rich and influential class to skew it in favor of those with the most lobbyists. Politicians get elected by promising benefits to the masses while being funded by rich people and big corporations. A tax code of 60,000 pages, with over 600 IRS tax forms, and filled with tax breaks for influential constituents (farmers, oil companies, homeowners, foreign corporations, etc.) is not designed to benefit the average American. The tax code is used to pay off those who “contribute” to the politicians that control the tax code.

Congress frequently holds hearings on tax simplification so members can denounce the tax code’s complexity. Congressional experts and impartial think tanks provide useful simplification ideas. When the TV cameras are turned off, Congress swiftly ignores them and votes for more special interest breaks for their biggest contributors. The storyline that is pounded into the minds of all Americans is that 50% of the population pays no taxes and the rich pay an inordinate amount of taxes. The Republicans and Democrats fight a battle of false talking points to confuse and obscure the truth.

The Republican mantra since the Reagan era has been to cut taxes and allow the “free market” to work its magic. They have succeeded in convincing a vast swath of Americans that lowering the highest tax rates have benefitted the masses. This is completely untrue. An unfunded tax cut today is just a tax increase on future generations. Democrats went along with tax cuts as long as the Republicans went along with spending increases. The Democrats hit the jackpot, with a supposedly fiscal conservative president signing a Medicare D bill that added trillions of unfunded liabilities to our national balance sheet. The Republicans are on cloud 9, as a supposedly liberal anti-war president has increased war spending to $1 trillion per year while ramping up our foreign wars of choice. Everyone gets what they want in Washington D.C. This is called bi-partisanship.

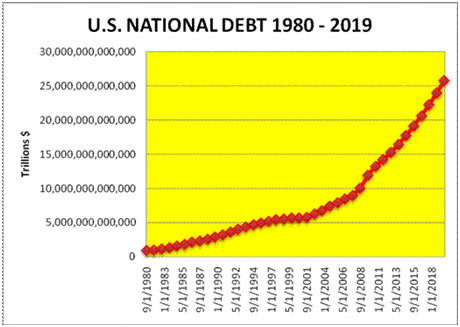

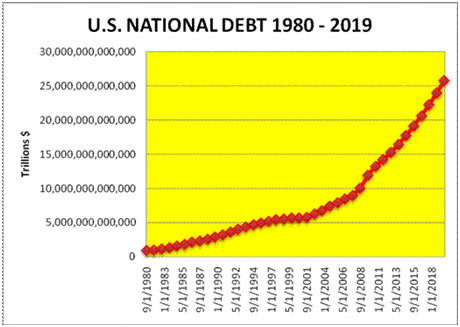

The Big Lie

As the chart above shows, at least before Reagan the top marginal rates were kept high to pay for the social programs instituted by Congress and the wars of choice fought by our Presidents. After 1980, in some sort of warped Twilight Zone episode, politicians across the land convinced themselves and the masses they could have lower taxes, more entitlement goodies, never ending war, and an unlimited heaping of material goods, with no adverse consequences. Well, it was a lie.

- The GDP in 1981 was $3.1 trillion, today it is $14.7 trillion.

- The National Debt in 1981 was $907 billion, today it is $14.4 trillion.

- The amount of annual Federal income tax revenue in 1981 was $347 billion, today it is $1.1 trillion.

- The amount of annual Federal spending in 1981 was $678 billion; today it is $3.8 trillion.

- Total consumer debt in 1981 totaled $353 billion, today it is $2.4 trillion.

- Total mortgage debt outstanding grew from $1.5 trillion in 1981 to $14.6 trillion by 2008.

- Median household income was $17,710 in 1980 and is now $49,777.

These facts reveal an empire spiraling out of control, delusional and living on borrowed time with borrowed money. The output of the country has grown by 474% in the last 30 years, while the National Debt has grown by 1,588%. Those two facts alone paint a picture of eventual collapse. The lesson of allowing politicians and bankers unfettered access to unlimited amounts of fiat currency backed by nothing but a hollow promise to pay is clear, in the divergence of income tax revenue and spending. The dramatic slashing of top marginal rates from 70%, which had been in place for a fifty year period when the U.S. economy boomed, was supposed to invigorate the economy and unleash the free market spirit of our entrepreneurs. A funny thing happened on the way to prosperity for all. Federal income tax revenue has only grown by 317% in the thirty years since the Reagan Revolution. The CPI has grown by 289% over this same time frame. Therefore, tax revenue is essentially flat with 1980 on an inflation adjusted basis. This wouldn’t be a problem, except that the politicians we elected ramped up spending by 560% over these same thirty years. Federal spending has grown at almost twice the rate of income tax revenue. Bug meet windshield. I guess this is called supply side economics.

Politicians of both parties have promised the American public they could have low taxes, unlimited social welfare benefits, a house that always appreciated in price, electronic gadgets galore, and the true American dream of getting something for nothing. And it was all made possible by your friendly Wall Street banker and their friends at the Federal Reserve. The data above already paints a dire picture for the American Empire, but the next ten years will finish the job. GDP is stagnant as Federal government spending props up the teetering edifice of economic activity. The National Debt will reach $20 trillion by 2015 and is on course to reach at least $25 trillion by 2019. Both the Republican and Democratic “plans” to “reduce” the deficit are a joke. They don’t reduce anything. They add to the debt.

The citizens of this country should be outraged by such fiscal irresponsibility, and marching on Washington D.C. with pitchforks and torches. But, there is no outrage across the countryside. This is because the vast majority of Americans followed the example of their beloved government leaders and lived far beyond their means in a delusional attempt to borrow their way to material prosperity. The median household income has risen by 281% since 1981, less than inflation over the same time frame. The median household is taking home less than they did in 1981 on an inflation adjusted basis. The McMansions, BMWs, computers, 52 inch HDTVs, and 15 other essential electronic gadgets that represent the current American Dream were financed. Consumer debt, used to buy (rent) luxury automobiles and essentials like 4 TVs and 3 computers, grew by 680%, more than twice the rate of median household income. Mortgage debt grew by an astounding 973% in the last thirty years.

![[Mortgage+Debt+Outstanding+1952-2007.bmp]](https://2.bp.blogspot.com/__V1GJlBadyE/SZRz3kTxSfI/AAAAAAAAAag/Za3ExRYRDK8/s1600/Mortgage%2BDebt%2BOutstanding%2B1952-2007.bmp)

The last thirty years have been a faux American Dream. The madness of crowds has been replaced by the sober reality that the material goods purchased with debt steadily depreciate day by day, while the debt stays firmly in place. Who benefitted and who lost during these thirty years of delusion? There is only one beneficiary from the issuance of trillions in debt – Wall Street bankers. The ten biggest banks in the country hold more than 50% of the mortgage debt and 80% of the credit card debt in the U.S. The poor never had much, and they still don’t. Politicians have averted riots and social unrest by pouring trillions into welfare, social security disability, SNAP programs, earned income credits, and hundreds of other transfer payment bribes to the poor. The middle class has borne the brunt of the banker plundering and pillaging.

The Super Rich Storyline

There are three storylines that are pounded home repeatedly by the mainstream media and the Republican Party ideologues.

- More than 50% of Americans don’t pay any taxes.

- The top 1% pays 38% of all the Federal income taxes.

- Increasing the highest tax rate above 35% would destroy jobs and kill small business owners.

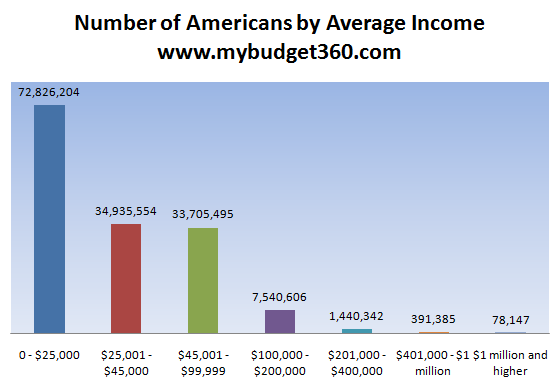

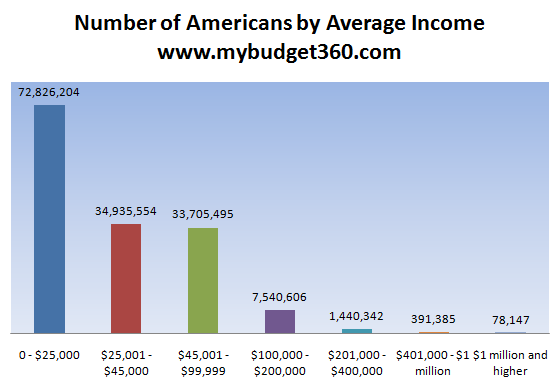

The misinformation spewed forth by the super rich, who control the media, politicians, and media message, to disguise their continued looting of the American middle class, is unrelenting. There are 117 million households in the United States with a median household income of $48,000. Data from the Tax Foundation shows that in 2008, the average income for the bottom half of taxpayers was $15,300. The first $9,350 of income is exempt from taxes for singles and $18,700 for married couples. Politicians of both parties also provided credits for children, earned income credits, mortgage tax deductions, property tax deductions, and a myriad of other tax goodie payoffs for votes. When half the households in the country make less than $48,000 per year in income, of course they won’t be paying any Federal income taxes. There are approximately 151 million Americans earning income. Almost 73 million, or 48%, make less than $25,000. As Wall Street enriched billionaires are interviewed by millionaire journalists on CNBC, scorning those who don’t pay their fair share of taxes, they outsource the blue collar jobs of those on the lower income scale to China and India. Without good paying jobs, the middle class uses debt to maintain their American dream, further enriching the billionaire class in a circle of death.

This chart reveals the true nature of who controls our country. It is a battle between a few thousand of the richest people in America versus the other 150 million. The facts are the middle class and poor pay a much higher percentage of their income in taxes than the rich. The Social Security tax cuts off at $106,800. Therefore, the median household pays 6.2% of their income, while the rich household making $5 million per year pays .13% of their income. This applies to sales taxes, property taxes, state taxes, local taxes and the thousand other taxes and fees charged on utility bills, etc. William Domhoff notes that the top 1% who make $1.3 million per year only pay 30.9% of their income in taxes, while those making $141,000 per year pay 31.5% of their income in taxes. I guess their tax lawyers aren’t as well paid. Even those making $34,000 pay 27% of their income in taxes.

Source: Citizens for Tax Justice

The top 1% does pay 38% of the Federal income tax because they have a 23.5% share of the national income. The last time the top 1% reached this level of income was in 1928, just before the Great Stock Market Crash and the Great Depression. During the glory years of the American Empire, between 1946 and 1971, the top 1% of households’ share of the national income ranged between 8% and 13%. With the era of unbridled greed and debt that began in the 1980s, the inequitable distribution of wealth has risen to new heights. This level of pillaging by those in control of the finance sector of the economy, supported by their mouthpieces in Congress, and championed by their controlled media pundits, has reached a level that will eventually lead to revolution.

The biggest lie pushed forth by the powerful super rich in this country is related to the top marginal tax rate, which is currently 35%. The Republican agenda includes a further cut in the top rate to 25%. It is sold to the American public as a good thing for them. It has nothing to do with them. The 35% rate applies to only taxable income over $379,000. Of the 151 million Americans earning a living, this rate would apply to about 200,000 people. The top marginal tax rates during the glory years of the American Empire (1946 – 1971) were between 70% and 90%. These rates only applied to taxable income above $400,000, when the average income was less than $10,000 per year. These were the best years for the American middle class.

The IRS issues an annual report on the 400 highest income tax payers. In 1961, there were 398 taxpayers who made $1 million or more. Today there are over 78,000 taxpayers who make more than $1 million. The loopholes written into the tax code over decades by lobbyists paid for by the super rich, plus much lower tax rates on the largest sources of income of the wealthy (capital gains taxed at 15%), explain why the average federal income tax rate on the 400 richest people in America was 18.11% in 2008, according to the IRS, down from 26.38% when this data were first calculated in 1992. Among the top 400, 7.5% had an average tax rate of less than 10%, 25% paid between 10% and 15%, and 28% paid between 15% and 20%. The average American’s share of their income going to federal taxes increased from 13.1% in 1961 to 22.5% in 2008. William Domhoff explains how the super rich have paid off Congress to rig the system in their favor:

“According to another analysis by Johnston (2010a), the average income of the top 400 tripled during the Clinton Administration and doubled during the first seven years of the Bush Administration. So by 2007, the top 400 averaged $344.8 million per person, up 31% from an average of $263.3 million just one year earlier. How are these huge gains possible for the top 400? It’s due to cuts in the tax rates on capital gains and dividends, which were down to a mere 15% in 2007 thanks to the tax cuts proposed by the Bush Administration and passed by Congress in 2003. Since almost 75% of the income for the top 400 comes from capital gains and dividends, it’s not hard to see why tax cuts on income sources available to only a tiny percent of Americans mattered greatly for the high-earning few. Overall, the effective tax rate on high incomes fell by 7% during the Clinton presidency and 6% in the Bush era, so the top 400 had a tax rate of 20% or less in 2007, far lower than the marginal tax rate of 35% that the highest income earners (over $372,650) supposedly pay.” – Wealth, Income, and Power – William Domhoff

As an added bonus, hedge fund managers like John Paulson, who made $9 billion over two years, paid no income taxes on his windfall. In 2007, Republicans and a key Democrat, Sen. Charles Schumer of New York, fought to keep the tax rate on hedge fund managers at 15%, arguing that the profits from hedge funds should be considered capital gains. Schumer, the ultra-liberal champion of the poor, knows who butters his bread – Wall Street. But it gets better. As long as they leave their money, known as “carried interest,” in the hedge fund, their taxes are deferred. They pay taxes only when they cash out, which could be decades from now. These upstanding citizens access their jackpot winnings by borrowing against the carried interest, often at rates as low as 2%. I’m sure every youngster in America dreams of becoming a hedge fund manager so they can use system risking leverage to make bets on derivatives, reap billions in profits, pay no taxes, and produce no value for the country. The new American Dream.

It is plain to see by anyone without an ideological agenda that a few thousand corrupt individuals have managed to gain control of the American economic system. The introduction of the personal income tax and creation of the Federal Reserve in 1913 have provided the means for the few to dominate the many. Over the last century, a rich super class has created their wealth through issuing debt to the masses, writing the tax code in their favor through their captive politician protectors, using their own private bank to issue trillions in fiat currency and create inflation, and used their control of the mass media to convince the average American that this was beneficial. Chris Whalen in his brilliant economic history of the United States – Inflated – How Money & Debt Built the American Dream sums up what has happened:

“Once the two functions, controlling the amount of currency in circulation, and second the government’s fiscal operations, are housed under the same roof, inflation and a decrease in the value of money are the inevitable result. It is always easier to borrow than to raise taxes. Politicians who have access to the printing press will invariably use it.”

The small cabal of banking elite committed the crime of the century between 2001 and 2008. They used their power over the Federal Reserve and political class to reap hundreds of billions in ill-begotten profits and crashed the worldwide economic system in 2008. They then held the country hostage as they extorted trillions more in bailouts from the taxpayers. As a reward for their chutzpah, they have paid themselves billions in bonuses. While 44 million people try to make ends meet with food stamps, these criminals continue to pillage the countryside attempting to steal the remainder of middle class wealth. As the middle class sinks further into despair, anger is building. The political class has tried to pay off the poor with entitlement payments, but it is the middle class that will revolt when their hope for a better life is destroyed by the moneyed class. With debt in the system expanding at hyper-speed, the American Empire will not decline with a whimper but with a bang. All previous Fourth Turning’s in U.S. history have resulted in tremendous bloodshed. The next ten years will follow this pattern. I’ll address the coming revolution against the criminal banking element in the last part of this five part series – Unforgiven.

![[Mortgage+Debt+Outstanding+1952-2007.bmp]](https://2.bp.blogspot.com/__V1GJlBadyE/SZRz3kTxSfI/AAAAAAAAAag/Za3ExRYRDK8/s1600/Mortgage%2BDebt%2BOutstanding%2B1952-2007.bmp)