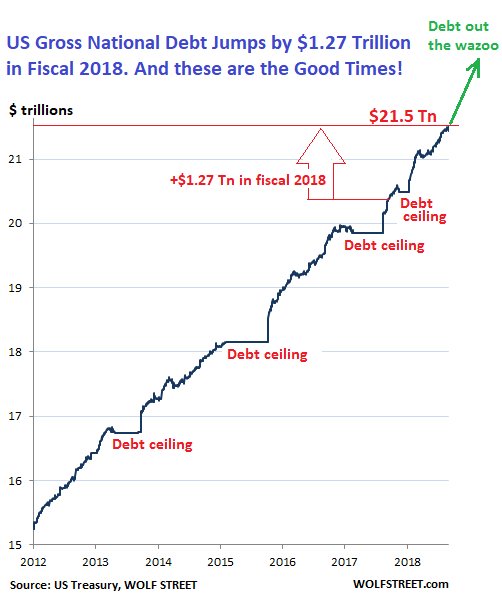

The national debt went up by $1.2 TRILLION in the last fiscal year. Tax revenue plummeted, while spending skyrocketed. Interest on the debt soared to an all-time high. Promise more tax cuts with no plan to pay for them by cutting spending. That’s the ticket. Now you know what they taught at the defunct Trump University. But when this mountain of debt come tumbling down, it will be the Fed’s fault for raising interest rates above 2%. So it goes. I wonder how much my taxes will go up after this “cut”.

Trump says he will propose 10% tax cut for middle-income earners

Speaking to reporters on the White House law, President Donald Trump said the administration will propose what he called a “resolution” to cut taxes by 10% for middle-income earners. He made clear that this would be for Congress to enact and not to be done administratively. He acknowledged that Congress would not take up any legislative proposal until after the election.