Guest Post by Harry Dent

The global real estate bubble is bursting.

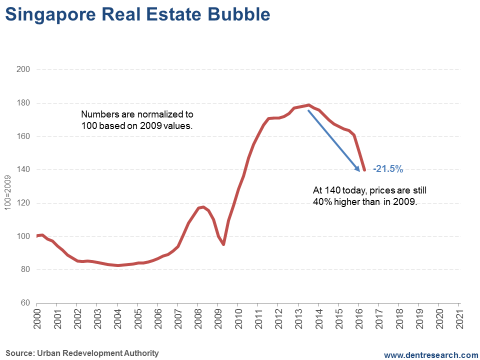

After imposing a hefty 26% tax on foreign buyers, and a 12% to 16% surcharge for buyers who flipped their house between one and two years, Singapore real estate has declined 21.5%.

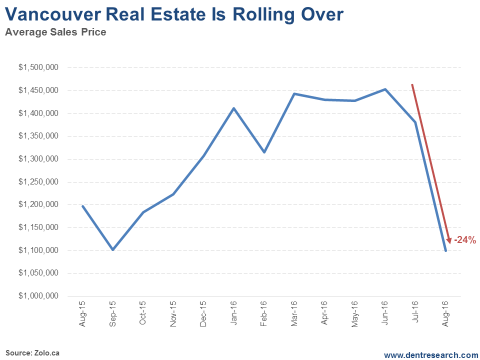

Vancouver has taken similar measures, and – surprise, surprise – its real estate is down 24% in just five months!

That’s what I mean when I say that when bubbles burst, they do so dramatically and rapidly.

But this is likely just the beginning…

I put Singapore into razor-sharp focus in February of last year when I noted it had some of the most expensive real estate in the world. It has the highest standard of living of any country in Asia – even higher than in the U.S.!

The problem is that the country is 100% urban and has limited land – making it incredibly susceptible to the kind of bubble that’s formed there.

And boy, has one ever.

Prior to this recent crash, real estate prices there had risen 68% since early 2009 following the global financial crisis…

And 110% since the 1999 low after the financial crisis across Southeast Asia.

Now, they’re down 21.5%:

Clearly, it was a bubble waiting to burst!

Eventually, there was public backlash against foreign buyers who were bidding up prices. After a certain point, the everyday, $60,000-a-year household couldn’t afford to live in its own city!

And now that the government has slapped a bunch of fines on those buyers, those foreigners aren’t buying like they used to – and Singapore’s prices are crashing down to earth!

Just like I said they would a year and a half ago.

I also covered Vancouver about a year ago prior to heading there for our third annual Irrational Economic Summit. (We’re hosting our fourth in less than two months in West Palm Beach, FL. (Click here for details.)

As I said at the time, Vancouver is my favorite city in North America… and is also one of the single bubbliest cities on the planet.

Like Singapore, its residents were getting fed up with foreign buyers – mostly Chinese in their case – jacking up prices across the city.

From the beginning of 2002 to when I reported last year, home prices had gone up 290%!

A bubble, plain and simple.

I warned they would likely start punishing foreign investors as well – and they did. The city slapped a 15% tax on them. And given that Vancouver was a prime location for Chinese investors laundering their money out of China, the city got hit hard – again, down 24% in just five months.

What did I say? Bubbles. Always. Burst. There are no exceptions in history.

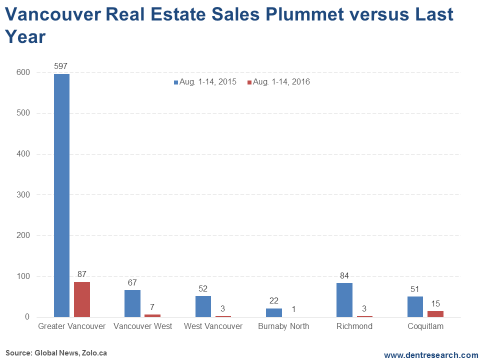

In greater Vancouver, sales have fallen from 597 in the first half of August last year to a mere fraction of that – 87 over the same timeframe. That’s an 85% crash, for crying out loud!

It gets worse. The most high-end part of the city, West Vancouver, dropped from 67 to seven – 90%.

And Vancouver West, the area across the bay with mostly upscale suburbs, which the Chinese love the most, is down from 52 to three, or a whopping 94%. The Richmond area got hit the hardest, falling from 84 to three, or 96%.

For now, buyers in Vancouver are staying put until they see how this shakes out.

But is this a crash in the making or what?

The question now is… who’s next?

My bet’s on London. I could see the highest-end falling off more rapidly after Brexit. Then San Francisco. And finally – the coup d’etat – Shanghai and China.

Let me make myself clear. This is the beginning of the greatest and most global real estate bust in all of modern history.

I see the lower end hold up reasonably well (people have to live somewhere and they compare renting versus owning) while the high end only makes sense based upon the greater fool theory. So the upper end gets suppressed.

More doom from Harry. There are so many of these guys that make predictions; once in a while they get it right and they become a guru.

I think Harry has it somewhat right…… The spinoff problem is that the B.C. government did not pass this law in the whole province, and the media said that the Asian populist would simply move to other towns.

Across the water on Vancouver Island – A city known as Victoria (the provincial capital) is seeing unprecedented new home construction on a scale never seen before. It is said that the rental market is equal to 6 tenths of 1%. So the “bubble” appears to have shifted to this town until the law is extended to this place, and on it goes to the next town!!

Question is…. where did these people get all the money!? Yep! From thin air…. thanks to Central Banks……

Who imposes the punitive taxes and fines?

Maggie – I believe the Province of B.C. reaps the booty on that law.

He’s pretty spot on with regards to Singapore though. Their growth is built on the back of the international explosion of debt and globalization.

They are living behind their means, and human societies act like island ecologies: both are highly vulnerable to outside intrusion.

In this case ripples in the globalist agenda will smack places like Singapore harder than places with natural resources to fall back on.

Best 7 years of my professional life were spent in Singapore in the 1990s. Yes they make mistakes, but they are few by comparison to anyone else….except maybe Bhutan 😉

location location location

I have been to Vancouver…just lovely,

however, I hear tell the once clean water has become

fouled and toxic. That is not lovely. Singapore may be the

bomb…unless it falls victim to an emp-like event…then it becomes

hell. It is best to live off the beaten paths, in the nooks and crannies, if one wants a simple life. Want a rocket filled life?

Try these super-cool cities, while they last.

It ain’t over ’til the Fat Lady sings.

I know, cliche, but still. Liquidity has sloshed all over Planet Earth for 35 years. One asset class and one region after another has had bull and bear markets, in some cases several of them.

I now know in my heart that what really matters is LONG TERM INTEREST RATES. It is the “wealth” sitting in the Bond Ocean that provides the liquidity all over the world. Until that “wealth” begins to evaporate in earnest, no one market’s behavior matters. Stocks can lose 50%, commodities can lose 80%, gold can drop 40%, none of those events signaled the end of the Bond Bubble.

There will come a day when even a Central Bank monetizing new bond offerings directly (AKA QE) will hammer the shit out of interest rates. That will be the End. Of. The. Line.

When few bonds are outstanding, a change in interest rates has little effect on the outstanding capital value of those bonds.

Now that there are untold trillions of dollars, a veritable galaxy of outstanding debt, if they hold a bond auction and no one comes, or the bid is weak, or somehow the interest rate established is notably higher than the trade before that, an incalculable quantity of money-wealth evaporates directly out of that galaxy of existing bonds. This is deflation in action, and it is utterly inevitable in every fiat monetary system now drowning in debt.

They can’t cancel the debt.

They can’t monetize it all.

They can’t keep a lid on interest rates because the market is the WORLD, and central bankers are just puny men full of Wizard of Oz delusions.

All we await is a change to the Unconscious Mind of the Masses. That change is entirely endogenous…no outside events affect it at all. We will soon be in what I term a “Cusp Zone,” where the probability of a turn rises because a shorter-term trend has reached its end. My guess is that we’re more likely to see stock weakness for a couple more weeks, then a final rally. If it plays out that way, October should be largely up, to new highs.

This would sadly play to Clinton’s political advantage.

The good news if that’s so? If that witch is elected, I’ll bet she is driven from office not only like Nixon, but 1) it will be during her first term and 2) she may leave in handcuffs.

My point is that we near what could be (no certainties, I’m not putting my money where my mouth is FTR) nearing THE high. Only if the 10 year and 30 year yields begin to run higher will I then conclude I’m right.

If Clinton is elected and the mood then turns, her own people will rip her to shreds.

Social mood is a fickle thing.

There was an article the other day on zero hedge about the high end housing market crashing in Aspen, the Hamptons and Miami, so it’s not just Vancouver. There is a limit to the central banks’ ability to manipulate all the markets. Can they regain control or are they losing it?

http://www.zerohedge.com/news/2016-08-27/%E2%80%9Ci%E2%80%99ve-never-seen-anything-housing-markets-hamptons-aspen-and-miami-are-all-crashing